Ocwen Narrows Loss, But Revenue Disappoints

October 28 2015 - 5:20PM

Dow Jones News

Ocwen Financial Corp. narrowed its loss during the third

quarter, though the embattled mortgage-servicing company posted a

21% drop in revenue.

After more than a year of problems with regulators, Ocwen has

been working to sell some of its mortgage-servicing rights and

concentrate on mortgages not owned by government agencies. It has

also been cutting jobs and in September announced plans to cut

about 10% of its U.S. workforce.

Ocwen's third-quarter results included a $41.2 million pre-tax

gain from the sale of mortgage-servicing rights, offset by

impairment and restructuring charges, among other items.

In all, for the period ended Sept. 30, Ocwen posted a loss of

$66.9 million, compared with a loss of $75.4 million a year

earlier. On a per-share basis, which reflects dividend-related

payments, the per-share loss narrowed to 53 cents a share from 58

cents a share a year earlier.

Revenue fell to $405 million from $513.7 million in the

prior-year period, as its revenue from servicing fees fell 23%.

Analysts polled by Thomson Reuters had forecast a loss of 35

cents a share on $410.2 million in revenue.

Total expenses slipped 15% from the prior year to $387.7

million.

Shares of Ocwen, inactive in after-hours trading, are down 53%

this year.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 28, 2015 17:05 ET (21:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

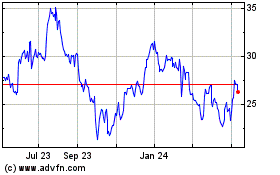

Ocwen Financial (NYSE:OCN)

Historical Stock Chart

From Aug 2024 to Sep 2024

Ocwen Financial (NYSE:OCN)

Historical Stock Chart

From Sep 2023 to Sep 2024