American Express Adds $3.3 Billion to Stock Buyback Plan After Stress Test -- 2nd Update

June 29 2016 - 6:44PM

Dow Jones News

By Robin Sidel

American Express Co. has the capital to keep lending in a severe

economic downturn, the Federal Reserve calculated Thursday in the

first stage of its annual stress tests, paving the way for the

credit-card company to set a dividend increase and share buyback

plan.

AmEx said the plan it submitted to the Fed calls for increasing

the quarterly dividend by 10% to 32 cents, starting in the third

quarter and subject to board approval.

It also said it plans to repurchase up to $3.3 billion of common

shares over the next year. The move will enable to company to buy

back up to $4.4 billion in common shares this year, including $1.7

billion of expected buybacks during the current quarter and up to

an additional $1.7 billion in the first half of 2017.

New York-based AmEx has suffered a share of strategic

difficulties over the past year, including the loss of its longtime

co-brand card with Costco Wholesale Corp., but the card company has

long been considered to be well-capitalized.

At the low point of a hypothetical recession, AmEx's common

equity Tier 1 ratio, which is a measure of high-quality capital as

a share of risk-weighted assets, was 11.4%, exceeding the 4.5%

level the Fed views as a minimum, the central bank estimated.

AmEx's Tier 1 leverage ratio, which measures high-quality

capital as a share of all assets, was 10.9%, exceeding a 4%

minimum.

The stress tests simulate a world-wide recession. The results

were under the Fed's "severely adverse" scenario of financial

stress, which this year includes a 10% U.S. unemployment rate,

significant losses in corporate and commercial real estate lending

portfolios, and negative rates on short-term U.S. Treasury

securities.

The results will factor into the Fed's decision next week about

whether to approve the bank's plan for rewarding shareholders with

dividends or potential share buybacks. Banks whose capital ratios

dropped close to minimum levels may choose to scale back their

dividend or buyback plans before the Fed announces its final

decision Wednesday. That day the banks can choose to announce

whether they are raising their dividends or buying back more

shares, important for enhancing shareholder returns.

Separately, Discover Financial Services said the Fed also had no

objections to its capital plan, which calls for an increase in the

company's quarterly dividend to 30 cents from 28 cents and share

repurchases of up to $1.95 billion over the next year.

Write to Robin Sidel at robin.sidel@wsj.com

(END) Dow Jones Newswires

June 29, 2016 18:29 ET (22:29 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

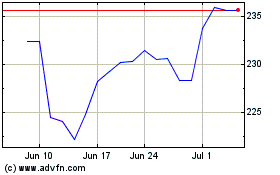

American Express (NYSE:AXP)

Historical Stock Chart

From Aug 2024 to Sep 2024

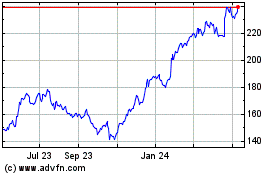

American Express (NYSE:AXP)

Historical Stock Chart

From Sep 2023 to Sep 2024