Candover's Parques Reunidos Sale Delayed Until Autumn-Sources

July 15 2010 - 2:19PM

Dow Jones News

Candover has postponed the sale of Spanish theme park operator

Parques Reunidos until after the summer, people familiar with the

situation told Dow Jones Newswires Thursday.

Second round bids from Providence Equity Partners, Apollo

Management and a consortium of Advent International and Carlyle

Group were expected shortly, people said.

However the bidders want to wait to see if the company meets its

budget targets, a key concern while Spain's economy remains in the

doldrums and the recession has curtailed travel and tourism

especially in Europe, people said.

Candover had originally planned to list Parques Reunidos and in

May hired JP Morgan Chase & Co. (JPM), Credit-Suisse Group (CS)

and Morgan Stanley (MS) to run the process.

The chances of a flotation receded amid renewed market

turbulence that halted a number of large IPOs, especially those

backed by private equity.

Candover bought Parques Reunidos for around EUR900 million and

had been hoping to get as much as EUR2 billion on a sale, according

to a recent press report.

-By Marietta Cauchi, Christopher Bjork and Jessica Hodgson of

Dow Jones Newswires; +44 207 842 9241;

marietta.cauchi@dowjones.com

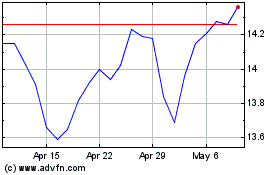

Antero Midstream (NYSE:AM)

Historical Stock Chart

From Mar 2024 to Apr 2024

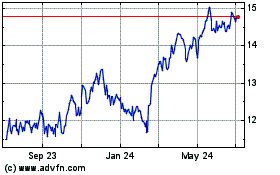

Antero Midstream (NYSE:AM)

Historical Stock Chart

From Apr 2023 to Apr 2024