By Paul Page

Sign up:With one click, get this newsletter delivered to your

inbox.

Best Buy Co. found itself in an unusual place for a retailer

during the holidays: the electronics giant saw plenty of demand for

electronics but the company couldn't keep its shelves stocked. The

supply-chain letdown triggered a surprising drop in revenue, the

WSJ's Khadeeja Safdar reports, and a warning that shortages may

continue through the first half of this year. It's a setback for a

retailer that's invested in e-commerce tools after losing customers

in recent years to Amazon.com Inc. and other price-cutting web

marketplaces. Best Buy has grown more nimble. But the new stumble

highlights how retailers are getting caught between conflicting

supply-chain demands: store owners are trying to keep inventories

lean to keep costs down, but e-commerce sales have fractured many

of the traditional forecasting tools retailers use to ensure the

right goods are in the right place to meet sales demand.

While Foxconn Technology Group talks about starting

manufacturing in the U.S. , the electronics giant is expanding its

factory footprint in southern China. Foxconn Chairman Terry Gou

pointed to the contrast as he launched construction of an $8.8

billion flat-panel screen factory in Guangzho, the WSJ's Eva Dou

reports, highlighting the high stakes and breakneck growth pace in

electronics supply chains. Foxconn has been talking for several

years about a potential flat-panel factory in the U.S. but hasn't

moved on the project. Any new factories carry extra weight for

Foxconn as they advance company efforts to move beyond contract

manufacturing and become more like Samsung Electronics Co., a

consumer brand that makes components for itself and others. That

would give Foxconn even greater weight in larger distribution

channels, from parts to final delivery, and potentially make

Foxconn's factories nodes in a more connected global network.

Harley-Davidson Inc.'s "hogs" are making noise in overseas

markets. President Donald Trump pointed to the iconic motorcycle

maker in his address to Congress this week as an American company

finding it "very hard" to do business abroad. The WSJ's Sean McLain

writes Harley-Davidson has been clearing trade barriers, however,

including 100% tariffs in at least one market, and boasts of

growing export business even as U.S. sales slip. Harley-Davidson

gets about 40% of its sales outside the U.S., in part through

nimble adjustments to meet both different customer demands and

local regulations. In India, which erects tall bars to many

overseas goods, the company has responded to tough duties and

preferences for smaller machines by setting up assembly for the

local market. In Japan, the company has tailored its bikes to the

tough pollution and noise regulations. One dealer there says the

barrier to growth isn't restrictive trade policy but an aging

population that's simply less likely to hop on a Harley.

SUPPLY CHAIN STRATEGIES

The growing food-delivery market is getting a whopper-sized

participant. McDonald's Corp. is testing home delivery in the U.S.

and Europe, the WSJ's Julie Jargon reports, as the fast-food chain

looks to meet its customers where more of them like to eat -- at

home. The move is part of a broader strategic overhaul the company

is undertaking, a response to a downturn in its business that will

include returning to its fast-food roots. It's embracing new

trends, however, by building on the rush toward food-delivery

services that's being fueled by mobile commerce and increasingly

sophisticated distribution operators. McDonald's says it's vast

network carries a big advantage: About 75% of the U.S. population

in its top five markets live within 3 miles of a McDonald's, the

company says, allowing the company to give its customers what they

want -- food that's fast and cheap.

Shipping a Kusama sculpture, it turns out, is something of an

art. The opening of an exhibit of works by the Japanese artist

Yayoi Kusama in New York this week caps an ambitious and intricate

shipping operation, WSJ Logistics Report's Jennifer Smith writes,

involving several transportation modes and some very, very delicate

handling. That's because the centerpiece of the "Guidepost to the

New World" exhibit is 11 cast-aluminum sculptures, one of them

nine-feet tall, painted candy-apple red with the artist's signature

polka dots and weighing more than a ton altogether. It's the kind

of epic logistics effort growing more familiar in the

contemporary-art world as galleries compete for the attention of

global collectors. That's helping build a growing field of

fine-arts logistics firms that specialize in moving and storing

irreplaceable freight.

QUOTABLE

IN OTHER NEWS

Tanker operators Frontline Ltd. and DHT Holdings Ltd. will meet

this month in an attempt to find common ground in Frontline's

hostile takeover bid. (WSJ)

The ISM manufacturing index surged to its highest point since

August 2014 and the New Orders index jumped more than five points

to its highest level in more than four years. (WSJ)

An official gauge of manufacturing activity in China rose faster

than expected in February. (WSJ)

U.S. inflation climbed 1.9% in January from the same month a

year ago. (WSJ)

Lawmakers are criticizing a Trump administration proposal to

circumvent the World Trade Organization by pursuing trade

complaints through domestic U.S. law. (WSJ)

U.S. auto makers are discounting vehicles more aggressively amid

swelling inventories. (WSJ)

General Motors Co. Chief Executive Mary Barra says tax proposals

affecting U.S. imports could be "problematic" for the auto maker.

(WSJ)

Lowe's Cos. issued an upbeat outlook after reporting that

same-store sales rose 4.2% in its most recent quarter. (WSJ)

Dollar Tree Chief Executive Bob Sasser says the market for

discount retail is "the most attractive sector" in a struggling

industry. (WSJ)

Crocs Inc. is closing nearly a third of its stores after

reporting that fourth-quarter sales fell 10%. (WSJ)

Hershey Co. plans to eliminate 15% of its global workforce over

the next two years. (WSJ)

Women's apparel retailer BCBG Max Azria Group LLC filed for

bankruptcy protection but has lined up financing to buy inventory

and keep stores open. (WSJ)

Maersk Line restricted bookings from Europe to Asia and the

Middle East under an apparent capacity crunch on the major shipping

lanes. (The Loadstar)

Container ship owner Seaspan Corp. slashed its dividend after

reporting that its fourth-quarter profit plummeted to $1.4 million.

(American Shipper)

Freight forwarder Kuehne + Nagel AG's net profit rose 6% to $712

million in 2016 as growing ocean and air freight volume offset a

1.4% slip in overall revenue. (Lloyd's Loading List)

Navistar International completed its equity investment in

Volkswagen Truck & Bus as part of a broader supply

collaboration. (Commercial Carrier Journal)

Amazon's logistics operation in India is sharply cutting payouts

to local stores that it uses to deliver orders. (Economic

Times)

DHL is testing use of bicycles modified to carry two containers

for "last-mile" urban delivery. (Logistics Manager)

Shipping line Nippon Yusen Kaisha Inc. sold all of its North

American truck chassis to Direct ChassisLink Inc. (DC Velocity)

U.S. grocers face a shortage of salad greens following a late

planting season in California. (NPR)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin, @jensmithWSJ and @EEPhillips_WSJ and follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Subscribe to this email newsletter by clicking here:

http://on.wsj.com/Logisticsnewsletter .

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

March 02, 2017 06:59 ET (11:59 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

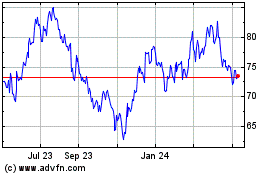

Best Buy (NYSE:BBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

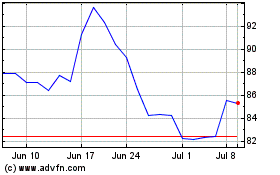

Best Buy (NYSE:BBY)

Historical Stock Chart

From Apr 2023 to Apr 2024