Current Report Filing (8-k)

October 23 2015 - 4:18PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 23, 2015

Allegheny Technologies Incorporated

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-12001 |

|

25-1792394 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

| 1000 Six PPG Place, Pittsburgh, Pennsylvania |

|

15222-5479 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (412) 394-2800

N/A

(Former name or

former address, if changed since last report).

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 5.04. |

Temporary Suspension of Trading Under Registrant’s Employee Benefit Plans. |

Beginning on October 23, 2015, Allegheny Technologies Incorporated (“ATI” or the “Company”) sent a notice to

participants in its 401(k) savings plans (the “40l(k) Plans”) who are not members of collective bargaining units (“Non-bargaining Participants”) informing them that the account balances of Non-bargaining Participants in the

40l(k) Plans would be consolidated into a single defined contribution plan to be known as the ATI 401(k) Savings Plan (the “New Plan”). The notice stated that, during a specified period of time while the consolidations of account balances

are implemented, Non-bargaining Participants will not be able to process any account transactions in either the 401(k) Plans or the New Plan, including portions of account balances held in a Company stock fund. The notice also stated that this time

period will begin at 3:00 p.m. Eastern Time on November 23, 2015 and is expected to end during the week of December 6, 2015.

On

October 23, 2015, the Company sent a blackout restriction notice (the “BTR Notice”) to its directors and executive officers informing them that, because the restrictions during the blackout period described above include restrictions

on investment changes involving the Company’s common stock held in the 40l(k) Plans and the New Plan, they would be prohibited during the blackout period, pursuant to Section 306(a) of the Sarbanes-Oxley Act of 2002 and the SEC’s

rules promulgated thereunder, from purchasing and selling shares of the Company’s common stock (including derivative securities pertaining to such shares) acquired in connection with their service as a director or employment as an executive

officer.

A copy of the BTR Notice is attached hereto as Exhibit 99.1 and is incorporated herein by reference. During the blackout period

and for a period of two years after the blackout period has ended, interested parties may obtain, without charge, information regarding the beginning and ending dates of the blackout period by contacting Allegheny Technologies Incorporated,

Attention: Corporate Secretary, 1000 Six PPG Place, Pittsburgh, Pennsylvania 15222-5479 (telephone (412) 394-2800).

| Item 9.01. |

Financial Statements and Exhibits. |

|

|

|

|

|

| Exhibit 99.1 |

|

Notice to Executive Officers and Directors of Allegheny Technologies Incorporated regarding a 40l(k) Plan Blackout Period and Trading Restrictions. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

| ALLEGHENY TECHNOLOGIES INCORPORATED |

|

|

| By: |

|

/s/ Elliot S. Davis |

|

|

Elliot S. Davis |

|

|

Senior Vice President, General Counsel, |

|

|

Chief Compliance Officer and Corporate Secretary |

Dated: October 23, 2015

EXHIBIT 99.1

IMPORTANT NOTICE REGARDING

BLACKOUT PERIOD AND RESTRICTIONS

ON YOUR ABILITY TO TRADE SHARES OF THE COMPANY’S EQUITY SECURITIES

BECAUSE OF A 401(k) PLAN BLACKOUT PERIOD

This notice is to inform you of significant restrictions on your ability to trade any equity securities of Allegheny Technologies Incorporated

(“ATI” or the “Company”) during an upcoming “blackout period” that will apply to the Company’s 401(k) savings plans (the “401(k) Plans”). Because certain participants in the 401(k) Plans will be

prohibited from trading Company equity securities, this special “blackout period” is imposed on executive officers and directors of the Company by the Sarbanes-Oxley Act of 2002 and Securities and Exchange Commission Regulation BTR

(Blackout Trading Restriction) and is in addition to the Company’s trading windows related to its earnings releases and other material developments from time to time.

The special blackout period is being imposed because the account balances of non-bargaining participants in the 401(k) Plans are being consolidated into a

single plan. The special blackout period will begin at 3:00 p.m. Eastern Time on November 23, 2015 and is expected to end during the week of December 6, 2015 (the “Blackout Period”). During the Blackout Period, participants in

the 401(k) Plans will not be able to process any account transactions, including from or to their Company stock funds.

In accordance with

Section 306(a) of the Sarbanes-Oxley Act of 2002 and Rule 104 of Securities and Exchange Commission Regulation BTR, the Company’s executive officers and directors are prohibited during the Blackout Period from purchasing, selling or

otherwise acquiring or transferring, directly or indirectly, any equity security of the Company acquired in connection with his or her employment as an executive officer or services as a director.

Please note the following:

| |

• |

|

“Equity securities” is defined broadly to include the Company’s common stock, stock options, and other derivative securities. |

| |

• |

|

Covered transactions are not limited to those involving your direct ownership, but include any transaction in which you have a pecuniary interest (for example, transactions by your immediate family members living in

your household). |

| |

• |

|

Among other things, these rules prohibit exercising options granted to you in connection with your employment as an executive officer or service as a director, selling shares of common stock acquired pursuant to such

options, selling shares of common stock originally received as a restricted stock unit grant or upon the vesting of a restricted stock unit, or selling shares to cover withholding taxes upon the vesting of restricted stock units. |

| |

• |

|

Exemptions from these rules generally apply for purchases or sales under dividend reinvestment plans, sales required by laws, regularly scheduled grants or awards under the Company’s equity compensation plans and

certain other “automatic” transactions. |

Inquiries with respect to this blackout period, including determining whether this blackout period has ended,

should be directed to:

Elliot S. Davis

Senior Vice President, General Counsel,

Chief Compliance Officer and Corporate Secretary

Allegheny Technologies Incorporated

1000 Six PPG Place

Pittsburgh,

PA 15222-5479

(412) 394-2800

These rules

apply in addition to the trading restrictions under the Company’s insider trading policy. If you engage in a transaction that violates these rules, you may be required to disgorge your profits from the transaction, and you may be subject to

civil and criminal penalties. The SEC regulations regarding the Blackout Period restrictions are complex. To avoid any inadvertent violations of the Blackout Period restrictions, executive officers and directors are required to follow the

Company’s pre-clearance procedures in connection with any proposed transaction in Company securities. If you have any questions regarding the Company’s pre-clearance procedures or your ability to engage in any transaction, please contact

Elliot S. Davis.

October 23, 2015

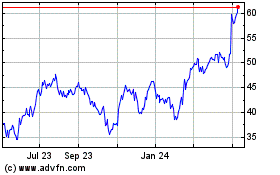

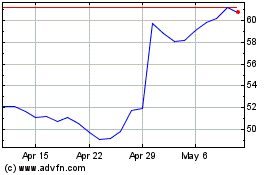

ATI (NYSE:ATI)

Historical Stock Chart

From Mar 2024 to Apr 2024

ATI (NYSE:ATI)

Historical Stock Chart

From Apr 2023 to Apr 2024