Whirlpool Tops Expectations, Despite Currency Hit

October 23 2015 - 7:40AM

Dow Jones News

Whirlpool Corp., the world's largest home-appliance manufacturer

by sales, beat earnings expectations in its latest quarter, thanks

to cost cuts and acquisitions that drove European and Asian

sales.

The company reported a profit of $235 million, or $2.95 a share,

up from year-earlier earnings of $230 million, or $2.88 a share.

Whirlpool said earnings from ongoing operations rose to $3.45 a

share, well above the $3.29 analysts predicted.

Revenue, hurt by unfavorable foreign exchange rates, rose 9.4%

to $5.28 billion, short of the $5.41 billion analyst estimate.

Stripping out currency fluctuations, sales jumped about 25%.

A near doubling of revenue in Whirlpool's Europe, Middle East

and Africa and a more-than-twofold increase in Asia sales offset

weakness in Latin America and lackluster North American sales.

Performance in those segments were driven by last year's

acquisitions of Indesit Co., an Italian company that sells

appliances under its name and the Hotpoint and Scholtes brands, and

51% of Hefei Rongshida Sanyo Electric Co. of China.

Benefits from acquisition integration activities, cost and

capacity-reduction initiatives and a more favorable price mix more

than offset the impact from currency moves and waning emerging

market demand, said Chief Executive Jeff Fettig.

The Benton Harbor, Mich.-based company has been hamstrung by a

stronger U.S. dollar, which makes its appliances more expensive

abroad, and by dropping demand in emerging markets. Brazil has been

a particularly sore spot for Whirlpool, where it does a chunk of

its business and where the economic downturn is the deepest since

the financial crisis.

In Latin America, third-quarter sales slid 27% to $800 million,

thanks to currencies and weaker demand in Brazil. Sales in North

America were flat in the quarter at $2.8 billion.

Because of continued weakness in Latin America, Whirlpool pulled

in the low-end of its full-year guidance range. The company expects

to earn $12 to $12.50 a share this year, versus an earlier range of

$12 to $13. Brazil is expected to knock 50 cents off of per-share

earnings this year, the company said.

Shares in the company, down about 18% this year, were inactive

premarket.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 23, 2015 07:25 ET (11:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

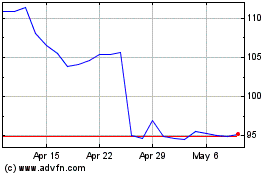

Whirlpool (NYSE:WHR)

Historical Stock Chart

From Aug 2024 to Sep 2024

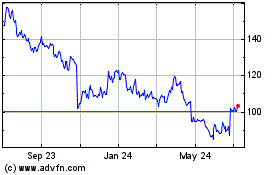

Whirlpool (NYSE:WHR)

Historical Stock Chart

From Sep 2023 to Sep 2024