Callon Petroleum

Company Employee

Savings and Protection Plan

Employer I.D. Nu

mber 94-0744280

Plan Number: 002

Audited Financial Statements

Years Ended

December 31, 2015

and

2014

Table of C

ontents

Note: Supplemental schedules required by the Employee Retirement Income Security Act of 1974 not included herein are deemed not applicable to Callon Petroleum Company Employee Savings and Protection Plan.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Participants and Plan Administrator

Callon Petroleum Company Employee Savings and Protection Plan

We have audited the accompanying statements of net assets available for benefits of Callon Petroleum Company Employee Savings and Protection Plan (the

“

Plan

”

) as of December 31, 201

5

and 201

4

, and the related statement of changes in net assets available for benefits for the year ended December 31, 201

5

. These financial statements are the responsibility of the Plan

’

s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States) (

“

PCAOB

”

). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 201

5

and 201

4

, and the changes in net assets available for benefits for the year ended December 31, 201

5

, in conformity with accounting principles generally accepted in the United States of America.

The supplemental information in the accompanying schedule of assets (held at end of year) as of December 31, 201

5

has been subjected to audit procedures performed in conjunction with the audit of the Plan

’

s financial statements. The supplemental information is presented for the purpose of additional analysis and is not a required part of the financial statements but includes supplemental information required by the Department of Labor

’

s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. The supplemental information is the responsibility of the Plan

’

s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information in the accompanying schedule, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor

’

s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated in all material respects in relation to the financial statements as a whole.

/s/ HORNE LLP

Ridgeland, Mississippi

June

1

5

, 201

6

CALLON PETROLEUM COMPANY

EMPLOYEE SAVINGS AND PROTECTION PLAN

Statements of Net Assets Available for Benefits

December 31, 2015

and

2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2015

|

|

|

2014

|

|

ASSETS

|

|

|

|

|

|

|

|

Investments

|

|

|

|

|

|

|

|

Participant directed

|

|

|

|

|

|

|

|

Pooled separate accounts

|

|

$

|

12,238,508

|

|

$

|

11,824,645

|

|

Guaranteed investment contract

|

|

|

9,130,273

|

|

|

13,124,880

|

|

Company stock unit fund

|

|

|

4,146,429

|

|

|

3,900,068

|

|

Total investments, at fair value

|

|

|

25,515,210

|

|

|

28,849,593

|

|

|

|

|

|

|

|

|

|

Receivables

|

|

|

|

|

|

|

|

Notes receivable from participants

|

|

|

387,157

|

|

|

389,251

|

|

Employer contribution receivable

|

|

|

55,002

|

|

|

58,755

|

|

Total receivables

|

|

|

442,159

|

|

|

448,006

|

|

|

|

|

|

|

|

|

|

Net assets available for benefits, at fair value

|

|

|

25,957,369

|

|

|

29,297,599

|

|

Adjustment from fair value to contract value for fully benefit-responsive contract

|

|

|

(179,382)

|

|

|

(647,314)

|

|

Net assets available for benefits

|

|

$

|

25,777,987

|

|

$

|

28,650,285

|

See accompanying notes.

CALLON PETROLEUM COMPANY

EMPLOYEE SAVINGS AND PROTECTION PLAN

Statement of Changes in Net Assets

Available for Benefits

Year Ended

December 31, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2015

|

|

Additions to net assets attributed to

|

|

|

|

|

Investment income

|

|

|

|

|

Net appreciation in fair value of investments

|

|

$

|

1,263,206

|

|

Dividends

|

|

|

801,201

|

|

Total investment income

|

|

|

2,064,407

|

|

|

|

|

|

|

Interest income on notes receivable from participants

|

|

|

16,854

|

|

|

|

|

|

|

Contributions

|

|

|

|

|

Employer – cash

|

|

|

733,850

|

|

Employer – stock

|

|

|

269,562

|

|

Employee

–

rollovers

|

|

|

291,019

|

|

Employee

|

|

|

938,334

|

|

Total contributions

|

|

|

2,232,765

|

|

Total additions

|

|

|

4,314,026

|

|

|

|

|

|

|

Deductions from net assets attributed to

|

|

|

|

|

Benefits paid to participants

|

|

|

7,169,109

|

|

Deemed distributions

|

|

|

14,365

|

|

Administrative expenses

|

|

|

2,850

|

|

Total deductions

|

|

|

7,186,324

|

|

Net decrease

|

|

|

(2,872,298)

|

|

|

|

|

|

|

Net assets available for Plan benefits

|

|

|

|

|

Beginning of year

|

|

|

28,650,285

|

|

End of year

|

|

$

|

25,777,987

|

See acc

ompanying notes.

Table of Contents

CALLON PETROLEUM COMPANY

EMPLOYEE SAVINGS AND PROTECTION PLAN

Year Ended December 31, 2015

NOTES TO FINANCIAL STATEMENTS

N

ote 1. Description of the Plan

The following description of the Callon Petroleum Company Employee Savings and Protection Plan (the

“

Plan

”

) provides only general information. Participants should refer to the Plan agreement for a more complete description of the Plan

’

s provisions.

General

Employees of Call

on Petroleum Company (the

“

Company

”

) become eligible to participate in the Plan

on the first eligibility date of their employment or attainment of age twenty-one while employed

. Eligibility dates are the first day of each month. The Plan is subject to the

provisions of the Employee Retirement I

ncome Security Act of 1974 (

“

ERISA

”

).

Contributions

Employee contributions/deferrals.

Each participant may make voluntary before-tax or Roth contributions

of 1% to

99

% of his or her qualified yearly earnings as defined by the Plan, subject to Internal Revenue Code (

“

IRC

”

) limitations for the current year. Employees at least 50 years of age are permitted to contribute additional amounts, or catch-up contributions, of his or her qualified yearly earnings up to a prescribed maximum in addition to the voluntary before-tax, Roth, and afte

r-tax maximums.

Employer non-matching and matching contributions.

For the year ended

December 31, 2015

, the Company contributed, in relation to each participating employee

’

s eligible compensation,

a 2.5

%

non-matching contribution in cash and a 2.5

%

non-matching contribution in the form of the Company

’

s stock unit fund. The Company also made a matching contribution at the rate of 0.625

%

in cash for every 1

%

that the participant deferred, limited to a maximum matching contribution by the Company of 5

%

in cash.

Rollover

c

ontributions

At the discretion of the

Plan

administrator, a participant in the Plan who is currently employed may be permitted to deposit into the Plan distributions received from other plans and certain IRAs. Such a deposit is called a

“

rollover

”

. This rollover

is

accounted for in a

“

rollover account,

”

and is 100

%

vested by the depositing participant. The participant may withdraw amounts in the

“

rollover account

”

only when an otherwise allowable distribution is permitted under the Plan.

Participant

a

ccounts

Each participant

’

s account is credited with the participant

’

s salary deferral, the Company

’

s matching and non-matching contributions

,

and an allocation of the Plan earnings thereon. Allocations are based on participant compensation or account balances, as defined. The benefit to which a participant is entitled is the benefit that can be provided from the participant

’

s vested account balance.

Investment

o

ptions

Participants direct contributions, including employer cash matching and non-matching contributions, into any of the investment options offered by

Voya

Financial Partners

,

LLC

, (

“

Voya

”

)

,

the Plan custodian. Participants may change their investment options at any time.

Vesting

Participants are immediately vested in all contributions to the Plan made on their behalf including their voluntary contributions plus actual earnings thereon and in the Company

’

s contributions and earnings thereon.

Notes

r

eceivable from

p

articipants

Notes receivable from participants (

“

loans

”

) are available to participants at a minimum am

ount of $1,000

.

Loans bear interest at a fixed

rate

,

which is comprised of the U.S. Prime Interest Rate plus a 1% adjustment factor

.

A

t

December 31, 2015, the U.S. Prime Interest Rate was 3.25%.

Participants have up to

five

years to repay the loan unless it is for a principal residence, in

which case the repayment period is up to

10

yea

rs. Participants may repay the loan by having an amount withheld from their compensation each pay period.

Each loan is co

llateralized by the borrowing participant

’

s vested account balance; however, additional collateral may also be required at the discretion of the Plan ad

ministrator.

The Plan allows

participants to have up to

four

loans

consisting of three regular loans and one residential l

oan.

The maximum amount of any new loans, when added to the outstanding balance of existing loans from

Table of Contents

CALLON PETROLEUM COMPANY

EMPLOYEE SAVINGS AND PROTECTION PLAN

Year Ended December 31, 2015

the Plan, is limited to the l

esser of (a) $50,000 redu

ced by the excess, if any, of the participant

’

s highest outstanding balance of loans from the Plan during the one-year period ending on the day before the date of the new loan over the participant

’

s current outstanding balance of loans as of the date of the new loan or (b) one-half of the participant

’

s vested interest in qualifying investments within the Plan.

Payment of

b

enefits

Benefits in the form of distributions are paid from the vested portion of a participant

’

s balance (1) upon termination, (2) normal retirement, (3) disability, (4) death of the participant

,

or (5) under certain, limited circumstances, in-service withdrawals, as defined by the Plan. Hardship withdrawals are allowed for participants incurring an immediate and heavy financial need, as defined by the Plan. Hardship withdrawals are strictly regulated by the Internal Revenue Service (

“

IRS

”

) and all requirements must be met before requesting a hardship withdrawal. Upon termination of service, a participant may elect to (a) receive a lump sum equal to the value of the participant

’

s vested interest in his or her account (b) receive installments over a period not to exceed the

participant

’

s or beneficiary

’

s assumed life expectancy

or (c) receive a partial withdrawal

.

Plan

t

ermination

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERI

SA.

Note 2. Summary of Significant Accounting Policies

Basis of

p

resentation

The accompanying financial statements of the Plan have been prepared on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America

(“GAAP”)

.

Use of

e

stimates

The preparation of financial statements in conformity with

GAAP

requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and changes therein and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

Investment

v

aluation and

i

ncome

r

ecognition

All Plan investments as of

December 31, 2015

and

2014

are held by

Voya

, the Plan custodian. Investments are reported at fair value. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. See

Note 9

for discussion of fair value measurements.

Investment security transactions are accounted for on the date the securities are purchased or sold (trade date). Interest income is recorded as it is earned. Dividends are recorded on the ex-dividend date. Realized and unrealized gains and losses on the Plan

’

s investments bought and sold as well as held during the year are i

ncluded in net appreciation in

fair value of investments in the statement of changes in net assets available for benefits.

Notes

r

eceivable from

p

articipants

Loans are measured at their unpaid principal balance plus any accrued but unpaid interest. Interest income is recorded on the accrual basis. Related fees are recorded as administrative expenses and are expensed when

they

are incurred. No allowance for credit losses has been recorded as of

December 31, 2015

. If a participant ceases to make loan repayments and the

P

lan administrator deems the participant loan to be in default, the participant loan balance is reduc

ed and a benefit payment is recorded.

Payment of

b

enefits

Benefits are recorded when paid.

Administrative

e

xpenses

Certain expenses for maintaining the Plan are paid directly by the Company and are excluded from these financial statements. Fees related to the administration of notes receivable

and payment of benefits

are charged directly to the participant

’

s account and are

Table of Contents

CALLON PETROLEUM COMPANY

EMPLOYEE SAVINGS AND PROTECTION PLAN

Year Ended December 31, 2015

included in administrative expenses. The participants incurred

expense of

$2,850

for fees related to the administration of notes receivable from participants

and payment of benefits

.

Recently issued accounting p

ronouncement

s

In Ju

ne

2015, the

FASB

issued accounting standards update No. 2015-1

0, Technical Corrections and Improvements (“ASU 2015-10”). The standard will affect a wide variety of topics in the FASB Accounting Standards Codification (the “Codification”) and is intended to make the Codification easier to understand and easier to apply by eliminating inconsistencies, providing needed clarifications, and improving the presentation of guidance in the Codification. Transition guidance varies based on the amendments in ASU 2015-10 and are effective for all entities for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2015. Early adoption is permitted, including adoption in an interim period.

The Company is currently evaluating the method of adoption and impact this standard may have on its financial statements and related disclosures.

In

July

201

5

, the Financial Accounting Standards Board

(“FASB”)

issued accounting standards update No. 201

5

-

12

,

Plan Accounting

–

Defined Benefit Pension Plans

(Topic

960

)

, Defined Contribution Pension Plans (Topic 962), and Health and Welfare Benefit Plans (Topic 965)

:

(i.)

Fully Benefit-Responsive Investment Contracts,

(ii.)

Plan Investment Disclosures, an

d

(iii.)

Measurement Date Practical Expedient

(“ASU 201

5

-

12

”). The standard is intended to

reduce complexity in employee benefit plan accounting.

The guidance in ASU 201

5

-

12

is effective for public entities for annual reporting periods beginning after December 15, 201

5

. Early adoption is permitted and is to be applied on

a

retrospective basis. The Company is currently evaluating the method of adoption and impact this standard may have on its financial statements and related disclosures.

Note 3. Investments

The following table presents the fair value of the Plan

’

s investments that represent 5

%

or more of the Plan

’

s net assets at

December 31, 2015

or

2014

.

|

|

|

|

|

|

|

|

|

|

|

|

2015

|

|

|

2014

|

|

Guaranteed investment contract:

|

|

|

|

|

|

|

|

Voya Fixed Account

|

|

$

|

9,130,273

|

|

$

|

13,124,880

|

|

Pooled separate accounts:

|

|

|

|

|

|

|

|

Fidelity Advisor New Insights Fund - Class A

|

|

|

1,963,714

|

|

|

2,139,003

|

|

T. Rowe Price Retirement 2035 Fund*

|

|

|

1,401,430

|

|

|

793,223

|

|

Vanguard 500 Index Fund - Admiral Shares**

|

|

|

1,118,390

|

|

|

1,474,837

|

|

Other:

|

|

|

|

|

|

|

|

Company stock unit fund

|

|

|

4,146,429

|

|

|

3,900,068

|

* Balance as of December 31, 2014 did not represent five percent of net assets.

** Balance as of December 31, 2015 did not represent five percent of net assets.

The Plan

’

s investments, including gains and losses on investments bought and sold, as well as held during the year, appreciated

(depreciated)

in value during the year ended

December 31, 2015

as follows:

|

|

|

|

|

|

|

|

|

Pooled separate accounts

|

|

|

|

|

$

|

(683,444)

|

|

Company stock unit fund

|

|

|

|

|

|

1,946,650

|

|

Net appreciation in fair value of investments

|

|

|

|

|

$

|

1,263,206

|

Note 4. Company Stock Unit Fund

The value of the Company stock unit fund is a combination of the ma

rket value of shares of Callon Common Stock (

“

Company Securities

”

)

and

short-term investments

. As of

December 31, 2015

and

2014

, the Company stock unit fund was made up of

487,540

and

701,114

shares of Company securities an

d

$80,334

and

$78,775

in short-term investments, respectively.

Note 5. Tax Status of Plan

The trust, established under the Plan to hold the Plan

’

s assets, is qualified pursuant to the appropriate section of the IRC, and accordingly, the trust

’

s net investment income is exempt from income taxes. The Plan has obtained a favorable tax determination letter from the IRS dated

September 1

, 20

14

. Although the Plan has been amended since receiving the determination letter, the Plan

’

s

Table of Contents

CALLON PETROLEUM COMPANY

EMPLOYEE SAVINGS AND PROTECTION PLAN

Year Ended December 31, 2015

administrator believes that the Plan is currently designed and being operated in compliance with the applicable requirements of the IRC.

The Plan had no uncertain tax positions at

December 31, 2015

or

2014

. If interest and penalties are incurred related to uncertain tax positions, such amounts are recognized in income tax expense. Tax periods for all fiscal years after 20

11

remain open to examination by the federal and state taxing jurisdictions to which the Plan is subject.

Note 6. Related Party Transact

ions

The investments in pooled separate accounts and the guaranteed investment contract are managed by

Voya

.

Voya

is the custodian of the Plan assets and therefore, transactions in these investments, as well as investments in employer securities and notes receivable from participants, qualify as exempt party-in-interest transactions. Fees paid by the Plan to

Voya

for certain administrative services totaled

$2,850

for the year ended

December 31, 2015

.

Note 7. Risks and Uncertainties

The Plan invests in various investment securities. Investment securities are exposed to various risks such as interest rate, market and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants

’

account balances and the amounts reported in the statement of net assets available for benefits.

Note 8. Reconciliation of Financial Statements to Form 5500

The financial information included in the Plan

’

s Form 5500 is reported on the cash basis of accounting. Therefore, reconciliations are included to reconcile the net assets available for benefits and the net

de

crease in net assets available for benefits per the financial statements to the Form 5500.

The following is a reconciliation of net assets available for benefits per the financial statements to the Form 5500:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

|

2015

|

|

2014

|

|

Net assets available for benefits per the financial statements

|

|

$

|

25,777,987

|

|

$

|

28,650,285

|

|

Employer contribution receivable

|

|

|

(55,002)

|

|

|

(58,755)

|

|

Net assets available for benefits per the Form 5500

|

|

$

|

25,722,985

|

|

$

|

28,591,530

|

The following is a reconciliation of

the

net

de

crease in net assets available for benefits per the financial statement to the Form 5500:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended

|

|

|

|

|

|

|

December 31, 2015

|

|

Net decrease in net assets available for benefits per the financial statements

|

|

|

|

|

$

|

(2,872,298)

|

|

Less: Current year employer contribution receivable

|

|

|

|

|

|

(55,002)

|

|

Plus: Prior year employer contribution receivable

|

|

|

|

|

|

58,755

|

|

Net decrease in net assets available for benefits per the Form 5500

|

|

|

|

|

$

|

(2,868,545)

|

N

ote 9. Fair Value Measurements

The fair value hierarchy outlined in the relevant accounting guidance gives the highest priority to Level 1 inputs, which consist of unadjusted quoted prices for identical instruments in active markets. Level 2 inputs consist of quoted prices for similar instruments. Level 3 valuations are derived from inputs that are significant and unobservable, and these valuations have the lowest priority.

The following is a description of the valuation methodologies used for assets measured at fair value on a recurring basis. There have been no changes in the methodologies used at

December 31, 2015

and

2014

.

Pooled separate accounts

(

“

PSA

”

)

:

PSAs are made up of a wide variety of underlying investments such as equities, preferred stock, bonds, real estate and mutual funds. The

accumulated unit

value (

“

AU

V

”

) of a PSA is based on the market value of its underlying

Table of Contents

CALLON PETROLEUM COMPANY

EMPLOYEE SAVINGS AND PROTECTION PLAN

Year Ended December 31, 2015

investments but the PSA A

U

V is not a publicly quoted price in an

active market. Therefore, the

A

U

V is used as a practical expedient to estimate fair value (Level 2)

.

G

uaranteed investment contract (

“

G

IC

”

):

The GIC is reported based upon observable inputs, including the Plan

’

s assumptions as to what market participants would use in pricing such instruments (Level 2).

Company stock unit fund

: The value of a unit of the Company stock unit fund reflects the combined value of Company common stock, which is valued at the closing price reported on the active market on which the individual securities are traded, and cash held by the fund on the same date. The cash buffer maintained in the Company stock unit fund, which is determined by

Voya Retirement Insurance and Annuity Company (

“

VRIAC

”

)

,

bas

ed on a specific for

mula, typically ranges between 1% and 3%

of the total value of the stock fund, and has a target buffer of 2

%

(Level 2).

The preceding methods described may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, although the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

The following table sets forth by level, within the fair value hierarchy, the Plan

’

s assets at fair value as of

December 31, 2015

:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

Guaranteed investment contract

|

|

|

|

|

|

|

|

|

|

|

Fixed account

|

|

$

|

-

|

|

$

|

9,130,273

|

|

$

|

-

|

|

Pooled separate accounts

|

|

|

|

|

|

|

|

|

|

|

Money market

|

|

|

-

|

|

|

155,082

|

|

|

-

|

|

Bonds

|

|

|

-

|

|

|

444,748

|

|

|

-

|

|

Asset allocation

|

|

|

-

|

|

|

4,300,480

|

|

|

-

|

|

Balanced

|

|

|

-

|

|

|

606,625

|

|

|

-

|

|

Large-cap value

|

|

|

-

|

|

|

1,617,521

|

|

|

-

|

|

Large-cap growth

|

|

|

-

|

|

|

1,963,714

|

|

|

-

|

|

Small/Mid/Specialty

|

|

|

-

|

|

|

1,969,252

|

|

|

-

|

|

Global/International

|

|

|

-

|

|

|

1,096,450

|

|

|

-

|

|

Real estate

|

|

|

-

|

|

|

84,636

|

|

|

-

|

|

Other

|

|

|

|

|

|

|

|

|

|

|

Company stock unit fund

|

|

|

-

|

|

|

4,146,429

|

|

|

-

|

|

Total assets at fair value

|

|

$

|

-

|

|

$

|

25,515,210

|

|

$

|

-

|

The following table sets forth by level, within the fair value hierarchy, the Plan

’

s assets at fair value as of

December 31, 2014

:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

Guaranteed investment contract

|

|

|

|

|

|

|

|

|

|

|

Fixed account

|

|

$

|

-

|

|

$

|

13,124,880

|

|

$

|

-

|

|

Pooled separate accounts

|

|

|

|

|

|

|

|

|

|

|

Money market

|

|

|

-

|

|

|

265,654

|

|

|

-

|

|

Bonds

|

|

|

-

|

|

|

591,769

|

|

|

-

|

|

Asset allocation

|

|

|

-

|

|

|

2,757,097

|

|

|

-

|

|

Balanced

|

|

|

-

|

|

|

818,103

|

|

|

-

|

|

Large-cap value

|

|

|

-

|

|

|

2,129,123

|

|

|

-

|

|

Large-cap growth

|

|

|

-

|

|

|

2,139,003

|

|

|

-

|

|

Small/Mid/Specialty

|

|

|

-

|

|

|

2,267,557

|

|

|

-

|

|

Global/International

|

|

|

-

|

|

|

856,339

|

|

|

-

|

|

Other

|

|

|

|

|

|

|

|

|

|

|

Company stock unit fund

|

|

|

-

|

|

|

3,900,068

|

|

|

-

|

|

Total assets at fair value

|

|

$

|

-

|

|

$

|

28,849,593

|

|

$

|

-

|

Table of Contents

CALLON PETROLEUM COMPANY

EMPLOYEE SAVINGS AND PROTECTION PLAN

Year Ended December 31, 2015

Note 10. Guaranteed Investment Contract (

“

GIC

”

)

As of

December 31, 2015

, the Plan maintained one GIC related investment option, the

Voya

Fixed Account. The contract underlying this investment option is considered to be fully benefit-responsive in accordance with ASC Topic 962. As of

December 31, 2015

and

2014

, the fair value of the investment in the

Voya

Fixed Account was

$9,130,273

and

$13,124,880

, respectively.

The average yield for the contract

for the year ended

December 31, 201

5, and

the periods of January 1, 2014

through December 18, 2014, and December 19, 2014 through December 31, 2014,

w

ere

1.00%

,

3.00%

and 1.85%

, respectively. The

average yield for the interest credited to participants

for the contract

for the year ended

December 31, 2015

and

the periods of January 1, 2014

through December 18, 2014, and December 19, 2014 through December 31, 2014, w

ere

1.00%

,

3.00

%

and

1.80%

, respectively

. The guaranteed minimum crediting interest rate for the contract

for the year ended

December 31, 201

5

, and

the periods of January 1, 2014

through December 18, 2014, and December 19, 2014 through December 31, 2014,

were

1.00%

,

3.00

%

and 1.75%

, respectively

.

VRIAC

makes this guarantee, and although

VRIAC

may credit a higher interest rate, the credited rate will never fall below the lifetime guaranteed minimum of

1

.00% under the current provisions of the GIC investment options for the year ended December 31, 201

5

.

VRIAC

’

s

determination of credited interest rates reflects a number of factors, including mortality and expense risks, interest rate guarantees, the investment income earned on invested assets and the amortization of any capital gains and/or losses realized on the sale of invested assets. A market value adjustment may apply to amounts withdrawn at the request of the contract holder.

The underlying contract has no restrictions on the use of Plan assets and there are no valuation reserves recorded to adjust contract amounts.

Certain events limit the ability of the Plan to transact at contract value with the issuer. Such events include the following: (i) amendments to the Plan documents (including complete or partial Plan termination or merger with another plan) (ii) changes to Plan

’

s prohibition on competing investment options or deletion of equity wash provisions; or (iii) the failure of the trust to qualify for exemption from federal income taxes or any required prohibited transaction exemption under ERISA. The Plan

a

dministrator does not believe that the occurrence of any such value event, which would limit the Plan

’

s ability to transact at contract value with participants, is probable.

VRIAC

, th

e GIC issuer, has the option to payout the current value of the contract only after completion of five contract years.

Note 11. Subsequent Events

The Plan has evaluated, for consideration of recognition or disclosure, subsequent events that have occurred through the date of issuance of its financial statements, and has determined that no significant events occurred after

December 31, 2015

but prior to the issuance of these financial statements that would have a material impact on its financial statements.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CALLON PETROLEUM COMPANY

|

|

|

|

EMPLOYEE SAVINGS AND PROTECTION PLAN

|

|

|

|

Employer Identification Number 94-0744280

|

|

|

|

Plan Number: 002

|

|

|

|

Schedule H, line 4(i)

|

|

|

|

Schedule of Assets (Held at End of Year)

|

|

|

|

December 31, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

|

(b)

Identity of Issue, Borrower, Lessor or Similar Party

|

|

(c)

Description of Investment, Including Maturity Date, Rate of Interest, Collateral, Par or Maturity Value

|

|

(d)

Cost

|

|

|

(e)

Current Value

|

|

|

|

Guaranteed investment contract

|

|

|

|

|

|

|

|

|

*

|

|

Voya

|

|

Fixed Account**

|

|

|

|

$

|

9,130,273

|

|

|

|

|

|

8,950,890.500 units

|

|

|

|

|

|

|

|

|

Pooled separate accounts

|

|

|

|

|

|

|

|

|

*

|

|

Voya

|

|

Money Market Portfolio - Class I

|

|

|

|

|

155,082

|

|

|

|

|

|

155,082.210 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BlackRock

|

|

High Yield Bond Portfolio

|

|

|

|

|

103,001

|

|

|

|

|

|

14,446.112 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

VY

|

|

PIMCO Real Return Fund - Institutional Class

|

|

|

|

|

3,494

|

|

|

|

|

|

332.401 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

American Funds

|

|

EuroPacific Growth Fund Class R-6

|

|

|

|

|

428,731

|

|

|

|

|

|

9,460.079 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fidelity Advisor

|

|

New Insights Fund - Class A

|

|

|

|

|

1,963,714

|

|

|

|

|

|

75,094.242 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Eaton Vance

|

|

Atlanta Capital SMID-Cap Fund - Class I

|

|

|

|

|

590,790

|

|

|

|

|

|

22,792.837 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Voya

|

|

Small-Cap Opportunities Portfolio - Class I

|

|

|

|

|

569,793

|

|

|

|

|

|

22,984.785 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Columbia

|

|

Mid-Cap Value Fund - Class A Shares

|

|

|

|

|

421,686

|

|

|

|

|

|

30,402.716 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vanguard

|

|

Mid-Cap Index Fund - Admiral Shares

|

|

|

|

|

270,991

|

|

|

|

|

|

1,822.159 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vanguard

|

|

500 Index Fund - Admiral Shares

|

|

|

|

|

1,118,390

|

|

|

|

|

|

5,933.733 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

VY

|

|

T. Rowe Price Equity Income Portfolio - Service Class

|

|

|

|

|

499,131

|

|

|

|

|

|

37,755.781 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Invesco

|

|

Equity & Income Fund A

|

|

|

|

|

606,625

|

|

|

|

|

|

63,058.773 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vanguard

|

|

Total International Stock Index Fund - Investor Shares

|

|

|

|

|

51,091

|

|

|

|

|

|

3,525.948 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pioneer

|

|

Pioneer Bond Fund - Class K Shares

|

|

|

|

|

290,887

|

|

|

|

|

|

30,587.533 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

VY

|

|

Oppenheimer Global Portfolio - Initial Class

|

|

|

|

|

516,254

|

|

|

|

|

|

28,728.661 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MFS

|

|

International New Discovery Fund - Class R5

|

|

|

|

|

100,374

|

|

|

|

|

|

3,534.288 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vanguard

|

|

Small-Cap Index Fund - Admiral Shares

|

|

|

|

|

99,983

|

|

|

|

|

|

1,884.693 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DFA U.S.

|

|

Targeted Value Portfolio - Institutional Class

|

|

|

|

|

16,009

|

|

|

|

|

|

810.603 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

American Century

|

|

Real Estate Fund - Investor Class

|

|

|

|

|

84,636

|

|

|

|

|

|

2,847.765 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vanguard

|

|

Total Bond Market Index Fund - Institutional

|

|

|

|

|

40,832

|

|

|

|

|

|

3,837.622 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Templeton

|

|

Global Bond Fund - Class R6

|

|

|

|

|

6,534

|

|

|

|

|

|

566.659 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

Retirement 2005 Fund

|

|

|

|

|

9,226

|

|

|

|

|

|

742.240 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

Retirement 2015 Fund

|

|

|

|

|

616,593

|

|

|

|

|

|

45,072.585 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

Retirement 2020 Fund

|

|

|

|

|

66,639

|

|

|

|

|

|

3,384.415 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

Retirement 2025 Fund

|

|

|

|

|

833,339

|

|

|

|

|

|

55,741.738 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

Retirement 2030 Fund

|

|

|

|

|

434,582

|

|

|

|

|

|

19,925.827 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

Retirement 2035 Fund

|

|

|

|

|

1,401,430

|

|

|

|

|

|

88,754.286 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

Retirement 2040 Fund

|

|

|

|

|

60,202

|

|

|

|

|

|

2,666.148 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

Retirement 2045 Fund

|

|

|

|

|

589,562

|

|

|

|

|

|

38,889.317 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

Retirement 2050 Fund

|

|

|

|

|

68,617

|

|

|

|

|

|

5,385.939 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

Retirement 2055 Fund

|

|

|

|

|

220,229

|

|

|

|

|

|

17,327.237 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price

|

|

Retirement 2060 Fund

|

|

|

|

|

61

|

|

|

|

|

|

6.285 units

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total pooled separate accounts

|

|

|

|

|

12,238,508

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Voya

|

|

Company stock unit fund

|

|

|

|

|

4,146,429

|

|

|

|

|

|

240,729.789 units

|

|

|

|

|

|

|

|

|

|

|

Total investments

|

|

|

|

|

25,515,210

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Notes receivable from participants

|

|

4.25% to 4.75% fixed rate interest, maturity of up to 5 years, with residential loans maturing in 10 to 30 years

|

|

|

|

|

387,157

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

25,902,367

|

|

|

|

|

|

|

|

|

|

|

|

|

*Denotes party-in-interest

|

|

|

|

|

|

|

|

|

**Contract value totals $

8,95

0,891

|

|

|

|

|

|

|

|

|

Note: Cost information is omitted due to transactions being participant or beneficiary directed under an individual account plan.

|

SIGNATURES

The Plan.

Pursuant to the requirement

s of the Securities Exchange Act of 1934, the Plan administrator has duly caused this annual report to be signed on their behalf by the undersigned hereunto duly authorized.

CALLON

PETROLEUM COMPANY

(Registrant)

|

.

|

|

|

|

June

1

5

, 201

6

|

|

/s/ Joseph C. Gatto, Jr.

|

|

|

|

Joseph C. Gatto, Jr.

|

|

|

|

Chief Financial Officer, Senior Vice President

|

|

|

|

and Treasurer

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit

|

|

Description

|

|

23.1

|

|

Consent of HORNE LLP , independent registered public accounting firm

|

|

|

|

|

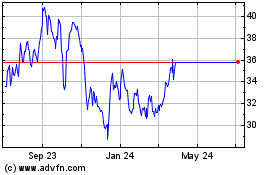

Callon Petroleum (NYSE:CPE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Callon Petroleum (NYSE:CPE)

Historical Stock Chart

From Apr 2023 to Apr 2024