York Water Company Reports 3rd Quarter and Nine Months Earnings and Closing on Two Water Acquisitions

November 07 2012 - 8:33AM

The York Water Company's (Nasdaq:YORW) President, Jeffrey R. Hines,

announced today the Company's financial results for the third

quarter and the first nine months of 2012.

President Hines reported that third quarter operating revenues

of $11,025,000 increased $574,000 and net income of $2,760,000

increased $396,000 compared to the third quarter of 2011. Earnings

per share of $0.22 for the three-month period increased $0.03

compared to the same period last year.

President Hines also reported that the first nine months

operating revenues of $31,046,000 increased $498,000, and net

income of $6,905,000 decreased $56,000 compared to the first nine

months of 2011. Higher revenues were due to an increase in the

Distribution System Improvement Charge (DSIC) and growth in the

customer base. Expense reductions, including a lower provision for

doubtful accounts, reduced power costs and lower life insurance

expenses, were offset by higher income taxes and increased expenses

for depreciation, distribution system maintenance, wages and

benefits. The DSIC is a surcharge allowed by the Pennsylvania

Public Utility Commission for the replacement of aging

infrastructure. Earnings per share of $0.54 for the nine-month

period decreased $0.01 compared to the same period last year.

During the first nine months of 2012, the Company invested $8.8

million in capital projects for upgrades to its water treatment and

enterprise software systems, as well as various scheduled

replacements of aging infrastructure. In addition, the Company

invested $463,000 in the acquisitions of water and wastewater

systems during the first nine months of 2012. The Company estimates

it will invest an additional $2.8 million in 2012 for acquisitions,

expansion and improvements to its systems and infrastructure to

continue providing excellent customer service, ensuring a safe,

adequate, and reliable supply of drinking water and to maintain

proper handling and disposal of wastewater for the Company's

growing customer base.

| |

Period Ended September

30 |

| |

In 000's (except per

share) |

| |

Quarter |

Nine

Months |

| |

2012 |

2011 |

2012 |

2011 |

| Operating Revenues |

$ 11,025 |

$ 10,451 |

$ 31,046 |

$ 30,548 |

| Net Income |

$ 2,760 |

$ 2,364 |

$ 6,905 |

$ 6,961 |

| Average Number of Common Shares

Outstanding |

12,861 |

12,748 |

12,832 |

12,722 |

| Basic Earnings Per Common Share |

$ 0.22 |

$ 0.19 |

$ 0.54 |

$ 0.55 |

| Dividends Paid Per Common Share |

$ 0.1336 |

$ 0.1310 |

$ 0.4008 |

$ 0.3930 |

On August 16, 2012, the Company completed the acquisition and

began operating the water system of York Starview, LP in York

County, Pennsylvania. The acquisition resulted in the addition of

approximately 240 new water customers with purchase price and

acquisition costs to date of approximately $133,000.

On October 12, 2012, the Company completed the acquisition of

the water system of Section A Water Corporation in Adams County,

Pennsylvania. The Company began operating the existing system as a

satellite location on October 15, 2012. The acquisition resulted in

the addition of approximately 100 new water customers at a purchase

price of approximately $135,000. One additional water acquisition

is expected to close during the first quarter of 2013.

The York Water Company logo is available at

http://www.globenewswire.com/newsroom/prs/?pkgid=5589

This news release may contain forward-looking statements

regarding the Company's operational and financial expectations.

These statements are based on currently available information and

are subject to risks, uncertainties, and other events which could

cause the Company's actual results to be materially different from

the results described in this statement. The Company undertakes no

duty to update any forward-looking statement.

CONTACT: Jeffrey R. Hines, President

jeffh@yorkwater.com

Kathleen M. Miller, Chief Financial Officer

kathym@yorkwater.com

717-845-3601

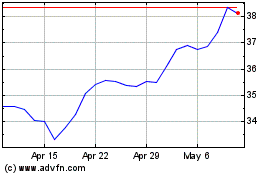

York Water (NASDAQ:YORW)

Historical Stock Chart

From Mar 2024 to Apr 2024

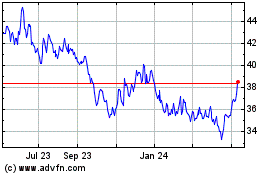

York Water (NASDAQ:YORW)

Historical Stock Chart

From Apr 2023 to Apr 2024