Honeywell CEO Cote to Step Down in March -- 3rd Update

June 28 2016 - 7:45PM

Dow Jones News

By Ted Mann and Josh Beckerman

Dave Cote will step down as chief executive of Honeywell

International Inc. at the end of March, ending a 14-year tenure

during which he revived the fortunes of the industrial

conglomerate.

Mr. Cote, who turns 64 next month, will be succeeded by Darius

Adamczyk, who was named the company's president and chief operating

officer in April. Mr. Cote will continue as executive chairman

through April 2018, and then start a five-year consulting and

noncompete agreement.

"Darius thinks independently and has demonstrated that he can

evolve business strategies to fit evolving circumstances -- a very

important skill because the world is changing rapidly," Mr. Cote

said in a written statement.

In an interview on Tuesday, Mr. Adamczyk said he would redouble

the company's efforts to expand its software offerings for

industrial customers. As industrial manufacturers evolve, Mr.

Adamczyk said, organic sales growth will increasingly come from

software that can help Honeywell's customers -- from airlines to

petroleum refineries -- squeeze more efficiency out of their heavy

machinery. "Software is going to be the medium by which that value

is going to be delivered," he said.

Mr. Adamczyk's promotion in April was seen as a signal that he

was in pole position to take over as CEO. As president and

operating chief, the 50-year-old gained oversight for Honeywell's

wide array of business units, which make products ranging from fire

alarms and thermostats to automotive turbochargers and rubber boots

for firefighters.

Before that, Mr. Adamczyk -- who joined the company eight years

ago through an acquisition -- had been leading the performance

materials business since 2014. A native of Poland and an engineer,

Mr. Adamczyk earned an M.B.A. from Harvard University. He

previously held executive roles at Ingersoll-Rand PLC and

Metrologic Instruments Inc., a company Honeywell acquired.

Mr. Cote took the reins of Honeywell in 2002, when the New

Jersey-based conglomerate was reeling in the aftermath of a bungled

merger with Allied Signal and a failed deal to be acquired by

General Electric Co. Under Mr. Cote, who cut his teeth at GE,

Honeywell has turned into a comeback story.

Honeywell shares have risen nearly 200% over the past decade,

compared with a 63% gain in the S&P 500 index. Honeywell shares

rose 2.3% to $114.06 on Tuesday.

"Dave has been a passionate and transformative leader throughout

his tenure at Honeywell, completely turning around the company from

its initial state of disarray," said Jaime Chico Pardo, who was

named Honeywell's lead director as part of the transition plan.

The company built a record of disciplined, well-executed midsize

deals, expanding product lines in areas like personal protective

equipment, building controls and mobile scanners without overpaying

for targets. Key, Mr. Cote has said, was avoiding "fad-surfing" --

chasing competitors into new markets and overpaying in the process,

as he felt other industrials had done.

This year, Mr. Cote changed his tune and attempted a megadeal,

launching a $90 billion takeover bid for rival United Technologies

Corp. that would have created an aerospace giant.

But the offer was rebuffed, and United Technologies executives

publicly attacked the deal as an impossibility because of likely

objections by regulators and big aerospace customers.

Mr. Adamczyk said the company also will continue to seek out

acquisitions as it has in the past. "We have a great skill set," he

said of Honeywell's deal team. "We exercise the right set of

muscles."

Honeywell also announced a plan to overhaul its compensation for

top executives. Mr. Pardo and Scott Davis, the chairman of the

board's compensation committee "will be actively engaging with the

Company's largest shareholders over the coming months" to consider

changes, including making incentive pay for executives "mostly

formulaic and less discretionary," the company said in a filing.

Honeywell plans to announce the changes in compensation before

issuing its 2017 proxy statement, the company said.

Write to Ted Mann at ted.mann@wsj.com and Josh Beckerman at

josh.beckerman@wsj.com

(END) Dow Jones Newswires

June 28, 2016 19:30 ET (23:30 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

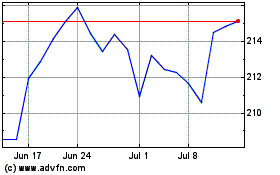

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Mar 2024 to Apr 2024

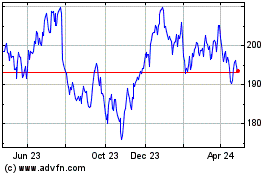

Honeywell (NASDAQ:HON)

Historical Stock Chart

From Apr 2023 to Apr 2024