Global Stocks Rally After Fed Decision

December 17 2015 - 5:10AM

Dow Jones News

Global stocks surged on Thursday as investors around the world

reacted positively to the Federal Reserve's decision to raise

interest rates and the confidence in the U.S. economy that

underpinned the move.

European stocks moved higher in early trade, following sharp

gains across Asian markets and a higher close on Wall Street in

response to the widely expected move by the Fed to end a seven-year

experiment with near-zero interest rates.

The Stoxx Europe 600 rose 2.1% in early trade, with gains across

the board, while Japan's Nikkei Stock Average gained 1.6% and the

Shanghai Composite was up 1.8% on signs of a strengthening U.S.

economy.

While ultralow interest rates have boosted equity markets in

recent years, investors were reassured by the Fed's relatively

upbeat outlook on the world's biggest economy and its plans to

raise rates only gradually over the next three years.

"What we see today is basically a sigh of relief," said Johan

Javeus, chief strategist at SEB Group. "Equity markets are taking

comfort in the fact that this is not the path of a rapid hiking

cycle, and it will be data-dependent and focused on inflation."

"The messaging around the decision is about as positive as one

could expect for investors: a positive economic assessment paired

with fairly dovish central bank guidance," said Eric Lascelles,

chief economist at RBC Global Asset Management.

The decision also removed an immediate source of uncertainty in

markets.

The yield on the rate-sensitive two-year U.S. Treasury settled

above 1% for the first time in over five years on Wednesday.

Selling in bond and currency markets was relatively muted as

policy members had long telegraphed their intentions to markets for

a rate rise in 2015. The dollar continued to edge up early

Thursday. The euro was down 0.3% against the dollar at $1.0856,

while the dollar was up slightly against the yen at Y122.44.

While the Fed signaled it was moving to normalize monetary

policy for the first time since the financial crisis, other central

banks, including the Bank of Japan and European Central Bank, have

continued with easing measures.

Investors will now consider the implications of diverging

policy. The European Central Bank needs the euro to fall against

the dollar to stoke inflation, and if U.S. rate rises fail to boost

the dollar it could prompt the ECB to tweak its own monetary

policy.

In commodities, Brent crude oil was down 1% at $37.01 a barrel.

Higher interest rates usually make dollar-denominated commodity

prices more expensive for foreign purchasers. A

larger-than-expected increase in U.S. crude stockpiles also weighed

on prices.

Gold continued to decline, falling 0.9% to $1,066, after the Fed

decision. Tighter monetary policy typically make gold less

attractive to investors as it competes with yield-bearing assets

and the prospect of higher rates in the U.S. has driven the

commodity down for much of the year.

Still, some market participants remained worried that the Fed is

ending a period of near-zero rates at a time of weak global

growth.

"Maybe it's the first step in a long journey to equilibrium,"

said Riad Younes, portfolio manager at RSQ International Equity

Fund. "But the question is it a premature step?"

Plunging commodities prices and worrying signs in the junk bond

market have hit equities in the past week, while signs of stress in

emerging markets have raised concerns about global demand.

Emerging markets have been rattled for months about the prospect

of rising U.S. rates, which strengthen the dollar and make it

difficult for emerging markets to repay their debts.

"We're still living in challenging times," said Mr. Younes.

Gains for European equities were led by the auto sector, with

shares in Daimler AG up 2.9%. Banks and health care stocks also

rose sharply, with Novartis AG up 2.5% and HSBC Holdings PLC

gaining 2%.

Write to Riva Gold at riva.gold@wsj.com

(END) Dow Jones Newswires

December 17, 2015 04:55 ET (09:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

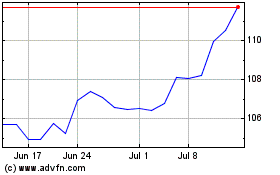

Novartis (NYSE:NVS)

Historical Stock Chart

From Aug 2024 to Sep 2024

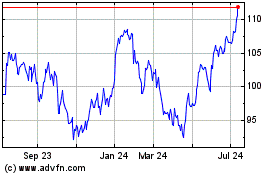

Novartis (NYSE:NVS)

Historical Stock Chart

From Sep 2023 to Sep 2024