Current Report Filing (8-k)

April 15 2015 - 6:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported) April 14, 2015 (April 14, 2015)

HERTZ GLOBAL HOLDINGS, INC.

THE HERTZ CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware |

|

001-33139 |

|

20-3530539 |

|

Delaware |

|

001-07541 |

|

13-1938568 |

|

(State of Incorporation) |

|

(Commission File Number) |

|

(I.R.S Employer Identification No.) |

999 Vanderbilt Beach Road, 3rd Floor

Naples, Florida 34108

999 Vanderbilt Beach Road, 3rd Floor

Naples, Florida 34108

(Address of principal executive offices,

including zip code)

(239) 552-5800

(239) 552-5800

(Registrant’s telephone number,

including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 8.01 OTHER EVENTS.

On April 14, 2015, Hertz Global Holdings, Inc., the parent company of The Hertz Corporation (“Hertz”), issued a press release announcing the issuance of $780 million in aggregate principal amount of medium term rental car asset backed notes (the “ABS Offering”) by Hertz’s subsidiary, Hertz Vehicle Financing II LP.

The full text of the press release with respect to the ABS Offering is filed herewith as Exhibit 99.1 and is incorporated by reference in this Item 8.01.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits. The following Exhibit is filed as part of this report:

|

Exhibit |

|

Description |

|

|

|

|

|

99.1 |

|

Press Release dated April 14, 2015. |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, each registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

HERTZ GLOBAL HOLDINGS, INC.

THE HERTZ CORPORATION |

|

|

(Registrant) |

|

|

|

|

|

|

|

|

By: |

/s/ Thomas C. Kennedy |

|

|

Name: |

Thomas C. Kennedy |

|

|

Title: |

Senior Executive Vice President and Chief Financial Officer |

|

|

|

|

|

|

|

|

|

Date: April 14, 2015 |

|

|

3

Exhibit 99.1

FOR IMMEDIATE RELEASE

HERTZ ANNOUNCES CLOSING OF PRIVATE OFFERING OF $780 MILLION

MEDIUM TERM RENTAL CAR ASSET BACKED NOTES

ESTERO, FL, April 14, 2015 — Hertz Global Holdings, Inc. (NYSE: HTZ) (“Hertz” or the “Company”) today announced that Hertz Vehicle Financing II LP (“HVF II”), a wholly owned special purpose subsidiary of the Company, successfully issued $780.0 million in aggregate principal amount of Series 2015-1 Rental Car Asset Backed Notes, Class A, Class B, and Class C (the “Series 2015-1 Notes”). The Company utilizes the HVF II securitization platform to finance its U.S. rental car fleet.

The expected maturity of the Series 2015-1 Notes is March 2020. The Series 2015-1 Notes are comprised of $622.44 million aggregate principal amount of 2.73% Rental Car Asset Backed Notes, Class A, $118.529 million aggregate principal amount of 3.52% Rental Car Asset Backed Notes, Class B, and $39.031 million aggregate principal amount of 4.35% Rental Car Asset Backed Notes, Class C. The Class B Notes are subordinated to the Class A Notes. The Class C Notes are subordinated to the Class A Notes and the Class B Notes.

The net proceeds from the sale of the Series 2015-1 Notes are expected to be used (i) to repay a portion of the outstanding principal amount of HVF II’s Series 2013-A Variable Funding Notes and HVF II’s Series 2014-A Variable Funding Notes and (ii) to make loans to Hertz Vehicle Financing LLC (“HVF”), a wholly owned special purpose subsidiary of the Company. HVF is expected to use the proceeds of any such loans to acquire or refinance vehicles to be leased to The Hertz Corporation or DTG Operations, Inc., each wholly owned subsidiaries of the Company, for use in their daily rental operations. The offering closed on April 14, 2015.

This press release does not constitute an offer to sell or the solicitation of an offer to buy any of the Series 2015-1 Notes or any other securities, nor will there be any sale of the Series 2015-1 Notes or any other securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or other jurisdiction. The Series 2015-1 Notes initially were offered and sold only to qualified institutional buyers in an offering exempt from registration pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), and are eligible for resale to investors pursuant to Rule 144A of the Securities Act and to investors outside the United States pursuant to Regulation S under the Securities Act. None of the Series 2015-1 Notes have been registered under the Securities Act or the securities laws of any state or other jurisdiction, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the Securities Act and the securities laws of any applicable state or other jurisdiction.

|

About Hertz

Hertz operates the Hertz, Dollar, Thrifty and Firefly car rental brands in more than 10,800 corporate and licensee locations throughout 145 countries in North America, Europe, Latin America, Asia, Australia, Africa, the Middle East and New Zealand. Hertz is the largest worldwide airport general use car rental company with more than 1,700 airport locations in the U.S. |

|

and more than 1,300 airport locations internationally. Product and service initiatives such as Hertz Gold Plus Rewards, NeverLost®, Carfirmations, Mobile Wi-Fi and unique vehicles offered through the Adrenaline, Dream, Green and Prestige Collections set Hertz apart from the competition. Additionally, Hertz owns the vehicle leasing and fleet management leader Donlen Corporation, operates the Hertz 24/7 hourly car rental business and sells vehicles through its Rent2Buy program. The Company also owns Hertz Equipment Rental Corporation (“HERC”), one of the largest equipment rental businesses with more than 350 locations worldwide offering a diverse line of equipment and tools for rent and sale. HERC primarily serves the construction, industrial, oil, gas, entertainment and government sectors. For more information about Hertz, visit: www.hertz.com.

Cautionary Note Concerning Forward Looking Statements

Certain statements contained in this press release include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements often include words such as “believe,” “expect,” “project,” “anticipate,” “intend,” “plan,” “estimate,” “seek,” “will,” “may,” “would,” “should,” “could,” “forecasts” or similar expressions. These statements are based on certain assumptions that the Company has made in light of its experience in the industry as well as its perceptions of historical trends, current conditions, expected future developments and other factors that the Company believes are appropriate in these circumstances. We believe these judgments are reasonable, but you should understand that these statements are not guarantees of performance or results. These forward-looking statements involve risks, uncertainties and assumptions. Many factors could affect our actual financial and operating results and could cause actual results to differ materially from those expressed in the forward-looking statements, due to a variety of important factors, both positive and negative.

Additional information concerning these factors can be found in our filings with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K and Current Reports on Form 8-K.

The Company therefore cautions you against relying on these forward-looking statements. All forward-looking statements attributable to the Company or persons acting on the Company’s behalf are expressly qualified in their entirety by the foregoing cautionary statements. All such statements speak only as of the date made, and the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Contacts:

Investor Relations:

Hertz

Leslie Hunziker

(239) 552-5700

lhunziker@hertz.com

Media:

Hertz

Richard Broome

(239) 552-5558

rbroome@hertz.com

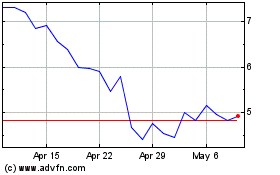

Hertz Global (NASDAQ:HTZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

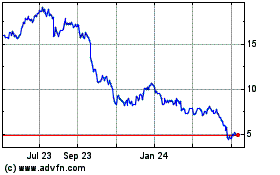

Hertz Global (NASDAQ:HTZ)

Historical Stock Chart

From Apr 2023 to Apr 2024