Stocks Slip on Falling Oil Prices -- Second Update

August 11 2016 - 7:56AM

Dow Jones News

By Riva Gold

Stocks ticked higher Thursday as a recovery in oil prices helped

reverse early losses in the energy sector.

The Stoxx Europe 600 erased morning declines to rise 0.4%, led

by gains in defensive stocks such as utilities and food and

beverage companies.

Futures pointed to a 0.2% opening gain for the S&P 500,

which closed Wednesday slightly shy of its all-time high reached

last week.

Even as global growth remains low, the feeling in the market is

that "there's no other alternative but to remain invested," said

Charles Hepworth, investment director at GAM.

Central banks are continuing to ease their policy, he said,

which has helped support stocks and sentiment toward risk.

In premarket trading, shares in Chesapeake Energy Corporation

were up over 7% after the oil and gas producer agreed to pay nearly

$340 million to exit the Barnett Shale in Texas.

Most energy and mining stocks retreated, however, as volatile

oil prices took their toll. Brent crude oil was last up 0.4% at

$44.23 a barrel after falling below $43.50 earlier in the day.

Signs of continued growth in U.S. crude stocks and record output

from Saudi Arabia have depressed oil prices, which are down around

6% in the past month.

London's FTSE 100 Index fell 0.2%, pressured by the earlier fall

in oil prices and a large number of companies going ex-dividend,

which tends to depress shares.

Earlier, oil price declines had weighed on stocks in Asia.

Australia's S&P/ ASX 200 shed 0.6%, while the Shanghai

Composite Index lost 0.5% after falling oil prices sent Wall Street

to a lower close on Wednesday.

Stocks in Hong Kong, however, rose on reports that the

Shenzhen-Hong Kong exchange trading link, which could channel cash

into Hong Kong stocks, will be started soon. Markets in Japan were

closed for a holiday.

Elsewhere, New Zealand's central bank lowered its main interest

rate to a record-low 2% on Thursday and signaled further cuts were

likely, but the kiwi dollar spiked against the greenback as markets

had anticipated a more dramatic cut.

The dollar was otherwise slightly firmer, inching up 0.3%

against the euro and 0.2% against the yen.

In bonds, the yield on the 10-year U.S. Treasury note inched up

slightly to 1.520% following two sessions of declines. Yields move

inversely to prices.

Ten-year U.K. government debt last yielded 0.546% after some

short-dated gilts briefly returned to negative territory Thursday

morning.

The gilt market has driven bond yields lower across the board

this week amid concerns about scarcity in the U.K.'s debt market as

the Bank of England embarks on its purchase program.

"The U.K. is really defying the rest of the global bond market,"

Mr. Hepworth said, pushing yields to incredibly low levels.

Kenan Machado

and Kate Geenty contributed to this article.

Write to Riva Gold at riva.gold@wsj.com

(END) Dow Jones Newswires

August 11, 2016 07:41 ET (11:41 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

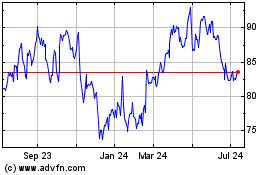

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Aug 2024 to Sep 2024

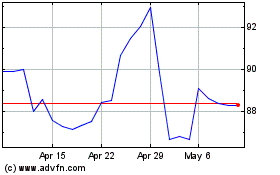

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Sep 2023 to Sep 2024