Sweden Cuts Rates Further Into Negative Zone; Signals More Action

February 11 2016 - 1:55AM

RTTF2

Sweden's central bank cuts its key interest rates deeper into

negative zone on Thursday in another attempt to bring krona down

and push inflation to the 2 percent target.

The bank also signaled that it was willing to take rates lower

from the current negative levels, among other steps such as an

extension of government bond purchases and foreign exchange market

interventions if the krona appreciates quickly.

The Executive Board of the Riksbank unexpectedly decided to cut

the repo rate by 0.15 percentage points to -0.50 percent, on

Thursday.

The bank was expected to keep its rate unchanged at -0.35

percent. The bank last lowered the repo in July, when it cut the

rate from -0.25 percent.

The period of low inflation will be longer than expected earlier

and any upturn in price growth will be uneven, the bank said.

Purchases of government bonds will continue for the first six

months of this year as planned and it will reinvest maturities and

coupons from the government bond portfolio until further

notice.

The bank said there is still scope to cut the repo rate further.

"The Riksbank is also analyzing whether it is possible within the

operational monetary policy framework to implement other measures

to underpin repo rate cuts," the bank said.

The bank also expressed its willingness to extend security

purchases by buying nominal and real government bonds and to

intervene on the foreign exchange market if the krona appreciates

so quickly as to threaten the upturn in inflation.

In an extra session in January, the board awarded Governor

Stefan Ingves, and the First Deputy Governor Kerstin af Jochnick,

powers to "instantly intervene" on the foreign exchange market when

necessary.

The Riksbank is still likely to need to take further action as

there is little sign that inflation will pick up any time soon,

Jessica Hinds at Capital Economics, said.

Swedish monetary policy should relate to several other central

banks' expansionary monetary policy. Otherwise, the krona exchange

rate would be at risk of strengthening at a faster rate than

forecast, which would make it harder to push up inflation, the bank

noted.

The bank lowered its inflation forecast for 2016 to 0.7 percent

from 1.3 percent and that for next year to 2.1 percent from 2.5

percent.

Riksbank also trimmed its growth forecasts for 2016 and 2017 by

0.1 percentage point. The growth is expected to be 3.5 percent in

this year and 2.8 percent next year.

As the economy continues to expand and house prices keep rising,

there is widespread concern that expansionary measures would cause

a bubble.

At the meeting, Governor Ingves and three others favored a rate

cut, while Martin Floden and Henry Ohlsson voted against the

move.

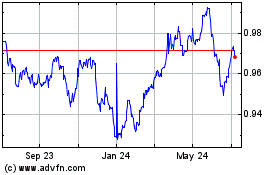

Euro vs CHF (FX:EURCHF)

Forex Chart

From Aug 2024 to Sep 2024

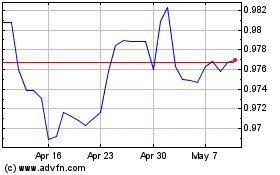

Euro vs CHF (FX:EURCHF)

Forex Chart

From Sep 2023 to Sep 2024