Swiss Franc Extends Slide Against Majors

January 26 2015 - 7:06AM

RTTF2

The Swiss franc extended its decline against its major rivals on

Monday's European deals, as a data showed that sight deposits of

domestic banks with the Swiss National Bank improved from last

week, suggesting the possibility of an intervention to prevent the

currency's appreciation.

Data from the SNB showed that sight deposits surged to 365.486

billion Swiss francs in the week ended January 23, up from 339.614

billion francs a week earlier.

Sight deposits could be increased through foreign exchange swaps

and debt repurchases.

The central bank scrapped its three-year currency ceiling in

mid-January and took its interest rates into further negative

territory, as it seeks to discourage new flows into Swiss

francs.

The European markets were mostly higher, after data showing

Germany's business sentiment was higher than expected served to

encourage risk appetite to some extent.

The Swiss franc dropped 1.3 percent to 0.8915 against the U.S.

dollar, an 11-day low, from last week's closing value of 0.8800. On

the downside, the franc may find downside target around the 0.90

mark.

The franc lost 1.6 percent to 1.3392 against the pound, its

weakest since January 15. At Friday's close, the pair was valued at

1.3177. Continuation of franc's downtrend may lead it to a support

surrounding the 1.45 area.

Reversing from an early high of 0.9782 against the euro, the

franc hit a 4-day low of 1.0025. The next possible support for the

franc is seen around the 1.20 mark. The euro-franc pair ended last

week's deals at 0.9857.

Germany's business sentiment was higher than expected in

January, latest figures from the IfO Institute showed.

The business confidence index came in at 106.7 in January,

slightly more than the 106.4 score expected by economists.

The franc resumed its early slide against the yen, touching a

10-day low of 132.36. Next key support for the franc-yen pair may

be located around the 124.00 area. The pair was quoted at 133.30 at

Friday's close.

The minutes of the Bank of Japan's December meeting showed that

majority of bank's policymakers believe that the drop in oil prices

will affect the economy and inflation positively in the long-term,

though it is expected to weigh on inflation in the short-term.

However, one member said that the primary focus should be on the

underlying trend in prices when considering the future conduct of

monetary policy, and that the key was developments in inflation

expectations in a broad context, the minutes said.

Looking ahead, at 9:00 am ET, Eurozone finance ministers hold a

meeting to discuss a range of financial issues in Brussels.

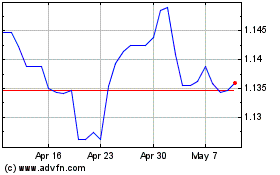

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Apr 2023 to Apr 2024