TIDMTSTL

RNS Number : 8785B

Tristel PLC

12 October 2015

12 October 2015

TRISTEL plc

("Tristel", "the Company" or "the Group")

Final Results

Audited Results for the year ended 30 June 2015

Tristel plc (AIM: TSTL), the manufacturer of infection

prevention and contamination control products, announces its

audited results for the year ended 30 June 2015 ahead of

expectations.

Tristel's lead technology is a proprietary chlorine dioxide

formulation and the Company addresses three distinct markets:

-- The Human Healthcare market (hospital infection prevention -

via the Tristel brand)

-- The Contamination Control market (control of contamination in

critical environments - via the Crystel brand)

-- The Animal Healthcare market (veterinary practice infection

prevention - via the Anistel brand)

Financial Highlights

-- Turnover up 14% to GBP15.3m (2014: GBP13.5m).

-- Overseas sales up 21% to GBP5.5m (2014: GBP4.5m),

representing 36% of total sales.

-- EBITDA up 25% to GBP3.4m (2014: GBP2.7m).

-- Pre-tax profit up 44% to GBP2.6m (2014: GBP1.8m).

-- Basic earnings per share up 67% to 5.44p (2014: 3.25p).

-- Dividend per share for the full year increased to 5.72p

(2014: 1.62p), including a special dividend of 3p per share.

-- Net cash of GBP4.0m at year end (2014: GBP2.7m). Company

remains debt free.

Operational Highlights

-- 2.6m instrument decontamination procedures carried out

worldwide using Tristel Wipes (2014: 2.2m).

-- First sales in Latin America.

-- United States regulatory submissions underway.

Paul Swinney, Chief Executive of Tristel plc, said:

"Tristel performed strongly during the year, growing its

presence in the out-patients area of the hospital which we target

with our high performance chlorine dioxide disinfectants. This

performance was achieved both in the UK and overseas, with overseas

sales now contributing 36% of the Group total. We are pursuing

regulatory approvals for a wide selection of Tristel products in

over ten countries to continue the international expansion of our

business, and the outlook for the Group remains very promising"

The annual report and financial statements will be available on

the Company's website www.tristel.com later today.

For further information:

Tristel plc Tel: 01638 721 500

Paul Swinney, Chief Executive

Liz Dixon, Finance Director

Walbrook PR Ltd Tel: 020 7933 8780 or tristel@walbrookpr.com

Paul McManus Mob: 07980 541 893

Lianne Cawthorne Mob: 07584 391 303

FinnCap

Geoff Nash / Giles Rolls Tel: 020 7600 1658

(Corporate Finance)

Stephen Norcross (Corporate

Broking)

Chairman's Statement

During 2015 Tristel made very satisfying progress towards the

objectives of our medium term financial plan and our goal of

becoming a global brand in infection and contamination control.

Turnover increased by 14% to GBP15.3m and our pre-tax margin rose

to 17% from 14% last year. Our international activities contributed

GBP5.5m to global turnover, representing 36% compared to 34% in

2014.

Our organisation and its employees

We have recently adopted a new marketing message for our

chlorine dioxide technology: "Better, Safer, Faster, Smarter" -

attributes that truly reflect our Tristel products. Our

organisation has to operate this way also, and I can confidently

report to our shareholders that the Company is in good shape, with

motivated and focused employees who are running a tight ship. We

have the appropriate skills and resources to continue our progress

and achieve our plans, which are straightforward and have been

clearly broadcast: to achieve revenue of GBP20m in the financial

year ending 30 June 2017; to maintain a pre-tax margin of at least

15% whilst investing in new markets and new products to sustain

high growth beyond 2017, and to create a global brand with our

chlorine dioxide technology. We are progressing well towards these

objectives and the Board is most appreciative of our employees who

have contributed so greatly this year.

Delivering to our shareholders

A key attribute of our business has been, and I believe will

continue to be, its ability to turn profit into cash. Post-tax

profit of GBP2.2m during the year translated into cash holdings at

30 June 2015 of GBP4.0m, up GBP1.3m from GBP2.7m at 30 June 2014,

after the payment of dividends during the year of GBP0.75m.

As I stated in February 2015 at the time of our interim results,

my philosophy is that our business should return to shareholders

cash when it is not required for future earnings enhancing

investment. In June 2015 we announced a special dividend of 3 pence

per share, distributing approximately GBP1.2m to shareholders in

August 2015. Going forward we will maintain our normal dividend

policy of two times cover, at least until our current four year

plan, initiated in 2014 and ending in 2017, is completed. The

policy will then be reviewed, and in the intervening two year

period we will adhere to our philosophy of returning cash to our

shareholders as circumstances allow.

For the year ended 30 June 2015 basic earnings per share were

5.44 pence (2014: 3.25 pence), an increase of 67%. In line with the

dividend policy stated above, the Board is recommending that the

final dividend is 2.135 pence (2014: 1.26 pence), an increase of

69%. Including the interim dividend of 0.585 pence (2014: 0.36

pence), the special dividend of 3 pence paid in August 2015, and

the final dividend, the total dividend for the year will be 5.72

pence (2014: 1.62 pence). If approved, the final dividend will be

paid on 18 December 2015 to shareholders on the register at 20

November 2015. The corresponding ex-dividend date is 19 November

2015.

Our Board

I am pleased to welcome David Orr to our Board as a

Non-Executive Director. His career spans the British Army, the City

and managing businesses in the packaging industry. He brings to our

Board very relevant experience of manufacturing in a tough business

environment.

Tristel as a public Company: a retrospective view of the first

ten years

We joined the AIM market on 5 June 2005. The flotation price was

37 pence per share. Revenue in our first year as a public Company

was GBP3.0m. During the past ten years we have achieved compound

annual growth in sales of 18%. Pre-tax profits have increased from

GBP0.1m to GBP2.55m.

Over the decade we have had to reinvent our product range

entirely, having focused 10 years ago on only one area of the

hospital - gastro-enterology - which went into decline a few years

after the Company went public. We have had to find new application

areas for our chlorine dioxide technology and create new products

to meet the needs of these application areas. We now focus upon the

out-patient clinic and have created significant strongholds in the

areas of ear, nose and throat (ENT), cardiology, ultrasound, GI

physiology, ophthalmology and urology. The products that we have

created for the out-patient clinic include chlorine dioxide wipes

and foams and over the past ten years their sales have grown at a

compound annual rate of 46%. Worldwide sales into the out-patient

market were GBP9.32m during the year representing 61% of all sales.

We have also applied our chlorine dioxide chemistry to surface

disinfection and since the first products for this purpose were

launched in 2007 their sales have grown at an annual compound rate

of 63%. Worldwide sales of surface disinfectants were GBP1.46m

during the year representing 10% of all sales.

We have established a significant geographical footprint and

sell through our own direct operations in the United Kingdom,

Germany, Switzerland, Austria, Russia, China, Hong Kong and New

Zealand and through 36 national distributors. In aggregate our

products are currently being supplied to 38 countries.

During the past decade we have returned GBP5.9m to our

shareholders as dividend. Between flotation and 30 June 2015 the

Tristel share price has increased by 173%. In comparison, during

this period the AIM All Share Index has declined by 22%.

Outlook

The value of this retrospective is not so much to judge the

achievements of the past, but more to provide us with an analytical

framework to assess what we can achieve over the next decade.

The overriding lesson that our management team and I have learnt

from our involvement in infection control, which now spans more

than twenty years, is how managers in hospitals, in all countries,

are slow to adopt a new technology, even when it is so far superior

to what is being used. Overcoming this inertia is Tristel's daily

challenge. One might think that products that are more effective in

killing the broadest range of micro-organisms, that are safer for

the user, that work more quickly so making the provision of

healthcare more efficient, and are easier and less costly to deploy

and maintain, would achieve rapid acceptance. But the pace of

adoption, although frustrating, is at least predictable and

consistent, as our top line CAGR of 18% over a decade testifies

to.

The corollary of having to fight the pace of change in

healthcare to gain (albeit slowly) dominance in clinical areas like

ENT is that we are equally difficult to dislodge by rival products

or a new technology. This characteristic of our business, combined

with the fact that over 95% of our revenues are of repeat

consumable products that perform a vital function in hospitals, has

always encouraged me to view the Tristel business model as very

resilient.

(MORE TO FOLLOW) Dow Jones Newswires

October 12, 2015 02:00 ET (06:00 GMT)

As we continue to extend our geographical footprint, and as the

enterprises of our distributors (many of which are today almost

exclusively focused on the Tristel product range) develop further

and expand, it is conceivable that the pace of our growth could

accelerate. Furthermore, we have embarked upon our United States

regulatory approvals project and we have a more exciting pipeline

of new product innovations than I have ever witnessed in our

corporate history. For now, however, I am comfortable with our

stated growth objectives.

Finally, and as I said in my interim statement in February 2015,

we have the people, experience of our industry, and physical

resources to make further progress this year and into the

foreseeable future.

Francisco Soler

Chairman

9 October 2015

Chief Executive's report

Tristel is a manufacturer and supplier of infection prevention

and contamination control products that are based upon its

proprietary chlorine dioxide chemistry.

Towards a global brand

With three distinctively branded portfolios - Tristel for human

health, Crystel for contamination control, and Anistel for animal

health - we are one of only a small number of companies that has an

exclusive focus on infection prevention and that has a significant

international presence. Our international sales of GBP5.5m

represented 36% of Group turnover in the year, compared to 34% in

2014 and 7% five years ago.

Becoming a global brand in infection prevention is a key

strategic objective for Tristel. Via our direct operations and

distributors, our products are represented in 38 countries.

However, our products have still to tap into such significant

geographical markets as the United States and Canada; the great

majority of South America; India; much of Central Europe; the

African continent with the exception of a very small presence in

South Africa; and much of South East Asia.

Continued international expansion is, therefore, going to be a

major driving force for our future growth.

Obtaining regulatory approval to sell our products is the

initial step in entering any overseas market. The regulatory

project is sometimes undertaken in conjunction with a distributor,

and sometimes on our own, and if we take the latter approach we

determine the route to market whilst the regulatory approval is

progressing. We have a regulatory approval programme underway in

the United States and we are committed to establish a presence in

most countries within the Central and South American region by

2017.

Group overseas sales 2008 to 2015

FY Sales GBP

2007-8 378,000

2008-9 450,000

2009-10 610,000

2010-11 932,000

2011-12 2,148,000

2012-13 3,403,000

2013-14 4,531,000

2014-15 5,501,000

CAGR 47%

Overseas sales by brand portfolio

Sales GBP 2014-15 % total 2013-14 % total Yr-on-Yr

Increase

Human Healthcare 4,857,000 88% 4,079,000 90% 19%

Contamination

Control 387,000 7% 240,000 5% 61%

Animal Healthcare 257,000 5% 212,000 5% 21%

Group overseas

sales 5,501,000 100% 4,531,000 100% 21%

The business model employed in the majority of countries in

which we sell products is to use a national distribution partner.

During the year we sold through 36 national distributors. It is

very rare for a national distributor to start its relationship with

Tristel by gaining approval for, and selling, all our Group

products and typically adds in products as its business grows. This

is a source of future organic growth for the Group that is in

addition to revenue growth resulting from the appointment of new

distributors in new markets.

During the year the Group had direct operations in the United

Kingdom, Germany, Switzerland, Austria, Russia, China, Hong Kong

and New Zealand. Within these countries our national sales teams

not only serve customers directly but also manage distributors and

dealers.

Overseas sales by business model

Sales GBP 2014-15 % total 2013-14 % total Yr-on-Yr

Increase

Sales by overseas direct

operations 3,171,000 58% 2,642,000 58% 20%

Sales to overseas distributors 2,330,000 42% 1,889,000 42% 23%

Group overseas sales 5,501,000 100% 4,531,000 100% 21%

Broadly based growth

When Tristel joined the AIM market in June 2005 all its

customers were hospitals and the great majority were located in the

United Kingdom. Since becoming a publicly traded company, and

whilst maintaining its focus on infection control, Tristel has

taken its core competencies and its proprietary chlorine dioxide

chemistry into two additional markets. In 2011 we expanded into the

sterile-packed disinfectants market serving clean rooms in

hospitals and industry (contamination control of critical

environments) and in 2012 we entered the animal healthcare market

focusing primarily on infection prevention in veterinary

practices.

Group sales by portfolio

Sales GBP Yr-on-Yr

2014-15 % total 2013-14 % total increase

Human healthcare 13,089,000 85% 11,518,000 85% 14%

Contamination

control 1,374,000 9% 1,190,000 9% 15%

Animal healthcare 871,000 6% 762,000 6% 14%

Group sales 15,334,000 100% 13,470,000 100% 14%

Human healthcare, or the hospital marketplace, is the most

important component of our business and we expect this to continue

to be the case. Our Contamination control business, which exposes

us to industry in addition to healthcare, is now in its fifth year

of development. Our animal healthcare infection control business is

in its fourth year of development.

High growth in niche markets

Group-wide revenues have grown at a compound annual rate of 18%

over the past decade. This rate of growth has been achieved even in

the face of the loss of over GBP2m of revenues that were generated

from the gastro-enterology area of the UK hospital market which was

our original focus.

Sales 2005 - 2015

FY Sales GBP

2004-5 3,009,000

2005-6 3,746,000

2006-7 5,148,000

2007-8 5,961,000

2008-9 6,847,000

2009-10 8,764,000

2010-11 9,287,000

2011-12 10,939,000

2012-13 10,558,000

2013-14 13,470,000

2014-15 15,334,000

CAGR 18%

In the hospital market we focus today upon two distinct areas of

infection prevention: instrument decontamination in the out-patient

area, and disinfection of critical surfaces. Sales growth within

both of these areas has far exceeded the group-wide CAGR of

18%.

Decontamination of instruments used in the out-patient area

We have moved instrument disinfection revenues away from

gastro-enterology to the out-patient areas of the hospital. We have

achieved this rapid re-positioning of our product portfolio by

innovating with our chlorine dioxide chemistry to create

disinfectant products that are ideally suited to the small medical

instruments used in ENT; cardiology; ultrasound; urology; GI

physiology and ophthalmology.

In these clinical areas there is a constant stream of patients

requiring diagnostic and minor therapeutic procedures for which

clinicians use small instruments that are relatively simple to

decontaminate. We have targeted these niches because they are not

addressed by our competitors. Globally, revenues from these

products have grown at a CAGR of 46% between 2004-5 and

2014-15.

Instrument disinfectant sales in the out-patient area

FY Sales GBP

2004-5 207,000

2005-6 442,000

2006-7 647,000

2007-8 1,178,000

2008-9 1,698,000

2009-10 2,073,000

2010-11 2,552,000

2011-12 4,366,000

2012-13 5,087,000

2013-14 7,329,000

2014-15 9,328,000

CAGR 46%

Disinfection of critical surfaces in hospitals

Tristel's proprietary chlorine dioxide chemistry has two

defining features: first, it kills bacterial spores very quickly;

second, it is safe to use. As a consequence, Tristel's surface

disinfectants provide the most effective stratagem to control

Clostridium difficile, one of the most problematic pathogens in

hospitals. Globally, revenues of our surface disinfectants have

grown at a CAGR of 63% between 2006-7 (when they were first

introduced) and 2014-15.

(MORE TO FOLLOW) Dow Jones Newswires

October 12, 2015 02:00 ET (06:00 GMT)

Chlorine dioxide surface disinfectant sales

Sales GBP Human health Contamination Group total

control

& Animal

health

FY

2006-7 30,000 - 30,000

2007-8 230,000 - 230,000

2008-9 434,000 - 434,000

2009-10 598,000 - 598,000

2010-11 867,000 - 867,000

2011-12 1,055,000 54,000 1,109,000

2012-13 784,000 54,000 838,000

2013-14 1,229,000 75,000 1,304,000

2014-15 1,363,000 101,000 1,464,000

CAGR 63%

Group Results and Finance

Revenue increased by 14% to GBP15,334,000 (2014:

GBP13,470,000).

Excluding amortisation of intangibles, share-based payments,

interest and results from associates, operating profits increased

by 31% to GBP3,023,000 (2014: GBP2,300,000). Profit before tax for

the year was GBP2,552,000 (2014: GBP1,823,000). The resulting basic

earnings per share were 5.44 pence (2014: 3.25 pence).

Capital investments in the development of new products, patents,

regulatory approvals and computer software resulted in additions to

intangible assets of GBP567,000 (2014: GBP479,000). Purchases of

plant, equipment, improvements to property, fixtures and fittings

and motor vehicles totalled GBP496,000 (2014: GBP677,000).

The level of profit during the year has resulted in cash

balances increasing to GBP4,045,000 as at 30 June 2015 from

GBP2,664,000 at 30 June 2014.

Paul Swinney

Chief Executive

9 October 2015

Tristel plc

Consolidated Income Statement

For the year ended 30 June 2015

---------------------------------

Note Year ended Year ended

30 June 30 June

2015 2014

GBP'000 GBP'000

Revenue 3 15,334 13,470

Cost of sales 3 (4,673) (4,066)

----------- -----------

Gross profit 10,661 9,404

Administrative expenses:

Share-based payments 3 (35) (15)

Depreciation and amortisation 3 (844) (885)

Other 3 (7,241) (6,685)

-------------------------------- ----- ----------- -----------

Total administrative

expenses (8,120) (7,585)

Operating profit 2,541 1,819

Finance income 12 6

Finance costs (9) (10)

Results from equity

accounted associate 8 8

Profit before tax 2,552 1,823

Taxation 4 (337) (551)

----------- -----------

Profit after tax 2,215 1,272

=========== ===========

Attributable to:

Non-controlling interests - (26)

Equity holders of

parent 2,215 1,298

2,215 1,272

=========== ===========

Earnings per share

from total and continuing

operations attributable

to equity holders

of the parent

Basic - pence 6 5.44 3.25

Diluted - pence 6 5.23 3.25

=========== ===========

All amounts relate to continuing operations.

Tristel plc

Consolidated Statement of Comprehensive Income

For the year ended 30 June 2015

------------------------------------------------

Year ended Year ended

30 June 30 June

2015 2014

GBP'000 GBP'000

Profit for the period 2,215 1,272

Other comprehensive

income:

Items that will not be reclassified

subsequently to profit and loss

Exchange differences on

translation of foreign

operations, related to

non-controlling interests - 15

Items that will be reclassified

subsequently to profit and loss

Exchange differences on

translation of foreign

operations (57) 34

----------- -----------

Other comprehensive

income for the period (57) 49

Total comprehensive

income for the period 2,158 1,321

===========

Attributable to:

Non controlling interests - (11)

Equity holders of the

parent 2,158 1,332

2,158 1,321

=========== ===========

Tristel plc

Consolidated Statement of Changes in Equity

For the year ended 30 June 2015

---------------------------------------------

Share Share Merger Foreign Retained Total Non- Total

earnings attributable controlling equity

to owners interests

of the

parent

capital premium reserve exchange

account reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

30 June 2013 400 9,151 478 (127) 1,126 11,028 (151) 10,877

Transactions with

owners

Dividends paid - - - - (272) (272) - (272)

Shares Issued 2 133 - - - 135 - 135

Share-based

payments -

IFRS 2 - - - - 15 15 - 15

Total transactions

with owners 2 133 - - (257) (122) - (122)

Profit for

the year ended

30 June 2014 - - - - 1,298 1,298 (26) 1,272

Other comprehensive

income:- Exchange

differences

on translation

of foreign

operations - - - 34 - 34 15 49

-------- -------- -------- --------- ---------- -------------- ------------- --------

Total comprehensive

income - - - 34 1,298 1,332 (11) 1,321

-------- -------- -------- --------- ---------- -------------- ------------- --------

30 June 2014 402 9,284 478 (93) 2,167 12,238 (162) 12,076

-------- -------- -------- --------- ---------- -------------- ------------- --------

Transactions with

owners

Dividends paid - - - - (752) (752) - (752)

Shares Issued 12 636 - - - 648 - 648

Adjustment

for change

of controlling

interest 3 (172) (169) 169 -

Share-based

payments -

IFRS 2 - - - - 35 35 - 35

Total transactions

with owners 12 636 - 3 (889) (238) 169 (69)

Profit for

the year ended

30 June 2015 - - - - 2,215 2,215 - 2,215

Other comprehensive

income:- Exchange

differences

on translation of

foreign

operations - - - (57) - (57) - (57)

Total comprehensive

income - - - (57) 2,215 2,158 - 2,158

-------- -------- -------- --------- ---------- -------------- ------------- --------

30 June 2015 414 9,920 478 (147) 3,493 14,158 7 14,165

======== ======== ======== ========= ========== ============== ============= ========

Tristel plc

Consolidated Balance Sheet

As at 30 June 2015

----------------------------

2015 2014

Note GBP'000 GBP'000

Non-current assets

Goodwill 667 667

(MORE TO FOLLOW) Dow Jones Newswires

October 12, 2015 02:00 ET (06:00 GMT)

Intangible assets 5,631 5,637

Property, plant and

equipment 1,347 1,277

Deferred tax 68 83

-------- --------

7,713 7,664

-------- --------

Current assets

Inventories 2,061 2,063

Trade and other receivables 3,194 2,690

Cash and cash equivalents 4,045 2,664

-------- --------

9,300 7,417

-------- --------

Total assets 17,013 15,081

======== ========

Capital and reserves

Share capital 7 414 402

Share premium account 9,920 9,284

Merger reserve 478 478

Foreign exchange reserve (147) (93)

Retained earnings 3,493 2,167

-------- --------

Equity attributable

to owners of the parent 14,158 12,238

-------- --------

Non-controlling interests 7 (162)

-------- --------

Total equity 14,165 12,076

-------- --------

Current liabilities

Trade and other payables 2,434 2,538

Interest bearing loans

and borrowings - 42

Current tax 247 213

-------- --------

2,681 2,793

-------- --------

Non-current liabilities

Interest bearing loans

and borrowings - 8

Deferred tax 167 204

Total liabilities 2,848 3,005

-------- --------

Total equity and liabilities 17,013 15,081

======== ========

Tristel plc

Consolidated Cash Flow Statement

For the year ended 30 June 2015

-----------------------------------

2015 2014

Note GBP'000 GBP'000

Cash flows from operating

activities

Cash generated from

operating activities i 2,936 3,250

Corporation tax (paid)

/ received (324) 21

-------- --------

2,612 3,271

-------- --------

Cash flows used in

investing activities

Interest received 12 6

Purchase of intangible

assets (567) (479)

Purchases of property,

plant and equipment (496) (677)

Proceeds from sale

of property, plant

and equipment 18 72

Net cash used in investing

activities (1,033) (1,078)

-------- --------

Cash flows from financing

activities

Loans repaid (52) (66)

Interest paid (9) (10)

Share issues 648 135

Dividends paid (752) (272)

-------- --------

Net cash used in financing

activities (165) (213)

-------- --------

Net increase in cash

and cash equivalents 1,414 1,980

Cash and cash equivalents

at the beginning of

the period ii 2,664 627

Exchange differences

on cash and cash equivalents (33) 57

-------- --------

Cash and cash equivalents

at the end of the period ii 4,045 2,664

======== ========

Tristel plc

Notes to the Consolidated Cash Flow Statement

For the year ended 30 June 2015

-----------------------------------------------

i. RECONCILIATION OF PROFIT BEFORE TAX TO CASH GENERATED

FROM OPERATIONS

2015 2014

GBP'000 GBP'000

Profit before tax 2,552 1,823

Depreciation of plant,

property & equipment 397 416

Amortisation of intangible

assets 447 469

Results from associates (8) (8)

Share-based payments

- IFRS2 35 15

Profit on disposal of property,

plant and equipment (3) (12)

Loss on disposal of

intangible asset 125 5

Finance costs 9 10

Finance income (12) (6)

3,542 2,726

Decrease/(increase)

in inventories 2 (195)

Increase in trade and

other receivables (504) (136)

(Decrease)/increase

in trade and other payables (104) 855

Cash generated from

operations 2,936 3,250

========== =========

ii. CASH AND CASH EQUIVALENTS

The amounts disclosed on the cash flow statement in respect of

cash and cash equivalents are in respect of these balance sheet

amounts.

30 June 30 June

2015 2014

Year ended 30 June GBP'000 GBP'000

2015

Cash and cash equivalents 4,045 2,664

4,045 2,664

======================= =======================

30 June 30 June

2014 2013

Year ended 30 June GBP'000 GBP'000

2014

Cash and cash equivalents 2,664 627

2,664 627

======================= =======================

1. ACCOUNTING POLICIES

Basis of accounting

These financial statements have been prepared in accordance with

International Financial Reporting Standards (IFRS) as adopted by

the European Union (EU).

Changes in accounting policies

The Group on 1 July 2014 adopted:

IFRS 10 - Consolidated financial statements

IFRS 12 - Disclosure of interests in other entities

IAS 27 - Separate financial statements

This resulted in the Group changing its accounting policy for

the basis of consolidation and definition of control, but has had

no further impact on the 2015 financial statements.

Basis of consolidation

The Group financial statements consolidate those of the Company

and all of its subsidiary undertakings drawn up to 30 June 2015.

Subsidiaries are entities over which the Group has rights or is

exposed to variable returns from its involvement with the investee

and has the power to affect those returns by controlling the

financial and operating policies so as to obtain benefits from its

activities. The Group obtains and exercises control through voting

rights.

Unrealised gains on transactions between the Group and its

subsidiaries are eliminated. Unrealised losses are also eliminated

unless the transaction provides evidence of an impairment of the

asset transferred. Amounts reported in the financial statements of

subsidiaries have been adjusted where necessary to ensure

consistency with the accounting policies adopted by the Group.

Acquisitions of subsidiaries are dealt with by the acquisition

method. The acquisition method involves the recognition at fair

value of all identifiable assets and liabilities, including

contingent liabilities of the subsidiary, at the acquisition date,

regardless of whether or not they were recorded in the financial

statements of the subsidiary prior to acquisition. These fair

values are also used as the basis for subsequent measurement in

accordance with the Group accounting policies. Goodwill is stated

after separating out identifiable intangible assets. Goodwill

represents the excess of the aggregate of the consideration

transferred and the amount of non-controlling interest over the

fair value of the Group's share of the identifiable net assets of

the acquired subsidiary at the date of acquisition.

(MORE TO FOLLOW) Dow Jones Newswires

October 12, 2015 02:00 ET (06:00 GMT)

Non-controlling interests, presented as part of equity,

represent a proportion of a subsidiary's profit or loss and net

assets that is not held by the Group. The Group attributes total

comprehensive income or loss of subsidiaries between the assets of

the parent and the non-controlling interests based on their

respective ownership interests

There was a change in controlling interest in the period related

to the Group's ownership of Tristel Asia and Tristel Medical

Equipment Co Ltd, the step acquisition makes both entities wholly

owned. There was an immaterial amount of consideration arising upon

acquisition. The difference between the non-controlling interest

and the fair value of the consideration paid is recognised directly

in equity attributable to the parent.

EU adopted IFRSs not yet applied

As of 30 June 2015, the following Standards and Interpretations

are in issue but not yet effective and have not been adopted early

by the Group:

-- IFRS 9 Financial Instruments (IASB effective date 1 January 2018)

-- IFRS 15 Revenue from Contracts with Customers (effective 1 January 2017)

-- Clarification of Acceptable Methods of Depreciation and

Amortisation - Amendments to IAS 16 and IAS 38 (IASB effective date

1 January 2016)

-- Annual Improvements to IFRSs 2010-2012 Cycle (EU effective 1 February 2015)

-- Annual Improvements to IFRSs 2011-2013 Cycle (EU effective 1 February 2015)

-- Annual Improvements to IFRSs 2012-2014 Cycle (effective 1 January 2016)

-- Amendments to IAS 27: Equity Method in Separate Financial

Statements (effective 1 January 2016)

-- Disclosure Initiative: Amendments to IAS 1 Presentation of

Financial statements (effective 1 January 2016)

The Directors anticipate that the adoption of these standards

and interpretations in future periods will have no material effect

on the financial statements of the Group.

2. PUBLICATION NON-STATUTORY ACCOUNTS

The financial information set out in this Audited Preliminary

Announcement does not constitute the Group's statutory accounts for

the years ended 30 June 2015 or 2014, as defined in Section 435 of

the Companies Act 2006, but is derived from those accounts.

Statutory accounts for the year ended 30 June 2014 have been

delivered to the Registrar of Companies, and those for 2015 will be

delivered in due course. The auditors Grant Thornton UK LLP have

reported on those accounts; their reports were (1) unqualified,

(ii) did not include a reference to any matters to which the

auditors drew attention by way of emphasis without qualifying their

report and (iii) did not contain a statement under section 498 (2)

or (3) of the Companies Act 2006.

The Board of Tristel plc approved the release of this audited

Preliminary Announcement on 9 October 2015.

3. SEGMENTAL ANLAYSIS

Management considers the Group's revenue lines to be split into

three operating segments, which span the different Group entities.

The operating segments consider the nature of the product sold, the

nature of production, the class of customer and the method of

distribution. The Group's operating segments are identified from

the information which is reported to the chief operating decision

maker.

The first segment concerns the manufacture, development and sale

of infection control and hygiene products which includes products

that incorporate the Company's chlorine dioxide chemistry, and are

used primarily for infection control in hospitals ("Human

Healthcare"). This segment generated approximately 85% (2014: 85%)

of Group revenues.

The second segment, which constitutes 5.6% (2014: 5.6%) of the

business activity, relates to manufacture and sale of disinfection

and cleaning products, into veterinary and animal welfare sectors

("Animal healthcare"). During prior years all sales for this

segment were made to a distributor who supplied the end user.

The third segment addresses the pharmaceutical and personal care

product manufacturing industries ("Contamination control") and has

generated 9.4% (2014: 9%) of the Group's revenues this year.

The operation is monitored and measured on the basis of the key

performance indicators of each segment, these being revenue and

gross profit, and strategic decisions are made on the basis of

revenue and gross profit generating from each segment.

Human Animal Contamination Group Human Animal Contamination Group

Healthcare Healthcare Control 2015 Healthcare healthcare Control 2014

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue

from

external

customers 13,089 871 1,374 15,334 11,518 762 1,190 13,470

--------------

Segment

revenues 13,089 871 1,374 15,334 11,518 762 1,190 13,470

Cost of

material 3,663 314 696 4,673 3,216 255 595 4,066

Gross

Profit 9,426 557 678 10,661 8,302 507 595 9,404

=========== =========== ============== ======== =========== =========== ============== ========

Gross

Profit % 72% 64% 49% 70% 72% 67% 50% 70%

Centrally incurred income and expenses not attributable to individual

segments:

Share based payments (35) (15)

Depreciation and amortisation of

non-financial assets (844) (885)

Other administrative

expenses (7,241) (6,685)

Segment operating

profit/(loss) 2,541 1,819

======== ========

Segment operating profit can be reconciled to Group

profit before tax as follows:

Segment operating profit/(loss) 2,541 1,819

Finance income 12 6

Finance costs (9) (10)

Results from equity accounted associate 8 8

Group profit/(loss) before tax 2,552 1,823

======== ========

The Group's revenues from external customers are divided into

the following geographical areas:-

Human Animal Contamination Group Human Animal Contamination Group

Healthcare Healthcare Control 2015 Healthcare healthcare Control 2014

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

United

Kingdom 8,232 614 987 9,833 7,439 550 950 8,939

Rest

of the

World 4,857 257 387 5,501 4,079 212 240 4,531

----------- ----------- -------------- --------- ----------- ----------- -------------- ---------

Group

revenues 13,089 871 1,374 15,334 11,518 762 1,190 13,470

=========== =========== ============== ========= =========== =========== ============== =========

Revenues from external customers in the Group's domicile -

"United Kingdom", as well as its other major markets, "Rest of the

World" - have been identified on the basis of internal management

reporting systems, which are also used for VAT purposes.

Human healthcare revenues were derived from a large number of

customers, including GBP4.081m from a single customer which makes

up 31% of this segment's revenue (2014: GBP3.499m being 30%).

Animal healthcare revenues were derived from a number of customers,

with the largest customer accountable for GBP0.309m, which

represents 35% of revenue for that segment (2014: GBP0.209m 27%

from a single customer).

During the year 26.6% of the Group's total revenues were earned

from a single customer (2014: 26%).

The Group's non-current assets are divided into the following

geographical areas and by segment:-

2015 2014 2015 2014

Geography GBP'000 GBP'000 Segment GBP'000 GBP'000

United Kingdom 7,544 7,455 Human Healthcare 4,863 4,706

Rest of the World 101 126 Animal Healthcare 2,510 2,510

Contamination Control 272 365

Non-current assets 7,645 7,581 7,645 7,581

======== ======== ======== ========

4. TAXATION

(MORE TO FOLLOW) Dow Jones Newswires

October 12, 2015 02:00 ET (06:00 GMT)

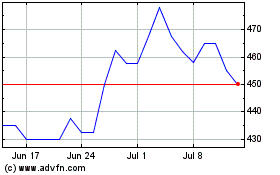

Tristel (LSE:TSTL)

Historical Stock Chart

From Mar 2024 to Apr 2024

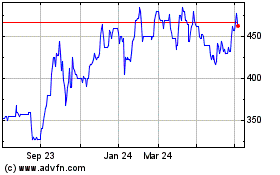

Tristel (LSE:TSTL)

Historical Stock Chart

From Apr 2023 to Apr 2024