Statoil Exits Production in Canadian Oil Sands -- Update

December 14 2016 - 9:13PM

Dow Jones News

By Chester Dawson

CALGARY, Alberta -- Norway's state-owned oil giant. Statoil ASA.

said Wednesday it is exiting its business in the Canadian oil

sands, selling off its assets to Athabasca Oil Corp. and taking a

loss of at least $500 million.

The move ends Statoil's nearly decadelong foray into oil sands

production and comes two years after the company canceled plans to

develop a major oil sands project, citing concerns about

profitability. It signals the challenges faced by Canada's oil

sands, which are some of the world's highest-cost and most

greenhouse gas intensive sources of crude oil.

"This transaction corresponds with Statoil's strategy of

portfolio optimization to enhance financial flexibility and focus

capital on core activities globally," Lars Christian Bacher, the

company's executive vice president for international development

and production, said in a statement.

Even with a recent uptick in crude-oil prices to above $50 a

barrel, oil sands producers in Canada have been squeezed by high

upfront investment costs, tough new regulations on carbon emissions

and limited pipeline access to markets.

Last year, Royal Dutch Shell canceled a major oil sands project

and took a $2 billion write-down. In October, Exxon Mobil said it

may remove billions of barrels of oil sands crude from its books,

citing low oil prices.

The deal includes Statoil's 100% ownership of two key oil sands

leases, a 24,000 barrel a day test project called Leismer and an

undeveloped project known as Corner. Statoil indefinitely postponed

plans in September of 2014 to develop Corner, which was expected to

produce 40,000 barrels of oil a day.

The 832 million Canadian dollars ($626 million) deal is

structured to give Statoil a nearly 20% stake in Athabasca.

That Calgary-based company said the Leismer project can

break-even on an operating income basis with West Texas

Intermediate crude prices as low as $44 a barrel. "Athabasca has

the financial strength to drive oil-weighted growth at competitive

metrics in the current environment," CEO Robert Broen said in a

statement.

The government of Alberta, where Canada's oil sands are

concentrated, said it welcomed Athabasca's acquisition of Statoil's

assets. "We are pleased to see that a strong Alberta-based company

has taken over these assets and we look forward to the continued

development of our oil sands, " said Brad Hartle, a spokesman for

the province's energy minister.

Statoil entered the oil sands in 2007 when it bought North

American Oil Sands Corp. in a deal then valued at $C2.2 billion. It

then sold a 40% stake to Thailand's state-run PTT Exploration and

Production Public Co., or PTTEP, which spun off those assets into a

separate entity in 2014.

The sale of its remaining operations to Athabasca will trigger a

balance sheet impairment of $500 million to $550 million, Statoil

said.

Environmental critics that have long pressured Statoil to divest

its oil sands holdings hailed the decision. "This is a victory for

common sense, " said Keith Stewart, the head of Greenpeace Canada's

climate and energy campaign. "Any serious attempt to meet the Paris

climate commitments will turn this kind of high carbon oil into a

stranded asset," he said.

Oil sands wells like those at Leismer are more costly and

energy-intensive than shale or conventional oil wells. They require

steam injections to leach out underground deposits of oil embedded

in sand. Natural gas is burned to generate steam at a rate of about

1000 cubic feet per barrel of crude.

The process, called steam-assisted gravity drainage, or SAGD,

has exposed the oil sands industry to higher carbon taxes and an

absolute cap on greenhouse gas emissions introduced by Alberta's

new left-leaning government.

The Norwegian oil giant said its offshore operations in Canada

wouldn't be affected by the sale of its oil sands assets. Statoil

has minority stakes in two producing assets off the coast of

Newfoundland and two developmental projects.

Statoil's business in North American also includes shale oil

production in the Eagle Ford formation of Texas and North Dakota's

Bakken Shale, as well as Marcellus basin shale gas on the U.S. east

coast and Gulf of Mexico operations.

Write to Chester Dawson at chester.dawson@wsj.com

(END) Dow Jones Newswires

December 14, 2016 20:58 ET (01:58 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

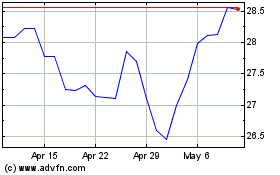

Equinor ASA (NYSE:EQNR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Equinor ASA (NYSE:EQNR)

Historical Stock Chart

From Apr 2023 to Apr 2024