Robbins Geller Rudman & Dowd LLP Files Class Action Suit against VOXX International Corporation

July 08 2014 - 1:55PM

Business Wire

Robbins Geller Rudman & Dowd LLP (“Robbins Geller”)

(http://www.rgrdlaw.com/cases/voxx/) today announced that a class

action has been commenced in the United States District Court for

the Eastern District of New York on behalf of purchasers of VOXX

International Corporation (“VOXX” or the “Company”) (Nasdaq:VOXX)

common stock between May 15, 2013 and May 14, 2014, inclusive (the

“Class Period”), seeking to pursue remedies under the Securities

Exchange Act of 1934 (the “Exchange Act”).

If you wish to serve as lead plaintiff, you must move the Court

no later than 60 days from today. If you wish to discuss this

action or have any questions concerning this notice or your rights

or interests, please contact plaintiff’s counsel, Samuel H. Rudman

or David A. Rosenfeld of Robbins Geller at 800/449-4900 or

619/231-1058, or via e-mail at djr@rgrdlaw.com. If you are a member

of this class, you can view a copy of the complaint as filed or

join this class action online at

http://www.rgrdlaw.com/cases/voxx/. Any member of the putative

class may move the Court to serve as lead plaintiff through counsel

of their choice, or may choose to do nothing and remain an absent

class member.

The complaint charges VOXX and certain of its officers and

directors with violations of the Exchange Act. VOXX, together with

its subsidiaries, operates as a manufacturer and distributor in the

automotive, premium audio, and consumer accessories industries in

the United States and internationally. The Company operates in

three different segments: (a) Automotive, which includes rear seat

entertainment systems, satellite radio products, remote start

systems, digital TV tuners, mobile antennas, and other multi-media

applications. Some of the Company’s brands in this segment include

Jensen®, Advent®, Audiovox®, Mac Audio®, Code Alarm®, InVision®,

and Hirschmann; (b) Premium Audio, which includes home theater

systems, high-end loudspeakers, outdoor speakers, sound bars, sound

bases and headphones. Some of the Company’s brands in this segment

include Klipsch®, Jamo®, Energy®, Heco® and Magnat®; and (c)

Consumer Accessories, which includes universal remote controls,

reception products, indoor Bluetooth speakers, outdoor iPod docks,

and other connectivity and charging applications. Some of the

Company’s brands in this segment include RCA, Acoustic Research,

Terk®, Audiovox®, Schwaiger® and Oehlbach®.

The complaint alleges that, during the Class Period, VOXX issued

materially false and misleading statements regarding the Company’s

financial performance and future prospects and failed to disclose

the following adverse facts: (i) that the Company was experiencing

declining headphone sales in its Premium Audio segment; (ii) that

the Company was experiencing a greater than expected sales decline

in its Consumer Accessories segment; (iii) that the Company failed

to timely record losses for its Hirschmann, Invision and Klipsch

acquisitions, trademarks of various brands, and its Technuity

business, among other things, thereby materially overstating the

Company’s financial condition and misstating the Company’s

financial results and financial statements; and (iv) as a result of

the foregoing, Defendants lacked a reasonable basis for their

positive statements about the Company’s financial performance and

outlook during the Class Period.

On January 9, 2014, the Company held a conference call with

analysts and investors. With regard to the Company’s outlook for

fiscal 2014, Defendants lowered their sales guidance from $840

million to $825-$830 million, raised their EBITDA guidance from $62

million to $65 million, and reiterated their gross margin guidance

of 28.8%. In reaction to these announcements, the price of VOXX

common stock fell $2.99 per share, or 18%, to close at $14.00 per

share, on heavy trading volume.

On May 14, 2014, after the markets closed, VOXX announced its

financial results for the fourth quarter and year end of 2014, the

period ending February 28, 2014. For the year, the Company reported

net sales of $809.7 million, gross margin of 28.4%, and EBITDA of

$54.5 (minus any impairment charges) – all below the Company’s

stated guidance. Moreover, the Company reported an impairment

charge of $57.6 million related to its Hirschmann, Invision and

Klipsch acquisitions, trademarks of various brands, and its

Technuity business, among other things. In reaction to these

announcements, the price of VOXX common stock fell $2.56 per share,

or 25%, to close at $7.51 per share, on heavy trading volume.

Plaintiff seeks to recover damages on behalf of all purchasers

of VOXX common stock during the Class Period (the “Class”). The

plaintiff is represented by Robbins Geller, which has expertise in

prosecuting investor class actions and extensive experience in

actions involving financial fraud.

Robbins Geller, with more than 200 lawyers in 10 offices,

represents U.S. and international institutional investors in

contingency-based securities and corporate litigation. The firm has

obtained many of the largest securities class action recoveries in

history, including the largest jury verdict ever in a securities

class action. Please visit http://www.rgrdlaw.com for more

information.

Robbins Geller Rudman & Dowd LLPSamuel H. Rudman,

800-449-4900orDavid A. Rosenfelddjr@rgrdlaw.com

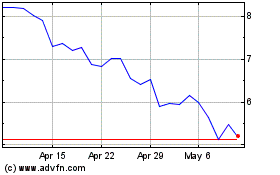

VOXX (NASDAQ:VOXX)

Historical Stock Chart

From Mar 2024 to Apr 2024

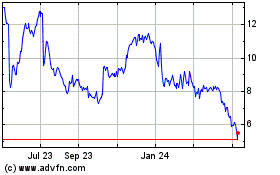

VOXX (NASDAQ:VOXX)

Historical Stock Chart

From Apr 2023 to Apr 2024