By Ellie Ismailidou and Victor Reklaitis, MarketWatch

Inflation fell 0.1% in December; manufacturing data on tap

U.S. stocks began the week on a sour note Monday, as oil prices

marched lower and U.S. manufacturing data showed signals of

contraction for a fourth straight month.

The S&P 500 lost 12 points, or 0.6%, at 1,928. The Dow Jones

Industrial Average fell 100 points, or 0.6%, to 16,363. Meanwhile,

the Nasdaq Composite began the day down 24 points, or 0.5%, at

4,589.

Sentiment was hit by fresh drops in oil prices

(http://www.marketwatch.com/story/oil-sags-on-china-data-production-cut-doubts-2016-02-01)

(http://www.marketwatch.com/story/oil-sags-on-china-data-production-cut-doubts-2016-02-01),

following a 4.4% gain last week, amid a new bump in China's economy

(http://www.marketwatch.com/story/china-manufacturing-numbers-indicate-sluggishness-2016-01-31)and

dimming prospects of a coordinated oil production cut by key

producers.

Read: A big reason it is too late for OPEC to cut production

(http://www.marketwatch.com/story/a-big-reason-its-too-late-for-opec-to-cut-production-2016-02-01)

The energy sector was the worst performer on the S&P 500

Monday morning, down 2.4% on the day, led by Southwestern Energy

Company (SWN). Energy names were among the worst performers on the

Dow industrials, led by Exxon Mobil Corp. (XOM), down 2.2%.

On the U.S. economic front, U.S. manufacturing companies

contracted for the fourth straight month

(http://www.marketwatch.com/story/weak-tone-to-manufacturing-report-from-ism-in-january-2016-02-01),

albeit at a slower pace in January than economists' expectations.

The reading of 48.2% as above forecasts but still below the reading

of 50% which is recognized as signaling expansion.

The PCE index, the Federal Reserve's preferred inflation gauge,

fell 0.1% in December and 1.4% over the past 12 months, remaining

well below the Fed's 2% target

(http://www.marketwatch.com/story/consumer-spending-goes-nowhere-in-december-2016-02-01).

"The lack of inflationary pressure in the PCE deflator measures

of prices is another reason why the Fed could stand pat in March,"

said Paul Ashworth, chief U.S. economist at Capital Economics, in a

note.

The market-implied probability of a rate increase in March was

at 16% Monday morning, according to the CME Group's FedWatch tool

(http://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html)that

tracks Fed-fund futures prices.

Also read:Wall Street sees shrinking likelihood of any rate

increase in 2016

(http://www.marketwatch.com/story/wall-street-sees-shrinking-likelihood-of-any-rate-hike-in-2016-2016-01-29)

Investors were also bracing for a speech by a key Fed official

and earnings from Google parent Alphabet Inc. and Mattel Inc.

On Friday, the S&P 500 gained 2.5%

(http://www.marketwatch.com/story/us-stocks-dow-futures-leap-after-surprise-boj-move-joining-in-global-rally-2016-01-29)

for its biggest daily gain since September, with credit going to a

surprise Bank of Japan stimulus effort. The benchmark added nearly

2% last week, yet finished down 5.1% in January.

Read: Bank of Japan's negative rate decision is a mark of

'desperation'

(http://www.marketwatch.com/story/critics-slam-bank-of-japans-negative-interest-rate-move-2016-01-29)

"While last week's gains in the stock market seemed to change

investor psychology overnight from an atmosphere of fear and gloom

to one of at least balanced risks, not much has changed

fundamentally," said James Meyer, chief investment officer at Tower

Bridge Advisors, in emailed comments.

"We think [S&P 500] support at the lows near 1,821-1,867 is

in jeopardy of ultimately being broken, and therefore would keep a

short-term time horizon for long positions," said Katie Stockton,

BTIG's chief technical strategist, in a note.

Other markets:Weak Chinese manufacturing data

(http://www.marketwatch.com/story/china-manufacturing-numbers-indicate-sluggishness-2016-01-31)drove

China's Shanghai Composite down by 1.8%

(http://www.marketwatch.com/story/nikkei-soars-for-second-day-following-negative-rate-cut-2016-01-31).

But Japan's Nikkei closed 2% higher, adding to its 2.8% surge on

Friday when the Bank of Japan surprised investors by pushing

interest rates into negative territory

(http://www.marketwatch.com/story/japan-follows-europe-into-negative-interest-rates-2016-01-29).

The Stoxx Europe 600

(http://www.marketwatch.com/story/european-stocks-start-february-in-the-red-as-manufacturing-data-soften-2016-02-01)

and a key dollar index lost ground, while gold futures gained.

Treasury yields inched lower toward a nine-month low.

Individual movers: Shares of Chipotle Mexican Grill, Inc. (CMG)

jumped 3.8% after the company declared an end of E. coli

outbreak.

Aetna (AET) was up 0.9% after the health insurer posted

better-than-expected quarterly earnings

(http://www.marketwatch.com/story/aetna-profit-jumps-more-than-forecast-in-fourth-quarter-2016-02-01)

ahead of the opening bell.

Shares in natural-gas company Questar Corp. (STR) reversed sharp

premarket gains to trade down 0.6% following news that utility

company Dominion Resources Inc. (D) plans to buy it for $4.4

billion

(http://www.marketwatch.com/story/dominion-resources-agrees-to-buy-questar-in-44-billion-deal-2016-02-01).

Dominion shares were down 1.4%.

Alphabet (GOOGL) (GOOGL) and toy giant Mattel (MAT) are

scheduled to release results after the closing bell.

Read more: Earnings may lift Google parent Alphabet's market

value above Apple's

(http://www.marketwatch.com/story/alphabet-earnings-could-push-google-parent-past-apple-as-worlds-most-valuable-company-2016-01-29)

Economic news: Consumer spending was flat in December as

Americans mostly pocketed their income gains, the Commerce

Department said Monday. Outlays were unchanged even though incomes

rose 0.3%--consumers saved more instead. The savings rate rose to

5.5% from 5.3%, to match a three-year high.

Construction spending rose 0.1% in December

(http://www.marketwatch.com/story/construction-spending-edges-up-01-in-december-2016-02-01),

below the 0.6% gain forecast.

Federal Reserve Vice Chairman Stanley Fischer is due to speak

(http://www.marketwatch.com/story/feds-fischer-to-get-opportunity-to-clear-up-central-bank-message-2016-01-29)

at 1 p.m. Eastern Time in New York. It is likely to be standing

room only at the Council on Foreign Relations as the market strains

to hear his latest views on the economy and interest-rate

policy.

(END) Dow Jones Newswires

February 01, 2016 10:28 ET (15:28 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

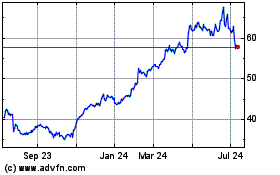

Chipotle Mexican Grill (NYSE:CMG)

Historical Stock Chart

From Mar 2024 to Apr 2024

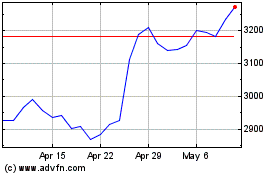

Chipotle Mexican Grill (NYSE:CMG)

Historical Stock Chart

From Apr 2023 to Apr 2024