Sumitomo Mitsui Unit to Buy GE's Japan Leasing Business

December 15 2015 - 4:10AM

Dow Jones News

TOKYO—The leasing unit of Sumitomo Mitsui Financial Group Inc.

said Tuesday it reached an agreement to buy General Electric Co.'s

Japan leasing business for ¥ 575 billion ($4.8 billion).

As part of its global plan to unwind its GE Capital financing

business, GE placed the Japanese business up for sale earlier this

year, and several Japanese financial institutions expressed

interest.

The business for sale has an asset value of nearly $5 billion.

It comprises several divisions, including auto leasing, equipment

and asset leasing targeted at large- and midsize companies, as well

as leasing of office and information technology equipment.

The acquisition of the GE business would make SMFG's leasing

business, called Sumitomo Mitsui Finance & Leasing, a joint

venture with Sumitomo Corp., one of the top players in Japan's

leasing industry. The business is more attractive than traditional

lending because of low interest rates on loans and sluggish loan

demand.

SMFG, Japan's second-largest bank by revenue after Mitsubishi

UFJ Financial Group Inc., has already bought other assets from GE.

In July, it bought GE's European private-equity financing business

for about $2.2 billion.

GE said it received financial advice on the transaction from

Morgan Stanley and the investment bank's Japanese joint venture,

Mitsubishi UFJ Morgan Stanley Securities.

Sumitomo Mitsui Finance & Leasing plans to make GE Japan its

subsidiary in April 2016.

Write to Atsuko Fukase at atsuko.fukase@wsj.com

(END) Dow Jones Newswires

December 15, 2015 03:55 ET (08:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

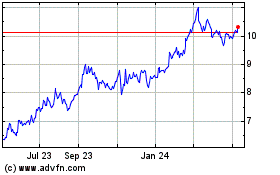

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

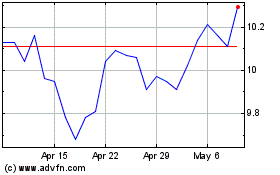

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024