Yen Advances After BoJ Rate Decision

April 27 2016 - 8:32PM

RTTF2

The Japanese yen strengthened against the other major currencies

in the Asian session on Thursday, after the Bank of Japan refrained

from raising its monetary stimulus and kept its negative interest

rate unchanged.

The policy board governed by Haruhiko Kuroda decided by an 8-1

majority vote to hold its target of raising the monetary base at an

annual pace of about JPY 80 trillion.

Policymakers voted 7-2 to maintain -0.1 percent interest rate on

current accounts that financial institutions maintain at the

bank.

The yen rose to nearly a 2-week high of 123.16 against the euro,

a 10-day high of 112.01 against the Swiss franc and a 9-day high of

108.74 against the U.S. dollar, from an early near 4-week low of

126.47, more than a 3-week low of 115.01 and nearly a 4-week low of

111.88, respectively.

Against the pound and the Australian dollar, the yen advanced to

a 6-day high of 158.07 against the pound and more than a 2-week

high of 82.44 from yesterday's closing quotes of 162.03 and 84.55,

respectively.

Against the New Zealand and the Canadian dollars, the yen

advances to a 10-day high of 75.13 and a 6-day high of 86.34 from

an early near 4-week low of 77.35 and more than a 4-month low of

88.79, respectively.

If the yen extends its uptrend, it is likely to find resistance

around 121.00 against the euro, 111.00 against the franc, 107.00

against the greenback, 152.00 against the pound, 81.00 against the

aussie, 73.00 against the kiwi and 81.00 against the loonie.

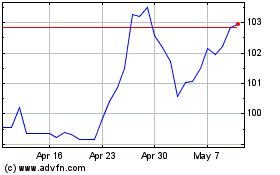

AUD vs Yen (FX:AUDJPY)

Forex Chart

From Apr 2024 to May 2024

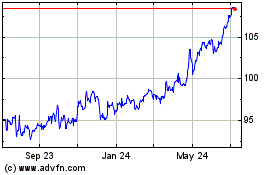

AUD vs Yen (FX:AUDJPY)

Forex Chart

From May 2023 to May 2024