Comerica Profit Hit Hard by Energy-Loan Weakness--Update

April 19 2016 - 12:25PM

Dow Jones News

By Rachel Louise Ensign

Comerica Inc.'s earnings were hit hard by souring energy loans,

leading the CEO to say the bank needs to "earn the right to remain

independent" and would consider potential deals.

The Dallas-based bank said profit fell by more than half in its

first quarter as it increased its reserves for bad energy loans due

to the prolonged slump in prices. More than half of the energy

loans at the bank are now marked as "criticized," meaning they are

at higher risk of default.

The regional bank's results missed analysts' expectations. It

reported a profit of $60 million, down from $134 million a year

earlier. On a per-share basis, earnings fell to 34 cents from 73

cents. Revenue rose 4.2% to $693 million. Analysts polled by

Thomson Reuters anticipated 45 cents in profit per share on $709

million in revenue.

Comerica also said it has hired a consulting firm to help the

bank become more profitable through expense cuts and revenue

enhancements. Chief executive Ralph Babb Jr. said the firm, Boston

Consulting Group, was expected to look at "everything," but didn't

specify exactly when the bank would start implementing the firm's

suggestions.

He also said Comerica would "not hesitate" to consider strategic

alternatives, though no specifics were given on any potential deal

opportunities. Shares rose after the earnings report and were up

more than 2% in morning trading.

The firm has a market capitalization of roughly $7 billion.

Higher interest rates boosted revenue at Comerica, which is

poised to benefit as rates rise. The bank said it expected to gain

about $90 million in revenue in 2016 from the December 2015 rate

increase, which helped lift net interest margin, a key metric of

lending profitability, to 2.81% from 2.58% in the prior

quarter.

Mr. Babb conceded that the rate-sensitive position hurt the bank

over the past few years. "In hindsight, we left too much yield on

the table during a weak recovery," he said.

The benefit from the Federal Reserve hike was overshadowed by

issues in the bank's energy book, which makes up a significant

portion of its lending when compared with other banks. Criticized

energy-related loans increased 41% to $2 billion, or 56% of the

segment's loans. That was up from 38% of energy-related loans in

the fourth quarter. Executives attributed some of that shift to new

guidelines on how to evaluate energy loans that were issued by

regulators earlier this year.

Comerica executives also said they saw a few energy customers

draw down on their credit lines, but that this wasn't a widespread

issue. The bank said exploration and production customers'

borrowing capacity has been cut an average of 22% in an ongoing

spring review.

The bank's overall provision for credit losses rose to $148

million from $60 million in the prior quarter.

--Austen Hufford contributed to this article.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

April 19, 2016 12:10 ET (16:10 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

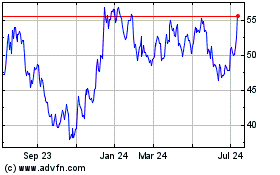

Comerica (NYSE:CMA)

Historical Stock Chart

From Aug 2024 to Sep 2024

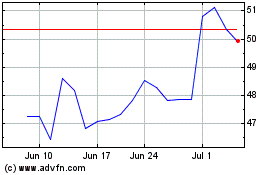

Comerica (NYSE:CMA)

Historical Stock Chart

From Sep 2023 to Sep 2024