Why Oil Isn't Everything to Standard Chartered -- Heard on the Street

April 26 2016 - 8:25AM

Dow Jones News

By Paul J. Davies

Many a fortune has been won and lost on oil and other stuff dug

out of the ground.

Standard Chartered is more dependent than most banks on lending

money to those who dig up commodities or move them around: that is

why its shares track the oil price closely and why commodities

drove the fears around its bad debts.

A recovery in commodities prices would mean a rebound in

revenues in a significant chunk of Standard Charter's business. But

it wouldn't cure all the bank's top-line ills.

The bank's corporate and institutional division, which contains

most of the commodities exposure, saw the biggest falls in revenues

versus the first quarter last year. They were down 27%, or $670

million, which includes not only trade finance, but also financial

markets and corporate finance.

Partly this is down to restructuring, shedding bad assets and

cutting back its risk appetite. But it is also down to cheaper

commodities. Much of the bank's commodities lending is trade

finance with short maturities, so if it stops making new loans, its

book shrinks quite quickly. That helped cut its commodities

exposure from $55 billion at the end of 2014 to $37 billion

today.

However, any new commodities financing it has done is against

lower priced material, which means smaller loans and lower

revenues. Andy Halford, chief finance officer, said perhaps

one-third of the shrinkage in commodities-related revenues was down

to lower prices, with some more related to reduced market

activity.

Assuming its risk appetite stays the same from here, there is a

decent chunk of revenues that can rebound if, for example, oil or

iron ore prices recover. This looks good for Standard Chartered,

which has less exposure than some larger European rivals to the

hard-to-shed fixed-income and derivatives businesses that no longer

work under new capital rules. When a turnaround in its wholesale

bank comes, it could be quite quick.

But other things still hold it back. Its first-quarter profits

beat expectations due to lower bad loan losses, but the bank still

added more bad loans in the period and for Bill Winters, chief

executive, it was too early to say asset quality had turned a

corner.

There have also been permanent revenue losses elsewhere. Retail

revenues, which account for about one-third of the total, were down

by 20% year on year and about half of that is gone for good because

the bank quit businesses. The smaller commercial clients business

saw a 36% drop in revenues and much of that comes from the bank

getting out of risks it no longer likes.

Standard Chartered is still shrinking and it will until there is

a rebound in commodities and Asian growth. As it grinds through its

restructuring this year, it will also need to show where the bank's

own rebound could come from.

Write to Paul J. Davies at paul.davies@wsj.com

(END) Dow Jones Newswires

April 26, 2016 08:10 ET (12:10 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

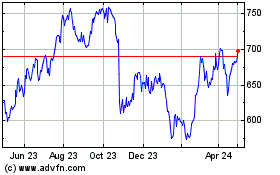

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

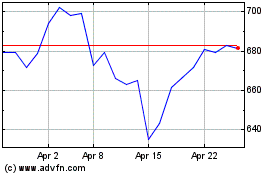

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Apr 2023 to Apr 2024