By Alyssa Abkowitz

BEIJING--Wang Xiaoxi once aspired to the skinny arms and legs

that fit the traditional Chinese standards of beauty.

These days, however, she works on toning her quadriceps while

clad in Nike shoes and Lululemon gear that cost her 5,000 yuan

(about $780). Gym fees set her back another 10,000 yuan for six

months.

Ms. Wang says her clothes fit better and she sleeps well now,

but "my wallet is crying because I always want to buy new workout

clothes."

"Crazy gym devils," as gym rats are called in China, are

generating big sales for the likes of Nike Inc. and Adidas AG.

These companies are increasingly focusing their marketing on young

women, many of whom now reject the waifish look in favor of toned,

strong silhouettes.

Gym and health-club revenue in China has nearly doubled during

the past five years and is expected to total more than $5 billion

this year, according to research firm IBIS World.

Overall, women's products make up less than 40% of the

sportswear market in China, according to Frost & Sullivan, a

business consulting company. Still, that niche has seen

double-digit year-over-year growth during the past five years.

"When choosing sportswear, female consumers consider brand and

product design first," said Neil Wang, managing director at Frost

& Sullivan.

Sports apparel retail value, as measured by retail sales prices,

rose at a mean annual growth rate of 10% from 2010 to 2014. Nike

and Adidas led the way with market shares of 14.4% and 13.8%,

respectively.

Sales of protein powder, which is used to help build muscle, hit

nearly 392 million yuan last year, up from 275 million yuan in

2012, according to data provider Euromonitor International.

Adidas' sales in China, Hong Kong and Taiwan grew 18% in the

first nine months of 2015 to 1.9 billion euros ($2 billion),

compared with 1.3 billion euros in the first nine months of last

year, while Nike's revenue rose 30% in its last quarter from the

same period a year before.

Under Armour, which had fewer than 40 stores in China at the

beginning of 2015, plans to establish more than 100 by the end of

the year. Lululemon opened two showrooms, or smaller versions of

their retails stores, in Shanghai last year and its Beijing

showroom opened last week.

Some of the push for chiseled abs and muscular legs is coming

from the Chinese government, which is trying to build a 5 trillion

yuan sports industry by 2025 and seeks to improve the health of its

citizens as it broadens government-sponsored medical care.

The Chinese government also wants to remove barriers that make

it difficult for these businesses to grow in an effort to attract

foreign investment in the domestic sports industry.

With Beijing hosting the 2022 Winter Olympics there is an

additional incentive to bolster this sector.

This year, China's sports industry is expected to account for

0.7% of GDP and the government would like that number to increase.

Also, as more people move into the middle class they have

additional money to spend on health and fitness.

In November, the People's Liberation Army released a five-minute

workout video that involved stretching, vigorous marching and arm

pumping.

One of the biggest segments driving much of the growth for

Western work-out brands is women.

"It used to be muscle tone is not what you wanted," said Erick

Haskell, managing director for greater China at Under Armour.

"There's a changing conversation of what it means to be a female

athlete in China."

Only a couple of years ago, it would have been difficult to find

Chinese women breaking a sweat while lifting weights or huffing and

puffing through strenuous workouts.

"A large amount of women have started exercising and western

brands are paying high attention," Mr. Wang said. "They are

conducting deep market research on women's fitness demand and

developing a specialized product mix for women."

Shen Danning, a 21-year-old college student from Shanghai who

lives in the city of Wuhan, hits the gym three times a week,

lifting 20-pound weights for shoulder presses and 15-pound weights

for squats and lunges.

The self-described "chubby girl for 10 years" gave up on dieting

and began going to the gym earlier this year. She now stocks up on

Nike sports bras (three for 860 yuan) and Adidas running shoes (two

pairs for about 1,000 yuan), and has spent about 18,000 yuan

(roughly $2,800) on gym and personal training fees during the past

six months.

"It's not necessary to save money when it comes to health," said

Ms. Shen, who noted that she has lost 15 pounds. "I want to feel

comfortable when I go to the gym and buy clothing that helps my

skin breathe."

Adidas has opened women's-only stores in Shanghai and the city

of Chengdu, featuring softer lighting, boutique-style clothing

displays and on-site fitness sessions.

Nike, which opened a women's-only store in Shanghai last year,

held three if its Women's Race Series in greater China in 2015. The

number of its female runners in China using the Nike+

fitness-tracking device is growing faster than the number of male

runners, the company said.

Brands that haven't been in the game as long also are determined

to garner favor with women.

GNC, which entered the market in 2011, has begun selling

women-specific health products such as herbal supplements, on the

online retailer xiaohongshu.com. Under Armour, which entered the

market in earnest three years ago, recently opened a

14,000-square-foot store in Shanghai. Lululemon regularly hosts

large events, such a recent 1,200-person party on the Bund in

Shanghai, that included a 10K race, beach yoga and volleyball, to

help promote the brand.

"The market presents an incredible opportunity to continue our

expansion efforts," said Ken Lee, Lululemon's Asia general

manager.

Lilian Lin contributed to this article.

Write to Alyssa Abkowitz at alyssa.abkowitz@wsj.com

(END) Dow Jones Newswires

December 21, 2015 22:46 ET (03:46 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

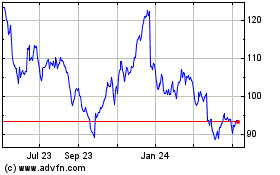

Nike (NYSE:NKE)

Historical Stock Chart

From Aug 2024 to Sep 2024

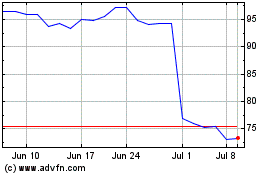

Nike (NYSE:NKE)

Historical Stock Chart

From Sep 2023 to Sep 2024