Tyco, IRS Reach Deal On Taxes

January 20 2016 - 3:02AM

Dow Jones News

(FROM THE WALL STREET JOURNAL 1/20/16)

By Bob Tita

Tyco International PLC said it reached a tentative settlement

with the U.S. Internal Revenue Service that would require Tyco and

two businesses it spun off in 2007 to pay as much as $525 million

in total claims for back taxes.

The settlement, disclosed Tuesday in a regulatory filing, is far

less than the $1 billion to $1.3 billion in taxes and penalties

projected by some analysts. Tyco, TE Connectivity Ltd. and Covidien

PLC, which was acquired last year by Medtronic PLC, would pay the

IRS between $475 million and $525 million.

Tyco, which makes fire suppression and security equipment for

commercial building, would pay 27% of the settlement amount, or

roughly $128 million to $142 million. TE Connectivity, which

manufacturers electronic components, and Medtronic, a

medical-device maker, would be responsible for 31% and 42% of the

settlement, respectively.

Tyco spun off TE Connectivity and Covidien as stand-alone public

companies as part of a decadelong dismantling of its business

portfolio. The industrial conglomerate also spun off home-security

service ADT Corp. and sold its industrial pipes and valves business

in 2012 to Pentair PLC.

Tyco, which is based in Ireland, said neither ADT nor Pentair

would be liable for a share of the settlement, under an earlier

agreement between Tyco and the IRS.

The settlement is subject to the approval of the IRS Appeals

Division and the U.S. Tax Court. Tyco's portion of the settlement

would be covered by $215 million that the company previously set

aside. Tyco said it expects to pay its share of the settlement in

the next six months.

(END) Dow Jones Newswires

January 20, 2016 02:47 ET (07:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

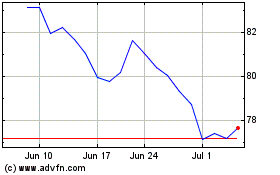

Medtronic (NYSE:MDT)

Historical Stock Chart

From Mar 2024 to Apr 2024

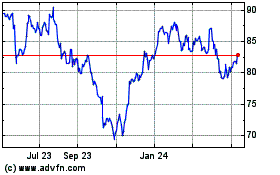

Medtronic (NYSE:MDT)

Historical Stock Chart

From Apr 2023 to Apr 2024