TIDMSPK TIDMGHE

RNS Number : 6718T

Spark Ventures PLC

21 July 2015

SPARK Ventures plc

21 July 2015

Placing, Asset Swap & Proposed Open Offer of up to GBP17

million,

Proposed Change to Investing Policy & Investment

Manager,

and Proposed Share Consolidation & Adoption of New

Articles.

The Board of SPARK Ventures plc, the investor in early stage

digital information and technology companies ("SPARK"), is pleased

to announce that it has successfully raised approximately GBP10.1

million from a Placing of new Ordinary shares arranged by Liberum

Capital Limited ("Liberum") and finnCap Limited ("finnCap"), a

further GBP3.8 million via asset swaps and proposes to raise up to

an additional GBP3.1 million from an Open offer of new Ordinary

shares, in order to pursue a new investment strategy in partnership

with Gresham House plc ("GH"), the specialist asset management

group. It is the intention of the board of SPARK to appoint Liberum

as joint corporate broker following the successful completion of

the Placing.

SPARK proposes to appoint GH as its new investment adviser,

replacing its existing manager SPARK Venture Management Holdings

Limited ("SVMH"), in order to pursue its Strategic Public Equity

("SPE") investment strategy. The SPE strategy targets superior

long-term investment returns through applying private equity

techniques to investing in public markets. GH will focus on

inefficient areas of the market, taking influential block stakes in

smaller companies and then constructively engage to identify value

creation catalysts. GH also has the ability to invest a limited

amount in private equity which will include selective venture

capital investments.

GH has also agreed heads of terms with SVMH with the intention

in principle to acquire a majority stake in the business.

In addition, SPARK is pleased that existing shareholders

together with GH have also agreed to inject a limited number of

selective shareholdings into the enlarged SPARK to the value of

approximately GBP3.8 million. These companies have the

characteristics that have historically generated strong returns

including potentially supporting management in shareholder value

creating strategies.

Thomas Teichman, the founder of SPARK and chairman of SVMH, will

join the Investment Committee of GH's SPE team. All these

transactions are subject to shareholder approval at the General

Meeting to be held on 6 August 2015.

SPARK will also consolidate its share capital on a 1:200

basis.

Announcing these key strategic moves, the chairman of SPARK,

David Potter, said - "Over the past six years we have succeeded in

tripling shareholder value in SPARK, and in recent months we have

been seeking to develop a new corporate strategy which will both

maximise the value of our existing assets and continue to create

similarly high levels of shareholder value in the future. We

believe that our proposed partnership with GH will enable us to

deliver those objectives, and we have a high degree of confidence,

in GH's ability to execute this strategy as our new Investment

Manager, with the Board also personally committing to participate

through the open offer alongside the Gresham team in the

fundraising.

"The successful placing has enhanced the strength and quality of

our shareholder base, and we have been much encouraged by the

enthusiasm our new and existing shareholders have shown for these

strategic changes. We also want to give our many loyal private

shareholders the opportunity to participate in these exciting

developments, and the Open Offer will allow them to do so. For

those who decide not to participate we will establish a dealing

facility following the General Meeting for smaller shareholders to

allow them to sell easily."

Gresham House's Chief Executive, Anthony Dalwood, added -

"Securing our first investment mandate is an exciting step for

Gresham House as we deliver on our plans to develop as a specialist

asset manager of differentiated and illiquid alternative investment

strategies. SPARK provides an ideal platform for us to execute our

Strategic Public Equity investment strategy.

"The SPARK board is supportive of our plan to deploy the initial

capital raised and then to scale the company in a staged approach.

The positive feedback from the narrow group of investors we have

seen recently is extremely encouraging and we believe there will be

strong interest from Family Offices and Private Wealth Managers in

addition to institutions."

For further information, please contact:

David Potter/

SPARK Ventures plc Andrew Betton 07478 189 178

Gresham House plc Anthony Dalwood 020 3837 6272

Matt Goode/

finnCap Emily Watts 020 7220 0500

Attila Consultants Charles Cook/ 020 7947 4489 or 07710

Sorrel Davies 910563

Peter Tracey/

Neil Elliot/

Liberum Clayton Bush 020 3100 2199

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

2015

Record Date for entitlement upon the Open Offer 6.00 p.m. on 16

July

Announcement of the Fundraising and posting of the Circular, 21 July

Application Form and Form of Proxy

Ex-entitlement date of the Open Offer 8.00 a.m. on 21

July

Open Offer Entitlements and Excess CREST Open Offer 8.00 a.m. on 22

Entitlements credited to stock accounts of Qualifying July

CREST Shareholders

Recommended latest time for requesting withdrawal of 4.30 p.m. on 28

Open Offer Entitlements and Excess CREST Open Offer July

Entitlements from CREST

Latest time and date for depositing Open Offer Entitlements 3.00 p.m. on 29

and Excess CREST Open Offer Entitlements into CREST July

Latest time and date for splitting Application Forms 3.00 p.m. on 31

(to satisfy bona fide market claims only) July

Latest time and date for receipt of completed Application 11.00 a.m. on

Forms and payment in full under the Open Offer and settlement 4 August

of relevant CREST instructions (as appropriate)

Latest time and date for receipt of the Form of Proxy 10.00 a.m. on

or CREST Proxy Instruction for the General Meeting 4 August

Announcement of result of the Open Offer 5 August

General Meeting 10.00 a.m. on

6 August

Announcement of result of the General Meeting 6 August

Record date for Share Consolidation 4:30 p.m. 6 August

New Ordinary Shares admitted to trading on AIM and dealings 8.00 a.m. on 7

in the New Ordinary Shares commence and enablement in August

CREST

1. Background to and reasons for the Fundraising

As has been mentioned in shareholder communications in the past,

the Board has striven to maximise the values of each of the

Company's investments, and it believe this has been a highly

successful operation on which the Company's investment managers,

SVM, should be congratulated. Over the last six years, investors

have received 13 pence per share in dividends. The Board has also

sought to ensure that all other values relating to the Company give

benefit to its Shareholders, these are the remaining primary asset

(IMImobile PLC), the brand value of the Company as a successful

investment company, our stock exchange status and our tax losses,

which are currently estimated at approximately GBP150 million. The

Board has sought to maximise these values for the benefit of

Shareholders and believe that the Proposals represent an attractive

opportunity to enable the Company to achieve these goals.

Some months ago, on the introduction of a shareholder, the

Company was brought together with Gresham House and the Proposals

emanate from those discussions. The Board believes that through

deploying SPE style investment, where the Company will take

influential stakes in publicly quoted smaller companies within a

concentrated portfolio and, through a policy of constructive

corporate engagement, seek to benefit from value created by

strategic, operational or management initiatives. The Company will

aim to generate superior investment returns over the longer term

and will also be able to continue to optimise the value of the

existing portfolio and the Company's unutilised tax losses.

The Company proposes to raise approximately GBP13.2 million from

new and existing investors through the Fundraising, and a further

GBP3.8 million via the asset swaps and to engage Gresham House as

its investment manager focussing on SPE and private equity, in

which they have a strong track record. Gresham House will invest

GBP5 million in the Company and undertake one of the asset swaps.

Once the Fundraising is complete and the New Investment Strategy

established, Messrs Teichman and Betton will retire from the Board

and two new independent directors will be appointed in due course.

David Potter will continue as Chairman.

2. SPE Strategy

The SPE strategy seeks to utilise private equity techniques

including due diligence and engagement with management teams to

identify value opportunities. The New Investment Manager believes

this approach can lead to superior investment returns as it targets

inefficiencies in certain segments of the public markets. There are

over 1,200 companies in the FTSE Small Cap index and on AIM: these

companies typically have limited research coverage and may often

have limited access to growth capital often leading to value

opportunities being overlooked by the wider market. In addition,

the Company is also aware of a number of privately held and venture

capital opportunities that may benefit from the SPE approach.

The Company will focus mainly on cash generative companies where

there is scope for management engagement to identify opportunities

to implement either strategic, management or operational changes to

create shareholder value in the business and to generate improved

equity returns.

In addition to publicly listed opportunities, the New Investment

Manager will also have the flexibility to invest up to 30 per cent.

of the portfolio in selected unquoted securities, including venture

capital opportunities.

3. SPE Investment Process

The Investment Manager has a disciplined four stage process

which it uses to identify and make suitable investments.

Initially, a one page summary of the investment opportunity will

be produced for the internal investment team to consider, which

will summarise the investment thesis and the suitability of the

opportunity against the Company's Investing Policy. If the

opportunity is deemed to be suitable the Investment Manager will

undertake preliminary due diligence, including procedures such as

meetings with the target investment management, board and advisers,

a peer group and industry review and an assessment of the target

company's strategy, and will produce a Preliminary Investment

Report ("PIR"). The Investment Committee will review the PIR and

identify the areas in which to focus a more detailed due diligence

exercise and will authorise the Investment Manager to proceed

accordingly. Additional due diligence may include, inter alia, the

following:

-- Counterparty analysis;

-- Financial, commercial or technical due diligence reports;

-- Bespoke research;

-- External research;

-- Management referencing; and

-- Exit and catalyst identification.

A Final Investment Report ("FIR") will be produced once the due

diligence exercise has been completed following which a decision

whether or not to invest a full portfolio position will be made.

The Investment Committee will then continue to monitor the

performance of the investment against the original investment

thesis. The manager has the ability to invest in limited and

prescribed levels as the diligence process progresses.

4. New Investing Policy

In accordance with Rule 8 of the AIM Rules, the Company is

seeking the consent of the Shareholders at the General Meeting to

its proposed revised investing policy which will, if approved, read

as follows:

Business characteristics

The Company will seek to use the expertise and experience of its

Board and the members of its Investment Committee to invest

according to a rigorous strategic public equity process. The

Company will have an active investing policy, investing in assets

that will typically have a number of the following

characteristics:

-- investments that can generate a 15 per cent. IRR over the

medium to long term principally through capital appreciation;

and

-- investments where the manager believes there are value

creation opportunities through strategic, management or operational

changes.

The Company intends to invest the majority of its capital in a

concentrated portfolio of between 10 to 15 smaller UK/European

publicly traded companies, typically with market capitalisations of

less than GBP250 million and would typically expect a holding

period of three to five years. In addition, the Company may also

invest in interests in privately held companies, primarily in

equity and equity-related instruments and also in preferred equity,

convertible and non-convertible debt instruments. The Company will

seek to acquire influential block stakes (typically between 10 per

cent. and 25 per cent.) for cash or share consideration.

Exposure limits

Any investment which represents more than 15 per cent. of the

Group's gross assets, at the time when the investment is made, in

securities issued by any single company will require the Board's

approval. An investment will only be made after the Investment

Committee believes that the risk/return relationship is acceptable

and the target return hurdle is exceeded.

Gearing

The Company intends to put in place a bank facility but will

limit borrowing to no more than 20 per cent. of gross assets.

Returns on investment

The initial intention is to distribute up to 50 per cent. of

profits on realisations through dividends, share buybacks or other

returns of capital.

Any material change to the New Investing Policy by the Company

will require prior Shareholder approval in accordance with the AIM

Rules.

5. Change of Investment Manager

The Company has agreed to appoint Gresham House as its new

investment manager (the "New Investment Manager") subject to the

terms of the New Management Agreement, which will become effective

on Admission.

The Company will give three months' notice to terminate the

Existing Management Agreement following Admission: this will give

rise a payment of approximately GBP2.3 million to the Existing

Investment Manager to settle the amounts due to it (including the

incentive fee in respect of IMImobile PLC). As the SPARK name is

owned by the Existing Investment Manager and licensed to the

Company pursuant to a licence which expires in October 2015, the

Company and the Existing Investment Manager intend to extend this

licence until October 2017.

In addition, Gresham House has agreed heads of terms with an

intention to acquire the Existing Investment Manager. Upon

completion of this transaction, Gresham House will (in addition to

its existing investment team detailed below) have the continued

venture capital investment expertise of the Existing Investment

Manager at its disposal.

6. Information in relation to Gresham House

Gresham House is an Investing Company (as defined in the AIM

Rules) quoted on AIM. Gresham House holds a mixture of property

assets and quoted and unquoted securities. As at 31 December 2014,

Gresham House had a NAV per ordinary share of 298.0 pence.

Gresham House will continue to operate as an Investing Company

in the short to medium term. However, the directors of Gresham

House intend to develop the company as a specialist asset

management group, either organically or through acquisitions,

focussed on managing funds and co-investments across a range of

differentiated and illiquid alternative investment strategies.

Future investments by Gresham House which meet the criteria for the

SPE Strategy will be made through SPARK or other funds or vehicles

managed by GHAM such that Gresham House's exposure to such

opportunities will be through its investment in SPARK, such funds

or other vehicles only.

In pursuit of this objective, Gresham House has established

Gresham House Asset Management Limited ("GHAM") and applied to the

FCA for regulatory approval. Following Admission, and until GHAM

receives regulatory approval, Sapia Partners LLP ("Sapia") will

act, on an interim basis, as investment manager to the Company and

GHAM will act as investment adviser. Upon receiving regulatory

approval, GHAM will be appointed investment manager and adviser to

the Company and the relationship with Sapia will cease. Gresham

House, in accordance with its investment policy, will make

cornerstone investments in specialist funds managed by GHAM.

Further information on Gresham House can be found on its website

www.greshamhouse.com.

The Investment Committee

Following Admission, it is intended that SPARK's Investment

Committee will be chaired by Anthony (Tony) Dalwood with the other

members being Graham Bird (Head of Gresham House Strategic

Investments), Tom Teichman, Bruce Carnegie-Brown and Rupert

Robinson. Further details of the Investment Committee's relevant

experience is set out below.

Anthony (Tony) Dalwood

Tony is an experienced investor and adviser to public and

private equity businesses and CEO of Gresham House. Tony

established SVG Investment Managers (a former subsidiary of SVG

Capital plc), acted as CEO and chairman of this entity, and

launched Strategic Equity Capital plc. His previous appointments

include CEO of SVG Advisers (formerly Schroder Ventures (London)

Limited), membership of the UK Investment Committee of UBS Phillips

& Drew Fund Management (PDFM), chairman of Downing Active

Management Investment Committee and the board of Schroders Private

Equity Funds.

He is currently on the investment committee and board of the

London Pensions Fund Authority, a non-executive director of JP

Morgan Private Equity Limited and a director of Branton Capital

Limited. Tony is also an adviser to LDC through Gresham House.

Graham Bird

Graham leads the strategic public equity strategy alongside Tony

Dalwood. He is experienced in fund management and in corporate

advisory.

Graham has spent the last six years as a senior executive at

PayPoint plc, most recently as Director of Strategic Planning and

Corporate Development. He was Executive Chairman and President of

PayByPhone, a multi-national division of PayPoint operating out of

Canada, the UK and France between 2010-2014. Prior to joining

PayPoint, Graham was a fund manager and Head of Strategic

Investment at SVG Investment Managers where he helped to establish

and then co-manage the Strategic Recovery Fund II and the

investment trust, Strategic Equity Capital plc. Before joining

SVGIM he was a Director in Corporate Finance at JP Morgan

Cazenove.

Thomas Teichman

Tom was previously Chairman of NewMedia Investors Limited, which

he founded in 1996 and from which SPARK was created in 1999 when it

was admitted to trading on AIM. He was Executive Chairman of SPARK

from 1999 to 2009 and re-joined the Board in July 2014 in a

non-Executive role. He chairs SVM, which has managed SPARK's

investment portfolio since 2009. He was responsible for the

investments in Kobalt Music, Mergermarket and notonthehighstreet,

SPARK's largest exits to date. Tom has over 30 years of venture

capital and investment banking experience with firms including

Credit Suisse/CSFB, Mitsubishi and Bank of Montreal, where he ran

corporate finance. He has extensive venture capital experience in

technology ranging from on-line information, telecoms, video games

and chip design to travel and healthcare and online retailing. He

has backed many successful early stage technology businesses,

mostly from start-up, all the way to flotation (London and NASDAQ)

or trade sale. He was on the boards of these companies normally for

many years, chairing several of them.

Bruce Carnegie-Brown

Bruce is chairman of Aon UK Limited and of Moneysupermarket.com

Group plc and a non-executive director of Santander UK plc and

Close Brothers Group plc. He was previously a managing partner of

3i QPE plc, a managing director of JP Morgan and CEO of Marsh

Limited.

Rupert Robinson

Rupert was previously CEO of Schroders (UK) Private Bank and

head of private clients at Rothschild Asset Management Limited.

7. Share Consolidation

Pursuant to the Share Consolidation it is proposed that, the

Ordinary Shares will be subject to a 1 for 200 consolidation

resulting in Ordinary Shares of the Company with nominal value of

50 pence each.

Save as explained below with regards to fractional entitlements,

following the Share Consolidation each Shareholder will hold such

number of Ordinary Shares as is equal to 0.5 per cent. of the

number of Existing Ordinary Shares that he or she held immediately

beforehand, with a nominal value per Ordinary Share of 50

pence.

With regards to fractional entitlements, where the Share

Consolidation results in any member being entitled to a fraction of

a share, such fraction shall, so far as is possible, be aggregated

with the fractions of Ordinary Shares to which other members of the

Company may be entitled. It is proposed that the Directors will be

authorised to sell (or appoint any other person to sell) to any

person, on behalf of the relevant members, all the Ordinary Shares

representing such fractions at the best price reasonably obtainable

to any person and to distribute the net process of sale of such

Ordinary Shares (less expenses) representing such fractions in due

proportion amongst the persons entitled (except that if the amount

due to a person is less than GBP5 the sum may be retained for the

benefit of the Company).

It is proposed that the Ordinary Shares resulting from the Share

Capital Reorganisation will have exactly the same rights as those

currently accruing to the Existing Ordinary Shares under the

Articles, including those relating to voting and entitlement to

dividends.

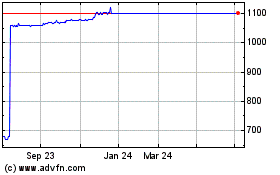

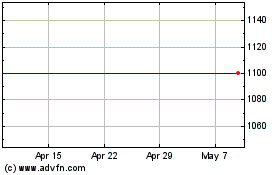

8. Details of the Placing and details of the Directors Intentions

The Company proposes to raise gross proceeds up to GBP10.1

million (approximately GBP9.8 million net of estimated expenses)

from new and existing institutional investors, pursuant to the

Placing. The Placing Shares have been conditionally placed by the

Joint Brokers with new and existing institutional investors. The

Placing is not being underwritten and, therefore, there is no

certainty that any funds will be raised under the Placing.

David Potter, Thomas Teichman, Charles Berry and Helen Sinclair,

who are directors of the Company, intend to subscribe for New

Ordinary Shares pursuant to the Open Offer (using excess

entitlements where required) with a value at the Issue Price of

GBP25,000; GBP25,000; GBP5,000; and GBP5,000 respectively. In

addition, Anthony Dalwood, Graham Bird, Bruce Carnegie-Brown,

Rupert Robinson and Michael Philips, who are members of the Gresham

House management team, intend to subscribe for New Ordinary Shares

pursuant to the Placing with a value in aggregate at the Issue

Price of GBP425,000. Gresham House has also agreed to subscribe

GBP5.0 million (representing approximately 50.0 per cent of the

Placing Shares).

The Issue Price represents a discount of 10 per cent to the 1000

pence post- Share Consolidation equivalent closing price of an

Ordinary Share on 20 July 2015 (based on the Closing Price of 5

pence), being the Last Practicable Date. The Placing Shares will,

when issued, rank pari passu in all respects with the Existing

Ordinary Shares. Application will be made for the Placing Shares to

be admitted to trading on AIM. It is expected that Admission will

take place, and dealings in the New Ordinary Shares will commence,

on 7 August 2015.

The Placing is conditional, inter alia, on:

-- the passing of the Resolutions at the General Meeting;

-- the Placing Agreement becoming unconditional in all relevant

respects and not having been terminated in accordance with its

terms prior to Admission; and

-- Admission becoming effective by no later than 8.00 a.m. on 7

August 2015 or such other date (being not later than 8.00 a.m. on

31 August 2015) as the Joint Brokers and the Company may agree.

9. Details of the Open Offer

The Board considers it important to provide the Company's loyal

and supportive Shareholders with an opportunity to participate in

the Fundraising in recognition of their continued support of the

Company.

Qualifying Shareholders can therefore subscribe for, in

aggregate, up to approximately GBP3.1 million (before expenses) in

Open Offer Shares without the Company having to produce a

prospectus (in accordance with the Prospectus Rules) which would

have both cost and timing implications for the Company.

Qualifying Shareholders, on and subject to the terms and

conditions of the Open Offer, will be given the opportunity under

the Open Offer to apply for any number of Open Offer Shares at the

Issue Price pro rata to their holdings on the following basis:

1 Open Offer Share for every 1,200 Existing Ordinary Shares

The Open Offer Shares will rank pari passu in all respects with

the Existing Ordinary Shares. Fractions of Open Offer Shares will

not be allotted to Qualifying Shareholders in the Open Offer and

entitlements under the Open Offer will be rounded down to the

nearest whole number of Open Offer Shares. The Issue Price

represents a discount of 10 per cent to the 1000 pence post-Share

Consolidation equivalent closing price of an Ordinary Share on 20

July 2015 (based on the Closing Price of 5 pence), being the Latest

Practicable Date.

There will be up to 349,038 New Ordinary Shares available to

Qualifying Shareholders under the Open Offer. A full take up of the

Open Offer Shares would represent approximately 8.8 per cent of the

Enlarged Issued Share Capital.

Qualifying Shareholders are being offered the opportunity to

apply for additional Open Offer Shares in excess of their Open

Offer Entitlement to the extent that other Qualifying Shareholders

do not take up their Open Offer Entitlements in full.

The Open Offer is not underwritten and therefore there is no

certainty that any funds will be raised under the Open Offer.

A Qualifying Shareholder may only apply for additional Open

Offer Shares if they have taken up their Open Offer Entitlement in

full.

In the event that applications are received from Qualifying

Shareholders for in excess of 349,038 Open Offer Shares, it is

intended excess applications will be scaled back pro rata to such

Qualifying Shareholders' entitlements taken up under the Open

Offer.

Application has been made for the Open Offer Entitlements and

Excess CREST Open Offer Entitlements to be admitted to CREST. It is

expected that the Open Offer Entitlements and Excess CREST Open

Offer Entitlements will be admitted to CREST on 22 July 2015. The

Open Offer Entitlements and Excess CREST Open Offer Entitlements

will also be enabled for settlement in CREST on 22 July 2015.

Applications through the CREST system may only be made by the

Qualifying Shareholder originally entitled or by a person entitled

by virtue of a bona fide market claim.

The latest time and date for acceptance and payment in full

under the Open Offer will be 11.00 a.m. on 4 August 2015, unless

otherwise announced by the Company via a Regulatory Information

Service. Qualifying CREST Shareholders should note that, although

the Open Offer Entitlements and Excess CREST Open Offer

Entitlements will be admitted to CREST and be enabled for

settlement, applications in respect of entitlements under the Open

Offer may only be made by the Qualifying Shareholder originally

entitled or by a person entitled by virtue of a bona fide market

claim raised by Euroclear's Claims Processing Unit. Qualifying

Non-CREST Shareholders should note that their Application Form is

not a negotiable document and cannot be traded.

The Open Offer will be conditional, inter alia, on the approval

of the Resolutions by the Shareholders at the General Meeting and

upon the Placing Agreement becoming unconditional in all respects

(other than as to Admission) and Admission of the Open Offer Shares

becoming effective by not later than 8.00 a.m. on 7 August 2015 (or

such later time and/or date as the Company and the Joint Brokers

may determine, not being later than 8.00 a.m. on 31 August

2015).

If Admission does not take place on or before 8.00 a.m. on 7

August 2015 (or such later time and/or date as the Company, and the

Joint Brokers may determine, not being later than 8.00 a.m. on 31

August 2015), the Open Offer will lapse, any Open Offer

Entitlements and Excess CREST Open Offer Entitlements admitted to

CREST will thereafter be disabled and application monies under the

Open Offer will be refunded to the applicants, by cheque (at the

applicant's risk) in the case of Qualifying Non-CREST Shareholders

and by way of a CREST payment in the case of Qualifying CREST

Shareholders, without interest as soon as practicable

thereafter.

Settlement and dealings

Application will be made to the London Stock Exchange for the

Open Offer Shares to be admitted to trading on AIM. It is expected

that Admission will become effective and that dealings in the New

Ordinary Shares will commence at 8.00 a.m. on 7 August 2015.

10. Details of the Asset Swap

As part of its New Investing Policy, the Company has agreed,

conditional upon Admission, to acquire the following interests in

other public companies:

(a) 2,062,500 ordinary shares in SpaceandPeople plc: this

interest is being acquired from Gresham House at a value of

approximately GBP1.4 million to be satisfied by the issue of

151,250 New Ordinary Shares. This valuation represents a discount

of 7 per cent to the Closing Price on the Last Practicable Date of

an ordinary share in SpaceandPeople plc;

(b) 5,000,000 ordinary shares in Miton Group plc: this interest

is being acquired from River & Mercantile Asset Management at a

value of approximately GBP1.3 million to be satisfied by the issue

of 145,833 New Ordinary Shares. This valuation represents the

Closing Price on the Last Practicable Date of an ordinary share in

Miton Group plc;

(c) 3,492,065 ordinary shares in Castle Street Investments plc:

this interest is being acquired from Majedie Asset Management at a

value of approximately GBP1.1 million to be satisfied by the issue

of 123,192 New Ordinary Shares. This valuation represents the

Closing Price on the Last Practicable Date of an ordinary share in

Castle Street Investments plc.

11. Share dealing facility

The Company recognises that some Shareholders may not want to

continue as investors as the Company pursues its New Investing

Policy. Accordingly, the Company has arranged with Capita Asset

Services to provide a low cost dealing facility to allow

Shareholders to realise their investment's potential in a cost

effective way. The service will be available to all private

Shareholders resident in the EEA. After the Share Consolidation has

taken place, Capita Asset Services will be offering free dealing to

Shareholders wishing to sell their entire shareholdings of up to

500 Ordinary Shares (following the Share Consolidation). A reduced

dealing fee of 0.75 per cent, (subject to a minimum of GBP25) will

be applied to all sales of over 500 Ordinary Shares (following the

Share Consolidation). Further information including instruction

forms and details of your shareholdings, will be provided with the

despatch of your new share certificates following the

implementation of the Share Consolidation.

12. General Meeting

The General Meeting has been convened at the offices of Nabarro

LLP, 125 London Wall, London EC2Y 5AL at 10.00 a.m. on Thursday 6

August 2015. Notice of the General Meeting is set out at the end of

the shareholder circular. In order to consider and vote on each of

the Resolutions that are put to the meeting Shareholders will also

be sent a Form of Proxy for use in respect of the General Meeting.

Resolutions 1 to 3 will be proposed as ordinary resolutions and

will be passed if at least 50 per cent. of the votes cast (whether

in person or by proxy) are in favour. Resolutions 4 and 5

(inclusive) will be proposed as special resolutions and will be

passed if at least 75 per cent. of the votes cast (whether in

person or by proxy) are in favour.

Shareholders have the right to attend, speak and vote at the

General Meeting (or, if they are not attending the meeting, to

appoint someone else as their proxy to vote on their behalf) if

they are on the Register at the Voting Record Time (namely 6.00

p.m. on 5 August 2015). Changes to entries in the Register after

the Voting Record Time will be disregarded in determining the

rights of any person to attend and/or vote at the General Meeting.

If the General Meeting is adjourned, only those Shareholders on the

Register 48 hours before the time of the adjourned General Meeting

(excluding any part of a day that is not a Business Day) will be

entitled to attend, speak and vote or to appoint a proxy.

The number of Ordinary Shares a Shareholder holds as at the

Voting Record Time will determine how many votes a Shareholder or

his proxy will have in the event of a poll.

Explanation of the Resolutions to be proposed at the General

Meeting

The notice convening the General Meeting will set out the

Resolutions to be proposed at the General Meeting. An explanation

of these Resolutions is set out below:

Resolution 1 - Change of Investing Policy

In accordance with Rule 8 of the AIM Rules, the Company is

required to seek the consent of Shareholders at the General Meeting

to its proposed revised investing policy. The Company proposes to

revise the existing investment policy, such that the Company will

implement an SPE strategy utilising private-equity style

techniques. The Company intends to invest in assets that can

generate a 15 per cent. IRR over the medium to long term and those

assets will have value creation opportunities through effecting

strategic, management or operational changes.

Resolution 2 - Share Consolidation

This resolution is to consolidate the ordinary shares of 0.25

pence each on a 200 for 1 basis into New Ordinary Shares of 50

pence each. This resolution also authorises the Directors to deal

with fractional entitlements that arise under the Share

Consolidation.

Resolution 3 - Authority to allot shares

This resolution is to authorise the Directors, for the purposes

of section 551 of the Act, to allot shares in the Company or grant

rights to subscribe for or convert any security into shares in the

Company of up to a maximum aggregate nominal amount of

GBP943,748.50 in connection with the Proposals and a further

nominal amount of GBP663,620.50 generally. The general authority is

equal to approximately one third of the Enlarged Issued Share

Capital. Resolution 3 also authorises the directors of the Company

from time to time to allot up to a further nominal amount of

GBP663,620.50 for use only in connection with a fully pre-emptive

rights issue. Save as disclosed in the shareholder circular, there

are no immediate plans to exercise these authorities. The

authorities will expire at the date of the annual general meeting

in 2016 or, if earlier, 6 November 2016.

Resolution 4 - Disapplication of pre-emption rights

This resolution is to disapply statutory pre-emption rights up

to an aggregate nominal amount of GBP769,229.50 in connection with

the Proposals, a rights or other pre-emptive issue and any other

issue of equity securities for cash up to an aggregate nominal

amount of GBP199,086 (representing approximately 10 per cent. of

the Enlarged Issued Share Capital). The authority will expire on

the date of the annual general meeting in 2016 or, if earlier, 6

November 2016.

Resolution 5 - Amendment to the articles of association

This resolution is to approve the amendment of the articles of

association of the Company to change the definition of Ordinary

Shares to reflect the Share Consolidation.

13. Irrevocable Undertakings and letters of support

Insofar as they are interested in Ordinary Shares, certain of

the Directors and persons connected with them have given

irrevocable undertakings to the Company to vote in favour of the

Resolutions (and, where relevant, to procure that such action is

taken by the relevant registered holders if that is not them), in

respect of their entire beneficial holdings totalling, in

aggregate, 16,990,469 Ordinary Shares, representing approximately

4.1 per cent. of the Existing Total Voting Rights

In addition, certain other Shareholders have given irrevocable

undertakings to the Company to vote in favour of the Resolutions to

be proposed at the General Meeting (and, where relevant, to procure

that such action is taken by the relevant registered holders if

that is not one of them) in respect of their holdings totalling, in

aggregate, 71,555,190 Ordinary Shares, representing approximately

17.1 per cent. of the Existing Total Voting Rights and other

shareholders have given letters of support in favour of the

Resolutions to be proposed at the General Meeting in respect of

their holdings of 95,571,567 Ordinary Shares, representing

approximately 22.8 per cent. of the Existing Total Voting

Rights.

In total, therefore, the Company has received irrevocable

undertakings or letters of support to vote in favour of the

Resolutions in respect of holdings totalling in aggregate

184,117,226 Ordinary Shares, representing approximately 44.0 per

cent. of the Existing Total Voting Rights.

14. Action to taken

A Form of Proxy for use in connection with the General Meeting

will be sent with the Circular. Whether or not Shareholders intend

to be present at the General Meeting, they are requested to

complete and sign the Form of Proxy and return it, in accordance

with the instructions printed on it, by post or (during normal

business hours only) by hand to Capita Asset Services, The

Registry, 34 Beckenham Road, Beckenham, Kent BR3 4TU to arrive as

soon as possible and, in any event, by no later than 10.00 a.m. on

4 August 2015. Shareholders who hold their Existing Ordinary Shares

in CREST may appoint a proxy by completing and transmitting a CREST

Proxy Instruction to Capita Asset Services so that it is received

by no later than 10.00 a.m. on 4 August 2015. The return of a

completed Form of Proxy or the transmission of an electronic proxy

or CREST Proxy Instruction will not prevent a Shareholder from

attending the General Meeting and voting in person (in substitution

for their proxy vote) should they wish to do so and are so

entitled.

15. Recommendation

The Board considers the Resolutions are likely to promote the

success of the Company and are in the best interests of the Company

and its Shareholders as a whole. The Directors unanimously

recommend that Shareholders vote in favour of the Resolutions which

are proposed at the General Meeting.

The Directors have irrevocably undertaken or intend to vote in

favour of all of the Resolutions which are proposed at the General

Meeting in respect of their own beneficial holdings, amounting in

aggregate to 19,673,019 Existing Ordinary Shares (representing

approximately 4.7 per cent of the Existing Total Voting Rights

.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, SOUTH

AFRICA OR JAPAN.

Certain statements in this announcement are forward-looking

statements which are based on the Company's expectations,

intentions and projections regarding its future performance,

anticipated events or trends and other matters that are not

historical facts. These statements are not guarantees of future

performance and are subject to known and unknown risks,

uncertainties and other factors that could cause actual results to

differ materially from those expressed or implied by such

forward-looking statements. Factors that would cause actual results

or events to differ from current expectations, intentions or

projections might include, amongst other things, changes in equity

markets, political risks, changes to regulations affecting the

Company's activities, delays in obtaining or failure to obtain any

required regulatory approval, uncertainties relating to the

availability and costs of financing needed in the future,

acquisitions and other strategic transactions. Given these risks

and uncertainties, prospective investors are cautioned not to place

undue reliance on forward-looking statements, which are not

guarantees of future performance. Forward-looking statements speak

only as of the date of such statements and, except as required by

the FCA, the London Stock Exchange or applicable law, each of the

Company, finnCap and Liberum expressly disclaims any obligation or

undertaking to review, revise or release publicly any updates to

any forward-looking statements to reflect any changes in SPARK's

expectations with regard thereto or any changes in events,

conditions or circumstances on which any such statement is based,

whether as a result of new information, future events or

otherwise.

This announcement is for information purposes only and shall not

constitute an offer to buy, sell, issue, or subscribe for, or the

solicitation of an offer to buy, sell, issue, or subscribe for any

securities, nor shall there be any sale of securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. This announcement has

been issued by and is the sole responsibility of SPARK.

No representation or warranty, express or implied, is or will be

made as to, or in relation to, and no responsibility or liability

is or will be accepted by finnCap or Liberum or by any of their

respective affiliates or agents as to, or in relation to, the

accuracy or completeness of this announcement, including the

Appendices, or any other written or oral information made available

to or publicly available to any interested party or its advisers,

and any liability therefore is expressly disclaimed.

finnCap, which is authorised and regulated in the United Kingdom

by the FCA, is acting for SPARK and for no-one else in connection

with the Placing, and will not be responsible to anyone other than

SPARK for providing the protections afforded to customers of

finnCap nor for providing advice to any other person in relation to

the Placing or any other matter referred to herein.

Liberum, which is authorised and regulated in the United Kingdom

by the FCA, is acting for SPARK and for no-one else in connection

with the Placing, and will not be responsible to anyone other than

SPARK for providing the protections afforded to customers of

Liberum nor for providing advice to any other person in relation to

the Placing or any other matter referred to herein.

The distribution of this announcement and the offering of the

Placing Shares in certain jurisdictions may be restricted by law.

No action has been taken by SPARK, finnCap or Liberum that would

permit an offering of such shares or possession or distribution of

this announcement or any other offering or publicity material

relating to such shares in any jurisdiction where action for that

purpose is required. Persons into whose possession this

announcement comes are required by SPARK, finnCap and Liberum to

inform themselves about, and to observe such restrictions.

The price of shares and the income from them may go down as well

as up and investors may not get back the full amount invested on

disposal of the shares.

MEMBERS OF THE PUBLIC ARE NOT ELIGIBLE TO TAKE PART IN THE

PLACING. THIS ANNOUNCEMENT (INCLUDING THE APPENDICES) AND THE TERMS

AND CONDITIONS SET OUT IN THIS ANNOUNCEMENT ARE FOR INFORMATION

PURPOSES ONLY AND ARE DIRECTED ONLY AT PERSONS WHO ARE: (A) (I)

INVESTMENT PROFESSIONALS FALLING WITHIN ARTICLE 19(5) OF THE

FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER

2005 (THE "ORDER"), OR (II) PERSONS FALLING WITHIN ARTICLE 49(2)(A)

TO (D) ("HIGH NET WORTH COMPANIES, UNINCORPORATED ASSOCIATIONS,

ETC") OF THE ORDER, OR (III) PERSONS TO WHOM IT MAY OTHERWISE BE

LAWFULLY COMMUNICATED; AND (B) (I) PERSONS IN MEMBER STATES OF THE

EUROPEAN ECONOMIC AREA WHO ARE QUALIFIED INVESTORS (AS DEFINED IN

ARTICLE 2(1)(E) OF EU DIRECTIVE 2003/71/EC (THE "PROSPECTUS

DIRECTIVE")), AND/OR (II) PERSONS IN THE UNITED KINGDOM WHO ARE

QUALIFIED INVESTORS (ALL SUCH PERSONS TOGETHER BEING REFERRED TO AS

"RELEVANT PERSONS"). THIS ANNOUNCEMENT (INCLUDING THE APPENDICES)

AND THE TERMS AND CONDITIONS SET OUT IN THIS ANNOUNCEMENT MUST NOT

BE ACTED ON OR RELIED ON BY PERSONS WHO ARE NOT RELEVANT PERSONS.

ANY INVESTMENT OR INVESTMENT ACTIVITY TO WHICH THIS ANNOUNCEMENT

(INCLUDING THE APPENDICES) AND THE TERMS AND CONDITIONS SET OUT IN

THIS ANNOUNCEMENT RELATE IS AVAILABLE ONLY TO RELEVANT PERSONS AND

WILL BE ENGAGED IN ONLY WITH RELEVANT PERSONS. THIS ANNOUNCEMENT

(INCLUDING THE APPENDICES) DOES NOT ITSELF CONSTITUTE AN OFFER FOR

SALE OR SUBSCRIPTION OF ANY SECURITIES IN SPARK VENTURES PLC.

Persons (including individuals, funds or otherwise) by whom or

on whose behalf a commitment to acquire Placing Shares has been

given ("Placees") will be deemed to have read and understood this

announcement, including the Appendices, in its entirety and to be

making such offer on the terms and conditions, and to be providing

the representations, warranties, acknowledgements, and undertakings

contained in Appendix I. In particular, each such Placee

represents, warrants and acknowledges that it is: (i) a Relevant

Person (as defined above) and undertakes that it will acquire,

hold, manage or dispose of any Placing Shares that are allocated to

it for the purposes of its business; (ii) not within the United

States; (iii) not within Australia, Canada, South Africa, Japan or

any other jurisdiction in which it is unlawful to make or accept an

offer to acquire the Placing Shares; (iv) not acquiring the Placing

Shares for the account of any person who is located in the United

States, unless the instruction to acquire was received from a

person outside the United States and the person giving such

instruction has confirmed that it has the authority to give such

instruction, and that either (a) it has investment discretion over

such account or (b) it is an investment manager or investment

company and, in the case of each of (a) and (b), that it is

acquiring the Placing Shares in an "offshore transaction" (within

the meaning of Regulation S under the United States Securities Act

of 1933, as amended ("Securities Act"); and (v) it is not acquiring

the Placing Shares with a view to the offer, sale, resale,

transfer, delivery or distribution, directly or indirectly, of any

such Placing Shares into the United States or any other

jurisdiction referred to in (iii) above.

This announcement, including the Appendices, is not for

distribution directly or indirectly in or into the United States

(including its territories and possessions, any State of the United

States and the District of Columbia), Canada, Australia, South

Africa or Japan or any jurisdiction into which the same would be

unlawful. This announcement is not an offer of securities for sale

in the United States. Securities may not be offered or sold in the

United States absent registration or an exemption from

registration. No offering of securities will be made in the United

States by SPARK in connection with the Placing.

This announcement does not constitute or form part of an offer

or solicitation to purchase or subscribe for shares in the capital

of SPARK in Canada, Australia, South Africa or Japan or any

jurisdiction in which such an offer or solicitation is unlawful. No

public offering of securities of SPARK will be made in connection

with the Placing in the United Kingdom or elsewhere.

The relevant clearances have not been, and nor will they be,

obtained from the securities commission of any province or

territory of Canada; no prospectus has been lodged with, or

registered by, the Australian Securities and Investments Commission

or the Japanese Ministry of Finance; and the Placing Shares have

not been, and nor will they be, registered under or offered in

compliance with the securities laws of any state, province or

territory of Canada, Australia, South Africa or Japan. Accordingly,

the Placing Shares may not (unless an exemption under the relevant

securities laws is applicable) be offered, sold, resold or

delivered, directly or indirectly, in or into the United States,

Canada, Australia, South Africa or Japan or any other jurisdiction

outside the United Kingdom.

The Placing Shares have not been approved or disapproved by the

US Securities and Exchange Commission, any State securities

commission or any other regulatory authority in the United States,

nor have any of the foregoing authorities passed upon or endorsed

the merits of the Placing or the accuracy or adequacy of this

announcement. Any representation to the contrary is unlawful.

Persons (including, without limitation, nominees and trustees)

who have a contractual or other legal obligation to forward a copy

of the Appendices or this announcement should seek appropriate

advice before taking any action.

The Placing Shares to be issued pursuant to the Placing will not

be admitted to trading on any stock exchange other than the London

Stock Exchange. Neither the content of SPARK's website nor any

website accessible by hyperlinks on SPARK's website is incorporated

in, or forms part of, this announcement.

APPENDIX I

TERMS AND CONDITIONS OF THE PLACING

IMPORTANT INFORMATION FOR PLACEES ONLY REGARDING THE PLACING

Details of the Placing

The Joint Brokers have entered into an agreement with SPARK (the

"Placing Agreement") under which, subject to the conditions set out

in that agreement, the Joint Brokers have agreed to use reasonable

endeavours to procure subscribers for the Placing Shares at a price

of 900 pence per Placing Share (the "Placing Price") on the terms

and subject to the conditions set out in this announcement.

The Placing Shares will, when issued, be credited as fully paid

and will rank pari passu in all respects with the existing Ordinary

Shares including the right to receive all dividends and other

distributions declared in respect of such ordinary shares after the

date of issue of the Placing Shares.

Application for admission to trading

Application will be made to the London Stock Exchange for

admission of the Placing Shares to trading on AIM. Admission is

conditional upon the passing of the Resolutions at the General

Meeting proposed to be convened on or around 6 August 2015 by the

shareholders of the Company. It is expected that Admission will

become effective on or around 7 August 2015 and that dealings in

the Placing Shares will commence at that time.

Bookbuild

The Joint Brokers have undertaken a bookbuilding process in

respect of the Placing (the "Bookbuild") to determine demand for

participation in the Placing by Placees. This Appendix gives

details of the terms and conditions of, and the mechanics of

participation in, the Placing. No commissions will be paid to

Placees or by Placees in respect of any Placing Shares.

The Joint Brokers and SPARK shall be entitled to effect the

Placing by such alternative method to the Bookbuild as they may, in

their sole discretion, determine.

Participation in, and principal terms of, the Placing:

1. finnCap and Liberum are acting as joint brokers and agents of SPARK.

2. Participation in the Placing will only be available to

persons who may lawfully be, and are, invited to participate by the

Joint Brokers. The Joint Brokers and their affiliates are each

entitled to enter bids in the Bookbuild as principal.

3. The Bookbuild has closed. The Joint Brokers may, in agreement

with SPARK, accept bids that are received after the Bookbuild has

closed. SPARK reserves the right (upon the agreement of the Joint

Brokers) to reduce or seek to increase the amount to be raised

pursuant to the Placing, in its absolute discretion.

4. Each prospective Placee's allocation will be agreed between

the Joint Brokers and SPARK and will be confirmed orally by one of

the Joint Brokers as agent of SPARK following the close of the

Bookbuild. That oral confirmation will constitute an irrevocable

legally binding commitment upon that person (who will at that point

become a Placee) in favour of the Joint Brokers and SPARK to

subscribe for the number of Placing Shares allocated to it at the

Placing Price on the terms and conditions set out in this Appendix

and in accordance with SPARK's articles of association.

5. Each prospective Placee's allocation and commitment will be

evidenced by a contract note issued to such Placee by one of the

Joint Brokers. The terms of this Appendix will be deemed

incorporated in that contract note.

6. Each Placee will also have an immediate, separate,

irrevocable and binding obligation, owed to SPARK and the relevant

Joint Broker as agent of SPARK, to pay the relevant Joint Broker

(or as it may direct) in cleared funds, an amount equal to the

product of the Placing Price and the number of Placing Shares such

Placee has agreed to subscribe and SPARK has agreed to allot and

issue to that Placee.

7. The Joint Brokers may choose to accept bids, either in whole

or in part, on the basis of allocations determined in agreement

with SPARK and may scale down any bids for this purpose on such

basis as they may determine. The Joint Brokers may also,

notwithstanding paragraphs 4 and 5 above, subject to the prior

consent of SPARK (i) allocate Placing Shares after the time of any

initial allocation to any person submitting a bid after that time

and (ii) allocate Placing Shares after the Bookbuild has closed to

any person submitting a bid after that time.

8. A bid in the Bookbuild will be made on the terms and subject

to the conditions in this announcement and will be legally binding

on the Placee on behalf of which it is made and except with the

consent of either of the Joint Brokers will not be capable of

variation or revocation after the time at which it is

submitted.

9. Irrespective of the time at which a Placee's allocation

pursuant to the Placing is confirmed, settlement for all Placing

Shares to be acquired pursuant to the Placing will be required to

be made at the same time, on the basis explained below under

"Registration and Settlement".

10. All obligations under the Bookbuild and Placing will be

subject to fulfilment of the conditions referred to below under

"Conditions of the Placing" and to the Placing not being terminated

on the basis referred to below.

11. By participating in the Bookbuild, each Placee will agree

that its rights and obligations in respect of the Placing will

terminate only in the circumstances described below and will not be

capable of rescission or termination by the Placee.

12. To the fullest extent permissible by law, neither of the

Joint Brokers nor any of their affiliates shall have any liability

to Placees (or to any other person whether acting on behalf of a

Placee or otherwise). In particular, neither of the Joint Brokers

nor any of their affiliates shall have any liability (including to

the fullest extent permissible by law, any fiduciary duties) in

respect of the Joint Broker's conduct of the Bookbuild or of such

alternative method of effecting the Placing as the Joint Brokers

and SPARK may agree.

Conditions of the Placing

The obligations of the Joint Brokers under the Placing Agreement

are conditional on, amongst other things:

(a) the passing of the Resolutions, without amendment, at the

General Meeting of the Company to be convened on or around 6 August

2015;

(b) Admission taking place by 8.00 a.m. (London time) on 7

August 2015 (or such later date as SPARK and the Joint Brokers may

otherwise agree); and

(c) the Placing Agreement becoming unconditional in all other respects.

If any of the conditions contained in the Placing Agreement in

relation to the Placing Shares are not fulfilled or waived by the

Joint Brokers, by the respective time or date where specified (or

such later time and/or date as SPARK and the Joint Brokers may

agree), the Placing will not proceed and the Placee's rights and

obligations hereunder in relation to the Placing Shares shall cease

and terminate at such time and each Placee agrees that no claim can

be made by the Placee in respect thereof.

The Joint Brokers may, at their discretion and upon such terms

as they think fit, waive compliance by SPARK with the whole or any

part of any of SPARK's obligations in relation to the conditions in

the Placing Agreement save that the conditions in the Placing

Agreement relating to Admission taking place may not be waived. Any

such extension or waiver will not affect Placees' commitments as

set out in this announcement.

None of the Joint Brokers, SPARK or any other person shall have

any liability to any Placee (or to any other person whether acting

on behalf of a Placee or otherwise) in respect of any decision they

may make as to whether or not to waive or to extend the time and /

or the date for the satisfaction of any condition to the Placing

nor for any decision they may make as to the satisfaction of any

condition or in respect of the Placing generally, and by

participating in the Placing each Placee agrees that any such

decision is within the absolute discretion of the Joint

Brokers.

The Placing Agreement may be terminated by the Joint Brokers at

any time prior to Admission in certain circumstances including,

among other things, following a breach of the Placing Agreement by

the Company or the occurrence of certain force majeure events.

Upon such termination, the parties to the Placing Agreement

shall be released and discharged (except for any liability arising

before or in relation to such termination) from their respective

obligations under or pursuant to the Placing Agreement subject to

certain exceptions.

By participating in the Placing, Placees agree that the exercise

by the Joint Brokers of any right of termination or other

discretion under the Placing Agreement shall be within the absolute

discretion of the Joint Brokers and that they need not make any

reference to Placees and that they shall have no liability to

Placees whatsoever in connection with any such exercise or failure

so to exercise.

No prospectus

No offering document, prospectus or admission document has been

or will be submitted to be approved by the FCA or submitted to the

London Stock Exchange in relation to the Placing and Placees'

commitments will be made solely on the basis of the information

contained in this announcement (including the Appendices) released

by SPARK today and any information previously published by SPARK by

notification to a Regulatory Information Service, and subject to

the further terms set forth in the contract note to be provided to

individual prospective Placees.

Each Placee, by accepting a participation in the Placing, agrees

that the content of this announcement (including the Appendices) is

exclusively the responsibility of SPARK and confirms that it has

neither received nor relied on any other information (other than

any information previously published by SPARK by notification to a

Regulatory Information Service), representation, warranty, or

statement made by or on behalf of SPARK or the Joint Brokers or any

other person and none of the Joint Brokers or SPARK nor any other

person will be liable for any Placee's decision to participate in

the Placing based on any other information, representation,

warranty or statement which the Placees may have obtained or

received. Each Placee acknowledges and agrees that it has relied on

its own investigation of the business, financial or other position

of SPARK in accepting a participation in the Placing. Nothing in

this paragraph shall exclude the liability of any person for

fraudulent misrepresentation.

Registration and settlement

Settlement of transactions in the Placing Shares following

Admission will take place within the system administered by

Euroclear UK & Ireland Limited ("CREST"), subject to certain

exceptions. SPARK reserves the right to require settlement for and

delivery of the Placing Shares (or a portion thereof) to Placees in

certificated form if, in the Joint Brokers' opinion, delivery or

settlement is not possible or practicable within the CREST system

or would not be consistent with the regulatory requirements in the

Placee's jurisdiction.

Following the close of the Bookbuild for the Placing, each

Placee allocated Placing Shares in the Placing will be sent a

contract note stating the number of Placing Shares to be allocated

to it at the Placing Price and settlement instructions.

Each Placee agrees that it will do all things necessary to

ensure that delivery and payment is completed in accordance with

the standing CREST or certificated settlement instructions that it

has in place with the Joint Brokers. SPARK will deliver the Placing

Shares to CREST accounts operated by each of the Joint Brokers as

agents for SPARK, and the Joint Brokers will enter their respective

delivery (DEL) instruction into the CREST system. The input to

CREST by a Placee of a matching or acceptance instruction will then

allow delivery of the relevant Placing Shares to that Placee

against payment.

It is expected that settlement will take place on 7 August 2015,

being the business day following the General Meeting, on a delivery

versus payment basis.

Interest is chargeable daily on payments not received from

Placees on the due date in accordance with the arrangements set out

above at the rate of two percentage points above LIBOR as

determined by the Joint Brokers.

Each Placee is deemed to agree that, if it does not comply with

these obligations, SPARK may sell any or all of the Placing Shares

allocated to that Placee on such Placee's behalf and retain from

the proceeds, for SPARK's account and benefit, an amount equal to

the aggregate amount owed by the Placee plus any interest due. The

relevant Placee will, however, remain liable for any shortfall

below the aggregate amount owed by it and may be required to bear

any stamp duty or stamp duty reserve tax (together with any

interest or penalties) which may arise upon the sale of such

Placing Shares on such Placee's behalf.

If Placing Shares are to be delivered to a custodian or

settlement agent, Placees should ensure that the trade confirmation

is copied and delivered immediately to the relevant person within

that organisation. Insofar as Placing Shares are registered in a

Placee's name or that of its nominee or in the name of any person

for whom a Placee is contracting as agent or that of a nominee for

such person, such Placing Shares should, subject as provided below,

be so registered free from any liability to UK stamp duty or stamp

duty reserve tax. Placees will not be entitled to receive any fee

or commission in connection with the Placing.

Representations and warranties

By participating in the Placing each Placee (and any person

acting on such Placee's behalf) irrevocably acknowledges, confirms,

undertakes, represents, warrants and agrees (as the case may be)

with each of the Joint Brokers (in their capacity as joint brokers

and placing agents of the Company in respect of the Placing) and

the Company, in each case as a fundamental term of their

application for Placing Shares the following:

1. it has read this announcement, including the appendices, in its entirety;

2. that (i) no offering document, listing particulars,

prospectus or admission document has been or will be prepared in

connection with the Placing and (ii) it has not received a

prospectus, admission document or other offering document in

connection with the Bookbuild, the Placing or the Placing

Shares;

3. that the Ordinary Shares are admitted to trading on AIM, and

SPARK is therefore required to publish certain business and

financial information in accordance with the rules and practices of

AIM (collectively, the "Exchange Information"), which includes a

description of the nature of SPARK's business and SPARK's most

recent balance sheet and profit and loss account and that it is

able to obtain or access (i) such Exchange Information and (ii)

such information or comparable information concerning any other

publicly traded company, in each case without undue difficulty;

4. that none of the Joint Brokers or SPARK nor any of their

affiliates nor any person acting on behalf of any of them has

provided, and will not provide, it with any material regarding the

Placing Shares or SPARK or any other person other than this

announcement; nor has it requested any of the Joint Brokers, SPARK,

any of their affiliates or any person acting on behalf of any of

them to provide it with any such information;

5. acknowledges that the Placing Shares have not been and will

not be registered under the securities legislation of the United

States, Australia, Canada, South Africa or Japan and, subject to

certain exceptions, may not be offered, sold, transferred,

delivered or distributed, directly or indirectly, in or into those

jurisdictions;

6. that (i) it is not within the United States; (ii) it is not

within Australia, Canada, South Africa, Japan or any other

jurisdiction in which it is unlawful to make or accept an offer to

acquire the Placing Shares; (iii) it is not acquiring the Placing

Shares for the account of any person who is located in the United

States, unless the instruction to acquire was received from a

person outside the United States and the person giving such

instruction has confirmed that it has the authority to give such

instruction, and that either (a) it has investment discretion over

such account or (b) it is an investment manager or investment

company and, in the case of each of (a) and (b), that it is

acquiring the Placing Shares in an "offshore transaction" (within

the meaning of Regulation S under the Securities Act); and (iv) it

is not acquiring the Placing Shares with a view to the offer, sale,

resale, transfer, delivery or distribution, directly or indirectly,

of any such Placing Shares into the United States or any other

jurisdiction referred to in (ii) above;

7. that the content of this announcement is exclusively the

responsibility of SPARK and that neither of the Joint Brokers nor

any person acting on their behalf has or shall have any liability

for any information, representation or statement contained in this

announcement or any information previously published by or on

behalf of SPARK and will not be liable for any Placee's decision to

participate in the Placing based on any information, representation

or statement contained in this announcement or otherwise. Each

Placee further represents, warrants and agrees that the only

information on which it is entitled to rely and on which such

Placee has relied in committing itself to subscribe for the Placing

Shares is contained in this announcement and any information

previously published by SPARK by notification to a Regulatory

Information Service, such information being all that it deems

necessary to make an investment decision in respect of the Placing

Shares and that it has neither received nor relied on any other

information given or representations, warranties or statements made

by any of the Joint Brokers or SPARK and none of the Joint Brokers

or SPARK will be liable for any Placee's decision to accept an

invitation to participate in the Placing based on any other

information, representation, warranty or statement. Each Placee

further acknowledges and agrees that it has relied on its own

investigation of the business, financial or other position of SPARK

in deciding to participate in the Placing;

8. that neither of the Joint Brokers nor any person acting on

behalf of them nor any of their affiliates has or shall have any

liability for any publicly available or filed information, or any

representation relating to SPARK, provided that nothing in this

paragraph excludes the liability of any person for fraudulent

misrepresentation made by that person;

9. that neither it, nor the person specified by it for

registration as a holder of Placing Shares is, or is acting as

nominee or agent for, and that the Placing Shares will not be

allotted to, a person who is or may be liable to stamp duty or

stamp duty reserve tax under any of sections 67, 70, 93 and 96 of

the Finance Act 1986 (depositary receipts and clearance

services);

10. that it has complied with its obligations in connection with

money laundering and terrorist financing under the Proceeds of

Crime Act 2002, the Terrorism Act 2000, the Terrorism Act 2006 and

the Money Laundering Regulations 2007 (the "Regulations") and, if

making payment on behalf of a third party, that satisfactory

evidence has been obtained and recorded by it to verify the

identity of the third party as required by the Regulations;

11. that it is acting as principal only in respect of the

Placing or, if it is acting for any other person (i) it is duly

authorised to do so, (ii) it is and will remain liable to the

Company and/or the Joint Brokers for the performance of all its

obligations as a Placee in respect of the Placing (regardless of

the fact that it is acting for another person), (iii) it is both an

"authorised person" for the purposes of FSMA and a "qualified

investor" as defined at Article 2.1(e)(i) of Directive 2003/71/EC

(known as the Prospectus Directive) acting as agent for such

person, and (iv) such person is either (1) a "qualified investor"

as referred to at section 86(7) of FSMA or (2) a "client" (as

defined in section 86(2) of FSMA) of its that has engaged it to act

as such client's agent on terms which enable it to make decisions

concerning the Placing or any other offers of transferable

securities on such client's behalf without reference to such

client;

12. that, if a financial intermediary, as that term is used in

Article 3(2) of EU Directive 2003/71/EC (the "Prospectus

Directive") (including any relevant implementing measure in any

member state), the Placing Shares purchased by it in the Placing

will not be acquired on a non-discretionary basis on behalf of, nor

will they be acquired with a view to their offer or resale to,

persons in a member state of the European Economic Area which has

implemented the Prospectus Directive other than to qualified

investors, or in circumstances in which the prior consent of the

Joint Brokers has been given to the proposed offer or resale;

13. that it has not offered or sold and, prior to the expiry of

a period of six months from Admission, will not offer or sell any

Placing Shares to persons in the United Kingdom, except to persons

whose ordinary activities involve them in acquiring, holding,

managing or disposing of investments (as principal or agent) for

the purposes of their business or otherwise in circumstances which

have not resulted and which will not result in an offer to the

public in the United Kingdom within the meaning of section 85(1) of

the Financial Services and Markets Act 2000 ("FSMA");

14. that it has not offered or sold and will not offer or sell

any Placing Shares to persons in the European Economic Area prior

to Admission except to persons whose ordinary activities involve

them in acquiring, holding, managing or disposing of investments

(as principal or agent) for the purposes of their business or

otherwise in circumstances which have not resulted in and which

will not result in an offer to the public in any member state of

the European Economic Area within the meaning of the Prospectus

Directive (including any relevant implementing measure in any

member state);

15. that it has only communicated or caused to be communicated

and will only communicate or cause to be communicated any

invitation or inducement to engage in investment activity (within

the meaning of section 21 of FSMA) relating to the Placing Shares

in circumstances in which section 21(1) of FSMA does not require

approval of the communication by an authorised person;

16. that it has complied and will comply with all applicable

provisions of FSMA with respect to anything done by it in relation

to the Placing Shares in, from or otherwise involving, the United

Kingdom;

17. that (i) it is a person falling within Article 19(5) and /

or Article 49(2)(a) to (d) of the Financial Services and Markets

Act 2000 (Financial Promotion) Order 2005 or is a person to whom

this announcement may otherwise be lawfully communicated; and (ii)

any offer of Placing Shares may only be directed at persons to the

extent in member states of the European Economic Area who are

"qualified investors" within the meaning of Article 2(1)(e) of the

Prospectus Directive (Directive 2003/71/EC) and represents and