Chesapeake Energy Plans to Cut 15% of Jobs--2nd Update

September 29 2015 - 5:52PM

Dow Jones News

By Erin Ailworth And Tess Stynes

Chesapeake Energy Corp. said it is reducing its workforce by 15%

to reduce costs amid low prices for crude and natural gas.

In a regulatory filing Tuesday, the U.S. shale driller said it

expects to post third-quarter charges of roughly $55.5 million

related to the move.

Because of the swoon in oil prices, Chesapeake has reduced rig

operations and cut capital expenditures after failing to offset the

plunge with higher production.

Chesapeake, based in Oklahoma City, had about 5,000 employees.

Today, 740 of them will be laid off, with about 560 of those

positions coming from the home office in Oklahoma, the company

said.

"As you are fully aware, the current commodity price environment

continues to be a challenge for our industry and for Chesapeake,"

Chief Executive Doug Lawler wrote in an email to employees. "While

this was extremely difficult, we are acting decisively and

prudently to enhance the long-term competitiveness and strength of

Chesapeake."

Shares of Chesapeake Energy, down 71% over the past year, fell

0.3% to $6.77 in after-hours trading.

Chesapeake is among the U.S. large energy companies that have

written down the value of their oil fields this year as a rout in

commodities prices has made properties across the country not worth

drilling.

In August, Chesapeake posted a deep loss for the second quarter,

hurt by a write-down of $4.02 billion on some properties.

Mr. Lawler has been trying to reshape the company since he took

the helm in the summer of 2013.

For many years before the global financial crisis, Chesapeake

co-founder and then-chief executive Aubrey McClendon borrowed

heavily to snap up oil and gas prospects around the U.S. and drill

more wells than his rivals. Under his direction, the company's debt

load ballooned to more than $16 billion, and shareholders began to

fret about his appetite for risk and enthusiasm for spending on

borrowed money.

Mr. McClendon left Chesapeake two years ago. Mr. Lawler stepped

in and almost immediately began to sell off energy properties from

West Virginia to Pennsylvania that weren't core to Chesapeake's

business in order to raise money and pay down debt. The boldest

deal of this sort came a year ago in October 2014 when Chesapeake

struck a $5.38 billion deal to sell a significant piece of itself

to rival driller Southwestern Energy Corp.

Mr. Lawler has reined in spending, but plummeting oil and gas

prices continued to take a toll on the company, along with many

other American energy producers. Today the entire company is valued

at less than $5 billion as measured by market capitalization.

Write to Erin Ailworth at Erin.Ailworth@wsj.com and Tess Stynes

at tess.stynes@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 29, 2015 17:37 ET (21:37 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

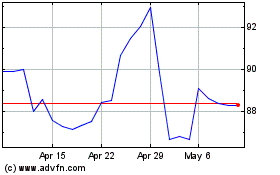

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

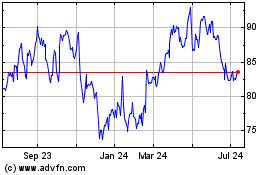

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024