TIDMSPX

RNS Number : 6441A

Spirax-Sarco Engineering PLC

22 March 2013

22nd March 2013

Spirax-Sarco Engineering plc

2012 Annual Report and Accounts and

Notice of Annual General Meeting

Spirax-Sarco Engineering plc (the "Company") released its

preliminary results announcement of annual results for the year

ended 31st December 2012 ("Final Results announcement") on 7th

March 2013. The announcement made on that date included inter alia

a condensed set of the Company's financial statements and extracts

from the management report.

The Company announces that its 2013 Annual General Meeting will

be held at 2.00 pm on Thursday, 9th May 2013 at Charlton House,

Cheltenham, Gloucestershire, GL53 8ER.

In connection with this, the following documents have been

posted to shareholders:

- Notice of 2013 Annual General Meeting;

- 2012 Annual Report and Accounts; and

- Proxy form for 2013 Annual General Meeting.

In accordance with Listing Rule 9.6.1, printed copies of these

documents have also been submitted to the National Storage

Mechanism and will shortly be available for inspection on the

National Storage Mechanism

(http://www.morningstar.co.uk/uk/NSM).

The Company confirms that the Annual Report and Accounts and the

Notice of 2013 Annual General Meeting are now available to view or

download in a pdf format from the Spirax-Sarco Engineering website.

The direct link to download the Annual Report and Accounts is

http://www.spiraxsarcoengineering.com/pdfs/reports/2012-annual-report.pdf

and the direct link to download the Notice of 2013 Annual General

Meeting is

http://www.spiraxsarcoengineering.com/pdfs/circulars/2013/Cicular%20to%20Shareholders.pdf.

A condensed set of the Company's financial statements and

extracts of the management report including the Business Review,

were included in the Company's Final Results announcement. That

information, together with the Appendix to this announcement, which

contains additional information which has been extracted from the

Annual Report and Accounts for the year ended 31st December 2012,

constitutes the material required for the purposes of compliance

with the Transparency Rules and should be read together with the

Final Results announcement, which can be downloaded from the

Company's website at

http://www.spiraxsarcoengineering.com/pdfs/news/News%20Release%202012%20Preliminary%20Results.pdf.

This announcement should be read in conjunction with and is not a

substitute for reading the full Annual Report and Accounts.

Together these constitute the information required by DTR 6.3.5,

which is required to be communicated to media in unedited full text

through a Regulatory Information Service. Page and note references

in the text below refer to page numbers and notes in the Annual

Report and Accounts.

Appendix

Risks and uncertainties

A description of the Company's principal risk and uncertainties

is extracted from pages 58 and 59 of the 2012 Annual Report and

Accounts.

"Principal risks

A summary of the principal risks, their likely impact and an

explanation of how the Group mitigates each risk is set out in the

table below. The direction of change in particular risks during the

year is explained in the 'Principal Risk' column and illustrated by

the arrow in the 'Change' column. Finally, we have also set out the

relevance of the risk to our strategy.

Please note that the 'Change' column shows the change in the

risk and not the mitigation of the risk.

Principal Risk Change Impact Mitigation Relevance

to strategy

---------------- ------- --------------------------------------------------------- ------------------------------------------------------------- ------------

Economic and

political

instability: Ç * Fluctuations in profit from significant currency * Compliance with Group Treasury Policy Broaden

The Group movements our

operates global

worldwide. * Strong internal controls with internal audit and presence

Economic * Reduced profit due to impact on customers from appropriate insurance

and political economic problems

instability

creates risks * Resilient business model (as explained in the

for our * Potential redenomination of local currency, Business Review on page 17).

locally based devaluation and high inflation.

direct

operations. * Well spread business - approximately 10% of Group

The Group sales originate in the higher risk countries of

has reviewed Greece, Ireland, Italy, Portugal and Spain. Sales in

country, Greece are immaterial.

credit,

liquidity and

currency risks

and,

in particular,

those

arising from

European

debt issues.

The risk has

increased

as a

result of the

deterioration

in some

European

economies

and the

general world

economic

outlook.

---------------- ------- --------------------------------------------------------- ------------------------------------------------------------- ------------

Breach of

regulatory

requirements: Ç * Fines and regulatory action and resultant reduced * Robust internal controls, policies and procedures and Create

The Group profit Group Management Code strong

operates market

in a large positions

number of * Damage to reputation * Establish strong ethical culture supported by

countries communication and training

across the

world and is * Diversion of management time.

subject * Review of commercial arrangements and regulatory

to many requirements with appropriate professional advice

different laws

and

regulations, * Maintain local quality accreditations.

including

the UK Bribery

Act,

the US Foreign

and

Corrupt

Practices Act,

health

and safety,

competition

laws and local

quality

regulations.

Breaching

these laws and

regulations

could have

serious

consequences.

This risk has

increased

in the year as

sales

in Asia

Pacific have

risen.

---------------- ------- --------------------------------------------------------- ------------------------------------------------------------- ------------

Non-compliance

with

health, safety

and Æ * Damage to reputation * Compliance with legislation and codes of best Create

environmental practice strong

legislation: market

The Group * Reduced profit due to fines, compensation and positions

places great clean-up costs * Regular audits, checks and reporting to management

emphasis on and the Board on health, safety and environmental

health, issues

safety and * Enforcement action by regulatory authorities.

environmental

issues in * Ongoing training

relation

to our

employees and * In the course of appointing a Senior Group Health and

operations, Safety Manager.

and those

of our

customers,

suppliers

and

communities so

as to avoid

the risk

of major

health, safety

or

environmental

problems.

---------------- ------- --------------------------------------------------------- ------------------------------------------------------------- ------------

Failure to

respond

to

technological Æ * Failure to achieve expected return on the R&D * Maintain market knowledge and monitor competitor Generate

developments investment developments, making effective use of our direct consistent

or customer field sales force organic

needs: growth

The Group has * Reduced profit

significantly * Maintain investment in R&D programmes Deliver

increased R&D solutions

resources * Loss of market share to reduce

and risks, * Maintain appropriate intellectual property energy

this being registrations, taking enforcement action where usage

ineffective if * Loss of intellectual property. appropriate.

we fail

to respond to

development

and customer

needs

or if we fail

to manage

and protect

our

intellectual

property.

---------------- ------- --------------------------------------------------------- ------------------------------------------------------------- ------------

There may be other risks and uncertainties which are unknown to

the Group or which could become material in the future. These risks

may cause the Group's results to vary materially from historic and

expected results.

Risk of

product Ç * Damage to customer relationships * Products designed and tested to international Create

failure: standards and strict quality procedures strong

The Group market

provides * Reduced profit due to increased costs to correct the positions

a wide range problems caused at customers' plants * Training of sales/installation staff

of products Deliver

into many solutions

different * Litigation following product liability claim. * Appropriate conditions of sale and contractual to reduce

plants and restrictions on liability energy

industries usage

many of which

are in * Insurance cover.

critical

parts of

our

customers'

processes.

A risk exists

that

products are

wrongly

specified or

installed,

fail, or

contain

design

or

manufacturing

faults.

This risk has

increased

during the

year as

a result of

the Group

providing

more fully

integrated

solutions.

--------------- ------- ------------------------------------------------------------ ------------------------------------------------------------ -----------

Loss of

manufacturing

output at any È * Reduced sales and profit due to inability to meet * Group manufacturing strategy to regionalise Broaden

Group customer orders manufacturing base and increase resilience our

factory: global

The Group presence

manufactures * Loss of market share * Business continuity planning and disaster recovery

most of the plans

products

we sell in * Damage to reputation.

eight main * Stocks of components and finished products in sales

factory units companies

which

supply our

sales * Regular and comprehensive back-- ups of IT systems

operations

worldwide.

Loss of * Use of insurance audits/ inspections and business

manufacturing interruption insurance.

output

at any

important

plant

risks serious

disruption

to sales

operations.

This risk has

reduced

in the year

due to

the

realisation

of

the Group's

manufacturing

strategy of

regionalising

the

manufacturing

base.

--------------- ------- ------------------------------------------------------------ ------------------------------------------------------------ -----------

Defined

benefit È * Increase in liabilities * Use of independent professional advisers and

pension custodians for defined benefit pension schemes

deficit:

Defined * Increase in pension costs and cash contributions

benefit * Pension scheme de--risking strategy to automatically

pension reduce equity exposure and increase matching assets

schemes carry * Fluctuations in pension fund asset and liability at pre--agreed trigger points.

risks in values.

relation to

investment

performance,

security of

assets,

longevity and

inflation.

Total defined

benefit

pension

liabilities

represent

approximately

52% of total

Group

assets.

This risk has

reduced

in the year

as a result

of the

operation of

the Mercer

'Dynamic

De-Risking

Solution'.

--------------- ------- ------------------------------------------------------------ ------------------------------------------------------------ -----------

Failure to

realise

acquisition Æ * Failure to achieve expected return on investment * Evaluation of potential targets against Strategic Grow

objectives: Plan and acquisition criteria market

The Group's share

strategy * Assumption of unexpected liabilities.

is focused on * Project management disciplines Deliver

organic solutions

growth to educe

complemented * Appropriate due diligence by Group personnel and energy

by external advisers covering commercial, legal, usage"

acquisitions accounting and environmental issues.

(as

explained in

the Business

Review on

page 17).

We risk

failing to

achieve the

expected

return on

investment

if

acquisitions

are

not properly

identified,

executed and

integrated.

--------------- ------- ------------------------------------------------------------ ------------------------------------------------------------ -----------

Related Party Transactions

The following related parties transactions are extracted from

page 118 of the 2012 Annual Report and Accounts.

2012 2011

"THE GROUP GBP000 GBP000

------------------------------------------ ------- -------

Sales to associated companies 567 732

Dividends from associated companies 1,454 1,461

Amounts due from associated companies at

31st December 47 21

------------------------------------------ ------- -------

2012 2011

PARENT COMPANY GBP000 GBP000

---------------------------------------------- -------- --------

Dividends received from subsidiaries 16,500 99,000

Dividends received from associates 1,454 1,461

Loans and amounts due from subsidiaries at

31st December 143,748 203,172

Amounts due to subsidiaries at 31st December 23,941 1,277

---------------------------------------------- -------- --------

The transactions above were priced on an arm's length basis and

on standard business terms."

Statement of Directors' responsibility

The following responsibility statement is repeated here solely

for the purpose of complying with Disclosure and Transparency Rule

6.3.5. This statement relates to and is extracted from page 83 of

the 2012 Annual Report and Accounts. Responsibility is for the full

2012 Annual Report and Accounts not the extracted information

presented in this announcement and the Final Results

announcement.

"Responsibility statement

We confirm that to the best of our knowledge:

-- The financial statements, prepared in accordance with the

applicable set of accounting standards, give a true and fair view

of the assets, liabilities, financial position and profit or loss

of the Company and the undertakings included in the consolidation

taken as a whole; and

-- The management report includes a fair review of the

development and performance of the business and the position of the

Company and the undertakings included in the consolidation taken as

a whole, together with a description of the principal risks that

they face.

Signed by

D J Meredith

Finance Director

on behalf of the Board of Directors

6th March 2013"

For further information, please contact:

Andy Robson, General Counsel & Company Secretary

Tel: 01242 535276

About Spirax Sarco

Spirax-Sarco Engineering plc is the world leader in both steam

system management and peristaltic pumping. The Company provides a

broad range of fluid control products, engineered packages, site

services and systems expertise for its diverse range of over

100,000 industrial and institutional customers. The Company helps

its customers to optimise production capacity, reduce energy costs

and emissions, improve product quality and enhance the safety of

their operations. Spirax Sarco is headquartered in Cheltenham,

England, has strategically located manufacturing plants around the

world and employs approximately 4,700 people, of whom around 1,300

are direct sales and service engineers. Its shares have been listed

on the London Stock Exchange since 1959 (symbol: SPX). Further

information can be found at www.spiraxsarcoengineering.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACSUUOKROVAOURR

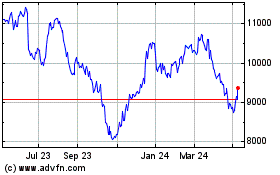

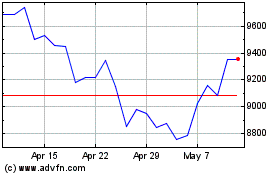

Spirax (LSE:SPX)

Historical Stock Chart

From Aug 2024 to Sep 2024

Spirax (LSE:SPX)

Historical Stock Chart

From Sep 2023 to Sep 2024