Medtronic to Buy Privately Held Twelve Inc. -- Update

August 25 2015 - 10:41AM

Dow Jones News

By Ezequiel Minaya

Medtronic PLC said Tuesday it has agreed to acquire Twelve Inc.,

a company that develops valve replacement devices, for $458

million.

Redwood City, Calif.-based Twelve is focused on developing a

transcatheter mitral valve replacement device, an area Medtronic

hopes will be a source of growth.

"We have followed the transcatheter mitral valve space closely

and firmly believe that Twelve has the most novel technology along

with a strong, proven team," said Sean Salmon, a senior vice

president at Medtronic and head of its coronary and structural

heart division.

The transaction, expected to close in October, is for $408

million at closing and a $50 million milestone payment.

The Ireland-based Medtronic expects the deal to be earnings

neutral as the company intends to offset the dilutive impact of the

transaction. Twelve will join Medtronic's coronary and structural

heart division within the cardiac and vascular group.

Medtronic has been on an acquisition spree this year. In

January, the company's shareholders approved the company's $43

billion acquisition of Ireland's Covidien PLC.

A string of smaller deals followed in June with Medtronic

acquiring Aptus Endosystems Inc. for roughly $110 million and

cardiac-mapping company CardioInsight Technologies Inc. in a deal

valued at $93 million. Last month, the company agreed to acquire RF

Surgical Systems Inc. for about $235 million.

Medtronic relocated to Dublin earlier this year as part of a

wave of similar moves aimed at taking advantage of lower

corporate-tax rates overseas.

Write to Ezequiel Minaya at ezequiel.minaya@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 25, 2015 10:26 ET (14:26 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

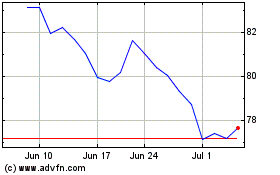

Medtronic (NYSE:MDT)

Historical Stock Chart

From Mar 2024 to Apr 2024

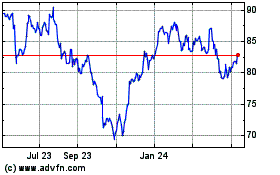

Medtronic (NYSE:MDT)

Historical Stock Chart

From Apr 2023 to Apr 2024