UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: (Date of earliest event reported): March 27, 2015

Diamond Offshore Drilling, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-13926 |

|

76-0321760 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

file number) |

|

(I.R.S. Employer

Identification No.) |

15415 Katy Freeway

Houston, Texas 77094

(Address of principal executive offices, including Zip Code)

(281) 492-5300

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers

On March 27, 2015, the Compensation Committee (the

“Committee”) of the Board of Directors of Diamond Offshore Drilling, Inc. (the “Company”) approved forms of award agreements for use in connection with grants of restricted stock units (“RSUs”) pursuant to the

Company’s Equity Incentive Compensation Plan (the “Plan”). RSUs are contractual rights to receive shares of the Company’s common stock in the future if the applicable vesting conditions are met. Each RSU represents a contingent

right to receive one share of the Company’s common stock. The Committee approved a form of RSU award agreement for awards of RSUs under the Plan to executive officers and certain other officers of the Company (the “Specimen

Agreement”) and a form of RSU award agreement for awards of RSUs under the Plan to the Company’s chief executive officer (the “CEO Specimen Agreement”).

Officer Awards. The Specimen Agreement provides for grants of RSUs that vest based upon the passage of time and/or grants of RSUs that

vest based upon the attainment of the financial performance goal to be specified in the particular award agreement, all of which are subject to forfeiture if the applicable vesting conditions are not met. The Specimen Agreement provides that half of

the time-vesting RSUs vest on the second anniversary of the grant date and the remainder of the time-vesting RSUs vest on the third anniversary of the grant date, on the terms and subject to the conditions set forth therein. The Specimen Agreement

provides for a three-year performance period for performance-vesting RSUs and that the level of achievement compared to the performance goal set forth therein will govern the number of RSUs that cliff vest following the performance period, on the

terms and subject to the conditions set forth therein, based on the schedule set forth in the Specimen Agreement, and subject to the Compensation Committee’s right to exercise negative discretion to reduce the amount of the performance RSUs

that would otherwise be eligible to vest.

As an additional condition to the vesting of RSUs awarded pursuant to a grant pursuant to the

Specimen Agreement, the grantee is required to remain an employee of the Company or its subsidiary through the applicable vesting date, except as set forth in the Specimen Agreement with respect to performance-vesting RSUs in the case of termination

of employment by the Company without Cause (as defined in the Plan) or due to retirement (as defined in the Specimen Agreement). The Company has the right to settle any vested RSUs in cash in lieu of shares of the Company’s common stock.

The Specimen Agreement also obligates the grantee to comply with certain restrictive covenants, including obligations of confidentiality, a

prohibition on solicitation of certain employees of the Company and its subsidiaries, and a prohibition on competition with the Company for a period of one year after termination of employment.

CEO Awards. The CEO Specimen Agreement provides for grants of RSUs that vest based upon the attainment of the financial performance

goal to be specified in the particular award agreement, which are subject to forfeiture if the applicable vesting conditions are not met. The CEO Specimen Agreement provides for cliff vesting following a three-year performance period. The level of

achievement compared to the performance goal set forth therein will govern the number of RSUs that vest following the performance period, on the terms and subject to the conditions set forth therein, based on the schedule set forth in the CEO

Specimen Agreement, and subject to the Compensation Committee’s right to exercise negative discretion to reduce the

2

amount of the performance RSUs that would otherwise be eligible to vest. Upon the Company’s payment of any cash or stock dividend in respect of its common stock prior to vesting of an award,

the grantee will be credited with a number of additional RSUs based upon the amount of the dividend that would be payable with respect to shares underlying the RSUs outstanding on the record date for such dividend, in accordance with the terms of

the CEO Specimen Agreement.

As an additional condition to the vesting of RSUs awarded pursuant to a grant pursuant to the CEO Specimen

Agreement, the chief executive officer is required to remain an employee of the Company or its subsidiary through the vesting date, except as set forth in the CEO Specimen Agreement in the case of termination of employment by the Company without

“Cause” or by the chief executive officer for “Good Reason”, or termination on account of “retirement” (each as defined in the CEO Specimen Agreement) or as otherwise specified in the CEO Specimen Agreement. The Company

has the right to settle any vested RSUs in cash in lieu of shares of the Company’s common stock.

The foregoing descriptions of the

Specimen Agreement and the CEO Specimen Agreement are summaries only and are qualified in their entirety by the full text of the Specimen Agreement and the CEO Specimen Agreement, respectively, copies of which are filed as Exhibit 10.1 and Exhibit

10.2, respectively, to this Current Report on Form 8-K and are incorporated herein by reference.

Item 9.01. Financial Statements and

Exhibits

|

|

|

| Exhibit

number |

|

Description |

|

|

| 10.1 |

|

Specimen Agreement for grants of RSUs to Officers |

|

|

| 10.2 |

|

Specimen Agreement for grants of RSUs to the Chief Executive Officer |

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Date: March 30, 2015 |

|

|

|

DIAMOND OFFSHORE DRILLING, INC. |

|

|

|

|

|

|

|

|

By: |

|

/s/ DAVID L. ROLAND |

|

|

|

|

|

|

David L. Roland |

|

|

|

|

|

|

Senior Vice President, General Counsel and Secretary |

4

Exhibit 10.1

[Officer Specimen]

DIAMOND OFFSHORE DRILLING, INC.

RESTRICTED STOCK UNIT AWARD AGREEMENT

THIS RESTRICTED STOCK UNIT AWARD AGREEMENT (this “Agreement”) is made and entered into as of the grant date set forth below (the “Grant

Date”) and evidences the grant of the Award set forth below by Diamond Offshore Drilling, Inc., a Delaware corporation (the “Company”), to the individual named below (the “Grantee”). Capitalized terms not defined herein

shall have the meanings ascribed to them in the Diamond Offshore Drilling, Inc. Equity Incentive Compensation Plan (the “Plan”).

|

|

|

| Name of Grantee: |

|

[ ] |

|

|

| Grant Date: |

|

[ ] |

|

|

| Number of Time-Vesting RSUs Subject to

Award: |

|

[ ] |

|

|

| Target Number of Performance RSUs Subject to

Award: |

|

[ ] |

|

|

| Performance Period for Performance

RSUs: |

|

Calendar years [calendar year including Grant Date and two

following calendar years] |

|

|

| Vesting Date for Time-Vesting RSUs: |

|

[2 years after Grant Date] as to [50%] Time-Vesting RSUs |

|

|

[3 years after Grant Date] as to [50%] Time-Vesting RSUs |

|

|

| Vesting of Performance RSUs: |

|

See Section 2 below |

1. Grant of Awards. The Company hereby grants to the Grantee Restricted Stock Units (“RSUs”) as set forth

herein, subject to the terms and conditions of this Agreement and the Plan. RSUs granted under this Agreement that are not subject to the achievement of performance goals are referred to herein as “Time-Vesting RSUs.” RSUs granted under

this Agreement that are subject to the achievement of performance goals are referred to herein as “Performance RSUs.” This Agreement shall constitute the Award Terms for purposes of the Plan.

2. Form of Payment and Vesting.

(a)

Time-Vesting RSUs. Each Time-Vesting RSU granted under this Agreement shall, subject to the vesting schedule set forth above and the other terms herein, represent the

right to receive a payment of one share of Stock (rounded down to the nearest whole share in the aggregate on each Vesting Date). Any Time-Vesting RSUs that become vested shall thereafter be

payable in accordance with Section 2(c).

(b) Performance RSUs. Each Performance RSU granted under this Agreement shall,

subject to the attainment of certain performance goals set forth in this Agreement and the other terms herein, represent the right to receive a payment of one share of Stock (rounded down to the nearest whole share in the aggregate on each Vesting

Date). The attached Schedule A specifies the financial performance goals (“Performance Goals”) required to be attained during the performance period designated above (the “Performance Period”) in order for the Performance RSUs to

become eligible to vest, provided that, in determining the number of Performance RSUs eligible to vest, the Committee shall at all times have the right in its sole discretion to reduce the number of Performance RSUs that would otherwise be eligible

to vest as a result of the performance as measured against the Performance Goal (“Negative Discretion”). Any Performance RSUs that vest in accordance with this Agreement shall thereafter be payable in accordance with Section 2(c). Any

Performance RSUs that do not vest pursuant to this Agreement shall be immediately forfeited.

(c) Timing and Manner of Payment after

Vesting of RSUs.

(i) Following the end of the Performance Period (but in no event later than two and one-half (2 1⁄2) months following the end of the Performance Period), the Committee shall determine the actual level of attainment of the Performance Goal for the

Performance Period. On the basis of the Committee’s determination, the Committee will determine the number of Performance RSUs eligible to vest as calculated in accordance with the percentile matrix set forth in Schedule A, subject to the

Committee’s Negative Discretion. The number of Performance RSUs determined by the Committee through such process shall constitute the number of RSUs in which the Grantee shall vest under this Award.

(ii) With regard to Performance RSUs subject to this Award, the “Vesting Date” for such Performance RSUs shall be the date that the

Committee determines the vesting of Performance RSUs in accordance with this Section 2(c). With regard to Time-Vesting RSUs subject to this Award, the “Vesting Date” shall be the applicable date set forth above for such Time Vesting

RSUs.

(iii) Within thirty (30) days following each Vesting Date of a Time-Vesting RSU pursuant to this Section 2(c) and within

two and one-half (2 1⁄2) months following the end of the Performance Period with regard to vested Performance RSUs, the Company shall deliver to the

account of the Grantee a number of shares of Stock (either by delivering one or more certificates for such shares or by entering such shares in book entry form, as determined by the Company in its discretion) equal to the number of RSUs subject to

this Award that vest on the applicable Vesting Date, less withholding pursuant to Section 7(e) of the Plan, unless such RSUs terminated or are forfeited prior to the applicable Vesting Date pursuant to this Agreement or the Plan or unless the

Company has elected in its discretion to settle such vested RSUs in cash in lieu of Stock. The Company’s obligation to deliver shares of Stock or otherwise make payment with respect to vested RSUs is subject to the condition precedent that the

Grantee or other person

2

entitled under the Plan to receive any shares of Stock with respect to the vested RSUs deliver to the Company any representations or other documents or assurances required pursuant to

Section 7(j) of the Plan. Neither the Grantee nor any of the Grantee’s successors, heirs, assigns or personal representatives shall have any further rights or interests with respect to any RSUs that are paid or that terminate pursuant to

this Agreement or the Plan. Notwithstanding anything herein to the contrary, the Company shall have no obligation to issue shares of Stock in payment of the RSUs unless such issuance and such payment shall comply with all relevant provisions of law

and the requirements of any applicable stock exchange.

(iv) Except as otherwise provided in Section 3 of this Agreement, the vesting

schedules in this Agreement require continued employment or service with the Company or one of its Subsidiaries through the applicable Vesting Date as a condition to the vesting of the applicable portion of this Award and the rights and benefits

under this Agreement. Except as otherwise provided in Section 3 of this Agreement, employment or service for only a portion of the vesting period, even if a substantial portion, will not entitle the Grantee to any proportionate vesting or avoid

or mitigate a termination of rights and benefits upon or following a termination of employment or services as provided in this Agreement or under the Plan.

(v) Notwithstanding anything to the contrary in this Agreement, the Company reserves the right, at its sole discretion, to settle any vested

RSU by cash payment in lieu of Stock. If the Company elects to settle any RSU in cash, the amount of cash to be paid by the Company in settlement shall be determined by multiplying (a) the number of vested RSUs to be settled in cash, less any

withholding pursuant to Section 7(e) of the Plan, by (b) the Fair Market Value of a share of Stock as of the applicable Vesting Date.

3.

Termination of Award. This Award is subject to termination as follows:

(a) Termination of Employment by the Company without

Cause. Upon termination of the Grantee’s employment by the Company or its Subsidiary without Cause on or after [2 years after Grant Date] but prior to the Vesting Date for Performance RSUs, then this Award of Performance RSUs shall

remain outstanding and the number of Performance RSUs to vest shall be determined in accordance with the process set forth in Section 2, provided that the resulting number of vested Performance RSUs will be reduced by 50% (and the remainder of

this Award of Performance RSUs will be forfeited).

(b) Termination of Employment On Account of Retirement. Upon the Grantee’s

retirement (as defined below) prior to the Vesting Date for Performance RSUs, then this Award of Performance RSUs shall remain outstanding and the number of Performance RSUs to vest shall be determined in accordance with the process set forth in

Section 2, provided that the resulting number of vested Performance RSUs will be reduced pro rata to correspond with the portion of the period commencing on the Grant Date and ending on [last day of Performance Period] that has elapsed

as of the effective date of the Grantee’s retirement (and the remainder of this Award of Performance RSUs will be forfeited).

For

purposes of this Section 3(b), “retirement” means the termination of employment with the Company and each of its Subsidiaries or Affiliates by the Grantee on or after reaching

3

age 63; provided that the Grantee’s employment is not terminated for Cause and provided further that such termination will constitute a retirement for these purposes only if, at least one

year prior to the Grantee’s desired retirement date, the Grantee delivers a written notice (by any means, including by email) to the VP - Human Resources or other employee within the Human Resources Department of the Company that

(x) indicates the Grantee intends to retire and (y) specifies an intended retirement date.

(c) Other Termination. Except

as otherwise set forth in Section 3(a) or 3(b) above, if the Grantee’s employment with the Company and/or its Subsidiaries terminates prior to a Vesting Date for any reason, the unvested portion of this Award shall be forfeited as of the

date of such termination of employment.

4. Dividend and Voting Rights.

(a) Limitation on Rights. The RSUs are bookkeeping entries only. Notwithstanding Section 5(b) of the Plan, the Grantee shall have

no rights as a stockholder of the Company, no dividend rights (except as expressly provided in Section 4(b) below with respect to Dividend Equivalent Rights) and no voting rights with respect to the RSUs or any shares of Stock underlying or

issuable in respect of the RSUs until such shares of Stock are actually issued to and held of record by the Grantee pursuant to the terms of this Agreement. Notwithstanding Section 5(b) of the Plan, no adjustments will be made for dividends or

other rights of a holder for which the record date is prior to the date of issuance of the stock certificate or book entry evidencing such shares of Stock (except as expressly provided in Section 4(b) below with respect to Dividend Equivalent

Rights).

(b) Dividend Equivalent Rights Distributions. As of any date that the Company pays a special cash dividend on its Stock

prior to vesting of any RSUs subject to this Award, the Company shall credit the Grantee with a dollar amount equal to (i) the per share special cash dividend paid by the Company on its Stock on such date, multiplied by (ii) the total

number of unvested RSUs subject to this Award that are outstanding on the record date for that dividend (a “Dividend Equivalent Right”). With respect to Performance RSUs, the number of RSUs that are outstanding shall be based on the target

number of Performance RSUs. Any Dividend Equivalent Rights credited pursuant to the foregoing provisions of this Section 4(b) shall be subject to the same vesting, payment and other terms, conditions and restrictions as the original RSUs to

which they relate; provided, however, that the amount of any vested Dividend Equivalent Rights shall be paid to the Grantee only in cash. No crediting of Dividend Equivalent Rights shall be made pursuant to this Section 4(b) with respect to any

RSUs that, as of the record date for that dividend, have either been paid pursuant to Section 2(c)(v) or have terminated or been forfeited pursuant to this Agreement. No crediting of Dividend Equivalent Rights shall be made pursuant to this

Section 4(b) with respect to any regular or ordinary cash dividends.

5. RSU Award Subject to Plan. This Award is granted under and subject to

and governed by the terms and conditions of this Agreement and the terms and conditions of the Plan, which are incorporated herein by reference. In the event of any conflict between this Agreement and the Plan, the Plan shall control unless

specifically stated otherwise in this Agreement. In the event of any ambiguity in this Agreement, any term that is not defined in this Agreement, or any matters as to which this Agreement is silent, the Plan shall govern.

4

6. Restrictive Covenants.

(a) Confidentiality. The Grantee agrees that, during the Performance Period and at all times thereafter, the Grantee shall not reveal

or utilize Confidential Information (as hereinafter defined) that the Grantee acquired during the course of or as a result of the Grantee’s employment with the Company or one of its Subsidiaries and that relates to (x) the Company or any

of its Subsidiaries or (y) Company’s and its Subsidiaries’ customers, employees, agents or vendors. The Grantee acknowledges that all such Confidential Information is commercially valuable and is the property of the Company. Upon the

termination of the Grantee’s employment with the Company and its Subsidiaries, the Grantee shall immediately return all such Confidential Information to the Company, whether it exists in written, electronic, computerized or other form.

Notwithstanding anything elsewhere to the contrary, the Grantee (a) may disclose Confidential Information (i) to the Company and its Subsidiaries and affiliates, or to any authorized agent or representative of any of them, (ii) in

confidence to any attorney or accountant actually retained by the Grantee for the purpose of securing professional advice (but not the Company’s privileged information), or (iii) when required to do so by law or by a court, governmental

agency, legislative body, arbitrator or other person with jurisdiction to order the Grantee to divulge, disclose or make accessible such information, and (b) may disclose or use Confidential Information (i) with the Company’s prior

written consent, (ii) in connection with performing the Grantee’s employment duties for the Company and its Subsidiaries or (iii) in connection with any legal proceeding involving the Company or its Subsidiaries. In the event that the

Grantee is required to disclose any Confidential Information pursuant to clause (a)(iii) or (b)(iii) of the immediately preceding sentence, the Grantee shall (A) promptly give the Company advance notice that such disclosure may be made and

(B) not oppose, and affirmatively cooperate with, the Company, at its reasonable request and sole expense, in seeking to protect the confidentiality of the Confidential Information. For purposes hereof, “Confidential Information”

shall mean information, knowledge or data (whether or not a trade secret or protected by laws pertaining to intellectual property and including, without limitation, information relating to data, finances, marketing, pricing, profit margins, claims,

legal matters, loss control, marketing and business plans and strategies, software, processing, vendors, administrators, customers or prospective customers, products, brokers and employees), other than information, knowledge or data that

(x) has previously been disclosed to the public, or is in the public domain, other than as a result of the Grantee’s breach of this Section 6(a) or other obligation of confidentiality, or (y) is known or generally available to

the public.

(b) Solicitation of Employees. The Grantee covenants and agrees that during the Grantee’s employment and for a

period of two (2) years after the termination of the Grantee’s employment, whether such termination occurs at the insistence of the Company or the Grantee (for whatever reason), the Grantee shall not, individually or jointly with others,

directly or indirectly:

(i) recruit, hire, encourage, or attempt to recruit or hire, alone or by assisting others, any employees of the

Company or former employees of the Company with whom the Grantee worked, had business contact, or about whom the Grantee gained non-public or Confidential Information (hereinafter, “Company’s employees or former employees”);

5

(ii) contact or communicate with Company’s employees or former employees for the purpose of

inducing, assisting, encouraging and/or facilitating Company’s employees or former employees to terminate their employment with the Company or find employment or work with another person or entity;

(iii) provide or pass along to any person or entity the name, contact and/or background information about any of Company’s employees or

former employees or provide references or any other information about them;

(iv) provide or pass along to Company’s employees or

former employees any information regarding potential jobs or entities or persons to work for, including but not limited to, job openings, job postings, or the names or contact information of individuals or companies hiring people or accepting job

applications; or

(v) offer employment or work to Company’s employees or former employees.

For purposes of this covenant, “former employees” shall refer to employees who are not employed by the Company or any of its

Subsidiaries at the time of the attempted recruiting or hiring, but were employed by, or working for the Company or any of its Subsidiaries at any time in the six (6) months prior to the time of the attempted recruiting or hiring and/or

interference.

(c) Competition. The Grantee covenants and agrees that during the Grantee’s employment and for a period of one

(1) year after the termination of the Grantee’s employment, whether such termination occurs at the insistence of the Company or the Grantee (for whatever reason), the Grantee shall not, individually or jointly with others, directly or

indirectly, perform services for, prepare or take steps to prepare to perform services for, or otherwise have any involvement with (other than in connection with performing services pursuant to Grantee’s employment), in each case, whether as an

officer, director, partner, consultant, security holder, owner, employee, independent contractor or otherwise, any entity that competes (whether directly or indirectly) with the Company or its Subsidiaries in the Business (as hereinafter defined)

anywhere in the world as of the date of the Grantee’s termination of employment with the Company and its Subsidiaries (any such entity, a “Competitor”); provided, however, that the Grantee may in any event own up to a 2% passive

ownership interest in any public entity or through a private, non-operating investment vehicle and may become employed by or otherwise affiliated with a Competitor if the Grantee works in a business unit thereof that does not compete with the

Company or any Subsidiary in connection with the Business and the Grantee does not communicate about the Business with any employee in a business unit of such Competitor that does so compete with the Company or any of its Subsidiaries. For purposes

hereof, the term “Business” shall mean the offshore oil and gas drilling business. Upon the written request of the Grantee, the Company’s President will reasonably determine whether a business or other entity constitutes a

“Competitor” for purposes of this Section 6(c); provided that the President may require the Grantee to provide such information as the Company reasonably determines to be necessary to make such determination; and provided, further

that the current and continuing effectiveness of such determination may be conditioned upon the accuracy of such information, and upon such other factors as the Company may reasonably determine.

6

(d) Equitable Relief. The Grantee agrees that any actual or threatened breach of covenants

set forth in this Section 6 could cause the Company irreparable harm. Therefore, in the event of any actual or threatened breach by the Grantee, the Company shall be entitled to seek and obtain, through any court with jurisdiction over the

matter and the Grantee, temporary, preliminary and/or permanent equitable/injunctive relief restraining the Grantee from violating such provisions and to seek, in addition, money damages, together with any and all other remedies available under

applicable law.

(e) Forfeiture for Breach. Notwithstanding any other provision hereof, if the Grantee breaches or otherwise fails

to comply with any of the obligations contained in this Section 6, as applicable, in addition to all rights the Company and its Subsidiaries have under this Agreement and any other agreement, at law or in equity, any and all RSUs that have not

become vested and settled before such breach or failure to comply shall expire at that time, may not become vested or settled after such time and will be forfeited at such time without any payment therefor.

7. Section 409A Compliance. It is the intention of the Company and the Grantee that all payments, benefits and entitlements received by the

Grantee under this Agreement be provided in a manner that does not impose any additional taxes, interest or penalties on the Grantee with respect to such payments, benefits and entitlements under Section 409A of the Code, and its implementing

regulations (“Section 409A”), and the provisions of this Agreement shall be construed and administered in accordance with such intent. Each of the Company and the Grantee has used, and will continue to use, their best reasonable efforts to

avoid the imposition of such additional taxes, interest or penalties, and the Company and the Grantee agree to work together in good faith to amend this Agreement, and to structure any payment, benefit or other entitlement received by the Grantee

hereunder, in a manner that avoids imposition of such additional taxes, interest or penalties while preserving the affected payment, benefit or entitlement to the maximum extent practicable and maintaining the basic financial provisions of this

Agreement without violating any applicable requirement of Section 409A.

8. Governing Law. This Agreement shall be governed by, interpreted

under, and construed and enforced in accordance with the internal laws, and not the laws pertaining to conflicts or choice of laws, of the State of Delaware applicable to agreements made and to be performed wholly within the State of Delaware.

9. Imposition of Other Requirements. If the Grantee relocates to another country after the Grant Date, even if at the Company’s request, the

Company reserves the right to impose other requirements on the Grantee’s participation in the Plan, including with regard to RSUs subject to this Award, to the extent the Company determines it is necessary or advisable in order to comply with

local law or facilitate the administration of the Plan, and to require the Grantee to sign any additional agreements or undertakings that may be necessary to accomplish the foregoing.

10. Binding on Successors. The terms of this Agreement shall be binding upon the Grantee and upon the Grantee’s heirs, executors, administrators,

personal representatives, transferees, assignees and successors in interest, and upon the Company and its successors and assignees, subject to the terms of the Plan.

7

11. Transferability. The RSUs shall not be treated as property or as a trust fund of any kind. This Award,

including the RSUs subject to this Award, is not transferable except as permitted by the Plan.

12. Entire Agreement. This Agreement and the Plan

contain the entire agreement and understanding between the parties as to the subject matter hereof.

13. Notices. All notices and other

communications under this Agreement shall be in writing and shall be given by hand delivery to the other party or confirmed fax or overnight courier, or by postage paid first class mail, addressed as follows:

If to the Grantee:

The address

of his or her principal residence as it appears in the Company’s records, with a copy to him or her at his or her office in Houston, Texas.

If to the Company:

Diamond

Offshore Drilling, Inc.

15415 Katy Freeway, Suite 100

Houston, Texas 77094-1800

|

|

|

| Attention: |

|

Corporate Secretary |

| Facsimile: |

|

(281) 647-2223 |

or to such other address as any party shall have furnished to the other in writing in accordance with this Section 13.

Notice and communications shall be effective when actually received by the addressee if given by hand delivery or confirmed fax, when deposited with a courier service if given by overnight courier, or two (2) business days following mailing if

delivered by first class mail.

14. Amendment. This Agreement may not be modified, amended or waived except by an instrument in writing signed by

the Company and the Grantee. The waiver by either party of compliance with any provision of this Agreement shall not operate or be construed as a waiver of any other provision of this Agreement, or of any subsequent breach by the other party of a

provision of this Agreement.

15. Authority of the Administrator. The Plan is administered by the Committee, which shall have full authority to

interpret and construe the terms of the Plan and this Agreement. The determination of the Committee administrator as to any such matter of interpretation or construction shall be final, binding and conclusive.

16. Data Privacy. The Grantee acknowledges and consents to the collection, use, processing and transfer of personal data as described in this

Section 16. The Company, its related entities, and the Grantee’s employer hold certain personal information about the Grantee, including, but not limited to, the Grantee’s name, home address and telephone number, date of birth, social

security number or other employee identification number, salary, nationality, job title, any shares

8

of Stock held in the Company and details of all Awards, for the purpose of managing and administering the Plan (“Data”). The Company and its related entities may transfer Data amongst

themselves as necessary for the purpose of implementation, administration and management of the Grantee’s participation in the Plan, and the Company and its related entities may each further transfer Data to any third parties assisting the

Company or any such related entity in the implementation, administration and management of the Plan. The Grantee acknowledges that the transferors and transferees of such Data may be located anywhere in the world and hereby authorizes each of them

to receive, possess, use, retain and transfer the Data, in electronic or other form, for the purposes of implementing, administering and managing the Grantee’s participation in the Plan, including any transfer of such Data as may be required

for the administration of the Plan and/or the subsequent holding of RSUs or shares of Stock on the Grantee’s behalf to a broker or to any other third party with whom the Grantee may elect to deposit any shares of Stock acquired under the Plan

(whether pursuant to this Award or otherwise).

17. Acceptance. Acceptance of this Agreement by the Grantee acknowledges receipt of a copy of the

Plan and this Agreement, and acknowledges that the Grantee has read and understands the terms and provisions hereof and accepts this Award subject to all the terms and conditions of the Plan and this Agreement. The Company may, in its sole

discretion, deliver any documents related to this Award by electronic means. The Grantee hereby consents to receive all applicable documentation by electronic delivery and to participate in the Plan through an on-line (and/or voice activated) system

established and maintained by the Company or a third party vendor designated by the Company. By Grantee’s signature and the signature of the Company’s representative below, or by Grantee’s acceptance of this Award through the

Company’s online acceptance procedure, this Agreement shall be deemed to have been executed and delivered by the parties hereto as of the Grant Date.

18. No Rights to Continuation of Employment. Nothing in the Plan or this Agreement shall confer upon the Grantee any right to continue in the employ of

the Company or any Subsidiary thereof or shall interfere with or restrict the right of the Company to terminate the Grantee’s employment at any time for any reason.

19. Headings. Headings are used solely for the convenience of the parties and shall not be deemed to be a limitation upon or descriptive of the

contents of any Section.

[Signature Page Follows]

9

IN WITNESS WHEREOF, effective as of the Grant Date, the Company has caused this Agreement to be executed on its

behalf by a duly authorized officer.

|

|

|

| DIAMOND OFFSHORE DRILLING, INC. |

|

|

| By: |

|

|

|

|

|

| ACCEPTED AND AGREED: |

|

| |

| Grantee |

10

Schedule A

Vesting of Performance RSUs

The Award of

Performance RSUs pursuant to this Agreement shall vest dependent upon level of achievement of the following Performance Goal for the Performance Period, subject to the Negative Discretion of the Committee:

The average, for the three calendar years included in the Performance Period, of the quotient obtained (with respect to each such calendar year) from the

following formula shall equal [ ]% (“Target”):

|

|

|

|

|

|

|

Adjusted EBITDA for such year |

|

|

|

|

Adjusted Net PP&E as of 31 December of such year |

|

|

Where:

“Adjusted EBITDA” means, for any calendar year, for the Company and its subsidiaries, on a consolidated basis, an amount equal to

consolidated net income (excluding the cumulative effect of any change in accounting principle) determined in accordance with United States generally accepted accounting principles (“GAAP”) for such year plus or minus, as applicable, the

following to the extent deducted in calculating such consolidated net income: (a) plus an amount equal to interest expense in accordance with GAAP, for such year, (b) plus or minus the provision for tax expense or benefit accrued by the

Company and its consolidated subsidiaries for such year, (c) plus the amount of depreciation and amortization expense for such year, (d) minus, without duplication, interest income for such year, as determined in accordance with GAAP,

(e) plus or minus, without duplication, the amount of non-operating expenses or income for such year, all as determined in accordance with GAAP, and (f) excluding (i) the effects of any asset impairments recorded during such year,

(ii) any gain or loss on the sale of assets during such year and (iii) any rig margin – defined by the Company as rig revenue less controllable expenses – associated with an asset acquired during the Performance Period; and

“Adjusted Net PP&E” means, at any date of determination, for the Company and its subsidiaries, on a consolidated basis, an amount

equal to the net book value of all property, plant, and equipment (including, without limitation, land, mineral rights, buildings, structures, machinery, and equipment), determined in accordance with GAAP, plus an amount equal to the net book value

of all property, plant, and equipment (including, without limitation, land, mineral rights, buildings, structures, machinery, and equipment) classified on the Company’s balance sheet as held for sale, as determined in accordance with GAAP, in

each case excluding, over the elapsed portion of the Performance Period to date of such determination, (i) the effects of any impairment of assets and (ii) the net book value added to or removed from net property, plant and equipment or

assets held for sale as a result of any asset acquired or sold during such period.

11

The level of achievement against the Performance Goal shall govern the number of Performance RSUs that vest based

on the schedule in the table below, subject to the Negative Discretion of the Committee and based upon a target of 100% of Performance Goal achievement:

|

|

|

|

|

|

|

| Performance Level |

|

Performance as a

Percentage of Target |

|

Performance

RSUs Vesting |

|

| Below Threshold |

|

Less than 50% |

|

|

0 |

% |

| Threshold |

|

50% |

|

|

67 |

% |

| Target |

|

100% |

|

|

100 |

% |

| Maximum |

|

150% or greater |

|

|

133 |

% |

Linear interpolation shall be applied to determine payments in the event of performance falling between the levels stated in

the above table.

12

Exhibit 10.2

[CEO Specimen]

DIAMOND

OFFSHORE DRILLING, INC.

RESTRICTED STOCK UNIT AWARD AGREEMENT

THIS RESTRICTED STOCK UNIT AWARD AGREEMENT (this “Agreement”) is made and entered into as of the date of grant set forth below (the “Grant

Date”) and evidences the grant of the Performance Award set forth below by Diamond Offshore Drilling, Inc., a Delaware corporation (the “Company”), to the individual named below (the “Grantee”). Capitalized terms not defined

herein shall have the meanings ascribed to them in the Diamond Offshore Drilling, Inc. Equity Incentive Compensation Plan (the “Plan”).

|

|

|

| Name of Grantee: |

|

[ ] |

|

|

| Target Number of Performance RSUs: |

|

[ ] |

|

|

| Grant Date: |

|

[ ] |

|

|

| Performance Period: |

|

Calendar years [calendar year including Grant Date and two following calendar years] |

|

|

| Vesting of RSUs: |

|

See Section 2 below |

1. Grant of Performance Awards. The Company hereby grants to the Grantee performance-based Restricted Stock Units

(“Performance RSUs” or “RSUs”) as set forth herein (the “Performance Award”), subject to all of the terms and conditions of this Agreement and the Plan. Each RSU represents the right to receive one share of Stock upon

the vesting of such RSU, rounded down to the nearest whole share in the aggregate on the Vesting Date. This Agreement shall constitute the Award Terms for purposes of the Plan.

2. Form of Payment and Vesting.

(a) The

attached Schedule A specifies the financial performance goals (“Performance Goals”) required to be attained during the performance period designated above (the “Performance Period”) in order for the Performance RSUs to become

eligible to vest, provided that, in determining the number of Performance RSUs eligible to vest, the Committee shall at all times have the right in its sole discretion to reduce the number of Performance RSUs that would otherwise be eligible to vest

as a result of the performance as measured against the Performance Goal (“Negative Discretion”). Any Performance RSUs that vest in accordance with this Agreement shall thereafter be payable in accordance with this Section 2. Any

Performance RSUs that do not vest pursuant to this Agreement shall be immediately forfeited.

(b) Following the end of the Performance

Period (but in no event later than two and one-half (2 1⁄2) months following the end of the Performance Period), the Committee shall

determine the actual level of attainment of the Performance Goal for the Performance Period. On the basis of the Committee’s determination, the Committee will determine the number of

Performance RSUs eligible to vest as calculated in accordance with the percentile matrix set forth in Schedule A, subject to the Committee’s Negative Discretion. The number of Performance RSUs determined by the Committee through such process

shall constitute the number of RSUs in which the Grantee shall vest under this Award. With regard to Performance RSUs subject to this Award, the “Vesting Date” for such Performance RSUs shall be the date that the Committee determines the

vesting of Performance RSUs in accordance with this Section 2(b).

(c) Not later than two and one-half (2 1⁄2) months following the end of the Performance Period, the Company shall deliver to the account of the Grantee a number of shares of Stock (either by

delivering one or more certificates for such shares or by entering such shares in book entry form, as determined by the Company in its discretion) equal to the number of RSUs subject to this Award that vest on the Vesting Date, less withholding

pursuant to Section 7(e) of the Plan, unless such RSUs terminated or are forfeited prior to the Vesting Date pursuant to this Agreement or the Plan or unless the Company has elected in its discretion to settle such vested RSUs in cash in lieu

of Stock. The Company’s obligation to deliver shares of Stock or otherwise make payment with respect to vested RSUs is subject to the condition precedent that the Grantee or other person entitled under the Plan to receive any shares of Stock

with respect to the vested RSUs deliver to the Company any representations or other documents or assurances required pursuant to Section 7(j) of the Plan. Neither the Grantee nor any of the Grantee’s successors, heirs, assigns or personal

representatives shall have any further rights or interests with respect to any RSUs that are paid or that terminate pursuant to this Agreement or the Plan. Notwithstanding anything herein to the contrary, the Company shall have no obligation to

issue shares of Stock in payment of the RSUs unless such issuance and such payment shall comply with all relevant provisions of law and the requirements of any applicable stock exchange.

(d) Except as otherwise provided in Section 3 of this Agreement and except as otherwise provided in the Employment Agreement to the

extent then in effect, the vesting schedule in this Agreement requires continued employment or service with the Company or one of its Subsidiaries through the Vesting Date as a condition to the vesting of the Award and the rights and benefits under

this Agreement. Except as otherwise provided in Section 3 of this Agreement and except as otherwise provided in the Employment Agreement to the extent then in effect, employment or service for only a portion of the vesting period, even if a

substantial portion, will not entitle the Grantee to any proportionate vesting or avoid or mitigate a termination of rights and benefits upon or following a termination of employment or services as provided in this Agreement or under the Plan.

(e) Notwithstanding anything to the contrary in this Agreement, the Company reserves the right, at its sole discretion, to settle any vested

RSU by cash payment in lieu of Stock. If the Company elects to settle any RSU in cash, the amount of cash to be paid by the Company in settlement shall be determined by multiplying (a) the number of vested RSUs to be settled in cash, less any

withholding pursuant to Section 7(e) of the Plan, by (b) the Fair Market Value of a share of Stock as of the Vesting Date.

2

3. Termination of Performance Award. Reference is hereby made to the Employment Agreement, dated as of

February 12, 2014, between the Company and the Grantee (as may be extended or amended, the “Employment Agreement”). For purposes of this Agreement, the terms “Permanent Disability,” “Cause” and “Good

Reason” shall have the meanings set forth in the Employment Agreement. The Performance Award is subject to termination as follows:

(a) Termination of Employment For Cause. Upon the termination of the Grantee’s employment with the Company and/or its Subsidiaries

for Cause (in accordance with Section 6.6 of the Employment Agreement) prior to the Vesting Date, the unvested portion of the Grantee’s Performance Award shall be forfeited as of the date of such termination of employment.

(b) Termination of Employment by the Company without Cause or by the Grantee for Good Reason. Except as otherwise provided in the

Employment Agreement to the extent then in effect, upon termination of the Grantee’s employment by the Company without Cause or by the Grantee for Good Reason (in accordance with Section 6.3 of the Employment Agreement), in either case on

or after [2 years after Grant Date] but prior to the Vesting Date, then this Award of RSUs shall remain outstanding and the number of RSUs to vest shall be determined in accordance with the process set forth in Section 2, provided that

the resulting number of vested RSUs will be reduced by 50% (and the remainder of this Award of RSUs will be forfeited).

(c)

Termination of Employment On Account of Retirement. Except as otherwise provided in the Employment Agreement to the extent then in effect, upon the Grantee’s retirement (as defined below) prior to the Vesting Date, then this Award of

RSUs shall remain outstanding and the number of RSUs to vest shall be determined in accordance with the process set forth in Section 2, provided that the resulting number of vested RSUs will be reduced pro rata to correspond with the portion of

the period commencing on the Grant Date and ending on [last day of Performance Period] that has elapsed as of the effective date of the Grantee’s retirement (and the remainder of this Award of RSUs will be forfeited).

For purposes of this Section 3(c), “retirement” means the termination of employment with the Company and each of its

Subsidiaries or Affiliates by the Grantee on or after reaching age 63; provided that the Grantee’s employment is not terminated for Cause and provided further that such termination will constitute a retirement for these purposes only if, at

least one year prior to the Grantee’s desired retirement date, the Grantee delivers a written notice (by any means, including by email) to the VP - Human Resources or other employee within the Human Resources Department of the Company that

(x) indicates the Grantee intends to retire and (y) specifies an intended retirement date.

(d) Other Termination of

Employment After Second Year. Except as otherwise provided in the Employment Agreement to the extent then in effect, upon termination of the Grantee’s employment for any reason not addressed in Sections 3(a), (b) or (c) above,

including Grantee’s voluntary resignation, in any event on or after [2 years after Grant Date] but prior to the Vesting Date, then this Award of RSUs shall remain outstanding and the number of RSUs to vest shall be determined in

accordance with the process set forth in Section 2, provided that the resulting number of vested RSUs will be reduced by 80% (and the remainder of this Award of RSUs will be forfeited).

(e) Other Termination of Employment. Except as otherwise provided in the Employment Agreement to the extent then in effect and except

as otherwise set forth in Sections 3(a), (b), (c) or (d) above, if the Grantee’s employment with the Company and/or its Subsidiaries terminates prior to the Vesting Date for any reason, the unvested portion of this Award shall be

forfeited as of the date of such termination of employment.

3

4. No Shareholder Rights Prior to Vesting. The Grantee shall have no rights of a shareholder (including

the right to distributions or dividends) with respect to the Company’s stock issuable hereunder until such stock is issued pursuant to the terms of this Agreement.

5. Dividend Treatment. Upon the Company’s payment of a cash dividend or stock dividend in respect of the Company’s Stock and prior to vesting

of this Performance Award, the Grantee shall be credited with a number of additional RSUs in respect of RSUs outstanding on the record date for such dividend (for this purpose, the number of RSUs that are outstanding shall be based on the target

number of RSUs), with such number of additional RSUs to equal the aggregate dividend payable with respect to the shares subject to the RSUs with respect to which the dividend is paid, divided by the volume weighted average trading price of the Stock

for the ten (10) trading days immediately preceding the dividend record date, rounded down to the nearest whole share. Such additional RSUs shall be eligible to vest on the same schedule and subject to the same conditions as the original RSUs

grant to which the additional RSUs are attributable. Notwithstanding the foregoing, additional RSUs credited pursuant to the operation of this Section 5 may be settled in cash or Stock, as determined by the Committee.

6. Performance Award Subject to Plan. The Performance Award is subject to the provisions of the Plan, which are hereby incorporated by reference. In

the event of any conflict between this Agreement and the Plan, the Plan shall control. In the event of any ambiguity in this Agreement, any term which is not defined in this Agreement, or any matters as to which this Agreement is silent, the Plan

shall govern.

7. No Rights to Continuation of Employment. Nothing in the Plan or this Agreement shall confer upon the Grantee any right to

continue in the employ of the Company or any Subsidiary thereof or shall interfere with or restrict the right of the Company to terminate the Grantee’s employment at any time for any reason.

8. Tax Withholding. The Company shall be entitled to require a cash payment by or on behalf of the Grantee (and/or to deduct from the number of shares

of Stock otherwise deliverable hereunder a number of shares of Stock with a Fair Market Value equal to) any sums required by federal, state or local tax law to be withheld or to satisfy any applicable payroll deductions with respect to the vesting

the Performance Award.

9. Section 409A Compliance. It is the intention of the Company and the Grantee that all payments, benefits and

entitlements received by the Grantee under this Agreement be provided in a manner that does not impose any additional taxes, interest or penalties on the Grantee with respect to such payments, benefits and entitlements under Section 409A of the

Code, and its implementing regulations (“Section 409A”), and the provisions of this Agreement shall be

4

construed and administered in accordance with such intent. Each of the Company and the Grantee has used, and will continue to use, their best reasonable efforts to avoid the imposition of such

additional taxes, interest or penalties, and the Company and the Grantee agree to work together in good faith to amend this Agreement, and to structure any payment, benefit or other entitlement received by the Grantee hereunder, in a manner that

avoids imposition of such additional taxes, interest or penalties while preserving the affected payment, benefit or entitlement to the maximum extent practicable and maintaining the basic financial provisions of this Agreement without violating any

applicable requirement of Section 409A.

10. Governing Law. This Agreement shall be governed by, interpreted under, and construed and enforced

in accordance with the internal laws, and not the laws pertaining to conflicts or choice of laws, of the State of Delaware applicable to agreements made and to be performed wholly within the State of Delaware.

11. Binding on Successors. The terms of this Agreement shall be binding upon the Grantee and upon the Grantee’s heirs, executors, administrators,

personal representatives, transferees, assignees and successors in interest, and upon the Company and its successors and assignees, subject to the terms of the Plan.

12. Transferability. The Performance Award is not transferable except (i) as designated by the Grantee by will or by the laws of descent and

distribution or (ii) as otherwise expressly permitted by the Committee. If any rights exercisable by the Grantee or benefits deliverable to the Grantee under this Agreement have not been exercised or delivered at the time of the Grantee’s

death, such rights shall be exercisable by the Designated Beneficiary, and such benefits shall be delivered to the Designated Beneficiary, in accordance with the provisions of the Plan.

13. Entire Agreement. This Agreement and the Plan contain the entire agreement and understanding between the parties as to the subject matter hereof.

14. Headings. Headings are used solely for the convenience of the parties and shall not be deemed to be a limitation upon or descriptive of the

contents of any Section.

15. Notices. All notices and other communications under this Agreement shall be in writing and shall be given by hand

delivery to the other party or confirmed fax or overnight courier, or by postage paid first class mail, addressed as follows:

If to the

Grantee:

The address of his principal residence as it appears in the Company’s records, with a copy to him at his office in Houston,

Texas.

If to the Company:

Diamond Offshore Drilling, Inc.

15415 Katy Freeway, Suite 100

Houston, Texas 77094-1800

Attention: Corporate Secretary

Facsimile: (281) 647-2223

5

or to such other address as any party shall have furnished to the other in writing in accordance with this

Section 15. Notice and communications shall be effective when actually received by the addressee if given by hand delivery or confirmed fax, when deposited with a courier service if given by overnight courier, or two (2) business days

following mailing if delivered by first class mail.

16. Amendment. This Agreement may not be modified, amended or waived except by an instrument

in writing signed by the Company and the Grantee. The waiver by either party of compliance with any provision of this Agreement shall not operate or be construed as a waiver of any other provision of this Agreement, or of any subsequent breach by

the other party of a provision of this Agreement.

17. Coordination With Employment Agreement. The provisions of Section 21 and 22 of the

Employment Agreement are hereby incorporated herein by reference.

18. Acceptance. Acceptance of this Agreement by the Grantee acknowledges receipt

of a copy of the Plan and this Agreement, and acknowledges that the Grantee has read and understands the terms and provisions hereof and accepts the Performance Award subject to all the terms and conditions of the Plan and this Agreement. The

Company may, in its sole discretion, deliver any documents related to this Award by electronic means. The Grantee hereby consents to receive all applicable documentation by electronic delivery and to participate in the Plan through an on-line

(and/or voice activated) system established and maintained by the Company or a third party vendor designated by the Company. By Grantee’s signature and the signature of the Company’s representative below, or by Grantee’s acceptance of

this Award through the Company’s online acceptance procedure, this Agreement shall be deemed to have been executed and delivered by the parties hereto as of the Grant Date.

IN WITNESS WHEREOF, effective as of the Grant Date, the Company has caused the Agreement to be executed on its behalf by a duly authorized officer.

|

|

|

| DIAMOND OFFSHORE DRILLING, INC. |

|

|

| By: |

|

|

|

|

[Name] |

|

|

[Title] |

|

| ACCEPTED AND AGREED: |

|

| |

| [Name] |

6

Schedule A

Vesting of Performance RSUs

The Award of

Performance RSUs pursuant to this Agreement shall vest dependent upon level of achievement of the following Performance Goal for the Performance Period, subject to the Negative Discretion of the Committee:

The average, for the three calendar years included in the Performance Period, of the quotient obtained (with respect to each such calendar year) from the

following formula shall equal [ ]% (“Target”):

|

|

|

|

|

|

|

Adjusted EBITDA for such year |

|

|

|

|

Adjusted Net PP&E as of 31 December of such year |

|

|

Where:

“Adjusted EBITDA” means, for any calendar year, for the Company and its subsidiaries, on a consolidated basis, an amount equal to

consolidated net income (excluding the cumulative effect of any change in accounting principle) determined in accordance with United States generally accepted accounting principles (“GAAP”) for such year plus or minus, as applicable, the

following to the extent deducted in calculating such consolidated net income: (a) plus an amount equal to interest expense in accordance with GAAP, for such year, (b) plus or minus the provision for tax expense or benefit accrued by the

Company and its consolidated subsidiaries for such year, (c) plus the amount of depreciation and amortization expense for such year, (d) minus, without duplication, interest income for such year, as determined in accordance with GAAP,

(e) plus or minus, without duplication, the amount of non-operating expenses or income for such year, all as determined in accordance with GAAP, and (f) excluding (i) the effects of any asset impairments recorded during such year,

(ii) any gain or loss on the sale of assets during such year and (iii) any rig margin – defined by the Company as rig revenue less controllable expenses – associated with an asset acquired during the Performance Period; and

“Adjusted Net PP&E” means, at any date of determination, for the Company and its subsidiaries, on a consolidated basis, an amount

equal to the net book value of all property, plant, and equipment (including, without limitation, land, mineral rights, buildings, structures, machinery, and equipment), determined in accordance with GAAP, plus an amount equal to the net book value

of all property, plant, and equipment (including, without limitation, land, mineral rights, buildings, structures, machinery, and equipment) classified on the Company’s balance sheet as held for sale, as determined in accordance with GAAP, in

each case excluding, over the elapsed portion of the Performance Period to date of such determination, (i) the effects of any impairment of assets and (ii) the net book value added to or removed from net property, plant and equipment or

assets held for sale as a result of any asset acquired or sold during such period.

7

The level of achievement against the Performance Goal shall govern the number of Performance RSUs that vest based

on the schedule in the table below, subject to the Negative Discretion of the Committee and based upon a target of 100% of Performance Goal achievement:

|

|

|

|

|

|

|

| Performance Level |

|

Performance as a

Percentage of Target |

|

Performance

RSUs Vesting |

|

| Below Threshold |

|

Less than 50% |

|

|

0 |

% |

| Threshold |

|

50% |

|

|

67 |

% |

| Target |

|

100% |

|

|

100 |

% |

| Maximum |

|

150% or greater |

|

|

133 |

% |

Linear interpolation shall be applied to determine payments in the event of performance falling between the levels stated in

the above table.

8

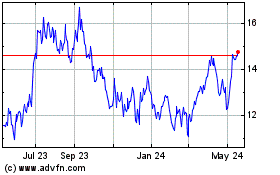

Diamond Offshore Drilling (NYSE:DO)

Historical Stock Chart

From Mar 2024 to Apr 2024

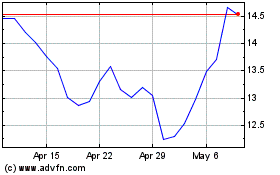

Diamond Offshore Drilling (NYSE:DO)

Historical Stock Chart

From Apr 2023 to Apr 2024