TIDMTRP

RNS Number : 6292A

Tower Resources PLC

30 September 2015

Tower Resources plc

Operational Update and Interim Results to 30 June 2015

30 September 2015

Tower Resources plc (the "Company" or "Tower" (TRP.L, TRP LN)),

the AIM-listed Africa-focussed oil and gas exploration company,

announces an Operational Update and its Interim Results for the six

months ended 30 June 2015.

HIGHLIGHTS

o Signing in September 2015 of the Thali Block PSC, located in

the prolific proven producing Niger delta, offshore Cameroon; Tower

is now reviewing existing discoveries (7 million bbls) and upside,

as well as planning for H1 2016 3D seismic;

o Institutional placing in July 2015 raising approximately

GBP5.2 million (US$8.0 million), after expenses, at a price of 0.19

pence per share: Key support from M&G Investments who now hold

an 18% interest in the enlarged share capital and directors,

consultants and employees who now hold a 15%+ interest;

o Completion of the Company's Initial Period commitments in

Blocks 40 and 41 of the frontier Zambezi basin, Zambia, with

encouraging results;

o Application for new licences covering PEL0010 and other areas

submitted to the Namibian Ministry of Mines and Energy following

PEL0010 relinquishment notice being submitted by the Operator,

Repsol;

o Drilling of the unsuccessful Badada-1 exploration well in the

Block-2B, Anza Basin, onshore Kenya. Premier Oil plc (55%) and

Tower (15%) have given notice to withdraw from the licence;

o Cost reductions including closure of regional East Africa

office in Uganda and relocation of Tower's corporate office;

and

o Appointment to the Board of highly experienced technical

experts, Phil Frank as Independent Non-Executive Director and Nigel

Quinton as Exploration Director.

Graeme Thomson, CEO, commented "Our September entry into the

Cameroon shallow waters marks a shift in our risk profile from

frontier towards proven producing basins and introduces an asset

with existing discoveries and significant upside to the Tower

portfolio. In Namibia, we have a number of applications in process

as we seek to build our acreage position in what remains a hugely

underexplored but highly prospective area. Our early stage field

work in Zambia has been encouraging, and we have now received

approvals in South Africa to move into the next licence stage on

Algoa-Gamtoos. These positive developments have been made possible

largely through the support of existing and major new institutional

shareholders and the unstinting efforts of the directors, employees

and consultants, for which we are grateful.

We have now refocussed our portfolio and resources to areas

predominantly on the Atlantic Margin where we are confident we can

add value even in this difficult market. Accordingly, we have

withdrawn from areas where we feel there is no medium-term

likelihood of commercially worthwhile success. Our near-term

commitments are low, and yet we have significant working interest

holdings which we aim to farm down as appropriate to manage our

risk-reward position. Tower intends to take advantage of the

current difficulties in the sector to continue to assemble a high

quality acreage portfolio in our focus areas. "

Contacts

Tower Resources plc

Jeremy Asher (Chairman)

Graeme Thomson (CEO)

Andrew Matharu (VP - Corporate Affairs)

+44 20 7253 6639

Peel Hunt LLP (Nominated Adviser and Joint Broker)

Richard Crichton/Ross Allister

+44 20 7418 8900

GMP Securities Europe LLP (Joint Broker)

Rob Collins/Emily Morris

+44 20 7647 2800

Vigo Communications

Chris McMahon/ Alex Aleksandrov

+44 20 7016 9572

JOINT CHAIRMAN AND CHIEF EXECUTIVE OFFICER'S STATEMENT FOR THE

SIX MONTHS ENDED 30 JUNE 2015

Dear Shareholder,

The year to date has been a very tough one for the exploration

and production sector but we have positioned ourselves favourably

with a growing focus on proven and prospective basins and

increasingly as an early-stage Operator.

Our September entry into the Cameroon shallow waters marks a

shift in our risk profile from frontier towards proven producing

basins and introduces an asset with existing discoveries of some

seven million barrels to the Tower portfolio. In Namibia, we have a

number of applications in process as we seek to build our acreage

position in what remains a hugely underexplored but highly

prospective area. Our early stage fieldwork in Zambia has been

encouraging, and we have now received approvals in South Africa to

move into the next licence stage on Algoa-Gamtoos. These positive

developments have been made possible largely through the support of

existing and major new institutional shareholders and the

unstinting efforts of the directors, employees and consultants for

which we are grateful.

We have now refocused our portfolio and resources to areas,

predominantly on the Atlantic Margin, where we are confident we can

add value even in this difficult market. Accordingly, we have

withdrawn from areas where we feel there is no medium-term

likelihood of commercially worthwhile success. Our near-term

commitments are low, and yet we have significant working interest

holdings which we aim to farm down in due course as appropriate to

manage our risk-reward position.

Our July 2015 placing to raise c$8.0 million net was

over-subscribed with a mixture of existing and new major

institutional shareholders, including M&G Investments with an

18% interest in the current issued share capital and Standard Life

with a 5% interest. We are grateful for their support. Like all

companies in the sector, our share price has been hit hard by

external factors, not least the sharp drop in oil prices, which

have fallen by about two-thirds in the last year. However, our

directors, employees and consultants showed their belief in the

Company, subscribing $1.4 million of the Placing funds.

With the increase in technical and operational capability

required for Tower's portfolio, we have been seeking to add a

broader range of technical voices to the Boardroom. Accordingly, we

are delighted to welcome Dr Phil Frank as Independent Non-Executive

Technical Director and Nigel Quinton, formerly Head of Exploration,

as Executive Exploration Director. Phil and Nigel each have over 30

years' extensive technical experience and expertise and will

contribute greatly to the Company's development.

We believe Tower is well positioned, we are comfortable with our

current funding position, and we are optimistic about the

future.

Jeremy Asher Graeme Thomson

Chairman Chief Executive Officer

OPERATIONAL UPDATE

__________________________________________________________________________________

JULY 2015 PLACING

On 14 July 2015, the Company announced a placing and

subscription to institutional and other investors of 2,904,989,747

new ordinary shares in the capital of the Company at a price of

0.19 pence per share to raise net proceeds of approximately GBP5.2

million (US$8.0 million). Of note, M&G Investments invested

GBP2.3 million ($3.6 million) in the Placing and currently holds an

18% interest in the enlarged share capital of the Company.

M&G's investment in Tower was made in conjunction with the

Company's broader strategy in Namibia.

CAMEROON

Negotiations for a 100% interest in the shallow water Thali

Block PSC (the "Thali PSC" or the "PSC", previously referred to as

"Dissoni") continued through 2015 and the PSC was signed with the

Government of Cameroon on 15 September 2015. Thali is located in

the Rio del Rey Basin, a proven producing sub-basin of the

petroliferous Niger Delta, offshore Cameroon.

The PSC covers an area of 119.2 km(2) , with water depths

ranging from 8 to 48 metres. The Rio del Rey basin has, to date,

produced over one billion barrels of oil and has estimated

remaining recoverable reserves of 1.2 billion boe, primarily within

water depths of less than 2,000 metres.

The Thali Block includes existing oil and gas discoveries

totalling 7 million barrels and contains a number of already

identified exploration opportunities across four distinct play

systems. We believe that the application of high quality modern

seismic technology has the potential to add further incremental

reserves to existing discoveries to achieve commerciality and also

de-risk the significant potential of the additional plays.

On signing the Thali PSC, a three-year Initial Exploration

Period commenced with a work programme designed to unlock both

appraisal and exploration potential. Tower's initial priority is

the acquisition of 3D seismic in the first half of 2016. The

seismic will be used to update the existing 24-year-old data set to

allow better resolution of shallow plays as well as imaging of

deeper sections. Tower expects to be drilling in 2017/18. The

market downturn in the services sector presents the opportunity for

the Company to leverage lower seismic and drilling costs and a

partner will be sought to share Tower's financial commitment and

provide additional technical input.

Entry into Cameroon marks a strategic shift in our risk

management philosophy, introducing an asset within a proven

producing basin to Tower's portfolio of high exploration upside

opportunities.

NAMIBIA

(MORE TO FOLLOW) Dow Jones Newswires

September 30, 2015 02:03 ET (06:03 GMT)

Tower, through its wholly-owned subsidiary, Neptune Petroleum

(Namibia) Limited ("Neptune"), received formal notification from

Repsol Exploration (Namibia) (Pty) Limited ("Repsol"), the Operator

of Namibia PEL0010 (Neptune 30% working interest), of their

decision not to proceed into the second year of the third and final

renewal period on PEL0010, which would have required a commitment

to drill a well. The first year of the third renewal period expired

on 23 August 2015 and therefore the joint venture's interest in

PEL0010 has been relinquished with all current licence obligations

being met. As part of a wider strategy for Namibia, Tower has

itself submitted a proposal to the Namibian Ministry of Mines and

Energy for a new licence covering the former PEL0010 acreage. As

previously announced, the Company is also negotiating other new

operated acreage positions offshore Namibia and these will be

announced once they have been formally awarded.

ZAMBIA

Tower is the Operator and Licence holder of Blocks 40 and 41

within the frontier Zambesi basin, onshore Zambia, and during

August 2014 completed a comprehensive programme of geological

fieldwork as part of the initial work period. Analysis of the

samples taken from the fieldwork programme continued throughout H1

2015. Results are encouraging and indicate that elements for a

working petroleum system are present with the potential for both

oil and gas generation. No modern seismic or drill data exists in

this basin.

In August 2015, Tower completed its second programme of

fieldwork and obtained more encouragement that the area has

significant exploration potential. The presence of potential source

rock, reservoir and seal is now proven.

Given the existing surrounding infrastructure and constrained

domestic energy market, Tower believes that there is a significant

gas to power opportunity in the area, with its Blocks well

positioned relative to markets and distribution infrastructure.

The three-year secondary period has been split into three one

year periods with respective commitments to further field work,

airborne gravity and magnetic data acquisition and interpretation,

and a 2D seismic programme. The acreage can be relinquished at the

end of each annual decision point if results are discouraging, so

commitments are light and proportionate to prospectivity. Tower is

actively looking for a partner to accelerate the programme so that

prospects could be drilled as early as 2017.

SOUTH AFRICA

In September 2015, approval was received to enter into the

two-year First Renewal Period on the offshore Algoa-Gamtoos licence

(Tower 50%). Evaluation continues by the Operator, New Age (50%),

of the previously acquired 3D and 2D seismic: several prospective

plays are being worked up. Whilst commitments are limited to

additional geophysical work, further seismic acquisition is

planned, although this will not be possible before 2017 due to

environmental restrictions. It is anticipated that drilling in

2016/17 by the "majors" will materially help to prove the potential

of these various plays. A funding partner will be sought in due

course.

Approval to convert the Orange Basin TCP (Tower 50%) into an

Exploration Right is awaited.

KENYA

In February 2015, Tower announced that the Block 2B Badada-1

well (Tower 15%) had been drilled to a total depth of 3,500 metres

MDBRT and following completion of logging operations would be

plugged and abandoned as a dry hole.

In May 2015 the Kenyan Ministry of Energy granted an extension

of six months to the First Additional Exploration Period to 30

November 2015 to enable the joint-venture partners to assess the

results of the well and its implication for any remaining

prospectivity on the block.

Following Tower's detailed assessment a decision has

nevertheless been made to exit the licence effective 31 August

2015, partly in order to prioritise its more prospective licences.

Premier Oil plc (55%) has also given notice to withdraw, and so the

operator, Taipan, will have a 100% interest. All licence

commitments of the First Additional Exploration Period have been

met.

NEW VENTURES

As a result of renewed political uncertainty in Madagascar and a

lack of progress with negotiations for Block 2102, the Company has

withdrawn its interest for the time being.

Tower will continue to be highly selective in pursuing new

ventures within its stated strategy and areas of focus, but

believes there will be outstanding opportunities as a result of the

current difficult market conditions.

OFFICES

With the Group's focus now being on the western parts of Africa,

the East African Regional office in Kampala, Uganda, has been

closed.

Following the completion of a review into head office

requirements and expenditures, the Company has now moved to more

suitable and cost effective premises at:

Tower Resources plc,

2(nd) Floor,

127 Cheapside

London EC2V 6BT.

APPOINTMENT OF NEW DIRECTORS

With the increase in Technical and Operational capability

required for Tower's portfolio, it has appointed Dr Phil Frank as

Independent Technical Non-Executive Director and Nigel Quinton,

formerly Head of Exploration, as Executive Exploration Director.

They both have many decades of experience in the international

exploration and production arenas, including extensive experience

in Africa. In the context of Tower's growing portfolio, including

the recent signing of the Thali PSC, the Company will be enhanced

by having their additional technical expertise on the Board.

INTERIM RESULTS FOR THE SIX MONTHS ENDED 30 JUNE 2015

During the six months to 30 June 2015, the Group capitalised

exploration and evaluation costs totalling $3.7 million. Included

within this figure were expenditures subsequently impaired

totalling $2.8 million, being approximately $2.2 million in Kenya

and $0.6 million in Namibia. Impairments in the first half of 2014

were $45.5 million. Subject to the resale of unused inventory items

in Kenya, it is not expected that there will be any further

material impairments for the year relating to Block 2B.

In addition to advancing the exploration programmes on existing

licences, the Group continues to actively seek out new venture

opportunities and spent a total of $1.5 million to 30 June 2015 (H1

2014: $1.3 million). On 16 September 2015, the Group announced the

award of the Thali licence, of which $0.8 million was included

within these pre-licence expenditures.

The loss for the period was $5.4 million (H1 2014: loss $49.1

million) as detailed in the Interim Consolidated Statement of

Comprehensive Income.

INTERIM CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Six months ended 30 June 2015 Six months ended 30 June 2014

(unaudited) (unaudited)

Note $ $

------------------------------------------ ----- ------------------------------ --- ------------------------------

Revenue - -

Cost of sales - -

------------------------------------------ ----- ------------------------------ --- ------------------------------

Gross profit - -

Other administrative expenses (1,047,275) (2,290,861)

Pre-licence expenditures (1,511,445) (1,315,770)

Impairments 4 (2,841,308) (45,476,399)

------------------------------------------ ----- ------------------------------ --- ------------------------------

Total administrative expenses (5,400,028) (49,083,030)

------------------------------------------ ----- ------------------------------ --- ------------------------------

Group operating loss (5,400,028) (49,083,030)

Finance income 1,436 5,512

Finance expense (5,781) -

------------------------------------------ ----- ------------------------------ --- ------------------------------

Loss for the period before taxation (5,404,373) (49,077,518)

Taxation - -

------------------------------------------ ----- ------------------------------ --- ------------------------------

Loss for the period after taxation (5,404,373) (49,077,518)

Other comprehensive income - -

------------------------------------------ ----- ------------------------------ --- ------------------------------

Total comprehensive expense for the

period (5,404,373) (49,077,518)

------------------------------------------ ----- ------------------------------ --- ------------------------------

Basic loss per share (USc) 3 (0.14c) (1.51c)

------------------------------------------ ----- ------------------------------ --- ------------------------------

(MORE TO FOLLOW) Dow Jones Newswires

September 30, 2015 02:03 ET (06:03 GMT)

Diluted loss per share (USc) 3 (0.14c) (1.51c)

------------------------------------------ ----- ------------------------------ --- ------------------------------

INTERIM CONSOLIDATED STATEMENT OF FINANCIAL POSITION

30 June 2015(unaudited) 31 December 2014

(audited)

Note $ $

----------------------------------- ----- ------------------------ --- -----------------

Non-current assets

Property, plant and equipment 6,026 2,611

Exploration and evaluation assets 4 34,834,483 34,004,145

----------------------------------- ----- ------------------------ --- -----------------

34,840,509 34,006,756

----------------------------------- ----- ------------------------ --- -----------------

Current assets

Trade and other receivables 5 2,623,066 2,313,714

Cash and cash equivalents (1) 1,227,810 7,941,833

----------------------------------- ----- ------------------------ --- -----------------

3,850,876 10,255,547

----------------------------------- ----- ------------------------ --- -----------------

Total assets 38,691,385 44,262,303

----------------------------------- ----- ------------------------ --- -----------------

Current liabilities

Trade and other payables 6 2,691,425 4,058,445

----------------------------------- ----- ------------------------ --- -----------------

Total liabilities 2,691,425 4,058,445

----------------------------------- ----- ------------------------ --- -----------------

Net assets 35,999,960 40,203,858

----------------------------------- ----- ------------------------ --- -----------------

Equity

Share capital 7 6,384,551 6,346,538

Share premium 137,703,078 137,554,592

Retained losses (108,087,669) (103,697,272)

----------------------------------- ----- ------------------------ --- -----------------

Total shareholders' equity 35,999,960 40,203,858

----------------------------------- ----- ------------------------ --- -----------------

(1) Includes restricted cash of $nil (2014: $693k).

Signed on behalf of the Board of Directors

Graeme Thomson

Chief Executive Officer

29 September 2015

INTERIM CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share-based

Share Share payments Retained

capital premium reserve (1) losses Total

$ $ $ $ $

At 1 January 2014 4,398,933 73,954,330 2,368,079 (51,126,593) 29,594,749

----------------------------------------------- ---------- ------------ ------------ -------------- -------------

Shares issued for cash net of costs 966,729 31,462,438 - - 32,429,167

Shares issued on acquisition of subsidiary 920,700 31,295,880 - - 32,216,580

Shares issued on settlement of third party

fees 12,511 466,482 - - 478,993

Share-based payment charges - - 544,006 - 544,006

Total comprehensive income for the period - - - (49,077,518) (49,077,518)

Transfers between reserves - - (817,119) 817,119 -

At 30 June 2014 6,298,873 137,179,130 2,094,966 (99,386,992) 46,185,977

----------------------------------------------- ---------- ------------ ------------ -------------- -------------

Shares issued on settlement of third party

fees 47,665 375,462 - - 423,127

Share-based payment charges - - 1,120,725 - 1,120,725

Total comprehensive income for the period - - - (7,525,971) (7,525,971)

Transfers between reserves - - 360,991 (360,991) -

At 31 December 2014 6,346,538 137,554,592 3,576,682 (107,273,954) 40,203,858

----------------------------------------------- ---------- ------------ ------------ -------------- -------------

Shares issued for cash net of costs 5,516 15,500 - - 21,016

Shares issued on settlement of third party

fees 32,497 132,986 - - 165,483

Share-based payment charges - - 1,013,976 - 1,013,976

Total comprehensive income for the period - - - (5,404,373) (5,404,373)

At 30 June 2015 6,384,551 137,703,078 4,590,658 (112,678,327) 35,999,960

----------------------------------------------- ---------- ------------ ------------ -------------- -------------

(1) The share-based payment reserve has been included within the

retained loss reserve and is a non-distributable reserve.

INTERIM CONSOLIDATED STATEMENT OF CASH FLOWS

Six months ended 30 June 2015 (unaudited) Six months ended 30

June 2014

(unaudited)

Note $ $

---------------------------------------- ----- ------------------------------------------ --- --------------------

Cash outflow from operating activities

Group operating loss for the period (5,400,028) (49,083,030)

Depreciation of property, plant and

equipment 826 135

Share-based payments 8 1,013,976 544,006

Impairment of intangible exploration

and evaluation assets 4 2,841,308 45,476,399

---------------------------------------- ----- ------------------------------------------ --- --------------------

Operating cash flow before changes in

working capital (1,543,918) (3,062,490)

(Increase)/decrease in receivables and

prepayments (309,352) 1,915,116

Decrease in trade and other payables (1,201,537) (152,548)

---------------------------------------- ----- ------------------------------------------ --- --------------------

Cash used in operations (3,054,807) (1,299,922)

Interest received 1,436 5,512

---------------------------------------- ----- ------------------------------------------ --- --------------------

Cash used in operating activities (3,053,371) (1,294,410)

---------------------------------------- ----- ------------------------------------------ --- --------------------

Investing activities

Exploration and evaluation costs 4 (3,671,646) (11,720,040)

Purchase of property, plant and (4,241) -

equipment

Cash element of licence farm-in - (4,025,474)

Cash acquired on acquisition of

subsidiary - 89,749

---------------------------------------- ----- ------------------------------------------ --- --------------------

Net cash used in investing activities (3,675,887) (15,655,765)

---------------------------------------- ----- ------------------------------------------ --- --------------------

Financing activities

Cash proceeds from issue of ordinary

share capital net of issue costs 7 21,016 32,429,167

(MORE TO FOLLOW) Dow Jones Newswires

September 30, 2015 02:03 ET (06:03 GMT)

Finance costs (5,781) -

---------------------------------------- ----- ------------------------------------------ --- --------------------

Net cash from financing activities 15,235 32,429,167

---------------------------------------- ----- ------------------------------------------ --- --------------------

(Decrease)/increase in cash and cash

equivalents (6,714,023) 15,478,992

Cash and cash equivalents at beginning

of year 7,941,833 17,454,712

---------------------------------------- ----- ------------------------------------------ --- --------------------

Cash and cash equivalents at end of

period 1,227,810 32,933,704

---------------------------------------- ----- ------------------------------------------ --- --------------------

NOTES TO THE INTERIM FINANCIAL INFORMATION

1. Accounting policies

a) Basis of preparation

This interim financial report, which includes a condensed set of

financial statements for the Company and its subsidiary

undertakings ("the Group"), has been prepared using the historical

cost convention and based on International Financial Reporting

Standards ("IFRS") including IAS 34 'Interim Financial Reporting'

and IFRS 6 'Exploration for and Evaluation of Mineral Reserves', as

adopted by the European Union ("EU").

The condensed set of financial statements for the six months

ended 30 June 2015 is unaudited and does not constitute statutory

accounts as defined in Section 434 of the Companies Act 2006. They

have been prepared using accounting bases and policies consistent

with those used in the preparation of the audited financial

statements of the Company and the Group for the year ended 31

December 2014 and those to be used for the year ending 31 December

2015. The comparative figures for the half year ended 30 June 2014

are unaudited. The comparative figures for the year ended 31

December 2014 are not the Company's full statutory accounts but

have been extracted from the financial statements for the year

ended 31 December 2014 which have been delivered to the Registrar

of Companies and the auditors' report thereon was unqualified and

did not contain a statement under sections 498 (2) and 498(3) of

the Companies Act 2006.

This half-yearly financial report was approved by the Board of

Directors on 29 September 2015.

b) Going concern

The Group's business activities, future development, financial

performance and position are discussed in the Operational

Update.

At 30 June 2015 the Group had cash balances of $1.2 million and

announced the completion of further equity funding totalling c$8.0

million on 15 July 2015. Subsequent to this fundraising, the

Directors believe that the Group now has sufficient cash resources

to meet its committed capital expenditure programme for at least

the next 12 months. As a consequence, the Directors believe that

the Group is well placed to manage its business risks and have a

reasonable expectation of it continuing in operational existence

for the foreseeable future. The Directors therefore continue to

adopt the going concern basis of accounting in preparing the

interim report and accounts.

2. Operating segments

The Group has two reportable operating segments: Africa and Head

Office. Non-current assets and operating liabilities are located in

Africa, whilst the majority of current assets are carried at Head

Office. The Group has not yet commenced production and therefore

has no revenue. Each reportable segment adopts the same accounting

policies. In compliance with IAS 34 'Interim Financial Reporting'

the following table reconciles the operational loss and the assets

and liabilities of each reportable segment with the consolidated

figures presented in these Financial Statements, together with

comparative figures for the period ended 30 June 2014.

Africa Head Office Total

Six months Six months Six months Six months Six months Six months

ended 30 June ended 30 June ended 30 June ended 30 June ended 30 June ended 30 June

2015 2014 2015 2014 2015 2014

(unaudited) (unaudited) (unaudited) (unaudited) (unaudited) (unaudited)

$ $ $ $ $ $

---------------- --------------- --------------- --------------- --------------- --------------- ---------------

Loss by

reportable

segment 3,089,774 45,646,902 2,314,599 3,430,616 5,404,373 49,077,518

Total assets by

reportable

segment (1) 36,870,172 46,179,123 1,821,213 26,480,446 38,691,385 72,659,569

---------------- --------------- --------------- --------------- --------------- --------------- ---------------

Total

liabilities by

reportable

segment (2) (2,112,333) (24,330,480) (579,092) (2,143,112) (2,691,425) (26,473,592)

---------------- --------------- --------------- --------------- --------------- --------------- ---------------

(1) Carrying amounts of segment

assets exclude investments in

subsidiaries.

(2) Carrying amounts of segment

liabilities exclude intra-group

financing.

3. Loss per ordinary share

Basic & Diluted

30 June 2015 30 June 2014

Loss for the year $5,404,373 $49,077,518

Weighted average number of ordinary shares in issue during the year 3,814,453,006 3,251,789,451

Dilutive effect of share options outstanding - -

Fully diluted average number of ordinary shares during the year 3,814,453,006 3,251,789,451

Loss per share (USc) 0.14c 1.51c

---------------------------------------------------------------------- -------------- --------------

4. Intangible Exploration and Evaluation (E&E) assets

Exploration and evaluation assets Goodwill Total

$ $ $

---------------------------------- ------------ -------------

Cost

At 1 January 2015 114,180,158 8,023,292 122,203,450

Additions during the period 3,671,646 - 3,671,646

At 30 June 2015 117,851,804 8,023,292 125,875,096

------------------------------- ---------------------------------- ------------ -------------

Amortisation and impairment

At 1 January 2015 (80,219,803) (7,979,502) (88,199,305)

Impairment during the period (2,841,308) - (2,841,308)

At 30 June 2015 (83,062,138) (7,979,502) (91,041,640)

------------------------------- ---------------------------------- ------------ -------------

Net book value

At 30 June 2015 34,790,693 43,790 34,834,483

------------------------------- ---------------------------------- ------------ -------------

At 31 December 2014 33,960,355 43,790 34,004,145

------------------------------- ---------------------------------- ------------ -------------

During the period the Company impaired assets totalling $2.8

million in accordance with IAS 36 "Impairment of Assets" following

the completion of drilling operations in Kenya (Badada-1 well) in

February 2015 and the continuing costs associated with the

appraisal of its Namibian licence on which an unsuccessful well was

drilled in June 2014 (Welwitschia-1A well). As the interests in

these licences were subsequently relinquished the Directors believe

it is appropriate to make a full provision against their costs.

Carrying values will be reviewed annually.

5. Trade and other receivables

30 June 2015 31 December 2014

(unaudited) (audited)

$ $

----------------------------- -------------- -----------------

Trade and other receivables 2,623,066 2,313,714

----------------------------- -------------- -----------------

6. Trade and other payables

30 June 2015 31 December 2014

(unaudited) (audited)

$ $

-------------------------- -------------- -----------------

Trade and other payables 2,493,720 3,989,244

Accruals 197,705 69,201

2,691,425 4,058,445

-------------------------- -------------- -----------------

7. Share capital

30 June 2015(unaudited) 31 December 2014

(MORE TO FOLLOW) Dow Jones Newswires

September 30, 2015 02:03 ET (06:03 GMT)

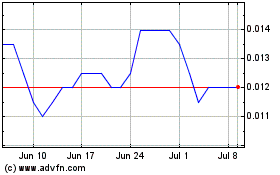

Tower Resources (LSE:TRP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tower Resources (LSE:TRP)

Historical Stock Chart

From Apr 2023 to Apr 2024