UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 17, 2015

MOLINA HEALTHCARE, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-31719 |

|

13-4204626 |

| (State of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification Number) |

200 Oceangate, Suite 100, Long Beach, California 90802

(Address of principal executive offices)

Registrant’s telephone number, including area code: (562) 435-3666

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01. |

Regulation FD Disclosure. |

On September 17, 2015, the Company presented and webcast certain slides

as part of the Company’s presentation at its Investor Day Conference held in New York City. A copy of the Company’s complete slide presentation is included as Exhibit 99.1 to this report. An audio and slide replay of the live

webcast of the Company’s Investor Day presentation will be available for 30 days from the date of the presentation at the Company’s website, www.molinahealthcare.com, or at www.earnings.com. The information contained in such websites is

not part of this current report.

The information in this Form 8-K current report and the exhibits attached hereto shall not be deemed to be

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the

Securities Exchange Act of 1934, except as expressly set forth by specific reference in such a filing.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits:

|

|

|

Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Slide presentation given at the Investor Day Conference of Molina Healthcare, Inc. on September 17, 2015. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

MOLINA HEALTHCARE, INC. |

|

|

|

| Date: September 17, 2015 |

|

By: |

|

/s/ Jeff D. Barlow |

|

|

|

|

Jeff D. Barlow Chief Legal Officer and

Secretary |

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Slide presentation given at the Investor Day Conference of Molina Healthcare, Inc. on September 17, 2015. |

Exhibit 99.1

Cautionary Statement

Safe Harbor Statement under

the Private Securities Litigation Reform Act of 1995:This slide presentation and our accompanying oral remarks contain numerous “forward-looking statements” regarding, without limitation: our growth and acquisition expectations and

strategies; the closing of our announced acquisitions, the success of our integration efforts, and the projected revenues and profitability of our acquisitions; our ongoing margin improvement efforts; dual demonstration program growth and program

extensions; financial reconciliations under our various government contracts; the reimbursement of the ACA health insurer fee; our projected earnings for the second half of 2015; our longer-term financial objectives; expected rate changes; the

continuation of our Puerto Rico contract; and various other matters. All of our forward-looking statements are subject to numerous risks, uncertainties, and other factors that could cause our actual results to differ materially. Anyone viewing or

listening to this presentation is urged to read the risk factors and cautionary statements found under Item 1A in our annual report on Form 10-K, as well as the risk factors and cautionary statements in our quarterly reports and in our other

reports and filings with the Securities and Exchange Commission and available for viewing on its website at www.sec.gov.Except to the extent otherwise required by federal securities laws, we do not undertake to address or update forward-looking

statements in future filings or communications regarding our business or operating results.

© 2015 MOLINA

HEALTHCARE, INC.

2

Investor day 2015B

Agenda

Approx. Time Topic Speaker

12:30pm-12:35pm Opening Remarks Juan José Orellana, SVP Investor Relations

12:35pm-1:20pm Business Overview J. Mario Molina, MD, Chief Executive Officer

1:20pm-1:35pm Operations Review Terry Bayer, Chief Operating Officer

1:35pm-1:55pm Q&A

1:55pm-2:15pm Break

2:15pm-2:45pm Accounting Review Joseph White, Chief Accounting Officer

2:45pm-3:30pm Acquisition and Margin Improvement Review John Molina, Chief Financial Officer

3:30pm-3:50pm Q&A

3:50pm End of Program

© 2015 MOLINA

HEALTHCARE, INC.

3

Key investor inquiries

How will Molina continue

to grow? What’s changing in our space? Why Providence Human Services? What else is expected in 2015?

What

progress is being made in improving margins?

© 2015 MOLINA HEALTHCARE, INC.

4

J. Mario Molina M.D.

President & Chief

Executive Officer

5

Our mission

To provide quality health care to

people receiving government assistance

© 2015 MOLINA HEALTHCARE, INC.

6

Our footprint today

Health plan footprint

includes 4 of 5 largest Medicaid markets

1. Total enrollment relates to effective membership as of

June 30, 2015

© 2015 MOLINA HEALTHCARE, INC.

Puerto Rico

Molina Health plans Molina Medicaid Solutions Direct delivery

1

3.4M

Members

1% Duals

1% Medicare

8% Marketplace

USVI

11% ABD

14% Expansion

65% TANF & CHIP

Member Mix

7

Growth

While growth in the Medicaid program was

significant between 2013-2015, steady organic growth is expected over the next five years.

85M

136kMedicaid/CHIP Growth Projections1

82.2M

80.8M 81.5M

80M 79.8M 53k

77.9M

76.3M 21k 66k

75M 135k

72.1M 64k

70M

65M

2013 2014 2015 2016 2017 2018 2019 2020

1. CMS, Office of the Actuary, National Health Expenditure Projections 2014—2024, Table 17 Health

Insurance Enrollment and Enrollment Growth Rates https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NationalHealthAccountsProjected.html

2. Enrollment as of June 30, 2015

© 2015 MOLINA HEALTHCARE, INC.

Year to Date

Enrollment Growth

December31, 2014

2.6M

members

Investor Day 2015B (today)

3.4M2

members

8

Where will our growth come from?

Organic growth

in existing markets and RFPs In-market acquisitions Marketplace Transition of members and benefits from FFS to managed care Capability-based provider acquisitions

© 2015 MOLINA HEALTHCARE, INC.

9

Continued organic growth in Medicare-Medicaid Plans (MMP)

Dual eligible markets

California Illinois USVI

Michigan Ohio South Carolina2

Puerto Rico

Texas

Total

Enrollment

December August 2014 20151 11K 15K

5K 4K

- 8K

2K 10K

- <1K

- 15K

18K 53K

MMP Markets

1. CMS enrollment data as of August,

2015

2. Voluntary enrollment only as of August, 2015

© 2015 MOLINA HEALTHCARE, INC.

10

In-market health plan acquisitions

State:

Illinois

Enrollment: 60,000

Annualized Revenue: $200M

State: Michigan

Enrollment: 85,000

Annualized Revenue: $270M

State: Florida

Enrollment: 62,000

Annualized Revenue: $200M

State: Florida

Enrollment: 25,000 Annualized Revenue: $80M

State: Florida

Enrollment: 90,000

Annualized Revenue: $250M

Generally asset purchases

Provide additional scale in existing areas

Increase access into new service areas

Accretive

Approximately $1.0B total annualized

revenue

Note: Estimated revenue based on annualized Company estimates

© 2015 MOLINA HEALTHCARE, INC.

11

Marketplace

15M

Penalty for not having coverage in 2016 is 2.5% of yearly household income or $695 per adult (half for those under 18)

USVI

Puerto Rico

Marketplace operations

230K1

Molina Marketplace Enrollment

18K

2Q2014 Aug 2015

93% of Molina marketplace members receive government subsidies

1. Company’s approximate enrollment as of August, 2015

© 2015 MOLINA HEALTHCARE, INC.

12

Increasing complexity drives higher spend

Complex

members continue to transition into managed care

Number of potential enrollees

$ $

Long Term Care

Dual Eligible $

Seniors & Persons $ with Disabilities

Medicaid Expansion

Temporary Assistance to Needy

Families

© 2015 MOLINA HEALTHCARE, INC.

13

Fee for service remains significant

Managed care

organizations and fee for service FY 2011

57M $404B

Fee-For-Service 15M 26% $307B 76%

Managed Care 42M 74%

$97B

24%

Medicaid Enrollment 2011

Medicaid Benefit

Spending 2011

76%

of Medicaid spending remains in Fee-for-Service

Sources:

1. Medicaid and CHIP Payment and Access Commission; Report to the Congress on Medicaid and CHIP; June 2014

2. CMS Medicaid Managed Care Enrollment Report, Summary Statistics as of July 1, 2011; June 1, 2012

© 2015 MOLINA HEALTHCARE, INC.

14

Medicaid Long Term Services and Supports (LTSS)

LTSS is a significant portion of fee for service spend

6%

People with Serious Mental Illness

30%

People with Developmental Disabilities

3%

Other/Multiple Populations

61%

Older People & People with Physical Disabilities

Full Medicaid LTSS Spend in 2012: $140 Billion1

1. Truven Health Analytics. ‘Medicaid Expenditures for Long-Term Services and Supports in FFY 2012; published April 28, 2014.

© 2015 MOLINA HEALTHCARE, INC.

15

Home and Community Based Services

Behavioral and

mental health services are significant drivers of cost

Medicaid HCBS Expenditures

FY 20101

Prevocational services

Day habilitation

Education services

Day treatment/partial hospitalization

Adult day

health

Adult day services

Community integration

Medical day care for

children

Home-based habilitation

Home health aide

Personal care

Companion

Homemaker

Chores

Group living, mental health services Round-the-clock services, unspecified Group living, other Shared living, other

In-home residential habilitation In-home round-the-clock services, other Group living, residential habilitation Shared living, residential habilitation In-home round-the-clock mental health services

Other2

14%

Day Services

15%

Home-Based

18%

Round-the-clock

46%

Mental Health

3%

Case Management

4%

Medicaid HCBS total spend in 2012: $69B

1. Mathematica Policy Research. ‘The HCBS Taxonomy: A New Language for Classifying Home- and Community-Based Services’, August 2013.

2. Other includes expenses related to goods and services, interpreters, housing consultation, and claims where the

procedure code could not be interpreted.

© 2015 MOLINA HEALTHCARE, INC.

16

Molina – changes in spend

Select Categories

2012 vs. 20151

$500M $465M

2012

$400M 2015E

$335M $330M

$300M

$200M

$160M

$110M

$100M $80M

$0M

Specialty Rx Personal Attendant 2 Behavioral Health

Services

1. 2015 estimates are based on full year annualized results as extrapolated from the results through the first half of 2015

2. Excludes amounts paid by state Medicaid agencies on Molina’s behalf

© 2015 MOLINA HEALTHCARE, INC.

17

Capability-based provider acquisitions – changes in delivery

5

Increasing Role of Data & Technology

1

Importance of the Member

Vertical Integration

& Broader

4

Continuum of Care

Member Centric Approach

Increasing Role of Government as a Payor 2

Value-Based Reimbursement

3

© 2015 MOLINA HEALTHCARE, INC.

1 Importance of the Member

Member will pay a larger portion of medical costs through Member-Directed / High Deductible Health Plans and Health Insurance Exchanges, and will demand increased choice and access to

care, more information regarding price, treatment options and information technology

2 Increasing Role of

Government as a Payor

Medicare, Medicaid and Exchanges represent the fastest growth areas

3 Value-Based Reimbursement

Shifting from Fee-For-Service to risk-based capitation and bundled payments, increasing role of Accountable Care Organizations (ACOs)

4 Vertical Integration & Broader Continuum of Care

Ownership of provider/care delivery assets to better manage care and medical costs, and capture “care margin”

5 Increasing Role of Data & Technology

HCIT is critical to the measurement and management of medical cost and engagement with the patient

18

Capability-based provider acquisition – behavioral health

Providence Human Services1, a multi-state, behavioral/mental health and social services provider

Operations in 23 states + DC? Medicaid focus:

80%

of revenue

Approximately 70% of all contracts are FFS

Diverse revenue base:

~100 contracts represent 70% of total revenue

More than 6,800 employees

Consideration ~ $200M2

1. The PHS transaction was

announced on September 3, 2015 and is subject to regulatory approvals and the satisfaction of other closing conditions

2. Subject to customary working capital and adjustments

© 2015 MOLINA HEALTHCARE, INC.

19

Diagnoses of behavioral and mental health conditions are increasing

Mental and substance use disorders are expected to surpass all physical diseases as a major cause of worldwide disability by 2020

Prevalence of mental illness among the Medicaid population is twice that of the general population

2X-3X

Treatment of chronic physical health issues for patients with behavioral health needs is 2 to 3 times more expensive than patients with physical health only needs.

68% of adults with mental illness also have at least 1 chronic physical illness.

49% of Medicaid enrollees with disabilities have a psychiatric illness.

Source: Annals of Internal Medicine: Crowley RA, Kirschner N, for the Health and Public Policy Committee of the American

College of Physicians. The Integration of Care for Mental Health, Substance Abuse, and Other Behavioral Health Conditions into Primary Care: Executive Summary of an American College of Physicians Position Paper. Ann Intern Med. 2015;163:298-299.

doi:10.7326/M15-0510

© 2015 MOLINA HEALTHCARE, INC.

20

Molina members with complex conditions

Top

diagnoses by segment by number of admits/cases trailing 12 months1

TANF Diagnoses ABD Diagnoses Dual Eligibles

Diagnoses

Inpatient Services

Delivery Septicemia Septicemia

Complications of

delivery Schizophrenic disorders Care involving use of rehabilitation procedures

Other maternal complications

Affective psychoses Schizophrenic disorders

Prolonged pregnancy Other diseases of lung Pneumonia

Affective psychoses Chronic bronchitis Diabetes

Outpatient Services

Well Child care Renal failure

Renal failure

Acute upper respiratory infection Schizophrenic disorders Schizophrenic disorders

Normal Pregnancy Hypertension Affective psychoses

Other maternal complications Diabetes Diabetes

General symptoms Affective psychoses Hypertension

1. Based on Company data ending June 30, 2015

© 2015 MOLINA HEALTHCARE, INC.

21

PHS – Adaptable contracting options

Different regulations/reimbursement policies dictate which services are offered in a particular geography

Medicaid Agency

Direct Behavioral Managed Care County Office or Behavioral Health Health Specialty Providers Local Organization Specialty Provider Provider

Indirect/Subcontracted Behavioral Health Specialty Provider

© 2015 MOLINA HEALTHCARE, INC.

22

What services does PHS provide?

More than 80% of

revenues are related to services focused on Mental Health1

Other2 10%

Autism & Intellectual and Developmental Disabilities 9%

Child Welfare 11%

Mental Health Child 44%

Mental Health Adult 26%

1. Based on Net Adjusted Revenues through 2014

2. Other includes Educational, Probational, and Substance Abuse

© 2015 MOLINA HEALTHCARE, INC.

23

Autism spectrum disorders (ASD) and Medicaid

1 in

68

children has been diagnosed with ASD1

72% of Medicaid recipients with ASD had at least 1 additional diagnosis2

CMS advised ASD treatment is considered covered under EPSDT benefits, not just waiver based (2014)3

1. US Centers for Disease Control and Prevention. http://www.cdc.gov/ncbddd/autism/data.html

2. Milliman Medicaid Issues Briefing Paper . http://us.milliman.com/uploadedFiles/insight/2015/expansion-asd-treatment.pdf

3. Early and Periodic Screening, Diagnosis, and Treatment (EPSDT) program. CMS CMCS Information Bulletin,

July 7, 2014. http://www.medicaid.gov/Federal-Policy-Guidance/Downloads/CIB-07-07-14.pdf

© 2015

MOLINA HEALTHCARE, INC.

Increasingly being included in new state RFPs and Federal Regulations.

2013 Virginia Medicaid

Puerto Rico? Care coordination

2015 Washington

Foster Care

Care coordination

2015 Iowa Medicaid

2015 Wisconsin rate build

24

A growing need in Medicaid

The Medicaid program

finances more than one-quarter of the nation’s spending for behavioral health care and it is, by far, the largest single source of funding for public mental health services.

Source: Kaiser Family Foundation. Integrating Physical and Behavioral Health Care: Promising Medicaid Models. Feb 2014.

© 2015 MOLINA HEALTHCARE, INC.

25

An essential benefit

The ACA specifically

includes mental health and substance use disorder services as one of the ten categories of required “essential health benefits,” and the law requires parity between the mental and physical health benefits covered by health plans.

Source: Kaiser Family Foundation. Integrating Physical and Behavioral Health Care: Promising Medicaid Models.

Feb 2014.

26

© 2015 MOLINA HEALTHCARE, INC.

Integration

Nationwide, many state agencies,

health plans and providers are implementing PH/BH integration strategies in Medicaid.

27

© 2015 MOLINA HEALTHCARE, INC.

A strategic focus identifies greater needs

The

strategic focus leading to Molina’s growth in ABD, Dual Eligible and Long Term Care members is contributing to a higher spend in behavioral/mental heath services.

28

© 2015 MOLINA HEALTHCARE, INC.

A new provider capability

PHS revenue is

generated by 5,700 client-facing social workers, behavioral/mental health workers, case managers, licensed clinicians, psychologists, nurses and psychiatrists.

29

© 2015 MOLINA HEALTHCARE, INC.

Providence acquisition pro-forma footprint

Molina

will have a presence in 28 states 2 Commonwealths + Washington D.C.

Please refer to the Company’s

cautionary statement on page 2 of this presentation

Today

Molina Health plans

Molina Medicaid Solutions

Primary Care Direct

delivery

Virgin Islands

Puerto Rico

1. Behavioral/Mental health and

social services capabilities added through the acquisition of Providence Human Services (PHS) and Providence Community Services (PCS), with an anticipated closing in 4Q2015, pending regulatory approvals and the satisfaction of other closing

conditions.

Post Close

Molina Health plans

Molina Medicaid Solutions

Providence Human Services1

Pimary Care Direct delivery

Virgin Islands

Puerto Rico

30

© 2015 MOLINA HEALTHCARE, INC.

One of a kind

Flexible health services portfolio

(health plans, direct delivery, MMIS)

Focused on people receiving government assistance

Scalable administrative infrastructure

Consistent national brand

Seasoned management

team

Unique culture

31

© 2015 MOLINA HEALTHCARE, INC.

2015B

Investor Day

Terry Bayer

Chief Operating Officer

September 17, 2015 /

New York, New York

Medicare-Medicaid Plans (MMP)

Dual eligible

markets

USVI

Puerto Rico

MMP Markets

Enrollment

December August

2014 20151

California 11K 15K

Illinois 5K 4K

Michigan — 8K

Ohio 2K 10K

South Carolina2 — <1K

Texas — 15K

Total 18K 53K

1. CMS enrollment data as of August, 2015

2.

Voluntary enrollment only as of August, 2015

33

© 2015 MOLINA HEALTHCARE, INC.

Medicare – Dual Eligible Special Needs Plan

Our DSNP enrollment extends our dual eligible reach beyond just the Medicare Medicaid Plans

1

40K

members

USVI

Puerto Rico

Molina DSNP operations

1. CMS enrollment data as of August, 2015

34

© 2015 MOLINA HEALTHCARE, INC.

What’s new with the duals

All 6 Molina demos

have gone live nationally

2 year extension

From CMS for existing dual demonstration programs. All 6 of Molina’s states submitted letters of intent before the

September 1st deadline

CA, IL, OH extended until December 2019

MI, SC, TX extended until December 2020

Opportunities for continued growth

Age-ins

Part D re-assignees

Other passive enrollment opportunities at the state level

Retention

Reaching out to members that have opted

out resulted in more than 2K members returning to Molina.

More than 7K dual members enrolled voluntarily, and

have a 50% lower rate of disenrollment.

35

© 2015 MOLINA HEALTHCARE, INC.

Marketplace

15M

Penalty for not having coverage in 2016 is 2.5% of yearly household income or $695 per adult (half for those under 18)

Health Insurance Marketplace

1

230K

members

USVI

Puerto Rico

Marketplace operations

81% of our Marketplace revenue is in the form of subsidies

Nationally 84% of Marketplace enrollees receive the advanced premium tax credit subsidys2

75% of Molina

Marketplace membership are in a

silver plan

93% of Molina marketplace members receive government subsidies

1. Company’s approximate enrollment as of August, 2015

2. CMS June 30, 2015 Effectuated Enrollment Snapshot, released September 8, 2015;

https://www.cms.gov/Newsroom/MediaReleaseDatabase/Fact-sheets/2015-Fact-sheets-items/2015-09-08.html

36

© 2015 MOLINA HEALTHCARE, INC.

Marketplace – staying true to the strategy

Priority segment: 100%-250% FPL

Medicaid transitioners; parents of CHIP members; ex-Medicaid members; low-income uninsured

Heavily subsidized

Used to getting care from

safety net providers

Require enhanced services

100%-250% FPL

Annual income levels for individuals $12K-$29K

250%-400% FPL

Annual income levels for individuals $29K-$47K

Ensuring continuity of care to those transitioning from Medicaid

37

© 2015 MOLINA HEALTHCARE, INC.

Marketplace – staying true to the strategy

Example: CA Minimum Wage

$9.00per hour

$18,720annualized

Premium assistance for marketplace is calculated based on the federal poverty scale. Individuals who earn <138% of the

FPL qualify for Medicaid.

FEDERAL POVERTY LEVELS & INCOME1,2

Size of 133% 138% 150% 200% 250%

Household

1 $ 15,654 $ 16,243 $ 17,655 $ 23,540 $

29,425

2 $ 21,187 $ 21,983 $ 23,895 $ 31,860 $ 39,825

3 $ 26,720 $ 27,724 $ 30,135 $ 40,180 $ 50,225

4 $ 32,253 $ 33,465 $ 36,375 $ 48,500 $ 60,625

5

$ 37,785 $ 39,206 $ 42,615 $ 56,820 $ 71,025

Hourly rate Hourly rate

$12.85 $14.49

Small hourly rate increases can affect Medicaid eligibility and marketplace subsidies

1. Office of the Assistant Secretary for Planning and Evaluation, http://aspe.hhs.gov/2015-poverty-guidelines

2. All dollar amounts are for the 48 contiguous states and DC

38

© 2015 MOLINA HEALTHCARE, INC.

Puerto Rico

Molina was awarded Medicaid contracts

in two regions in late 2014

San Juan

Caguas

Ponce

Southwest

East

Commenced operations on April 1, 2015

361,000 members as of 2Q2015 Estimated annualized revenue of $750M

Commonwealth continues to pay us weekly and

is current

39

© 2015 MOLINA HEALTHCARE, INC.

Q&A

40

2015B

Investor Day

Joseph White

Chief Accounting Officer

September 17, 2015

/ New York, New York

2015 income statement (unaudited)

Please refer to

the Company’s cautionary statement on page 2 of this presentation

Dollars (in millions)

YTD June 2015 FY 2015 Remaining

Actual Outlook1 Outlook2

Premium Revenue $6.3B

$13.5B $7.2B

Health Insurer Fee Revenue $122M $260M $138M

Premium Tax Revenue $190M $400M $210M

Service Revenue $99M $180M $81M

Investment and

Other Income $10M $17M $7M

Total Revenue $6.7B $14.3B $7.6B

Total Medical Care Cost $5.6B $12.1B $6.5B

Medical Care Ratio3 88.7% 89.5% n/a

Total Cost of

Service Revenue $69M $145M $76M

General & Administrative Expenses $0.5B $1.1B $0.6B

G&A Ratio4 8.1% 7.6% n/a

Premium Tax Expense $190M $400M $210M

Health

Insurer Fee Expense $81M $165M $84M

Depreciation & Amortization $50M $105M $55M

Interest & Other Expense $30M $60M $30M

Income before Taxes $168M $300M $132M

Net Income

$67M $132M $65M

EBITDA5 $256M $485M $229M

Effective Tax Rate 60.1% 56.0% n/a

Net Income Per Diluted Share $1.29 $2.35 $1.06

Adjusted Net Income Per Diluted Share5 $1.57 $2.90 $1.33

Amounts are estimates – actual results may differ materially. See our risk factors as discussed in our Form 10-K and

other periodic filings

1. Reflects fiscal year 2015 outlook as provided on June 1, 2015

2. Remaining outlook is the result of FYI 2015 outlook less YTD June 2015 actual only

3. Medical Care Ratio represents medical care costs as a percent of premium revenue

4. G&A ratio computed as a percentage of total revenue

5. See reconciliation of unaudited non-GAAP financial measures

42

© 2015 MOLINA HEALTHCARE, INC.

Reconciliation of non-GAAP financial measures

EBITDA and adjusted net income

Please refer to the Company’s cautionary statement on page 2 of this presentation.

EBITDA YTD June 2015 FY 2015 Remaining

Actual

Outlook1 Outlook2

Net income $67M $132M $65M

Adjustments:

Depreciation, and amortization of intangible assets and capitalized software $58M $125M $67M

Interest expense $30M $60M $30M

Income tax

expense $101M $168M $67M

EBITDA $256M $485M $229M

Adjusted net income per diluted share YTD June 2015 FY 2015 Remaining

Actual Outlook Outlook

Net income per diluted share $1.29 $2.35 $1.06

Adjustments, net of tax:

Amortization of convertible senior notes and lease financing obligations $0.18 $0.35 $0.17

Amortization of intangible assets $0.10 $0.20 $0.10

Adjusted net income per diluted share $1.57 $2.90 $1.33

Amounts are estimates – actual results may differ materially. See our risk factors as discussed in our Form 10-K and

other periodic filings

1. Reflects fiscal year 2015 outlook as provided on June 1, 2015

2. Remaining outlook is the result of FYI 2015 outlook less YTD June 2015 actual only

© 2015 MOLINA HEALTHCARE, INC.

43

Uncertainties relating to 2nd half earnings

Please refer to the Company’s cautionary statement on page 2 of this presentation

Issues State

MCR floor reconciliation CA, NM, WA

Cost plus

reconciliation NM

Quality revenue TX

HIF reimbursement MI

PR / MI MMP/ TX MMP /

MCR

Acquisitions / FL Rates

44

© 2015 MOLINA HEALTHCARE, INC.

Profit restrictions are significant

85% of

Premium revenue earned YTD 6/30/2015 is subject to profit restrictions

Marketplace, 6%

MMP, 7%

Medicaid Expansion, 17%

Medicare SNP, 4%

Medicaid no restrictions, 15%

Medicaid with restrictions, 51%

% of revenue

subject to

profit restrictions:

Medicaid: 75%

Medicaid Expansion: 100%

MMP Duals: 100%

Marketplace: 100%

Medicare SNP: 100%

45

© 2015 MOLINA HEALTHCARE, INC.

Payables due to profit restrictions

Please refer

to the Company’s cautionary statement on page 2 of this presentation

Dec-14 Jun-15

Medicaid Expansion:

California ~$120M ~$130M

New Mexico ~$25M ~$50M

Washington ~$240M ~$270M

Others — ~$15M

Medicaid Expansion Subtotal

~$385M ~$465M

Marketplace — ~$40M

Others ~$15M ~$35M

Total ~$400M ~$540M

46

© 2015 MOLINA HEALTHCARE, INC.

Marketplace medical care ratio

How do we report a

Marketplace MCR <80%

Six Months Ended June 30, 2015(1)

Premium Revenue Medical Care Costs

Member

Months(2) Total PMPM Total PMPM MCR(3)

Medical Margin

TANF and CHIP 12,035 $ 2,141,316 $177.93 $ 1,960,315 $162.89 91.5% $ 181,001

Medicaid Expansion 2,661 1,089,339 409.29 867,229 325.84 79.6 222,110

ABD 2,120 1,993,366 940.23 1,809,613 853.56 90.8 183,753

Marketplace 1,371 354,725 258.66 245,682 179.15 69.3 109,043

Medicare 264 273,472 1,036.95 269,005 1,020.01 98.4 4,467

MMP 213 422,806 1,986.04 413,474 1,942.20 97.8 9,332

18,664 $ 6,275,024 $336.21 $ 5,565,318 $298.18 88.7% $ 709,706

(1) Six months ended June 30, 2014 data not presented due to lack of comparability.

(2) A member month is defined as the aggregate of each month’s ending membership for the period presented.

(3) “MCR” represents medical costs as a percentage of premium revenue.

Molina healthcare 10-Q June 30, 2015

47

© 2015 MOLINA HEALTHCARE, INC.

Different calculations of Marketplace MCR

MOH

GAAP MCR

MOH 10K MCR

Medical Care Cost

MCR =

Premium Revenue

Min MCR Calculation

Federal Register Vol 78

No. 47; Monday March 11,

2013, Part II, HHS Notice of Benefit and Payment

Parameters for 2014, Page 15,505

MCR= [(i + q – s + n – r)/ {(p + s – n + r) – t – f – (s – n + r)}] + c

i = incurred claims

q = expenditures on quality

improving activities

p = earned premiums

t = Federal and State taxes and assessments

f = licensing and regulatory fees, including transitional reinsurance contributions

s = issuer’s transitional reinsurance receipts

n = issuer’s risk corridors and risk adjustment related payments

r=issuer’s risk corridors and risk adjustment related receipts

c = credibility adjustment, if any

48

© 2015 MOLINA HEALTHCARE, INC.

Marketplace example - GAAP vs. CMS minimum MCR

4%

(1%) 0%

1%

16%

80%

60%

1. GAAP MCR 2. Risk Adjustment / 3. QI Expenses 4. Taxes and Fees 5. Prior Year Adjustments 6. Credibilty Adjustments CMS MLR

Corridor and MLR Rebate

© 2015 MOLINA HEALTHCARE, INC.

49

Admin ratio – market place and profit restriction impact

Impact of lost revenue from profit restrictions

Impact of Marketplace fees

G&A ratio net of profit restrictions & Marketplace fees

12.0%

10.0%

8.0%

6.0%

4.0%

2.0%

0.0%

10.1%

10.0%

7.9%

7.5%

8.1%

7.2%

FY2013 FY2014 YTD-2Q15

50

© 2015 MOLINA HEALTHCARE, INC.

Diluted Shares outstanding 2015 (unaudited)

Please refer to the Company’s cautionary statement on page 2 of this presentation

70M

62M1 62M1

1M 1M

60M 56M1

54M

50M 56M 56M

50M

40M

30M

20M

10M

5M 6M

M

Q1 Q2 Q3 Q4 FY15

Other

Shares Outstanding

Convertible Note Dilution

Totals may not add due

to rounding

1. Q3, Q4 and FY 15 are estimates

© 2015 MOLINA HEALTHCARE, INC.

51

John C. Molina Chief Financial Officer

52

Acquisition strategy

How do the pieces fit

together

New Managed Care State Existing Managed Care State Provider / Capability

Rationale

Diversification – revenue, risk, contracts Fortify competitive position Enhance provider alignment

Administrative cost leverage – long term Administrative leverage – short term Medical cost improvement – medium term

Criteria

Increased member care oversite /

Competitive

provider environment Competitive provider environment

management

Sizeable Medicaid population Attractive price Complementary to Molina care model

Difficult /expensive / timely to develop

Favorable regulatory environment Favorable regulatory environment

internally

Valuable talent

© 2015 MOLINA HEALTHCARE, INC.

53

A closer look at our health plan acquisitions

Recent health plan M&A

Please refer to the Company’s cautionary statement on page 2 of this presentation

Transaction Status Membership1 Annualized Revenue1

MyCare Chicago Close pending 60,000 $200M

Integral Health Plan Close pending 90,000 $250M

HealthPlus Closed 85,000 $270M

Preferred Medical Plan Closed 25,000 $80M

Subtotal 260,000 $800M

1. Membership and annualized revenue reflect estimates as of the transaction announcement date for transaction that are pending close. For closed transactions membership reflects actual

members transferred to Molina and estimated revenues associated with those members.

© 2015 MOLINA

HEALTHCARE, INC.

54

Florida Medicaid footprint expansion

Recent

Florida acquisition summary1,2

Pensacola, Tampa & Sarasota service area served by

Integral Health Plan

December , 2015

90K members

Jacksonville service area served by

First Coast Advantage

December, 2014

62K members

Miami-Dade service area served by Molina and

Preferred Medical Plan

August, 2015

25K members

1. Transactions for Integral Health Plan & Preferred Medical have yet to close.

2. Enrollment numbers are estimates, based on the publically announced press release

© 2015 MOLINA HEALTHCARE, INC.

55

Capability-based provider acquisition – behavioral health

Providence Human Services1, a multi-state, behavioral/mental health and social services provider

Operations in 23 states + DC

Medicaid focus:

80% of revenue

Approximately 70% of all

contracts are FFS

Diverse revenue base:

~100 contracts represent 70%

of total revenue

More than 6,800 employees

Consideration ~ $200M2

1. The PHS transaction was

announced on September 3, 2015 and is subject to regulatory approvals and the satisfaction of other closing conditions

2. Subject to customary working capital and adjustments

© 2015 MOLINA HEALTHCARE, INC.

56

Providence Human Services strategic rationale

Why

Molina

Medicaid focus

Significantly advances our behavioral/mental health capabilities

Builds upon our direct delivery infrastructure

Creates market presence in new states relevant to these patients

Why PHS

Medicaid focus

A viable stand alone business that

brings new capabilities and overall margin improvement to our health plans

Large behavioral/mental health

provider with flexible model and adaptable services offering

Cross expansion opportunities to Molina

geographies

Cultural fit, mission and philosophy

2016+ FORTIFY

Consistent with our long term objectives of improving the model of care, enhancing our systems and improving our margins.

© 2015 MOLINA HEALTHCARE, INC.

57

PHS – Adaptable contracting options

Different regulations/reimbursement policies dictate which services are offered in a particular geography

Medicaid Agency

Direct Behavioral

Managed Care County Office or

Behavioral Health

Health Specialty

Providers Local Organization Specialty Provider

Provider

Indirect/Subcontracted Behavioral

Health

Specialty Provider

© 2015 MOLINA HEALTHCARE, INC.

58

What services does PHS provide

More than 80% of

revenues are related to services focused on Mental Health1

Mental Health

Other2 Child

10% 44%

Autism &

Intellectual and Mental Health

Developmental Adult

Disabilities 26%

9%

Child Welfare

11%

1. Based on Net Adjusted Revenues through 2014

2. Other includes Educational, Probational, and Substance Abuse

© 2015 MOLINA HEALTHCARE, INC.

59

PHS – net revenue breakdown by payor

Other1

7% Medicaid

Intermediaries

Medicaid (Government,

Direct State and

27% 35% US Agencies)

Medicaid

83% 21%

Insurance / HMO’s /

Other Health Plans

Medicaid Intermediaries

10% (Cities and Local Boards)

1. Other includes Educational, Probational, Workforce Development and Substance Abuse

© 2015 MOLINA HEALTHCARE, INC.

60

2015 and beyond

2013 2014 2015 2016+

INCUBATE TRANSITION & GROW DEVELOP & GROW FORTIFY

Acquire new business Transition members into model of Transition members into model of Improve model of care

Design systems care care Enhance systems

Test readiness Address pent-up demand Address pent-up demand Improve margins

Invest in infrastructure Adjust premiums Adjust premiums

New business: Process transition issues Improve systems

SC, Duals, Marketplace, Medicaid Begin leveraging infrastructure Ensure equitable rates

Expansion, NM & FL re- Invest to prepare for 2015 revenue Leverage administrative costs

procurements, WI Medicare

© 2015 MOLINA

HEALTHCARE, INC.

61

2017 Financial objectives

Please refer to the

Company’s cautionary statement on page 2 of this presentation

Revenue growth

~0.5%-1.5% decline in medical cost ratio ~0.5%—1.0% decline in G&A ratio Target: ~1.5%—2.0% after tax margin

How will we get there

Actuarially sound premium rates Manage inpatient costs Network alignment Retention of members

© 2015 MOLINA HEALTHCARE, INC.

62

Premium revenue

We expect 2016 premium revenue to

be at least $1.0B higher than in 2015

Please refer to the Company’s cautionary statement on page 2 of

this presentation

$14.6B

$13.5B

Full year 2015 Outlook December 2015 Run

Rate1

Both numbers are Company estimates

1. Month of December 2015 Annualized

© 2015 MOLINA HEALTHCARE, INC.

63

High cost member intervention

A look at dual

eligibles and ABDs

3%

30%

97%

70%

Members Medical Costs

3% of our dual eligible

members and 3% of our ABD members account for 30% of our medical costs under each line of business.

©

2015 MOLINA HEALTHCARE, INC.

64

Admin ratio – market place and profit restriction impact

Please refer to the Company’s cautionary statement on page 2 of this presentation

12.0%

10.1%

10.0%

7.9% 8.1%

8.0%

6.0%

10.0%

4.0% 49%

7.5% 7.2%

2.0%

0.0%

FY2013 FY2014 YTD-2Q15

Admin ratio sensitivity

Every $1 billion of

incremental revenue:

requires between $43 million and $50 million of new G&A spend

G&A ratio declines between 10 75% to 20 bps

40 bps decrease in G&A ratio increases after tax margins by 25 bps

Impact of Profit Restrictions on G&A Ratio

Impact of Marketplace Fees

G&A Ratio Net Profit Restrictions & Marketplace Fees

© 2015 MOLINA HEALTHCARE, INC.

65

Investment income

Interest rate sensitivity on

investment income

Please refer to the Company’s cautionary statement on page 2 of this presentation

Investment Income EPS

$35M $ 2.65

$30M $ 2.60

$25M

$ 2.55

$20M

$ 2.50

$15M

$ 2.45

$10M

$5M $ 2.40

$0M $ 2.35

0.50% 0.75% 1.00% 1.25% 1.50%

Increase in Fed Funds Rate

Investment Income EPS

Each 25bp increase in rates results in $5M to $6M more of annualized investment income

© 2015 MOLINA HEALTHCARE, INC.

66

Effective tax rate

ETR sensitivity to pretax

income1

Please refer to the Company’s cautionary statement on page 2 of this presentation

Growing pretax income mitigates the impact of non-deductible expenses, lowering the effective tax rate

100%

95%

90%

80%

70%

Tax Rate

60% 57%

50% 45%

40%

30%

$100M $200M $300M $400M $500M $600M $700M $800M

Pretax income

1. ETR includes estimated 2015 non deductible expenses

© 2015 MOLINA HEALTHCARE, INC.

67

After tax margin sensitivity

Each 25bps increase

in after tax margin increases EPS by $0.65

Please refer to the Company’s cautionary statement on page 2

of this presentation

$10.00

$8.00

$6.00

$5.10

EPS

$4.00 EPS

$2.35

$2.00

$0.00

0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0%

After Tax Margin

Based on 2015 Outlook

© 2015 MOLINA HEALTHCARE, INC.

68

After tax margin

Historical and outlook

Please refer to the Company’s cautionary statement on page 2 of this presentation

2.0%

2.0%

1.8%

1.6% 1.5%

1.4%

1.2%

1.0%

1.0%

0.8%

0.8%

0.6%

0.6%

0.4%

0.2%

0.0%

2013 2014 June 30, 2015 YTD 2016 2017 Long Term

Outlook

© 2015 MOLINA HEALTHCARE, INC.

69

Rate changes revisited

Please refer to the

Company’s cautionary statement on page 2 of this presentation

Baseline Outlook 1

State

Effective Date Rate Change

California Jul-15 +2%

Florida Sep-15 +4%

Illinois Jul-15 TBD

Michigan 8% Oct-15 TBD

LTC

New Mexico Jan-15 +3%

Ohio Jan-15 +1%

South Carolina Jul-15 (3%)

Texas Jul-153 /Sep-15 +3% /+2%

Utah Jan-154

/Jul-15 +3% / TBD

Washington 11% Jan-15 +3%

ABD

Wisconsin Jan-15 +0.5%

Medicaid Expansion

State

Effective Date Rate Change

California Jan-152

/Jul-15 (16%) / (12%)

Illinois Jul-15 TBD

Michigan Oct-15 TBD

New Mexico Jan-15 +4%

Ohio Jan-15 (3%)

Washington Jan-15/Jul-15 (41%) / (8%)

70

Q&A

71

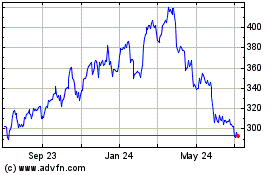

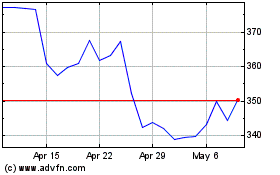

Molina Healthcare (NYSE:MOH)

Historical Stock Chart

From Aug 2024 to Sep 2024

Molina Healthcare (NYSE:MOH)

Historical Stock Chart

From Sep 2023 to Sep 2024