Additional Proxy Soliciting Materials (definitive) (defa14a)

April 21 2015 - 11:17AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant To Section 14(a) of the

Securities Exchange Act of 1934

Filed by the

Registrant x Filed by

a Party other than the Registrant ¨

Check the appropriate box:

|

|

|

|

|

|

|

| ¨ |

|

Preliminary Proxy Statement |

|

|

| ¨ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

| ¨ |

|

Definitive Proxy Statement |

|

|

| x |

|

Definitive Additional Materials |

|

|

| ¨ |

|

Soliciting Material Pursuant to §240.14a-12 |

|

|

|

|

Allegheny Technologies Incorporated |

|

|

|

|

(Name of Registrant as Specified In Its Charter) |

|

|

|

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

|

|

| x |

|

No fee required. |

|

|

| ¨ |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

|

|

(1) |

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

(2) |

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

(3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11

(set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

(4) |

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

(5) |

|

Total fee paid:

|

|

|

|

|

|

|

|

| ¨ |

|

Fee paid previously with preliminary materials. |

|

|

| ¨ |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and

identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

|

|

|

(1) |

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

(2) |

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

(3) |

|

Filing Party:

|

|

|

|

|

|

|

|

(4) |

|

Date Filed:

|

|

|

|

|

|

|

|

| April

2015 ©

2015 ATI. All Rights Reserved.

ATI Say on Pay Discussion

|

|

|

| Shareholder

Goals ATI Current State: CEO

Amount of compensation at risk

81%

Amount of equity-based compensation linked to

performance

83%

Level of compensation compared to industry peers

Total slightly below median

of peers

Contemporary best practices for executive compensation:

-Double trigger for change in control agreements

-Elimination of tax gross-ups

-Elimination of excessive perqs

-Anti-hedging, anti-pledging policies

-Clawback provisions

-Robust stock ownership guidelines for NEOs

-Comprehensive risk evaluation of program administration

Adopted from 2011-2015

Compensation programs designed to reflect company

strategy to create long-term shareholder value

Yes; see pages 3 and 4

Also described in CD&A

Investor Feedback on Say on Pay

©

ATI 2015. All Rights Reserved.

2 |

|

|

| ATI

Compensation Plans and Changes Factors affecting ATI’s compensation plans

from 2011-2015: •

Reduced several aspects of existing exec comp programs to align with investors

philosophies and changing exec comp environment

•

Implemented changes carefully in order to manage retention throughout the change

period (evolution vs. revolution)

•

Hot Rolling & Processing Facility completion/commissioning (Brackenridge,

PA) •

New titanium sponge facility Premium Quality qualification (Rowley, UT)

•

Strategic acquisitions (e.g., Ladish)

•

Addition of executive position (CCMO) for centralizing and standardizing market

penetration and emphasizing revenue growth

•

Other

changes

throughout

the

executive

staff

from

2012

–

early

2015

Completion of nearly $3 billion in strategic investments (including acquisitions)

within specific time frames necessary to realize the expected long-term

ROI ©

ATI 2015. All Rights Reserved.

3

Newly appointed CEO: Richard Harshman

Board

and

CEO

understanding

of

the

future

challenges

and

need

to

create

the

organization necessary to meet the challenges |

|

|

| CEO

Compensation and Relative TSR Relevant facts for CEO compensation:

©

ATI 2015. All Rights Reserved.

4

2011

2012

2013

2014

Equity Awards-LT

4,128,092

3,093,395

3,181,302

3,846,929

Cash Awards-LT (KEPP)

2,934,214

1,075,649

-

-

Cash Awards-ST (AIP)

2,200,000

1,680,187

-

1,376,450

Salary

806,667

923,123

954,006

993,019

Total Realized Compensation

8,223,066

6,888,539

2,763,169

3,289,353

3 Yr Relative TSR (ATI peers)

208%

76%

53%

74%

0%

50%

100%

150%

200%

250%

4,000,000

6,000,000

8,000,000

10,000,000

12,000,000

-

2,000,000

•

TSR for ATI past 12 months is in top quartile

•

No annual bonus paid for 2013 based on performance

•

Decreased CEO’s target awards year over year (combination of LTI and annual

bonus) •

Froze accruals under the DB plan and SERP (effective Dec. 31, 2014)

|

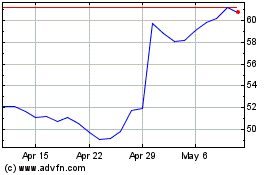

ATI (NYSE:ATI)

Historical Stock Chart

From Mar 2024 to Apr 2024

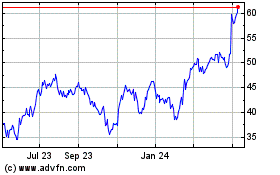

ATI (NYSE:ATI)

Historical Stock Chart

From Apr 2023 to Apr 2024