Sally Holdings LLC (the “Company”), a wholly-owned subsidiary of

Sally Beauty Holdings, Inc. (NYSE: SBH), today announced that it

intends to sell, in a registered public offering, $750.0 million

aggregate principal amount of Senior Notes due 2025 (the “Senior

Notes”). The Senior Notes will be guaranteed by Sally Beauty

Holdings, Inc., Sally Investment Holdings LLC and the Company’s

domestic subsidiaries who have guaranteed obligations under its

senior secured revolving credit facility and its existing

notes.

The Company intends to use the net proceeds from this offering,

together with cash on hand and/or additional borrowings, to redeem

all $750.0 million aggregate principal amount of its 6.875% senior

notes due 2019 at a redemption premium equal to 103.438% of the

outstanding principal amount being redeemed plus accrued and unpaid

interest to, but not including, the redemption date and to pay fees

and expenses incurred in connection with the offering and the

redemption. The Company expects to complete the redemption on

December 18, 2015, subject to certain conditions, including the

consummation of the offering of the Senior Notes.

BofA Merrill Lynch; J.P. Morgan; Wells Fargo Securities; Credit

Suisse; Deutsche Bank Securities; Goldman, Sachs & Co.; and RBC

Capital Markets are serving as joint book-running managers for the

offering.

A shelf registration statement (including a prospectus and a

preliminary prospectus supplement) relating to the offering has

previously been filed with the Securities and Exchange Commission

and has become effective. Before investing, you should read the

prospectus, the preliminary prospectus supplement and other

documents filed with the Securities and Exchange Commission for

information about the Company and the offering. Copies of the

prospectus and related supplement may be obtained by contacting any

of the joint book-running managers whose contact information is

listed at the bottom of this announcement. You may also obtain

these documents free of charge by visiting the Securities and

Exchange Commission's website at www.sec.gov.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of such jurisdiction. This

press release shall not constitute a notice of redemption with

respect to the notes being redeemed.

About Sally Beauty Holdings, Inc.

Sally Beauty Holdings, Inc. is an international specialty

retailer and distributor of professional beauty supplies with

revenues of $3.8 billion annually. Through the Sally Beauty Supply

and Beauty Systems Group businesses, the Company sells and

distributes through 5,000 stores, including approximately 175

franchised units, throughout the United States, the United Kingdom,

Belgium, Chile, Colombia, Peru, France, the Netherlands, Canada,

Puerto Rico, Mexico, Ireland, Spain and Germany. Sally Beauty

Supply stores offer up to 10,000 products for hair, skin, and nails

through professional lines such as Clairol, L’Oreal, Wella and

Conair, as well as an extensive selection of proprietary

merchandise. Beauty Systems Group stores, branded as CosmoProf or

Armstrong McCall stores, along with its outside sales consultants,

sell up to 10,000 professionally branded products including Paul

Mitchell, Wella, Sebastian, Goldwell, Joico, and Aquage which are

targeted exclusively for professional and salon use and resale to

their customers.

Cautionary Notice Regarding Forward-Looking

Statements

Any statements of the Company’s expectations in this press

release constitute “forward-looking statements” as defined in the

Private Securities Litigation Reform Act of 1995. Such statements,

including but not limited to, statements regarding senior notes

offering, are based on currently available information and are

subject to various risks and uncertainties that could cause actual

results to differ materially from the Company’s present

expectations.

Readers are cautioned not to place undue reliance on

forward-looking statements as such statements speak only as of the

date they were made. Any forward-looking statements involve risks

and uncertainties that could cause actual events or results to

differ materially from the events or results described in the

forward-looking statements.

Factors that could cause actual events or results to differ

materially from the events or results described in the

forward-looking statements can be found in our most recent Annual

Report on Form 10-K for the fiscal year ended September 30, 2015,

as filed with the Securities and Exchange Commission. Consequently,

all forward-looking statements in this release are qualified by the

factors, risks and uncertainties contained therein. We assume no

obligation to publicly update or revise any forward-looking

statements.

Joint book-running managers: BofA Merrill Lynch 222 Broadway

New York, NY 10038 Attention: Prospectus Department

Email: dg.prospectus_requests@baml.com

J.P. Morgan c/o Broadridge Financial Solutions 1155 Long

Island Avenue Edgewood, NY 11717 Attention: Post Sale Fulfillment

Telephone: 866-803-9204 Wells Fargo Securities, LLC Attn:

Client Support 608 2nd Avenue South Minneapolis, MN 55402

Telephone:(800) 645-3751 Opt 5

Email:

wfscustomerservice@wellsfargo.com

Credit Suisse Credit Suisse Prospectus Department, One

Madison Avenue New York, New York 10010 Telephone: 1-800-221-1037

Deutsche Bank Securities Inc. 60 Wall Street New York, NY

10005-2836 Attention: Prospectus Group Telephone: 1-800-503-4611

Email: prospectuscpdg@db.com

Goldman, Sachs & Co. Prospectus Department 200 West

Street New York, NY 10282 Telephone: 1-866-471-2526, facsimile:

212-902-9316

Email: prospectus-ny@ny.email.gs.com

RBC Capital Markets Attention: High Yield Capital Markets

Three World Financial Center 200 Vesey Street, 10th Floor New York,

NY 10281 Telephone: 1-877-280-1299

Email: CM-USA-PROSPECTUS@rbc.com

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151118005974/en/

Sally Beauty Holdings, Inc.Karen Fugate, 940-297-3877

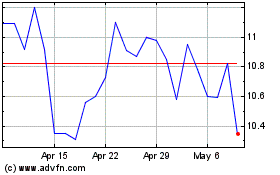

Sally Beauty (NYSE:SBH)

Historical Stock Chart

From Mar 2024 to Apr 2024

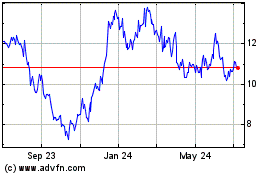

Sally Beauty (NYSE:SBH)

Historical Stock Chart

From Apr 2023 to Apr 2024