Molina Healthcare, Inc. (NYSE: MOH):

- Net income per diluted share for the

quarter of $0.58.

- Adjusted net income per diluted share

for the quarter of $0.67.

- Net income per diluted share for the

quarter up 35% over first quarter 2016.

- Adjusted net income per diluted share

for the quarter up 31% over first quarter 2016.

- Total revenue for the quarter of $4.4

billion, up 24% over second quarter 2015.

- Aggregate membership up 26% over second

quarter 2015.

Molina Healthcare, Inc. (NYSE: MOH) today reported its financial

results for the second quarter of 2016.

“The results we have reported today reflect meaningful progress

from the first quarter of 2016,” said J. Mario Molina, M.D., chief

executive officer of Molina Healthcare, Inc. “Last quarter, we

identified specific improvements that we needed to make to our

operations. Today’s announcement demonstrates that we are making

good headway with this work. The issues we identified in Ohio and

Texas in the first quarter are substantially resolved, and work in

Puerto Rico is well under way.”

Update on Financial

Performance

Second Quarter 2016 Compared With First Quarter 2016

Second quarter 2016 financial performance improved significantly

when compared with the first quarter of 2016. Earnings per diluted

share increased to $0.58 in the second quarter of 2016 from $0.43

in the first quarter. Adjusted earnings per diluted share increased

to $0.67 in the second quarter of 2016 from $0.51 in the first

quarter.

Higher profitability in the second quarter was primarily the

result of improvements at the Ohio and Texas health plans. The

medical care ratio of the Ohio health plan decreased to 89.7% in

the second quarter of 2016 from 92.0% in the first quarter. The

medical care ratio of the Texas health plan decreased to 78.5% in

the second quarter of 2016 from 92.8% in the first quarter. Even

without the benefit of out-of-period quality revenue adjustments

discussed below, the medical care ratio of the Texas health plan

would have been approximately 85.3% in the second quarter, still

well under the 92.8% medical care ratio reported in the first

quarter.

In total, out-of-period adjustments related to 2015 dates of

service were not significant to second quarter performance.

Out-of-period adjustments were significant, however, on a

geographic and program basis. Out-of-period adjustments were the

result of changes in accounting estimates made as new information

became available to the Company. The table below will help the

reader to understand the discussion that follows.

Summary of

Significant Out-of-Period Adjustments Affecting 2016 Financial

Results

Three Months Ended Six Months

Ended June 30, 2016 June 30, 2016 (In

millions, except per diluted share amounts) Amount

Per Diluted

Share

Amount

Per Diluted

Share

Marketplace adjustments for 2015 dates of service $ (37 ) $ (0.42 )

$ (68 ) $ (0.76 )

Texas quality revenue adjustment for

2014/2015 dates of service

44 0.50 44 0.49 Texas quality revenue adjustment for 1Q 2016 dates

of service 7 0.08 N/A N/A Puerto Rico premium revenue adjustment

for 2015 dates of service (11 ) (0.12 ) (11 ) (0.12 ) Florida

premium revenue adjustment for 2014/2015 dates of service —

— 18 0.20 Total out-of-period adjustments, net

$ 3 $ 0.04 $ (17 ) $ (0.19 )

Out-of-period adjustments increased pretax income by

approximately $3 million (or approximately $0.04 per diluted share)

in the second quarter of 2016. Specifically:

- Adjustments related to 2015 dates of

service reduced Marketplace pretax income by approximately $37

million (or approximately $0.42 per diluted share) in the second

quarter. On June 30, 2016, the Centers for Medicare and Medicaid

Services released the final update on risk adjustment and

reinsurance payments for the 2015 benefit year, and we adjusted our

accruals accordingly.

- During the second quarter, we were

informed by the Texas Department of Health and Human Services that

it will not recoup any quality revenue for calendar years 2014,

2015, and 2016. Therefore, we recognized previously deferred

quality revenue amounting to approximately $51 million (or

approximately $0.58 per diluted share) in the second quarter of

2016. Of the $51 million adjustment, $44 million related to 2015

and 2014 dates of service, and $7 million related to the first

quarter of 2016.

- Reductions to revenue previously

recorded for 2015 dates of service in Puerto Rico decreased pretax

income by approximately $11 million (or approximately $0.12 per

diluted share) in the second quarter.

Understanding the First Half of 2016

We reported pretax income of $144 million for the first half of

2016. These results were affected by several out-of-period

adjustments related to dates of service in 2015 and 2014. In total,

these adjustments reduced pretax income in the first half of 2016

by approximately $17 million (or approximately $0.19 per diluted

share). Specifically:

- Adjustments related to 2015 dates of

service reduced Marketplace pretax income by approximately $68

million (or approximately $0.76 per diluted share) in the first

half of 2016. We now estimate that the medical care ratio for our

Marketplace program for all of 2015 was approximately 80%. Through

June 30, 2016, the medical care ratio of our Marketplace program

for months of service in the first half of 2016 alone (exclusive of

out-of-period adjustments) was approximately 78%.

- As described above, the recognition of

Texas quality revenue associated with calendar years 2014 and 2015

increased pretax income in the first half of 2016 by approximately

$44 million (or approximately $0.49 per diluted share).

- Also as noted above, reductions to 2015

premium revenue in Puerto Rico reduced pretax income by

approximately $11 million (or approximately $0.12 per diluted

share) in the first half of 2016.

- Retroactive adjustments to premium

revenue in Florida for dates of service in 2014 and 2015 increased

pretax income by approximately $18 million (or approximately $0.20

per diluted share) in the first half of 2016. Prior to reporting

first quarter 2016 results, we were informed by the Florida Agency

for Health Care Administration that we were due a retroactive

increase to Medicaid premium revenue relating to dates of service

prior to 2016. We reported this development in our first quarter

2016 results.

Net Income per Share Guidance

Our net income per share guidance for fiscal year 2016 remains

unchanged. We expect the following factors, among others, to affect

our financial performance in the second half of 2016:

- The ultimate savings to be realized

from various cost savings initiatives and the speed at which such

savings will be realized.

- Medicaid rate increases (excluding

Medicaid Expansion) of approximately 3.0% in California (effective

July 1, 2016); approximately 2.5% in Puerto Rico (effective July 1,

2016); and approximately 3.0% in Texas (effective September 1,

2016). All rate changes are consistent with our previous

expectations.

- Medicaid Expansion rate decreases of

approximately 11.0% in California (effective July 1, 2016) and

approximately 2.0% in Ohio (effective July 1, 2016). All rate

changes are consistent with our previous expectations.

- The implementation of a medical care

ratio floor of 86.0% for the South Carolina Medicaid program

effective July 1, 2016.

- Declining margins for our Marketplace

business during the second half of 2016 due to normal membership

attrition; the addition of higher cost members through the special

enrollment process; higher costs as members reach the limits of the

cost-sharing provisions of their insurance coverage; and increasing

utilization as members become more engaged with our care networks.

This is consistent with our previous expectations.

Conference Call

Management will host a conference call and webcast to discuss

Molina Healthcare's second quarter results at 5:00 p.m. Eastern

time on Wednesday, July 27, 2016. The number to call for the

interactive teleconference is (212) 271-4651. A telephonic replay

of the conference call will be available from 7:00 p.m. Eastern

time on Wednesday, July 27, 2016, through 6:00 p.m. Eastern Time on

Thursday, July 28, 2016, by dialing (800) 633-8284 and entering

confirmation number 21812476. A live audio broadcast of Molina

Healthcare’s conference call will be available on our website,

molinahealthcare.com. A 30-day online

replay will be available approximately an hour following the

conclusion of the live broadcast.

About Molina Healthcare

Molina Healthcare, Inc., a FORTUNE 500 company, provides managed

health care services under the Medicaid and Medicare programs and

through the state insurance marketplaces. Through our locally

operated health plans in 11 states across the nation and in the

Commonwealth of Puerto Rico, Molina currently serves approximately

4.2 million members. Dr. C. David Molina founded our company in

1980 as a provider organization serving low-income families in

Southern California. Today, we continue his mission of providing

high quality and cost-effective health care to those who need it

most. For more information about Molina Healthcare, please visit

our website at molinahealthcare.com.

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995: This earnings release contains

“forward-looking statements” regarding our plans, expectations, and

anticipated future events. Actual results could differ materially

due to numerous known and unknown risks and uncertainties. Those

known risks and uncertainties include, but are not limited to, the

following:

- the success of our profit improvement

and cost-cutting initiatives;

- uncertainties and evolving market and

provider economics associated with the implementation of the

Affordable Care Act (the “ACA”), the Medicaid expansion, the

insurance marketplaces, the effect of various implementing

regulations, and uncertainties regarding the Medicare-Medicaid dual

eligible demonstration programs in California, Illinois, Michigan,

Ohio, South Carolina, and Texas;

- management of our medical costs,

including our ability to reduce over time the high medical costs

commonly associated with new patient populations;

- our ability to predict with a

reasonable degree of accuracy utilization rates, including

utilization rates in new plans, geographies, and programs where we

have less experience with patient and provider populations, and

also including utilization rates associated with seasonal flu

patterns or other newly emergent diseases;

- our ability to manage growth, including

maintaining and creating adequate internal systems and controls

relating to authorizations, approvals, provider payments, and the

overall success of our care management initiatives designed to

control costs;

- our receipt of adequate premium rates

to support increasing pharmacy costs, including costs associated

with specialty drugs and costs resulting from formulary changes

that allow the option of higher-priced non-generic drugs;

- our ability to operate profitably in an

environment where the trend in premium rate increases lags behind

the trend in increasing medical costs;

- the interpretation and implementation

of federal or state medical cost expenditure floors, administrative

cost and profit ceilings, premium stabilization programs, profit

sharing arrangements, and risk adjustment provisions;

- the interpretation and implementation

of at-risk premium rules regarding the achievement of certain

quality measures, and our ability to recognize revenue amounts

associated therewith;

- the interpretation and implementation

of state contract performance requirements regarding the

achievement of certain quality measures, and our ability to avoid

liquidated damages associated therewith;

- cyber-attacks or other privacy or data

security incidents resulting in an inadvertent unauthorized

disclosure of protected health information;

- the success of our health plan in

Puerto Rico, including the resolution of the Puerto Rico debt

crisis, payment of all amounts due under our Medicaid contract, the

effect of the newly enacted PROMESA law, and our efforts to better

manage the health care costs of our Puerto Rico health plan;

- significant budget pressures on state

governments and their potential inability to maintain current

rates, to implement expected rate increases, or to maintain

existing benefit packages or membership eligibility thresholds or

criteria, including the resolution of the Illinois budget impasse

and continued payment of all amounts due to our Illinois health

plan;

- the accurate estimation of incurred but

not reported or paid medical costs across our health plans;

- subsequent adjustments to reported

premium revenue based upon subsequent developments or new

information, including changes to estimated amounts due to or

receivable from CMS under the ACA's “three R’s” marketplace premium

stabilization programs;

- efforts by states to recoup previously

paid amounts, including our dispute with the state of New Mexico

related to reimbursement for retroactively enrolled members in

2014;

- the success of our efforts to retain

existing government contracts and to obtain new government

contracts in connection with state requests for proposals (RFPs) in

both existing and new states;

- the continuation and renewal of the

government contracts of our health plans, Molina Medicaid

Solutions, and Pathways, and the terms under which such contracts

are renewed;

- complications, member confusion, or

enrollment backlogs related to the annual renewal of Medicaid

coverage;

- government audits and reviews, and any

fine, enrollment freeze, or monitoring program that may result

therefrom;

- changes with respect to our provider

contracts and the loss of providers;

- approval by state regulators of

dividends and distributions by our health plan subsidiaries;

- changes in funding under our contracts

as a result of regulatory changes, programmatic adjustments, or

other reforms;

- high dollar claims related to

catastrophic illness;

- the favorable resolution of litigation,

arbitration, or administrative proceedings;

- the relatively small number of states

in which we operate health plans;

- the effect on our Los Angeles County

subcontract of Centene Corporation’s acquisition of Health Net

Inc.;

- the availability of adequate financing

on acceptable terms to fund and capitalize our expansion and

growth, repay our outstanding indebtedness at maturity and meet our

liquidity needs, including the interest expense and other costs

associated with such financing;

- the failure of a state in which we

operate to renew its federal Medicaid waiver;

- changes generally affecting the managed

care or Medicaid management information systems industries;

- increases in government surcharges,

taxes, and assessments, including but not limited to the

deductibility of certain compensation costs;

- newly emergent viruses or widespread

epidemics, including the Zika virus, public catastrophes or

terrorist attacks, and associated public alarm;

- changes in general economic conditions,

including unemployment rates;

- the sufficiency of our funds on hand to

pay the amounts due upon conversion of our outstanding notes;

- increasing competition and

consolidation in the Medicaid industry;

and numerous other risk factors, including those discussed in

our periodic reports and filings with the Securities and Exchange

Commission. These reports can be accessed under the investor

relations tab of our website or on the SEC’s website at

sec.gov. Given these risks and

uncertainties, we can give no assurances that our forward-looking

statements will prove to be accurate, or that any other results or

events projected or contemplated by our forward-looking statements

will in fact occur, and we caution investors not to place undue

reliance on these statements. All forward-looking statements in

this release represent our judgment as of July 27, 2016, and we

disclaim any obligation to update any forward-looking statements to

conform the statement to actual results or changes in our

expectations.

MOLINA HEALTHCARE, INC.

UNAUDITED CONSOLIDATED STATEMENTS OF

INCOME

Three Months Ended June 30, Six Months Ended June

30, 2016 2015 2016

2015 (Dollar amounts in millions, except net

income per share) Revenue: Premium revenue $ 4,029 $ 3,304 $

8,024 $ 6,275 Service revenue 135 47 275 99 Premium tax revenue 109

95 218 190 Health insurer fee revenue 76 74 166 122 Investment

income 8 4 16 7 Other revenue 2 1 3 3

Total revenue 4,359 3,525 8,702 6,696

Operating expenses: Medical care costs 3,594 2,929 7,182 5,565 Cost

of service revenue 116 33 243 69 General and administrative

expenses 351 287 691 543 Premium tax expenses 109 95 218 190 Health

insurer fee expenses 50 40 108 81 Depreciation and amortization 34

25 66 50 Total operating expenses 4,254

3,409 8,508 6,498 Operating income 105

116 194 198 Interest expense 25 15 50 30

Income before income tax expense 80 101 144 168 Income tax

expense 47 62 87 101 Net income $ 33

$ 39 $ 57 $ 67 Diluted net

income per share $ 0.58 $ 0.72 $ 1.01 $ 1.29

Diluted weighted average shares outstanding 55.5

53.9 56.3 52.0

Operating

Statistics: Medical care ratio (1) 89.2 % 88.7 % 89.5 % 88.7 %

General and administrative expense ratio (2) 8.1 % 8.1 % 7.9 % 8.1

% Premium tax ratio (1) 2.6 % 2.8 % 2.6 % 2.9 % Effective tax rate

59.8 % 61.3 % 60.7 % 60.1 % Net profit margin (2) 0.7 % 1.1 % 0.7 %

1.0 % (1) Medical care ratio represents medical care costs

as a percentage of premium revenue; premium tax ratio represents

premium tax expenses as a percentage of premium revenue plus

premium tax revenue. (2) Computed as a percentage of total revenue.

MOLINA HEALTHCARE, INC.

UNAUDITED CONSOLIDATED BALANCE

SHEETS

June 30, December 31, 2016 2015

(Unaudited) (Amounts in millions,except per-share

data) ASSETS Current assets: Cash and cash equivalents $

2,345 $ 2,329 Investments 1,968 1,801 Receivables 1,012 597 Income

taxes refundable 23 13 Prepaid expenses and other current assets

197 192 Derivative asset — 374 Total current assets

5,545 5,306 Property, equipment, and capitalized software, net 448

393 Deferred contract costs 80 81 Intangible assets, net 146 122

Goodwill 611 519 Restricted investments 107 109 Deferred income

taxes — 18 Derivative asset 226 — Other assets 39 28

$ 7,202 $ 6,576

LIABILITIES AND

STOCKHOLDERS’ EQUITY Current liabilities: Medical claims and

benefits payable $ 1,766 $ 1,685 Amounts due government agencies

1,238 729 Accounts payable and accrued liabilities 537 362 Deferred

revenue 104 223 Current portion of long-term debt 1 449 Derivative

liability — 374 Total current liabilities 3,646 3,822

Senior notes 1,428 962 Lease financing obligations 198 198 Deferred

income taxes 25 — Derivative liability 226 — Other long-term

liabilities 38 37 Total liabilities 5,561

5,019 Stockholders’ equity: Common stock, $0.001 par value;

150 shares authorized; outstanding: 57 shares at June 30, 2016 and

56 shares at December 31, 2015 — — Preferred stock, $0.001 par

value; 20 shares authorized, no shares issued and outstanding — —

Additional paid-in capital 822 803 Accumulated other comprehensive

gain (loss) 4 (4 ) Retained earnings 815 758 Total

stockholders’ equity 1,641 1,557 $ 7,202 $

6,576

MOLINA HEALTHCARE, INC.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

Three Months Ended June 30, Six Months Ended June

30, 2016 2015 2016

2015 (Amounts in millions) Operating

activities: Net income $ 33 $ 39 $ 57 $ 67 Adjustments to reconcile

net income to net cash provided by operating activities:

Depreciation and amortization 45 29 89 62 Deferred income taxes 9 6

39 7 Share-based compensation 9 3 16 9 Amortization of convertible

senior notes and lease financing obligations 7 8 15 15 Other, net 5

6 11 9 Changes in operating assets and liabilities: Receivables

(149 ) (140 ) (415 ) (35 ) Prepaid expenses and other assets 59 40

(143 ) (97 ) Medical claims and benefits payable (173 ) 44 82 292

Amounts due government agencies 328 203 509 298 Accounts payable

and accrued liabilities (58 ) (31 ) 147 158 Deferred revenue 10

(112 ) (119 ) (138 ) Income taxes 14 (1 ) (10 ) 1 Net

cash provided by operating activities 139 94 278

648 Investing activities: Purchases of

investments (363 ) (555 ) (974 ) (993 ) Proceeds from sales and

maturities of investments 464 286 812 541 Purchases of property,

equipment, and capitalized software (56 ) (41 ) (102 ) (66 )

Change in restricted investments

9 (9 ) 5 (14 ) Net cash paid in business combinations (6 ) — (8 )

(8 ) Other, net (7 ) (10 ) (6 ) (17 ) Net cash provided by (used

in) investing activities 41 (329 ) (273 ) (557 )

Financing activities: Proceeds from common stock offering, net of

issuance costs — 373 — 373 Proceeds from employee stock plans 10 7

10 8 Other, net (1 ) (1 ) 1 3 Net cash provided by

financing activities 9 379 11 384 Net

increase in cash and cash equivalents 189 144 16 475 Cash and cash

equivalents at beginning of period 2,156 1,870 2,329

1,539 Cash and cash equivalents at end of period $

2,345 $ 2,014 $ 2,345 $ 2,014

MOLINA HEALTHCARE, INC.UNAUDITED

NON-GAAP FINANCIAL MEASURES

We use two non-GAAP financial measures as supplemental metrics

in evaluating our financial performance, making financing and

business decisions, and forecasting and planning for future

periods. For these reasons, management believes such measures are

useful supplemental measures to investors in comparing our

performance to the performance of other public companies in the

health care industry. These non-GAAP financial measures should be

considered as supplements to, and not as substitutes for or

superior to, GAAP measures.

The first of these non-GAAP measures is earnings before

interest, taxes, depreciation and amortization (EBITDA). We believe

that EBITDA is particularly helpful in assessing our ability to

meet the cash demands of our operating units. The following table

reconciles net income, which we believe to be the most comparable

GAAP measure, to EBITDA.

Three Months Ended June 30,

Six Months Ended June 30, 2016

2015 2016 2015 (Amounts in

millions) Net income $ 33 $ 39 $ 57 $ 67 Adjustments:

Depreciation, and amortization of intangible assets and capitalized

software 39 29 76 58 Interest expense 25 15 50 30 Income tax

expense 47 62 87 101 EBITDA $ 144 $ 145

$ 270 $ 256

The second of these non-GAAP measures is adjusted net income

(including adjusted net income per diluted share). We believe that

adjusted net income per diluted share is very helpful in assessing

our financial performance exclusive of the non-cash impact of the

amortization of purchased intangibles. The following table

reconciles net income, which we believe to be the most comparable

GAAP measure, to adjusted net income.

Three Months Ended June 30,

Six Months Ended June 30, 2016

2015 2016 2015 (In millions,

except per diluted share amounts) Amount

Per share Amount Per share

Amount Per share Amount

Per share Net income $ 33 $ 0.58 $ 39 $ 0.72 $ 57 $

1.01 $ 67 $ 1.29 Adjustment, net of tax: Amortization of intangible

assets 5 0.09 3 0.05 10 0.17

6 0.10 Adjusted net income $ 38 $ 0.67

$ 42 $ 0.77 $ 67 $ 1.18 $ 73 $

1.39

MOLINA HEALTHCARE, INC.

UNAUDITED HEALTH PLANS SEGMENT

MEMBERSHIP

June 30, March 31, December 31, June

30, 2016 2016 2015 2015 Ending

Membership by Health Plan: California 680,000 676,000 620,000

593,000 Florida 565,000 576,000 440,000 348,000 Illinois 201,000

206,000 98,000 101,000 Michigan 393,000 399,000 328,000 260,000 New

Mexico 251,000 246,000 231,000 225,000 Ohio 341,000 336,000 327,000

332,000

Puerto Rico

336,000 339,000 348,000 361,000 South Carolina 105,000 102,000

99,000 114,000 Texas 367,000 380,000 260,000 266,000 Utah 151,000

151,000 102,000 92,000 Washington 709,000 672,000 582,000 553,000

Wisconsin 134,000 137,000 98,000 107,000

4,233,000 4,220,000 3,533,000 3,352,000

Ending Membership by Program:

Temporary Assistance for Needy Families

(TANF), CHIP(1)

2,500,000 2,485,000 2,312,000 2,180,000 Medicaid Expansion 654,000

632,000 557,000 475,000 Marketplace 597,000 630,000 205,000 261,000

Aged, Blind or Disabled (ABD) 387,000 380,000 366,000 353,000

Medicare-Medicaid Plan (MMP) - Integrated 51,000 50,000 51,000

39,000 Medicare Special Needs Plans 44,000 43,000

42,000 44,000 4,233,000 4,220,000 3,533,000

3,352,000

(1) CHIP stands for Children’s Health

Insurance Program.

MOLINA HEALTHCARE, INC.

UNAUDITED SELECTED HEALTH PLANS SEGMENT

FINANCIAL DATA

(In millions, except percentages and

per-member per-month amounts)

Three Months Ended June 30, 2016

Member

Months(1)

Premium Revenue Medical Care

Costs MCR(2)

Medical Margin Total PMPM

Total PMPM California 2.0 $ 554 $

268.95 $ 493 $ 239.63 89.1 % $ 61 Florida 1.8 464 273.90 426 251.69

91.9 38 Illinois 0.6 154 256.17 137 227.71 88.9 17 Michigan 1.2 369

312.18 334 282.86 90.6 35 New Mexico 0.8 342 451.72 305 403.52 89.3

37 Ohio 1.0 483 473.91 433 424.87 89.7 50 Puerto Rico 1.0 170

169.04 175 173.49 102.6 (5 ) South Carolina 0.3 87 277.22 71 226.27

81.6 16 Texas 1.1 635 571.14 499 448.23 78.5 136 Utah 0.5 110

240.26 106 233.12 97.0 4 Washington 2.1 559 264.40 500 236.32 89.4

59 Wisconsin 0.4 99 244.88 96 235.88 96.3 3 Other(3) — 3

— 19 — — (16 ) 12.8 $ 4,029 $ 316.72 $

3,594 $ 282.54 89.2 % $ 435

Three Months

Ended June 30, 2015 Member

Months(1)

Premium Revenue Medical Care Costs

MCR(2) Medical Margin Total PMPM

Total PMPM California 1.7 $ 503 $ 285.14 $ 459 $

259.85 91.1 % $ 44 Florida 1.1 257 244.35 217 205.97 84.3 40

Illinois 0.3 102 337.55 98 325.91 96.6 4 Michigan 0.8 237 307.27

200 258.67 84.2 37 New Mexico 0.7 322 466.46 276 400.27 85.8 46

Ohio 1.1 509 510.30 432 433.75 85.0 77 Puerto Rico 1.1 194 179.33

184 170.32 95.0 10 South Carolina 0.4 93 276.36 67 196.92 71.3 26

Texas 0.8 512 635.74 468 581.42 91.5 44 Utah 0.2 80 288.60 72

258.88 89.7 8 Washington 1.6 410 249.39 371 225.46 90.4 39

Wisconsin 0.3 75 233.15 56 175.62 75.3 19 Other(3) — 10

— 29 — — (19 ) 10.1 $ 3,304 $ 328.96 $

2,929 $ 291.65 88.7 % $ 375 (1) A

member month is defined as the aggregate of each month’s ending

membership for the period presented. (2) The MCR represents medical

costs as a percentage of premium revenue. (3) “Other” medical care

costs include primarily medically related administrative costs at

the parent company, and direct delivery costs.

MOLINA HEALTHCARE, INC.

UNAUDITED SELECTED HEALTH PLANS SEGMENT

FINANCIAL DATA

(In millions, except percentages and

per-member per-month amounts)

Six Months Ended June 30, 2016 Member

Months(1)

Premium Revenue Medical Care

Costs MCR(2)

Medical Margin Total PMPM

Total PMPM California 4.0 $ 1,095 $

271.14 $ 962 $ 238.30 87.9 % $ 133 Florida 3.4 953 284.53 839

250.58 88.1 114 Illinois 1.2 303 261.43 269 232.06 88.8 34 Michigan

2.4 756 316.18 681 285.13 90.2 75 New Mexico 1.5 678 450.62 601

399.17 88.6 77 Ohio 2.0 971 481.44 882 437.35 90.8 89 Puerto Rico

2.0 351 172.98 349 171.95 99.4 2 South Carolina 0.6 171 276.61 138

223.58 80.8 33 Texas 2.2 1,255 575.87 1,074 492.65 85.5 181 Utah

0.9 224 252.08 208 234.46 93.0 16 Washington 4.1 1,065 260.05 958

233.84 89.9 107 Wisconsin 0.8 196 247.57 188 236.92 95.7 8 Other(3)

— 6 — 33 — — (27 ) 25.1 $ 8,024

$ 320.17 $ 7,182 $ 286.57 89.5 % $ 842

Six

Months Ended June 30, 2015 Member

Months(1)

Premium Revenue Medical Care Costs

MCR(2) Medical Margin Total PMPM

Total PMPM California 3.4 $ 1,014 $ 294.85 $ 911 $

264.97 89.9 % $ 103 Florida 2.0 568 291.33 498 255.45 87.7 70

Illinois 0.6 206 339.72 188 309.66 91.2 18 Michigan 1.5 457 298.87

385 251.57 84.2 72 New Mexico 1.4 636 462.62 568 413.48 89.4 68

Ohio 2.1 1,024 498.96 845 412.05 82.6 179 Puerto Rico 1.1 194

179.33 184 170.32 95.0 10 South Carolina 0.7 184 271.35 141 206.88

76.2 43 Texas 1.6 894 565.45 820 518.60 91.7 74 Utah 0.5 157 289.42

146 268.72 92.8 11 Washington 3.2 786 245.22 723 225.47 91.9 63

Wisconsin 0.6 135 216.85 105 168.58 77.7 30 Other(3) — 20

— 51 — — (31 ) 18.7 $ 6,275 $ 336.21 $

5,565 $ 298.18 88.7 % $ 710 (1) A

member month is defined as the aggregate of each month’s ending

membership for the period presented. (2) The MCR represents medical

costs as a percentage of premium revenue. (3) “Other” medical care

costs include primarily medically related administrative costs at

the parent company, and direct delivery costs.

MOLINA HEALTHCARE, INC.

UNAUDITED SELECTED HEALTH PLANS SEGMENT

FINANCIAL DATA

(In millions, except percentages and

per-member per-month amounts)

Three Months Ended June 30, 2016 Member

Months(1)

Premium Revenue Medical Care

Costs MCR(2)

Medical

Margin

Total PMPM Total

PMPM TANF and CHIP 7.5 $ 1,302 $ 173.57 $ 1,202 $ 160.26

92.3 % $ 100 Medicaid Expansion 1.9 742 378.19 634 323.56 85.6 108

Marketplace 1.8 373 206.88 323 178.79 86.4 50 ABD 1.2 1,168 991.38

1,038 881.80 88.9 130 MMP 0.2 315 2,093.29 270 1,792.78 85.6 45

Medicare 0.2 129 997.44 127 974.30 97.7 2

12.8 $ 4,029 $ 316.72 $ 3,594 $ 282.54

89.2 % $ 435

Three Months Ended June 30, 2015

Member

Months(1)

Premium Revenue Medical Care Costs

MCR(2)

Medical

Margin

Total PMPM Total PMPM TANF and CHIP 6.5

$ 1,169 $ 178.38 $ 1,063 $ 162.24 91.0 % $ 106 Medicaid Expansion

1.4 582 419.67 474 341.67 81.4 108 Marketplace 0.8 161 204.22 90

113.21 55.4 71 ABD 1.1 1,053 984.99 947 885.84 89.9 106 MMP 0.1 198

1,784.30 214 1,934.40 108.4 (16 ) Medicare 0.2 141

1,059.90 141 1,062.71 100.3 — 10.1 $

3,304 $ 328.96 $ 2,929 $ 291.65 88.7 % $ 375

Six Months Ended June 30, 2016 Member

Months(1)

Premium Revenue Medical Care Costs

MCR(2)

Medical

Margin

Total PMPM Total PMPM TANF and CHIP

14.9 $ 2,626 $ 176.00 $ 2,400 $ 160.85 91.4 % $ 226 Medicaid

Expansion 3.8 1,421 371.82 1,208 316.13 85.0 213 Marketplace 3.4

782 228.19 657 191.62 84.0 125 ABD 2.4 2,280 976.58 2,079 890.71

91.2 201 MMP 0.3 655 2,157.55 587 1,932.73 89.6 68 Medicare 0.3

260 1,013.04 251 977.35 96.5 9 25.1

$ 8,024 $ 320.17 $ 7,182 $ 286.57 89.5 % $ 842

Six Months Ended June 30, 2015 Member

Months(1)

Premium Revenue Medical Care Costs

MCR(2)

Medical

Margin

Total PMPM Total PMPM TANF and CHIP

12.0 $ 2,141 $ 177.93 $ 1,960 $ 162.89 91.6 % $ 181 Medicaid

Expansion 2.7 1,089 409.29 867 325.84 79.6 222 Marketplace 1.4 355

258.66 246 179.15 69.3 109 ABD 2.1 1,993 940.23 1,810 853.56 90.8

183 MMP 0.2 423 1,986.04 413 1,942.20 97.8 10 Medicare 0.3

274 1,036.95 269 1,020.01 98.4 5 18.7 $

6,275 $ 336.21 $ 5,565 $ 298.18 88.7 % $ 710

(1) A member month is defined as the aggregate of

each month’s ending membership for the period presented. (2) The

MCR represents medical costs as a percentage of premium revenue.

MOLINA HEALTHCARE, INC. UNAUDITED

SELECTED HEALTH PLANS SEGMENT FINANCIAL DATA (In millions,

except percentages and per-member per-month amounts)

The following tables provide the details

of our medical care costs for the periods indicated:

Three Months Ended June 30, 2016

2015 Amount PMPM

% of

Total

Amount PMPM % of

Total

Fee for service $ 2,620 $ 206.01 72.9 % $ 2,103 $ 209.34 71.8 %

Pharmacy 529 41.59 14.7 392 39.01 13.3 Capitation 304 23.87 8.5 248

24.72 8.5 Direct delivery 18 1.39 0.5 27 2.78 1.0 Other 123

9.68 3.4 159 15.80 5.4 $ 3,594

$ 282.54 100.0 % $ 2,929 $ 291.65 100.0

%

Six Months Ended June 30, 2016 2015

Amount PMPM % of

Total

Amount PMPM % of

Total

Fee for service $ 5,357 $ 213.77 74.6 % $ 4,051 $ 217.05 72.8 %

Pharmacy 1,054 42.05 14.7 743 39.81 13.4 Capitation 599 23.87 8.3

465 24.90 8.3 Direct delivery 34 1.36 0.5 54 2.93 1.0 Other 138

5.52 1.9 252 13.49 4.5 $

7,182 $ 286.57 100.0 % $ 5,565 $ 298.18

100.0 %

The following table provides the details of our medical claims

and benefits payable as of the dates indicated:

June 30, December 31,

2016 2015 Fee-for-service claims incurred but not

paid (IBNP) $ 1,292 $ 1,191 Pharmacy payable 103 88 Capitation

payable 37 140 Other (1) 334 266 $ 1,766 $ 1,685

(1) “Other” medical claims and

benefits payable include amounts payable to certain providers for

which we act as an intermediary on behalf of various state agencies

without assuming financial risk. Such receipts and payments do not

impact our consolidated statements of income. As of June 30, 2016

and December 31, 2015, we had recorded non-risk provider

payables of approximately $191 million and $167 million,

respectively.

MOLINA HEALTHCARE, INC.UNAUDITED

CHANGE IN MEDICAL CLAIMS AND BENEFITS PAYABLE(Dollars in

millions, except per-member amounts)

Our claims liability includes a provision for adverse claims

deviation based on historical experience and other factors

including, but not limited to, variations in claims payment

patterns, changes in utilization and cost trends, known outbreaks

of disease, and large claims. Our reserving methodology is

consistently applied across all periods presented. The amounts

displayed for “Components of medical care costs related to: Prior

period” represent the amount by which our original estimate of

claims and benefits payable at the beginning of the period were

more than the actual amount of the liability based on information

(principally the payment of claims) developed since that liability

was first reported. The following table presents the components of

the change in medical claims and benefits payable for the periods

indicated:

Year Ended Six Months Ended

June 30, December 31, 2016

2015 2015 Medical claims and benefits payable,

beginning balance $ 1,685 $ 1,201 $ 1,201 Components of medical

care costs related to: Current period 7,371 5,703 11,935 Prior

period (189 ) (138 ) (141 ) Total medical care costs 7,182

5,565 11,794 Change in non-risk provider

payables 24 14 48 Payments for medical care

costs related to: Current period 5,885 4,449 10,448 Prior period

1,240 839 910 Total paid 7,125 5,288

11,358 Medical claims and benefits payable, ending

balance $ 1,766 $ 1,492 $ 1,685 Benefit

from prior period as a percentage of: Balance at beginning of

period 11.3 % 11.5 % 11.8 % Premium revenue, trailing twelve months

1.3 % 1.2 % 1.1 % Medical care costs, trailing twelve months 1.4 %

1.4 % 1.2 % Fee-For-Service Claims Data: Days in claims

payable, fee for service 48 49 48 Number of members at end of

period 4,233,000 3,352,000 3,533,000 Number of claims in inventory

at end of period 530,900 463,200 380,800 Billed charges of claims

in inventory at end of period $ 1,279 $ 905 $ 816 Claims in

inventory per member at end of period 0.13 0.14 0.11 Billed charges

of claims in inventory per member at end of period $ 302.06 $

269.93 $ 230.91 Number of claims received during the period

26,279,000 18,679,000 40,173,300 Billed charges of claims received

during the period $ 31,649 $ 21,505 $ 46,211

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160727006389/en/

Molina Healthcare, Inc.Investor Relations:Juan José Orellana,

562-435-3666, ext. 111143

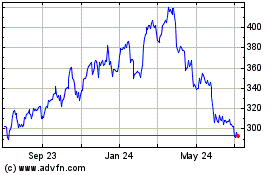

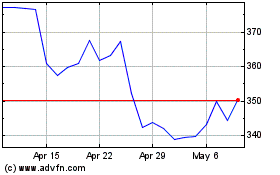

Molina Healthcare (NYSE:MOH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Molina Healthcare (NYSE:MOH)

Historical Stock Chart

From Apr 2023 to Apr 2024