UPDATE: Sanofi Profit Up, Beats Views; Plans More Acquisitions

February 10 2010 - 4:41AM

Dow Jones News

French drugs company Sanofi-Aventis (SNY) plans to maintain its

pace of acquisitions and focus on small- and mid-sized targets, the

company said Wednesday as it beat expectations with a 10% rise in

fourth-quarter net profit, spurred by sales of its key drugs,

including Lantus and Lovenox, as well as an extra boost from

vaccines.

"We're not particularly limited in size...the bigger the deal

becomes, the more a company gets bogged down in integrating it, so

I continue to believe smaller- to mid-size is certainly the way to

go" Chief Executive Chris Viehbacher said of the company's

acquisition plans for this year at a presentation on fourth-quarter

results.

Net profit for the last quarter of 2009 rose to EUR1.8 billion

from EUR1.63 billion a year earlier, beating analyst expectations

for EUR1.76 billion.

"Overall, a solid quarter," said Tim Anderson, analyst with

Sanford Bernstein in a note Thursday. Sanford rates the company

market perform with a EUR60 price target.

Sanofi's quarterly sales rose 3.8% to EUR7.36 billion from

EUR7.09 billion, lifted by fast growth in the vaccines division,

one of the company's platforms for future growth, as governments

stockpiled vaccines for the AH1N1 swine flu virus.

Sanofi said it expects to record growth of 'business' earnings

per share at constant rates of 2% to 5% this year, excluding the

effect of potential generic competition to its blood thinner

Lovenox.

CEO Viehbacher said it was too early to calculate the impact of

generic competition to Lovenox in the U.S. as it is not yet known

whether one or more generic alternatives will be approved

there.

Drugs companies are scrambling to find sources of growth to fill

in for the high-margin, blockbuster drugs business that is slipping

away as patents expire.

Analysts welcomed a pledge by Viehbacher last year to match 2008

sales by 2013 despite a drop off in revenues from expiring patents

on key drugs. Among Sanofi's top-selling drugs, sales of its cancer

treatment Eloxatin and heart treatment Plavix weakened over the

quarter due to competition from generic alternatives.

Over the past year, Viehbacher has embarked on an acquisition

spree, bolstering the company's over-the-counter business, vaccines

and generics, with a focus on emerging markets in a bid to steer

the company towards new sources of growth. Viehbacher stressed the

company is interested in further acquisitions in the field of

consumer health. Sanofi recently acquired U.S.-based Chattem, which

makes over-the-counter lotions and potions. Sanofi made EUR6.6

billion-worth of acquisitions last year.

"What changed in 2009 was the focus away from the patent cliff

towards new strategies of growth," Viehbacher said Wednesday.

Like peers, Sanofi has been weeding out its research

investments, and putting emphasis on acquisitions to bolster its

research and development pipeline. Larger rival U.K.-based

GlaxoSmithKine PLC (GSK) last week announced further cuts in its

research investment and a shift away from its core business.

Sanofi Wednesday said it expects cost savings and reductions in

research and development to generate EUR2 billion in 2013. Cost

savings in 2009 generated EUR480 million, and the company expects

cost savings this year to outpace its initial plans.

Sanofi also said it is 'highly probable' that it will merge its

animal health unit Merial with Merck & Co.'s (MRK)

Intervet/Schering-Plough business. Sanofi took over Merial, a

joint-venture run with Merck, as Merck sought clearance from U.S.

antitrust authorities for its takeover of Shering-Plough last year.

The $4 billion sale of Merck's half of the business included an

option for Sanofi to combine Merial with Shering Plough's Intervet

unit, and a decision is expected in the coming weeks.

Viehbacher Wednesday also said he doesn't expect results from

further studies on its diabetes drug Lantus before next year.

Sanofi managed to shake off investor concern after a study

suggested a possible link between the drug and higher rates of

cancer last year. Analysts in recent months have flagged the

possibility the issue could return to focus as results of further

studies are made public.

Viehbacher indicated that the company expects its cancer

treatment BSI-201, which gained fast-track status for approval with

U.S. authorities, to be filed with authorities there at the end of

this year or early next year.

At GMT, Sanofi shares traded EUR0.06 lower, or down 0.1%,

EUR52.6 while the CAC-40 index was up 0.4%.

-By Mimosa Spencer, Dow Jones Newswires; +33 1 40 17 17 73;

mimosa.spencer@dowjones.com

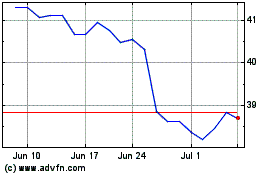

GSK (NYSE:GSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

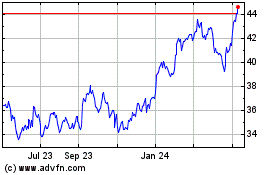

GSK (NYSE:GSK)

Historical Stock Chart

From Apr 2023 to Apr 2024