- Jeffrey C. Smith Joins Advance Auto

Parts Board

- Starboard to Designate Two

Independent Directors to the Board

- Advance Auto Parts to Name Two

Additional Independent Directors Prior to 2016 Annual

Meeting

Advance Auto Parts, Inc. (NYSE: AAP), a leading automotive

aftermarket parts provider in North America, serving both

professional installer and do-it-yourself customers, today

announced that it has entered into an agreement with Starboard

Value LP and its affiliates (“Starboard”), which has an ownership

stake of approximately 3.7 percent of Advance Auto Parts’ shares,

regarding the membership and composition of the Advance Auto Parts

Board of Directors.

Under the terms of the agreement, Jeffrey C. Smith, Starboard’s

CEO and Chief Investment Officer, has been appointed to the Advance

Auto Parts Board, effective immediately, and the size of the Board

has been expanded from 12 to 13 members. Mr. Smith will serve as

chair of the Nominating and Corporate Governance Committee and will

also be a member of the Compensation and Finance Committees. In

addition, Starboard will designate two independent directors to be

added to the Advance Auto Parts Board as soon as practical. The

Company will name two additional independent directors designated

by the Nominating and Corporate Governance Committee for election

at the Company’s 2016 Annual Meeting. It is expected that following

the 2016 Annual Meeting the Board will have 12 or 13 members.

“We are pleased to welcome Jeff Smith to the Advance Auto Parts

Board,” said Jack Brouillard, who has been named Executive

Chairman. “Jeff is a respected leader, investor, and valued board

member. We welcome his insights, and the Board and I look forward

to working closely together as we successfully execute on our

strategic objectives.”

Mr. Smith said, “I am pleased to join the Advance Auto Parts

Board. Advance Auto Parts is a terrific company which is well

positioned to be even more successful with best in class execution.

I look forward to working constructively with my fellow Board

members and the management team to help take advantage of the

tremendous opportunity to continue growing shareholder value.”

As part of the agreement, Starboard has agreed to vote all of

its shares in favor of the Company’s nominees at the 2016 Annual

Meeting as well as other customary standstill and voting

commitments. The full agreement between Advance Auto Parts and

Starboard will be filed with the Securities and Exchange

Commission.

Jeffrey C. Smith Biography

Jeffrey Smith is Managing Member, Chief Executive Officer and

Chief Investment Officer of Starboard Value LP. Prior to founding

Starboard Value LP, Mr. Smith was a Partner and Managing Director

of Ramius LLC, a subsidiary of the Cowen Group, Inc., and the Chief

Investment Officer of the Ramius Value and Opportunity Master Fund

Ltd. Mr. Smith was also a member of Cowen’s Operating Committee and

Cowen’s Investment Committee. Prior to joining Ramius in January

1998, he served as Vice President of Strategic Development and a

member of the Board of Directors of The Fresh Juice Company, Inc.

Mr. Smith began his career in the Mergers and Acquisitions

department at Société Générale. Mr. Smith is currently Chairman of

the Board of Darden Restaurants, Inc. and was formerly Chairman of

the Board of Phoenix Technologies Ltd. and formerly on the Boards

of Quantum Corporation, Office Depot, Regis Corporation, Surmodics

Inc., Zoran Corporation, Actel Corporation, Kensey Nash Corp., S1

Corp and the Fresh Juice Company. Mr. Smith graduated from The

Wharton School of Business at The University of Pennsylvania, where

he received a B.S. in Economics.

About Advance Auto Parts

Headquartered in Roanoke, Va., Advance Auto Parts, Inc., a

leading automotive aftermarket parts provider in North America,

serves both professional installer and do-it-yourself customers. As

of October 10, 2015 Advance operated 5,240 stores and 118 Worldpac

branches and served approximately 1,300 independently owned

Carquest branded stores in the United States, Puerto Rico, the U.S.

Virgin Islands and Canada. Advance employs approximately 75,000

Team Members. Additional information about the Company, employment

opportunities, customer services, and on-line shopping for parts,

accessories and other offerings can be found on the Company's

website at www.AdvanceAutoParts.com.

About Starboard Value LP

Starboard Value LP is a New York-based investment adviser with a

focused and fundamental approach to investing in publicly traded

U.S. companies. Starboard invests in deeply undervalued companies

and actively engages with management teams and boards of directors

to identify and execute on opportunities to unlock value for the

benefit of all shareholders.

Forward Looking Statements

Certain statements contained in this release are forward-looking

statements, as that term is used in the Private Securities

Litigation Reform Act of 1995. Forward-looking statements address

future events or developments, and typically use words such as

believe, anticipate, expect, intend, plan, forecast, outlook or

estimate. These forward looking statements include, but are not

limited to, expectations regarding leadership changes and their

impact on the company’s strategies, opportunities and results;

statements regarding growth in shareholder value; statements

regarding strategic plans or initiatives, growth or profitability;

guidance for 2015 financial performance; statements regarding the

benefits and other effects of the acquisition of General Parts

International, Inc. (General Parts) and the combined company’s

plans, objectives and expectations; statements regarding expected

growth and future performance of Advance Auto Parts, Inc. (AAP),

including store growth, capital expenditures, comparable store

sales, gross profit rate, SG&A, operating income, free cash

flow, income tax rate, General Parts integration costs and store

consolidation costs, synergies, expenses to achieve synergies,

comparable cash earnings per diluted share for fiscal year 2015 and

comparable operating income rate targets; and all other statements

that are not statements of historical facts. These forward-looking

statements are subject to significant risks, uncertainties and

assumptions, and actual future events or results may differ

materially from such forward-looking statements. Such differences

may result from, among other things, the risk that AAP may

experience difficulty in successfully implementing the announced

leadership changes; the ability of the persons appointed to lead

and provide results in their new roles; potential disruption to

AAP’s business resulting from the announced leadership changes; the

impact of the announced leadership changes on AAP’s relationships

with customers, suppliers and other business partners; AAP’s

ability to attract, develop and retain executives and other

employees; the risk that the benefits of the General Parts

acquisition, including synergies, may not be fully realized or may

take longer to realize than expected; the possibility that the

General Parts acquisition may not advance AAP’s business strategy;

the risk that AAP may experience difficulty integrating General

Parts’ employees, business systems and technology; the potential

diversion of AAP’s management’s attention from AAP’s other

businesses resulting from the General Parts acquisition; the impact

of the General Parts acquisition on third-party relationships,

including customers, wholesalers, independently owned and jobber

stores and suppliers; changes in regulatory, social and political

conditions, as well as general economic conditions; competitive

pressures; demand for AAP’s and General Parts' products; the market

for auto parts; the economy in general; inflation; consumer debt

levels; the weather; business interruptions; information technology

security; availability of suitable real estate; dependence on

foreign suppliers; and other factors disclosed in AAP’s 10-K for

the fiscal year ended January 3, 2015 and other filings made by AAP

with the Securities and Exchange Commission. Readers are cautioned

not to place undue reliance on these forward-looking statements.

AAP intends these forward-looking statements to speak only as of

the time of this communication and does not undertake to update or

revise them as more information becomes available.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151112005482/en/

Advance Auto Parts, Inc.Media:Laurie Stacyt:

540-561-8452e:

laurie.stacy@advanceautoparts.comorInvestor:Zaheed Mawanit:

919-573-3848e: zaheed.mawani@advanceautoparts.com

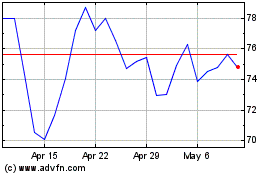

Advance Auto Parts (NYSE:AAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Advance Auto Parts (NYSE:AAP)

Historical Stock Chart

From Apr 2023 to Apr 2024