Union Bank Granted Federal Home Loan Bank of San Francisco Program Funds to Assist Qualified First-time Home Buyers

May 02 2016 - 11:00AM

Business Wire

Union Bank today announced that it has received $1.75 million in

program funds from The Federal Home Loan Bank (FHLB) of San

Francisco to provide matching grants to low- and moderate-income,

first-time home buyers. The bank received $1.5 million in Workforce

Initiative Subsidy for Homeownership (WISH) Program funds and

$250,000 in Individual Development and Empowerment Account (IDEA)

Program funds. This is the sixth year that the bank has received

WISH and IDEA program funds.

“We are honored that the FHLB of San Francisco has entrusted us

again this year with both WISH and IDEA program funds,” said Julius

Robinson, head of Corporate Social Responsibility for the Americas

at Union Bank. “Like the FHLB, we believe that home ownership is

critical to building strong, vibrant communities and we look

forward to putting these funds to work to help even more buyers

achieve the dream of home ownership.”

The WISH and IDEA first-time homebuyer programs offer eligible

low- and moderate-income households 3-to-1 matching grants of up to

$15,000 for the purchase of a home. The funds can be applied to the

home buyer’s down payment or closing costs. WISH grants are

targeted to working families and individuals who are ready to make

the transition from renting to owning. The WISH funds can

complement or supplement a number of local, state, and federal

homeownership programs and initiatives. IDEA grants are targeted to

homebuyers who have been saving for the purchase of their first

home through an Individual Development Account (IDA) or

participating in their local housing authority’s Family

Self-Sufficiency (FSS) homeownership program or in a lease-to-own

program administered by a government entity or nonprofit

organization.

Union Bank will provide this year’s matching grants to qualified

homebuyers in California, and for the first time, Oregon and

Washington. The funds will be available for home buyers with loans

in escrow between April 1, 2016 and July 31, 2017.

Last year, the bank provided 45 WISH matching grants for a total

of $650,000.

About MUFG Union Bank, N.A.

MUFG Union Bank, N.A., is a full-service bank with offices

across the United States. We provide a wide spectrum of corporate,

commercial and retail banking and wealth management solutions to

meet the needs of customers. We also offer an extensive portfolio

of value-added solutions for customers, including investment

banking, personal and corporate trust, global custody, transaction

banking, capital markets, and other services. With assets of $120.0

billion, as of March 31, 2016, MUFG Union Bank has strong capital

reserves, credit ratings and capital ratios relative to peer banks.

MUFG Union Bank is a proud member of the Mitsubishi UFJ Financial

Group (NYSE: MTU), one of the world’s largest financial

organizations with total assets of approximately ¥295.8 trillion

(JPY) or $2.5 trillion (USD)¹, as of December 31, 2015. The

corporate headquarters (principal executive office) for MUFG

Americas Holdings Corporation, which is the financial holding

company and MUFG Union Bank, is in New York City. The main banking

office of MUFG Union Bank is in San Francisco, California.

1 Exchange rate of 1 USD=¥120.6 (JPY) as of December 30,

2015

©2016 MUFG Union Bank, N.A. All rights reserved. Member

FDIC.Union Bank is a registered trademark and brand name of MUFG

Union Bank, N.A.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160502005218/en/

MUFG Union Bank, N.A.Jane Yedinak,

415-773-2497jane.yedinak@unionbank.com@UnionBankNews

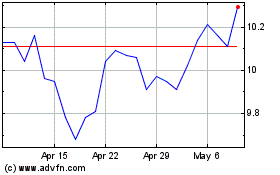

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

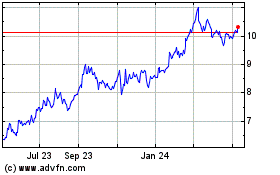

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024