Caterpillar Says Strong Dollar Adding to Its Woes -- WSJ

January 27 2017 - 3:02AM

Dow Jones News

By Andrew Tangel

Caterpillar Inc. trimmed its sales outlook on Thursday and said

revenue slid in 2016 for the fourth year in a row, providing

evidence that a prolonged slump in mining and construction is still

unfolding.

The Peoria, Ill.-based heavy-equipment giant said the recent

strengthening of the U.S. dollar could drag down sales this year,

after revenue fell 18% in 2016 to $38.5 billion.

Caterpillar's losses deepened in the fourth quarter. The company

reported a loss of $1.2 billion, or $2 a share, compared with a

year-earlier loss of $94 million, or 16 cents a share. Revenue fell

to $9.6 billion from $11 billion.

"We continue to execute in a challenging economic environment

and are focused on improving operating margins, profitability and

shareholder returns," Caterpillar Chief Executive Jim Umpleby said.

"While we see signs of positive activity in some of our key end

markets, the overall economic environment remains challenging."

The manufacturer's troubles were compounded by

higher-than-expected restructuring costs, losses related to pension

and retirement benefits and a $595 million impairment tied to its

2011 billion acquisition of mining-equipment maker Bucyrus

International Inc.

Excluding those items, the company said it earned 83 cents a

share, flat with a year ago and above the 66 cents expected by

analysts polled by Thomson Reuters. Analysts had expected revenue

of $9.8 billion.

Caterpillar's shares closed down about 1% to $97.22 in regular

trading.

The dollar's rise since President Donald Trump's election in

November could spell trouble for manufacturers such as Caterpillar

that depend on exports. A stronger dollar makes American products

more expensive overseas, and foreign sales less valuable.

Caterpillar said the dollar's climb is one reason it lowered its

revenue outlook for the year to a range of between $36 billion and

$39 billion.

The midpoint would be lower than the approximately $38 billion

it telegraphed in December, and potentially mark a fifth-straight

year of declining revenue for the world's largest mining and

construction equipment maker.

Caterpillar said it expects earnings per-share of about $2.30

this year, or $2.90 excluding estimated restructuring costs of

about $500 million.

Caterpillar's restructuring also weighed on its global

workforce, which it has cut recently. By the end of 2016, the

company counted 106,400 employees, down from 118,700 a year ago.

Most of the reductions were made in the U.S.

Caterpillar executives were optimistic about Mr. Trump's

proposed boost to infrastructure spending, which could lead to

increased sales of the company's construction equipment.

They also expressed support for the administration's aims of

reducing corporate taxes and regulations and of securing fair trade

deals.

"As we look at what's happening in the conversation in

Washington, both within the administration and Congress, there's a

number of things that we're very encouraged by," Mr. Umpleby

said.

Joshua Jamerson contributed to this article.

Write to Andrew Tangel at Andrew.Tangel@wsj.com

(END) Dow Jones Newswires

January 27, 2017 02:47 ET (07:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

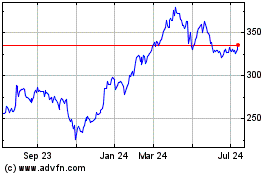

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

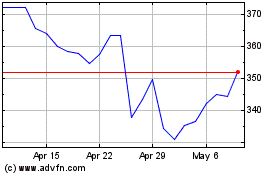

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024