Medtronic Revenue Boosted by Covidien Acquisition -- Update

September 03 2015 - 3:46PM

Dow Jones News

By Jeanne Whalen

Medtronic PLC reported strong revenue growth in its latest

quarter, helped by cardiovascular device sales, an extra week in

the quarter and its recent acquisition of Covidien PLC.

Thursday's report marks the second round of results since the

device manufacturer's $50 billion acquisition of Covidien closed in

January. The deal, which combined two of the world's largest

surgical-implant and hospital-supply companies, drew scrutiny over

a tax-lowering tactic criticized by U.S. government officials. The

acquisition involved Medtronic moving its official headquarters

from Minneapolis to Dublin, a so-called inversion deal that lowered

the company's tax burden.

Net profit in the quarter fell 6% to $820 million, from $871

million a year earlier, hurt by restructuring charges, higher

expenses for R&D and sales and administration, and $481 million

in amortization. Excluding these items, earnings rose 3% to $1.02 a

share, from 99 cents a share a year earlier.

Revenue in the quarter rose to $7.27 billion, a 70% increase

over the previous year's quarter, before Medtronic bought Covidien.

On a comparable, constant currency basis--which includes Covidien

in the year-earlier results--revenue grew 12%. Revenue was buoyed

by strong results in Medtronic's largest division, which sells

stents, pacemakers, implantable defibrillators and other

cardiovascular devices.

The cardiovascular unit also markets services such as the

management of hospital catheterization labs. Medtronic said revenue

from services nearly doubled in the quarter.

Sales of surgical tools and diabetes devices, including insulin

pumps, were also robust. And revenue was boosted by an extra

selling week in the quarter, a quirk of Medtronic's fiscal-year

reporting schedule.

Chief Executive Omar Ishrak said he sees strong growth

opportunity in the market for stroke treatment. Sales in the

company's neurovascular division rose in the double digits

percentage-wise in the latest quarter, driven by products such as

Solitaire FR, a device designed to decrease disability after a

stroke. Medtronic this week said it had paid $150 million to

acquire Medina Medical, a privately held California firm developing

devices to treat brain aneurysms, which can lead to stroke.

Sales of artificial discs and other products to treat spinal

conditions continue to be a weak link in Medtronic's performance.

In recent quarters the company has lost market share to competitors

that were faster to launch new products, and had some problems with

the organization of its sales force, Mr. Ishrak said in an

interview. "We have taken measures to correct that and will be

driving it more aggressively," he said.

Medtronic is "well on [its] way" to meeting the synergy target

of $850 million it set following its acquisition of Covidien, Chief

Financial Officer Gary Ellis said. The company took restructuring

charges of $67 million in the latest quarter, mostly to cover the

cost of laying off employees. Medtronic has eliminated about 500

jobs since acquiring Covidien, and now has about 85,000

employees.

Angela Chen contributed to this article.

Write to Jeanne Whalen at jeanne.whalen@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 03, 2015 15:31 ET (19:31 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

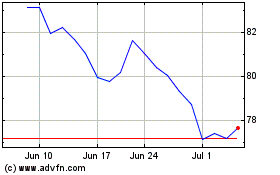

Medtronic (NYSE:MDT)

Historical Stock Chart

From Mar 2024 to Apr 2024

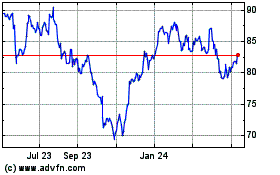

Medtronic (NYSE:MDT)

Historical Stock Chart

From Apr 2023 to Apr 2024