UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM SD

Specialized Disclosure Report

BARNES GROUP INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

|

| | |

| | |

1-4801 | | 06-0247840 |

(Commission File Number) | | (IRS Employer Identification No.) |

| |

123 Main Street, Bristol, Connecticut | | 06010 |

(Address of principal executive offices) | | (Zip Code) |

William K. Piotrowski - (860) 583-7070

(Name and telephone number of the person to contact in connection with this report)

Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies:

|

| |

ý | Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2014. |

Section 1 - Conflict Minerals Disclosure

Item 1.01 Conflict Minerals Disclosure and Report

Item 1.02 Exhibit

A copy of our Conflict Minerals Report is filed as Exhibit 1.01 and is publicly available at http://ir.barnesgroupinc.com/investor-relations/financial-reports/sec-filings/default.aspx.

Section 2 - Exhibits

Item 2.01 Exhibits

|

| | | | |

| | | | |

Designation | | Description | | Method of Filing |

| | |

Exhibit 1.01 | | Conflict Minerals Report | | Filed with this Form SD |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | BARNES GROUP INC. |

| | | | (Registrant) |

| | |

Date: June 1, 2015 | | By: | | /s/ KRISTINE M. MURPHY |

| | | | Kristine M. Murphy |

| | | | Acting General Counsel and Assistant Secretary |

Exhibit 1.01

Barnes Group Inc.

Conflict Minerals Report

Barnes Group Inc. (“BGI”) files this Conflict Minerals Report for the 2014 calendar year (the “2014 Report”) in accordance with Rule 13p-1 of the Securities Exchange Act of 1934 (the “Conflict Minerals Rule”). This is BGI’s second annual Conflict Minerals Report, following its report for the 2013 calendar year, filed on June 2, 2014 (the “2013 Report”).

Item 1.01(1) Conflict Minerals Disclosure and Report

Corporate Structure and Products

BGI is an international industrial and aerospace parts manufacturer and services provider operating under two global business segments - Industrial and Aerospace. BGI’s business segments are comprised of several strategic business units (“SBUs”).

Barnes Industrial manufactures hot runner systems and precision mold assemblies for injection molding applications. It also manufactures mechanical products, including precision mechanical springs and nitrogen gas products. Further, Industrial manufactures high-precision punched and fine-blanked components used in transportation and industrial applications, manifold systems used to precisely control stamping presses, and retention rings that position parts on a shaft or other axis.

Barnes Aerospace manufactures components and assemblies for aircraft engines, airframe manufacturers, and land-based industrial gas turbines; including products such as housings, segments, pistons and cylinders, rings, and casings.

Due Diligence

During 2014, BGI performed due diligence according to the 2013 process for new suppliers and new supply chain products. In addition, BGI refined its supplier list for active and inactive suppliers while enhancing the Conflict Minerals compliance program as discussed in the below 2014 update.

BGI conducted due diligence on its products and supply chain to ascertain:

| |

(1) | if columbite-tantalite (coltan), cassiterite, gold, wolframite, or their derivatives, which are limited to tantalum, tin and tungsten (collectively, “Minerals”) are necessary to the functionality or production of products that BGI manufactures; and if so, |

| |

(2) | if the Minerals are financing conflict in the Democratic Republic of the Congo or an adjoining country (“Conflict Minerals”). |

The purpose of such due diligence was to determine whether BGI is sourcing Conflict Minerals and to consider certain actions when necessary to reduce the risk of Conflict Minerals being present in BGI’s supply chain.

In conducting due diligence, BGI utilized the internationally recognized “OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas” (“OECD Framework”). In particular, in 2013:

| |

• | BGI formed a team to manage internal and supply chain due diligence (the “Conflict Minerals Team”). The Conflict Minerals Team consists of a representative familiar with the supply chain from each SBU and representatives from corporate Legal Services and Accounting. |

| |

• | The SBUs began incorporating Conflict Minerals contract language into their standard terms and conditions and/or purchase orders to restrict suppliers from supplying BGI with Conflict Minerals and to provide BGI with access to suppliers’ due diligence records related to the source of Minerals they may provide. |

| |

• | The SBUs began developing and implementing standard work related to Conflict Minerals due diligence for the approval of new suppliers. |

Further, in 2013, the SBUs conducted internal and supply chain due diligence on their respective products and suppliers as set forth below:

The SBUs planned and executed an internal due diligence approach based on the nature of the products and supply chain at each SBU. Certain SBUs performed extensive internal due diligence while others were more limited in their internal due diligence process. Internal due diligence involved the review of available bills of materials, material specifications, drawings, and/or other documentation that describe the materials contained in products (“Materials Documentation”). SBUs conducted this internal due diligence in parallel with the supply chain due diligence described in paragraph b below in order to obtain multiple sources of data to make their Conflict Minerals findings.

The SBUs that performed more limited internal due diligence primarily relied on the supply chain due diligence described in paragraph b below as the characteristics of their Materials Documentation and supply chain would not provide sufficient information to make Conflict Minerals findings.

| |

b. | Supply Chain Due Diligence |

Within Barnes Industrial, supply chain due diligence was conducted by starting with a supplier list and then down-selecting listed suppliers based on defined criteria that eliminated inactive suppliers, service providers, and suppliers of out-of-scope products. The respective SBU representative then sent the OECD-based “Conflict Minerals Reporting Template” (the “Report Form”) to the remaining suppliers on the list. The Report Form requests information from each supplier to enable BGI to determine whether the supplier is supplying Conflict Minerals.

Within Barnes Aerospace, supply chain due diligence was conducted by starting with the list of parts that it manufactures. For each part, Barnes Aerospace relied on its internal due diligence to determine if the part contained any Minerals. If so, the SBU representative then sent the Report Form to the material suppliers for that particular part.

The Conflict Minerals Team retains records of the Report Form and supplier responses in a centralized database for internal validation and future review and audit.

2014 Update

Prior to filing the 2013 Report, BGI adopted a Conflict Minerals policy and posted it on its Investor Relations website to communicate to the public and BGI’s supply chain its intent to support the social goals underlying the Conflict Minerals Rule (the “Policy”).

On October 31, 2013, BGI completed its acquisition of the Männer business from Otto Männer Holding AG and its three shareholders. In accordance with the applicable guidance of the Securities and Exchange Commission, which requires Conflict Minerals reporting for corporate acquisitions occurring during the first quarter of the calendar year, the 2013 Report excluded the Männer business as BGI did not have ownership of it until October 2013. In 2014, the Männer business conducted due diligence identical to the processes described above for the SBUs included in the 2013 Report within Barnes Industrial. This 2014 Report includes the results of the Männer business due diligence.

During 2014, BGI completed all planned activities listed in the 2013 Report. In 2013 and 2014, the Report Form was sent to a total of approximately 1,100 suppliers and BGI achieved a supplier response rate of approximately 91%, which includes the response rate of the Männer business' suppliers from its initial year of due diligence. This response rate also includes adjustments from the 2013 Report to: (i) remove certain suppliers that are no longer doing business with BGI; and (ii) include new BGI suppliers. Approximately 200 incremental suppliers received the Report Form in 2014, primarily due to the inclusion of the Männer business in this 2014 Report.

BGI continued to engage with suppliers who had not responded to BGI’s Report Form in 2013 to address the substantive response rate to the Report Form. For new suppliers, the SBUs incorporated Conflict Minerals due diligence into their standard work to perform pre-approval supplier Conflict Minerals due diligence. Further, the SBUs completed incorporation of the contract terms noted above in supplier contracts.

In 2014, BGI also benchmarked the Conflict Minerals reports of industry peers and reviewed expert commentary to ascertain best practices for due diligence and Conflict Minerals compliance.

Next Steps

As industry compliance with the Conflict Minerals Rule matures, BGI will continue to review best practices and expert guidance for opportunities to strengthen compliance controls as it further develops its Conflict Minerals compliance program. BGI plans to address Conflict Minerals issues in its supply chain as necessary by continuing to engage its suppliers in dialogue, discouraging suppliers from sourcing Conflict Minerals, requiring greater supply chain transparency, and/or potentially re-sourcing in certain circumstances.

For the 2015 reporting period, BGI will continue to address the substantive response rate to the Report Form through continual dialogue with non-responding suppliers and potentially taking one or more of the remedial measures described in the paragraph above. BGI plans to continue pre-approval Conflict Minerals due diligence for new suppliers and take appropriate action with respect to suppliers that breach BGI’s Conflict Minerals contract provisions.

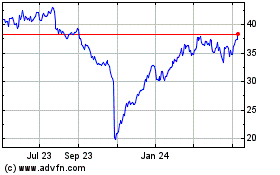

Barnes (NYSE:B)

Historical Stock Chart

From Mar 2024 to Apr 2024

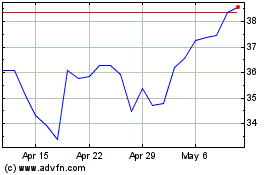

Barnes (NYSE:B)

Historical Stock Chart

From Apr 2023 to Apr 2024