Solo Oil Plc Further investment, Kiliwani North, Tanzania (7189O)

February 11 2016 - 2:00AM

UK Regulatory

TIDMSOLO

RNS Number : 7189O

Solo Oil Plc

11 February 2016

FOR IMMEDIATE RELEASE, 7am 11 February 2016

SOLO OIL PLC

("Solo" or the "Company")

Further Investment, Kiliwani North, Tanzania

Solo today announces that further to the various agreements

previously announced with Aminex plc ("Aminex") to acquire a

further interest in the Kiliwani North Development Licence ("KNDL")

Solo has agreed to increase its interest to 10%. Solo currently

holds a 6.175% interest in the KNDL where the Kiliwani North-1 well

is located and will pay Aminex US$2.16 million to increase its

holding by 3.825% to 10%.

The Gas Sales Agreement ("GSA") with the Tanzanian Petroleum

development Corporation ("TDPC") was signed in early January and

commissioning of the Kiliwani North-1 well ("KN-1") has been

underway over the last few weeks with gas production expected to

commence shortly. KN-1 gas will initially be used to commission the

new Songo Songo gas treatment plant before being transported by

pipeline to Dar es Salaam where it will be sold into the local

Tanzanian market at an agreed price of approximately US$3.07 per

mscf.

Aminex obtained approvals, including those from the Tanzanian

authorities, for a disposal of up to 13% in KNDL to Solo in early

2015. No further approvals are expected in relation to this

transaction.

In 2015 LR Senergy ascribed gross 28 billion cubic feet best

estimate contingent resources to Kiliwani North-1, which was

contingent on completion of the GSA, which has now occurred. It is

therefore Solo's expectation that reserves at Kiliwani North will

be booked later this year.

Neil Ritson, Solo's Chairman, commented:

"In order to balance various opportunities to deploy cash in the

Solo business we have elected to increase our interest in Kiliwani

North by just under 4 percent, slightly less than the maximum of 6

percent available to us under the option agreement signed last

year. Solo will receive 10% of the KNDL revenue once the purchase

is completed. Gas production at KN-1 is expected to commence

shortly."

The key terms of the proposed KNDL acquisition are set out

below:

1. Solo has agreed to reduce its option to acquire a further

6.175% in the KNDL in the Second Tranche Acquisition as originally

announced 14 October 2014 and modified by TPDC Back-in announced on

5 October 2015.

2. The Second Tranche Acquisition will now consist of Solo

acquiring a further 3.825% of the KNDL from Aminex for a

consideration of US$2,168,000.

3. The parties have agreed to enter into a formal sale and

purchase agreement ("SPA") within 30 days.

4. Solo will pay US$500,000 on signature of the SPA and the

balance on or before 30 April 2016, unless otherwise agreed between

the parties.

Current participants in the Kiliwani North Development Licence,

following TPDC back in, are: Ndovu Resources Ltd (Aminex) 55.575%

(operator), RAK Gas LLC 23.75%, Solo Oil plc 6.175%, Bounty Oil

& Gas NL 9.05% and TPDC 5%. On completion of the SPA Aminex

will hold 51.75% and Solo will hold 10%.

Qualified Person's Statement:

The information contained in this announcement has been reviewed

and approved by Neil Ritson, Chairman and Director for Solo Oil Plc

who has over 38 years of relevant experience in the energy sector.

Mr. Ritson is a member of the Society of Petroleum Engineers, an

Active Member of the American Association of Petroleum Geologists

and is a Fellow of the Geological Society of London.

For further information:

Solo Oil plc

Neil Ritson

Fergus Jenkins +44 (0) 20 3794 9230

Beaumont Cornish Limited

Nominated Adviser and

Joint Broker

Roland Cornish +44 (0) 20 7628 3396

Shore Capital

Joint Broker

Pascal Keane

Jerry Keen (Corporate

Broker)

Bell Pottinger

Public Relations

Henry Lerwill

Cassiopeia Services

LLP +44 (0) 20 7408 4090

Investor Relations +44 (0) 20 3772 2500

Stefania Barbaglio +44 (0) 79 4969 0338

Glossary:

bcf billion cubic feet

--------------------- -----------------------------------------------------------------------------------------------

contingent resources those quantities of petroleum estimated, as of a given date, to be potentially recoverable

from known accumulations, but the applied project(s) are not yet considered mature enough

for commercial development due to one or more contingencies

--------------------- -----------------------------------------------------------------------------------------------

GSA gas sales agreement

--------------------- -----------------------------------------------------------------------------------------------

mscf thousand standard cubic feet

--------------------- -----------------------------------------------------------------------------------------------

mmscfd million standard cubic feet of gas per day

--------------------- -----------------------------------------------------------------------------------------------

reserves reserves are defined by the SPE as those quantities of petroleum, here oil and gas, which

are anticipated to be commercially recovered from known accumulations from a given date

forward

--------------------- -----------------------------------------------------------------------------------------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

AGRBIGDDRSBBGLG

(END) Dow Jones Newswires

February 11, 2016 02:00 ET (07:00 GMT)

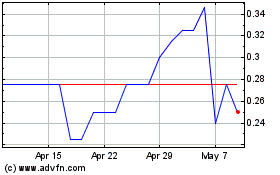

Scirocco Energy (LSE:SCIR)

Historical Stock Chart

From Aug 2024 to Sep 2024

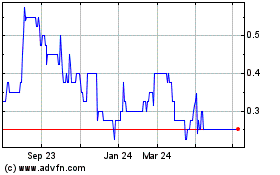

Scirocco Energy (LSE:SCIR)

Historical Stock Chart

From Sep 2023 to Sep 2024