Rockhopper Exploration plc Director/PDMR Shareholding (0663K)

April 13 2015 - 11:15AM

UK Regulatory

TIDMRKH

RNS Number : 0663K

Rockhopper Exploration plc

13 April 2015

13 April 2015

Rockhopper Exploration plc

("Rockhopper" or the "Company")

Exercise of Share Options, Allotment of Shares and Awards under

Long Term Incentive Plan

Rockhopper Exploration plc (AIM: RKH), the oil and gas

exploration and production company with interests in the North

Falkland Basin and the Greater Mediterranean region makes the

following announcements in relation to the Unapproved Employee

Share Option Scheme (the "ESOS") and the Long Term Incentive Plan

2013 (the "LTIP"):

Exercises of option and allotment of shares

The Company has been notified of the following exercises of

option on 10(th) April 2015 pursuant to the ESOS:

Name Number of shares Exercise price

subject to per share

option

---------------- ----------------- ---------------

Sam Moody (CEO) 1,500,000 42 pence

---------------- ----------------- ---------------

Pierre Jungels 1,500,000 42 pence

(Chairman)

---------------- ----------------- ---------------

The Company has also been notified of an exercise of option on

10(th) April 2015 by an ex-director in respect of 525,000 shares at

an exercise price of 42 pence per share.

All of the exercised options were due to expire in August 2015

and the optionholders have elected to exercise in one of the few

remaining open periods prior to their expiry.

Mr Moody elected to sell 1,236,472 shares and Dr Jungels elected

to sell 1,222,827 shares to discharge the cost of exercise and any

tax and national insurance obligations. On 13(th) April 2015, these

shares were purchased by the Rockhopper Employee Benefit Trust (the

"EBT"), which was established in 2013 for the purpose of holding

shares to satisfy future exercises of options and vesting of awards

under the LTIP. The 2,459,299 shares are being acquired by the EBT

by way of an off market purchase at a price of 63.25 pence being

the closing share price on the date prior to exercise. The

remaining shares have been retained by Mr Moody and Dr Jungels who

now hold:

Name Number of Number of % of issued

shares retained shares held share capital

following held

exercise

---------------- ----------------- ------------- ---------------

Sam Moody 263,528 2,013,553 0.68

---------------- ----------------- ------------- ---------------

Pierre Jungels 277,173 1,394,817 0.47

---------------- ----------------- ------------- ---------------

The EBT also purchased 434,565 shares from the ex-director at a

price of 63.25 pence per share, the proceeds of which were used to

satisfy his tax and national insurance obligations.

Application has been made for the admission of 3,525,000 new

ordinary shares of 1p each ("New Ordinary Shares") to trading on

AIM pursuant to the exercise of share options. The New Ordinary

Shares will rank pari passu in all respects with the existing

ordinary shares of the Company.

Following the issue of the New Ordinary Shares, the issued share

capital will comprise 296,451,305 ordinary shares.

The New Ordinary Shares are due to be admitted to trading on AIM

on 17 April 2015.

LTIP awards

The Company announces that on 13 April 2015 certain Directors

were granted awards in the form of options to acquire the number of

Shares in the capital of the Company under the Company's Long Term

Incentive Plan (LTIP) which has been operated annually since its

approval by shareholders at the 2013 Annual General Meeting.

Details of the awards are shown below:

Name Number of options under

award

------------------------- ------------------------

Sam Moody (CEO) 855,354

------------------------- ------------------------

Stewart MacDonald (CFO) 701,575

------------------------- ------------------------

Fiona MacAulay (COO) 750,591

------------------------- ------------------------

The awards are structured as nil-cost options and will normally

vest on 31 March 2018 subject to each director's continued

employment. The percentage of awards which will vest will be

dependent on total shareholder return measured against a peer group

of companies over a three year period ending 31 March 2018.

Performance measurement for these awards will be based on the

Company's average share price over the 90 day dealing period to 31

March 2015 measured against the 90 day dealing period to 31 March

2018. Once vested the awards will normally remain exercisable for a

period of seven years subject to the rules of the LTIP regarding

leavers.

A summary of the LTIP is included in the 2013 AGM notice which

can be found on the Company's website.

For further information, please contact:

Rockhopper Exploration plc

Tel: (via Vigo Communications) - 020 7016 9571

Jan Davies - Company Secretary

Canaccord Genuity Limited (NOMAD and Joint Broker)

Tel: 020 7523 8000

Henry Fitzgerald-O'Connor

This information is provided by RNS

The company news service from the London Stock Exchange

END

RDSLLFLESFIVLIE

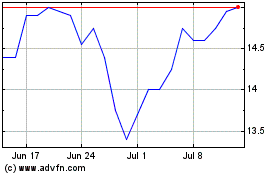

Rockhopper Exploration (LSE:RKH)

Historical Stock Chart

From Mar 2024 to Apr 2024

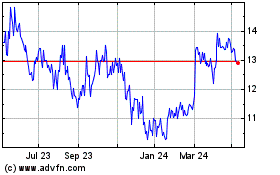

Rockhopper Exploration (LSE:RKH)

Historical Stock Chart

From Apr 2023 to Apr 2024