State Street Global Exchange™ to Provide Risk Management Services for Fiera Capital

January 05 2017 - 12:00PM

Business Wire

State Street Corporation (NYSE:STT) today announced that it will

provide daily risk, performance and attribution, liquidity

measurement and reporting services for Fiera Capital Inc., the US

division of Fiera Capital Corporation. Fiera is a global asset

management firm with US $80 billion (over CAD $110 billion) in

assets under management. The services will be delivered through

truView®, State Street Global Exchange's multi-asset class

enterprise risk management platform.

A recent State Street study, in partnership with the Alternative

Investment Management Association, found that more than

three-fifths of institutional investors, asset managers and hedge

funds surveyed say current market liquidity conditions have

impacted their investment management strategy, with nearly a third

rating this impact as significant, and many are reassessing how

they manage risk in their investment portfolios1.

“We are thrilled to be working with an entrepreneurial firm like

Fiera Capital,” said Lou Maiuri, executive vice president and head

of State Street’s Global Exchange and Global Markets businesses.

“Now more than ever, institutional investors are looking for new

and innovative tools to help them achieve their goals. We believe

our technology, and liquidity and risk solutions make State Street

well positioned to help support clients like Fiera Capital in our

current economic environment, and we look forward to developing a

long-term partnership.”

truView provides an online, end-to-end risk solution with broad

multi-asset class coverage that includes data collection, exception

handling and calculating of risk results. State Street recently

enhanced the truView offering with Factor-Risk Modelling and Data

from more than 4,000 ETFs to offer clients a more insightful view

of how market forces may influence their portfolio.

About State Street

State Street Corporation (NYSE: STT) is one of the world's

leading providers of financial services to institutional investors,

including investment servicing, investment management and

investment research and trading. With $29 trillion in assets under

custody and administration and $2.4 trillion* in assets under

management as of September 30, 2016, State Street operates in more

than 100 geographic markets worldwide, including the US, Canada,

Europe, the Middle East and Asia. For more information, visit State

Street’s website at www.statestreet.com.

* Assets under management were $2.4 trillion as of September 30,

2016. AUM reflects approx. $40 billion (as of September 30, 2016)

with respect to which State Street Global Markets, LLC (SSGM)

serves as marketing agent; SSGM and State Street Global Advisors

are affiliated.

All information has been obtained from sources believed to be

reliable, but its accuracy is not guaranteed. There is no

representation or warranty as to the current accuracy, reliability

or completeness of, nor liability for, decisions based on such

information and it should not be relied on as such.

Exp. Date: 12/31/17

CORP-2489

1 Research was made up of a quantitative survey conducted by

Longitude Research, and qualitative interviews with key industry

participants. A total of 300 respondents were surveyed, comprising

150 asset managers and 150 asset owners.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170105006038/en/

State Street CorporationJulie Kane,

617-664-3001jekane@statestreet.com@StateStreet

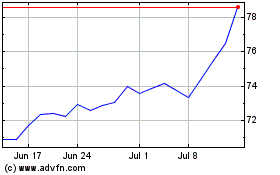

State Street (NYSE:STT)

Historical Stock Chart

From Mar 2024 to Apr 2024

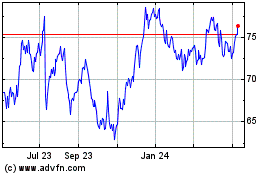

State Street (NYSE:STT)

Historical Stock Chart

From Apr 2023 to Apr 2024