Monster Beverage Posts Higher Adjusted Earnings

August 04 2016 - 6:10PM

Dow Jones News

Monster Beverage Corp. posted higher adjusted earnings in the

second quarter as net sales rose 19% and the energy-drink maker saw

improvements in its U.S. distribution levels.

Bottom-line profit fell 20%, reflecting several one-items,

including a 2015 gain on the sale of the company's non-energy drink

brands.

In June 2015, Coca-Cola Co. paid $2.15 billion to buy a 16.7%

stake in Monster as part of an asset swap in which it also became

Monster's preferred distributor. Issues related to the distribution

transition have weighed on Monster's results since then.

Monster said Thursday that the Coke agreement has fared well in

markets such as Mexico but there are still some uncertainties at

international non-Coca-Cola distribution networks.

Monster authorized the repurchase of up to $250 million of

stock, another capital-return move following a recent $2 billion

modified "Dutch auction" tender offer.

For the quarter ended June 30, net income was $184.2 million, or

90 cents a share, down from $229 million, or $1.26 a share, a year

earlier. Earnings excluding items rose to 99 cents a share from 79

cents. Net sales rose to $827.5 million from $693.7 million.

Analysts polled by Thomson Reuters had projected adjusted profit

of $1.03 a share on $804 million in revenue.

In April, Monster bought American Fruits & Flavors in a $690

million deal that brought its primary flavor supplier in-house.

Shares rose 1.2%, to $160.50, in after-hours trading.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

August 04, 2016 17:55 ET (21:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

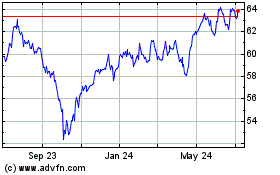

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

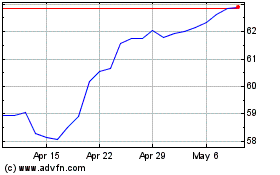

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024