Citi Report Highlights Strong Investor Interest in Depositary Receipts in the First Half of 2015

August 04 2015 - 3:59PM

Business Wire

Citi’s World ex-U.S. Liquid DR Index rose 4%

in the first half; DR trading volumes increased 3% to 81.3 billion

shares

Investor demand for Depositary Receipts (DRs) remained strong

during the first half of 2015, according to the findings of Citi’s

Depositary Receipt Services 2015 Midyear Report. Citi’s World

ex-U.S. Liquid DR Index, which offers insight into international

investor sentiment toward non-U.S. markets, rose 4% in the first

six months of 2015. Additionally, DR trading volumes increased 3%

in the first half of 2015 to 81.3 billion shares, up from 78.7

billion shares during the same period last year.

Non-U.S. companies raised $4.6 billion in DR form during the

first half of 2015, according to Citi’s report. Initial public

offerings in DR form represented $1.6 billion – or 36% – of the

total, driven by emerging growth companies accessing the U.S.

capital markets as a result of the JOBS Act. Follow-on offerings in

DR form represented approximately $3 billion – or 64% – of the

total.

“Citi’s Depositary Receipt Services business supported

transactions that raised 41% of the total DR capital issued in the

first half of 2015, which is a testament to our leading position in

the industry,” said Nancy Lissemore, Global Head of Depositary

Receipt Services at Citi. “We continue to provide our clients and

investors with the highest level of depositary receipt services and

remain a provider of choice for issuers.”

Recently, The Asset magazine honored Citi as the “Best DR Bank”

in Asia in its 2015 Triple A Asset Servicing, Investor and Fund

Management Awards. In addition, Citi was awarded the “Best DR

Mandate” for its role as the depositary bank for Alibaba Group

Holding Limited’s American Depositary Receipt (ADR) program.

Other notable DR market highlights in the first half of 2015

include:

- Transactions from India ($1.9 billion),

the United Kingdom ($492 million), Brazil ($476 million) and China

($462 million) combined for 71% of the total capital raised.

- The Banking, Pharmaceutical,

Biotechnology and Telecommunications industries accounted for

approximately 66% of the total capital raised.

- Trading volume of unsponsored ADR

programs increased 54% to nearly 2 billion DRs.

- Unsponsored ADR programs from Japan and

Greece accounted for 46% of the total unsponsored trading

volume.

Citi is a leading provider of depositary receipt services. With

depositary receipt programs in 56 markets, Citi leverages its

global network to help companies connect to new markets and raise

capital worldwide.

For more details on the 2015 DR highlights, please refer to the

2015 midyear report in the Research section of the Citi DR

website: www.citi.com/dr.

Citi

Citi, the leading global bank, has approximately 200 million

customer accounts and does business in more than 160 countries and

jurisdictions. Citi provides consumers, corporations, governments

and institutions with a broad range of financial products and

services, including consumer banking and credit, corporate and

investment banking, securities brokerage, transaction services, and

wealth management.

Additional information may be found at www.citigroup.com |

Twitter: @Citi | YouTube: www.youtube.com/citi | Blog:

http://blog.citigroup.com | Facebook: www.facebook.com/citi |

LinkedIn: www.linkedin.com/company/citi

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150804006870/en/

Media:CitiRobert Julavits,

212-816-8020robert.w.julavits@citi.com

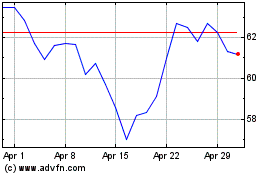

Citigroup (NYSE:C)

Historical Stock Chart

From Mar 2024 to Apr 2024

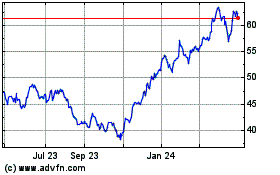

Citigroup (NYSE:C)

Historical Stock Chart

From Apr 2023 to Apr 2024