Crown Castle Boosts Outlook, but Earnings Miss

April 21 2016 - 6:18PM

Dow Jones News

By Anne Steele

Crown Castle International Corp. on Thursday raised its guidance

for the year despite posting top and bottom line results below

expectations in the first quarter.

Companies such as Crown Castle, which buys or builds portfolios

of cell towers and then rents them to carriers, have grown amid a

wave of investment driven by increased demand for wireless

Internet.

For the quarter ended March 31, Crown Castle's revenue grew 3.8%

to $934.4 million, edging in below analysts' estimates of $935

million, according to Thomson Reuters.

Site rental revenue rose 9.3% to $799.3 million, above the

midpoint of the company's guidance of $791 million.

Crown Castle reported a profit of $47.8 million before the

payout of preferred dividends and noncontrolling interests,

compared with $122.8 million a year earlier.

On a per-share basis, profit fell to 11 cents from 30 cents a

year earlier, below the 19 cents the company had forecast.

For 2016, Crown Castle raised the midpoint of its guidance for

site rental revenue to $3.22 billion from $3.18 billion. It raised

its forecast for adjusted earnings before interest, taxes,

depreciation and amortization to a range of $2.19 billion to $2.22

billion from $2.18 billion.

Shares, up 8.5% over the past three months, were flat

aftermarket.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

April 21, 2016 18:03 ET (22:03 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

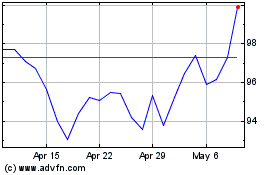

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

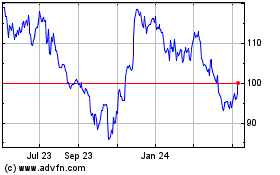

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Apr 2023 to Apr 2024