Best Buy's Holiday Sapped by Weak Smartphone Sales -- 2nd Update

January 14 2016 - 11:01AM

Dow Jones News

By Drew FitzGerald

Best Buy Co.'s holiday sales declined as the retailer sold fewer

smartphones than expected, another sign of soft demand for the

latest models from Apple Inc. and Samsung Electronics Co.

The electronics chain on Thursday said domestic sales over the

nine weeks through Jan. 2 fell 1.2%, excluding newly opened or

closed stores. Shoppers picked up fewer mobile devices and shunned

the cases and headphones that come with them, executives said.

For all its spending on brighter stores and a sharper website,

Best Buy remains at the mercy of big-name manufacturers. Apple

hasn't reported its holiday results, but Chinese parts suppliers

have recently warned of slower iPhone production. Samsung

executives this month said they were adjusting their strategy to

adapt to pressure on smartphone sales.

"Our categories are driven in part by product cycles," Chief

Executive Hubert Joly said in an interview. "In that context, we

were able to really perform well."

On Wednesday, camera maker GoPro Inc. said it would slash jobs

after posting weak holiday retail sales for its latest wearable

camera, despite two rounds of price cuts. Mr. Joly said the result

should come as no surprise because GoPro didn't release a new

product for the holidays.

Mr. Joly noted that one of every two ultrahigh-definition 4K

television sets sold in the U.S. came from Best Buy. The chain also

said its operating margins wouldn't narrow as much as expected in

the fourth quarter, which ends Jan. 30.

Shares of the company fell 11% to $26.15 early Thursday. The

last time Best Buy reported lower holiday sales, in early 2014, the

stock lost roughly a third of its value.

The shortfall shed light on a familiar predicament for Best Buy:

Despite massive revenue gains for Silicon Valley software

developers, there is relatively little growth among retailers

selling the gadgets that make much of that technology possible.

Best Buy's overall revenue slipped 3.6% to $10.96 billion over

the holidays, partly because the chain closed 66 Future Shop stores

in Canada earlier in the year. Mr. Joly on Thursday said the

company had no plans to cut its store count further.

Domestic sales of computers, tablets and mobile phones fell 7.2%

from a year ago, while appliance sales rose 13%. The sales excluded

the impact of wireless installment billing plans, which bring more

upfront revenue to retailers' top lines.

The results follow dismal reports from Hhregg Inc., a regional

competitor, and from videogame chain GameStop Corp., which managed

a 1.8% sales gain over the holidays only because it sold more game

consoles and collectibles.

Personal computer sales in the fourth quarter of 2015 sank to

their lowest levels since 2007, according to market researcher

International Data Corp.

Mr. Joly suggested the next wave of demand could be around the

corner, noting the number of new devices, from drones to apparel,

on display at last week's Consumer Electronics Show in Las

Vegas.

"There will always be ups and downs," he said. "We continue to

be excited about the rate of technology innovation."

Write to Drew FitzGerald at andrew.fitzgerald@wsj.com

(END) Dow Jones Newswires

January 14, 2016 10:46 ET (15:46 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

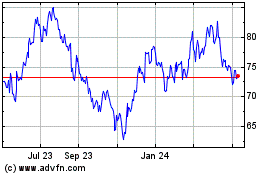

Best Buy (NYSE:BBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

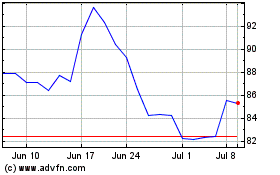

Best Buy (NYSE:BBY)

Historical Stock Chart

From Apr 2023 to Apr 2024