SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2017

(Commission File No. 001-32221) ,

GOL LINHAS AÉREAS INTELIGENTES S.A.

(Exact name of registrant as specified in its charter)

GOL INTELLIGENT AIRLINES INC.

(Translation of Registrant's name into English)

Praça Comandante Linneu Gomes, Portaria 3, Prédio 24

Jd. Aeroporto

04630-000 São Paulo, São Paulo

Federative Republic of Brazil

(Address of Regristrant's principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicated below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

|

Earnings Release

|

GOL Reports Net Revenues of R$2.7bn and EPS of R$(0.09) for 4Q16

Brazil's No. 1 Airline Reports full-year Operating Margin of 7.1% and EPS of R$3.17

São Paulo, February 17, 2017

- GOL Linhas Aéreas Inteligentes S.A. (“GLAI”), (NYSE: GOL and BM&FBOVESPA: GOLL4), Brazil's No. 1 airline, announces today its consolidated results for the fourth quarter (4Q16) and the full year of 2016. All information is presented in accordance with International Financial Reporting Standards (IFRS) and in Brazilian Reais (R$), and all comparisons are with the fourth quarter and full year of 2015 unless otherwise stated.

Operating and Financial Highlights

|

|

Operating result (EBIT) in 4Q16 was R$198.2 million, representing and EBIT margin of 7.4%. Full year 2016 EBIT reached R$696.5 million, representing a margin of 7.1%. Net cash flow in 4Q16 was R$93.8 million. Cash, cash equivalents, short-term investments and accounts receivable totaled R$1,922.4 million, an increase of R$93.7 million over 3Q16.

|

Operating cost per ASK (CASK), excluding non-operating expenses, decreased 10.1% from 21.94 cents (R$) in 4Q15 to 19.73 cents (R$) in 4Q16. Non-fuel CASK, excluding non-operating expenses, decreased 6.8% to 13.97 cents (R$) mainly due to lower level of aircraft rent per ASK

|

RPKs decreased 3.0% from 9,440 million in 4Q15 to 9,161 million in 4Q16. ASKs decreased by 5.7% from 12,518 million in 4Q15 to 11,800 million in 4Q16.

Average load factor increased 2.2 percentage points to 77.6% and average passenger yields increased 3.8% to 25.57 cents (R$), resulting in RASK of 22.58 cents (R$), a 6.6% increase versus 4Q15

. Average fares were R$289.0.

|

|

Contacts

Email:

ri@voegol.com.br

Tel:

+55 (11) 2128-4700

Site:

www.voegol.com.br/ri

4Q16 Earnings Calls

Date: Friday

February 17, 2017

In English

11:30 a.m. (US EST)

02:30 p.m. (Brazil)

Phone: +1 (412) 317-5453

Code: GOL

Replay: +1 (412) 317-0088

Replay Code: 10098733

In Portuguese

04:00 p.m. (Brazil)

01:00 p.m. (US EST)

Phone: +55 (11) 3193-1001

+55

(11) 2820-4001

Code: GOL

Replay: +55 (11) 3193-1012

Replay Code: 1744820#

Live webcast

www.voegol.com.br/ri

|

|

Net revenues reached R$2.7 billion, representing growth of 0.5%. Revenue per aircraft of US$6.3 million represented a high level of aircraft revenue productivity. Ancillary and cargo revenues decreased by 1.3% over 4Q15 to R$321.7 million, representing 12.1% of total net revenue. In the full year of 2016, ancillary and cargo revenues totaled R$1.2 billion.

|

GOL transported a total of 8.1 million passengers in 4Q16, and 15.4% decrease over 4Q15, and GOL’s market share of the domestic and international regular air transportation at the end of 4Q16 was 36.3% and 10.6%, respectively, up from 35.8% and 12.3% and the end of 4Q15.

|

On-time arrivals and flight completion averaged, respectively, 94.0% and 98.3% (ANAC data) during 4Q16. In 2016, GOL was the most on-time airline in Brazil according to OAG (Official Airline Guide). Passenger complaints and lost baggage per 1,000 passengers averaged 1.7329 and 2.15, respectively.

|

1

|

|

GOL Linhas Aéreas Inteligentes S.A.

|

|

Earnings Release

|

|

Five Boeing 737 aircraft were returned to lessors during 4Q16, reducing the total fleet to 121 operating aircraft. Seven 737s will be returned during 1Q17. Total debt was reduced by R$2.9 billion during 2016 to R$6,379.2 billion.

|

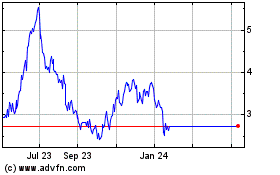

GOL’s ADRs had an average daily trading volume of US$3.7 million during 4Q16, as compared to US$493 thousand in 4Q15. GOL’s PNs had an average daily trading volume of R$19.5 million during 4Q16, as compared to R$4.4 million in 4Q15.

|

During 2016, for the 11

th

consecutive year, GOL conducted its 404 certification process. GOL was one of the first foreign private issuers to assess the effectiveness of the Company’s internal control over financial reporting and meet the requirements of Section 404 of the Sarbanes-Oxley Act of 2002.

Management’s Comments on Results

As previously guided, GOL’s load factors in the Brazilian summer have remained high and yields have risen as result of GOL’s network and fleet restructuring completed during the year to adjust capacity to the Brazilian economic contraction. GOL responded to the weaker environment by continuing to improve customer experience and cutting costs.

In the fourth quarter of 2016 GOL improved its high service quality and achieved net revenues of R$2.7 billion and continued to rationalize operations. While reducing the number of seats available for sale by 17%, full-year 2016 net revenues were a record R$10 billion, a result made possible due the flight network restructuring effected in May 2016. According to the ANAC, in 2016 GOL was the leading airline in the Brazilian domestic market with a share of 36% of RPKs (passenger demand per kilometers). According to ABRACORP - Brazilian Association of Travel Agencies, GOL was the leader in market share and number of tickets issued and sold to corporate clients.

“GOL further consolidated its position as Brazil’s No. 1 airline. The dedication and teamwork of GOL’s employees contributed to improved operating results in the fourth quarter,” commented GOL’s CEO Paulo Kakinoff. GOL is proud of its status as Brazil’s lowest cost carrier for the 16

th

consecutive year based its standardized single fleet generating smaller crew costs, smart spare parts management and best in class maintenance and lean and productive operations, low fixed costs. The Company’s order for new B-737 MAX 8s and investments in technology will maintain its cost leadership.

The Company strives to provide the best overall flying experience to its clients. GOL was most on-time airline in 2016 in the Brazilian market, with an 84.6% rating, according to OAG (Official Airline Guide), a specialized independent company that monitored over 54 million flights worldwide. For the fourth consecutive year, GOL remained the most on-time Brazilian airline with a 94.8% rate of flights taking off on schedule, according to the data from Infraero and airports concessionaires, which considers as a delay any departure with a delay of over 30 minutes.

The Company’s 4Q16 operating profit (EBIT) registered R$198 million with an operating margin of 7.4%. In 4Q16, GOL increased aircraft utilization rates while maintaining market cost leadership. Passengers transported in 4Q16 decreased 15.4% over 4Q15. GOL’s load factor increased 2.2 percentage points to 77.6% due to the maturity of the new network launched in May 2016 that achieved a 19.0% reduction in seats availability in the period. Aircraft utilization was at 11.7 block hours per day (increases 5.7% over 4Q15). Operating costs per ASK, excluding fuel and non-operating expenses, decreased approximately 6.8% to 13.97 cents (R$). Fuel costs per available seat kilometer (ASK) decreased 17.3% to 5.75 cents (R$). Cost reductions per ASK were

driven by lower aircraft rent expenses due to fleet restructuring. “Our absolute market cost leadership is key to our value proposition and allowed us to provide the best fares and service in the market, even during a challenging industry environment,” added Richard Lark, GOL’s CFO.

|

2

|

|

GOL Linhas Aéreas Inteligentes S.A.

|

|

Earnings Release

|

Full year operating profit (EBIT) registered R$697 million, with the EBIT margin registering 7.1%. In 4Q16, the EBIT was R$198 million with an EBIT margin of 7.4% compared to a negative 3.6% margin in 4Q15.

In terms of future perspectives, besides maintain high levels of productivity and profitability, short-term results will be driven by the maintenance of capacity discipline. GOL remains committed to its strategy of profitable growth based on a low cost structure and high quality customer service. “We are proud that almost 400 million passengers have chosen to fly GOL, and we continue to make every effort to offer our customers the best in air travel: new, modern aircraft, frequent flights in major markets, an integrated route system and low fares, all of which is made possible by our dedicated team of employees who are the key to our success,” stated CEO Kakinoff. “By remaining focused on our low-cost business model, while continuing to grow, innovate and provide low fares, we will create value for our customers, employees and shareholders.”

|

3

|

|

GOL Linhas Aéreas Inteligentes S.A.

|

|

Earnings Release

|

Operating and Financial Indicators

|

Traffic data – GOL

|

4Q16

|

4Q15

|

% Var.

|

2016

|

2015

|

% Var.

|

|

RPK GOL – Total

|

9,161

|

9,440

|

-3.0%

|

35,928

|

38,410

|

-6.5%

|

|

RPK GOL – Domestic

|

8,230

|

8,415

|

-2.2%

|

32,031

|

33,901

|

-5.5%

|

|

RPK GOL – International

|

931

|

1,025

|

-9.1%

|

3,897

|

4,509

|

-13.6%

|

|

ASK GOL – Total

|

11,800

|

12,518

|

-5.7%

|

46,329

|

49,742

|

-6.9%

|

|

ASK GOL – Domestic

|

10,568

|

11,071

|

-4.5%

|

41,104

|

43,447

|

-5.4%

|

|

ASK GOL – International

|

1,232

|

1,447

|

-14.9%

|

5,226

|

6,295

|

-17.0%

|

|

GOL Load Factor – Total

|

77.6%

|

75.4%

|

2.2 p.p

|

77.5%

|

77.2%

|

0.3 p.p

|

|

GOL Load Factor - Domestic

|

77.9%

|

76.0%

|

1.9 p.p

|

77.9%

|

78.0%

|

-0.1 p.p

|

|

GOL Load Factor - International

|

75.6%

|

70.8%

|

4.8 p.p

|

74.6%

|

71.6%

|

2.9 p.p

|

|

Operating data

|

4Q16

|

4Q15

|

% Var.

|

2016

|

2015

|

% Var.

|

|

Average Fare (R$)

|

289.0

|

242.7

|

19.0%

|

265.2

|

220.7

|

20.1%

|

|

Revenue Passengers - Pax on board ('000)

|

8,106.1

|

9,583.5

|

-15.4%

|

32,622.8

|

38,867.9

|

-16.1%

|

|

Aircraft Utilization (Block Hours/Day)

|

11.7

|

11.1

|

5.7%

|

11.2

|

11.3

|

-1.0%

|

|

Departures

|

63,860

|

79,377

|

-19.5%

|

261,514

|

315,902

|

-17.2%

|

|

Average Stage Length (km)

|

1,084

|

933

|

16.2%

|

1,043

|

933

|

11.7%

|

|

Fuel Consumption (mm liters)

|

350

|

391

|

-10.7%

|

1,391

|

1,551

|

-10.3%

|

|

Full-time Employees (at period end)

|

15,261

|

16,472

|

-7.4%

|

15,261

|

16,472

|

-7.4%

|

|

Average Operating Fleet

|

112

|

132

|

-14,9%

|

117

|

129

|

-9,1%

|

|

On-time Arrivals

|

94.0%

|

95,1%

|

-1.1 p.p

|

94.8%

|

95.4%

|

-0.6 p.p

|

|

Flight Completion

|

98.3%

|

90.9%

|

7.4 p.p

|

94.2%

|

91.9%

|

2.3 p.p

|

|

Passenger Complaints (per 1000 pax)

|

1.7329

|

1.7061

|

1.6%

|

1.9960

|

2.0379

|

-3.5%

|

|

Lost Baggage (per 1000 pax)

|

2.15

|

2.13

|

0.9%

|

2.23

|

2.64

|

-15.5%

|

|

Financial data

|

4Q16

|

4Q15

|

% Var.

|

2016

|

2015

|

% Var.

|

|

Net YIELD (R$ cents)

|

25.57

|

24.64

|

3.8%

|

24.14

|

22.35

|

8.0%

|

|

Net PRASK (R$ cents)

|

19.85

|

18.58

|

6.8%

|

18.72

|

17.26

|

8.5%

|

|

Net RASK (R$ cents)

|

22.58

|

21.19

|

6.6%

|

21.30

|

19.66

|

8.3%

|

|

CASK (R$ cents)

|

20.93

|

21.94

|

-4.6%

|

19.79

|

20.02

|

-1.1%

|

|

CASK ex-fuel (R$ cents)

|

15.17

|

14.99

|

1.2%

|

13.97

|

13.38

|

4.4%

|

|

CASK (R$ cents) adjusted

4

|

19.73

|

21.94

|

-10.1%

|

19.74

|

20.02

|

-1.4%

|

|

CASK ex-fuel (R$ cents)

adjusted

4

|

13.97

|

14.99

|

-6.8%

|

13.92

|

13.38

|

4.0%

|

|

Breakeven Load Factor

|

72.0%

|

78.1%

|

-6.1 p.p

|

72.1%

|

78.6%

|

-6.5 p.p

|

|

Average Exchange Rate

1

|

3.2953

|

3.8441

|

-14.3%

|

3.4878

|

3.3313

|

4.7%

|

|

End of period Exchange Rate

1

|

3.2591

|

3.9048

|

-16.5%

|

3.2591

|

3.9048

|

-16.5%

|

|

WTI (avg. per barrel, US$)

2

|

49.3

|

42.2

|

16.9%

|

43.4

|

48.8

|

-11.1%

|

|

Price per liter Fuel (R$)

3

|

1.94

|

2.22

|

-12.7%

|

1.94

|

2.13

|

-8.7%

|

|

Gulf Coast Jet Fuel (avg. per liter, US$)

2

|

0.38

|

0.34

|

11.3%

|

0.33

|

0.40

|

-18.6%

|

1. Source: Central Bank; 2. Source: Bloomberg; 3. Fuel expenses/liters consumed; 4. Excluding non-recurring results on return of aircraft under finance lease contracts and sale-leaseback transactions; 5. Traffic operational data for 2015 were updated according to information obtained on the website of the National Civil Aviation Agency (ANAC) * *Certain variation calculations in this report may not match due to rounding.

|

4

|

|

GOL Linhas Aéreas Inteligentes S.A.

|

|

Earnings Release

|

Domestic market – GOL

Domestic supply decreased by 4.5% in the quarter and 5.4% from January to December of 2016 compared to the same period of 2015, reflecting the network adjustments in May 2016.

Domestic demand decreased by 2.2% in 4Q16 and 5.5% in 2016, resulting in a domestic load factor of 77.9%, an increase of 1.9 p.p. compared to 4Q15, and a decrease of 0.1 p.p. compared to 2015.

GOL transported 7.7 million passengers in the domestic market in the quarter and 30.7 million in the full year, representing a decrease of 15.8% and 16.4%, respectively, when compared to the same periods in 2015. The Company is the leaderin the number of transported passengers in Brazil’s domestic aviation market.

International market - GOL

GOL’s international supply decreased 14.9% in the quarter and 17.0% in 2016, compared to 2015. International demand showed a decrease of 9.1% between October and December, registering load factor of 75.6%, and, in 2016, a decrease of 13.6%, leading the international load factor to 74.6%.

During the quarter, GOL transported 454.1 thousand passengers in the international market, 8.3% less than in 2015. For 2016, the Company transported 1,885.7 thousand passengers, a decrease of 10.2% compared to the same period in 2015.

Volume of departures and Total seats - GOL

The volume of departures in the overall system was reduced by 19.5% and 17.2% in the fourth quarter and full year of 2016, respectively,

in line with the guidance released for 2016 of approximately a 17% reduction

. The total number of seats available of the market fell 19.0% in 4Q16 and 16.9% in 2016, also

in line with the guidance released for 2016 of approximately a 17% reduction

.

PRASK, Yield and RASK

Net PRASK grew by 6.8% and 8.5%,

RASK improved 6.6% and 8.3%

and yield increased by 3.8% and 8.0%, in comparison with 4Q15 and 2015, respectively.

It is worth noting the ASK decreased 5.7% in the quarter and 6.9% from January to December of 2016.

|

5

|

|

GOL Linhas Aéreas Inteligentes S.A.

|

|

Earnings Release

|

Income statement in IFRS (R$ MM)

|

Income statement (R$ MM)

|

4Q16

|

4Q15

|

% Var.

|

2016

|

2015

|

% Var.

|

|

Net operating revenues

|

2,664.0

|

2,652.1

|

0.5%

|

9,867.3

|

9,778.0

|

0.9%

|

|

Passenger

|

2,342.3

|

2,326.2

|

0.7%

|

8,671.4

|

8,583.4

|

1.0%

|

|

Cargo and Other

|

321.7

|

325.9

|

-1.3%

|

1,195.9

|

1,194.6

|

0.1%

|

|

Operating Costs and Expenses

|

(2,469.3)

|

(2,746.8)

|

-10.1%

|

(9,169.5)

|

(9,957.8)

|

-7.9%

|

|

Salaries, wages and benefits

|

(480.3)

|

(384.9)

|

24.8%

|

(1,656.8)

|

(1,580.5)

|

4.8%

|

|

Aircraft fuel

|

(678.7)

|

(870.3)

|

-22.0%

|

(2,695.4)

|

(3,301.4)

|

-18.4%

|

|

Aircraft rent

|

(120.4)

|

(377.2)

|

-68.1%

|

(996.9)

|

(1,100.1)

|

-9.4%

|

|

Sales and marketing

|

(168.5)

|

(171.7)

|

-1.9%

|

(556.0)

|

(617.4)

|

-9.9%

|

|

Landing fees

|

(170.7)

|

(179.0)

|

-4.7%

|

(687.4)

|

(681.4)

|

0.9%

|

|

Aircraft and traffic servicing

|

(275.3)

|

(282.2)

|

-2.4%

|

(1,068.2)

|

(1,019.8)

|

4.7%

|

|

Maintenance materials and repairs

|

(203.3)

|

(207.8)

|

-2.2%

|

(593.1)

|

(603.9)

|

-1.8%

|

|

Depreciation and amortization

|

(121.9)

|

(117.0)

|

4.2%

|

(447.7)

|

(419.7)

|

6.7%

|

|

Other

|

(250.1)

|

(156.6)

|

59.7%

|

(468.1)

|

(633.6)

|

-26.1%

|

|

Equity Income

|

3.4

|

(0.6)

|

NM

|

(1.3)

|

(3.9)

|

-67.5%

|

|

Operating Result (EBIT)

|

198.2

|

(95.3)

|

NM

|

696.5

|

(183.8)

|

NM

|

|

EBIT Margin

|

7.4%

|

-3.6%

|

11.0 p.p

|

7.1%

|

-1.9%

|

9.0 p.p

|

|

Other Financial Income (expense)

|

(163.6)

|

(710.7)

|

-77.0%

|

664.9

|

(3,263.3)

|

NM

|

|

Interest on loans

|

(173.9)

|

(300.3)

|

-42.1%

|

(787.7)

|

(885.6)

|

-11.1%

|

|

Gains from financial investments

|

30.9

|

32.6

|

-5.0%

|

147.9

|

133.7

|

10.6%

|

|

Exchange and monetary variations

|

(29.8)

|

(257.9)

|

-88.5%

|

1,367.9

|

(2,267.0)

|

NM

|

|

Derivatives net results

|

38.6

|

(17.9)

|

NM

|

(156.8)

|

50.2

|

NM

|

|

Other expenses (revenues), net

|

(29.4)

|

(167.1)

|

-82.4%

|

93.5

|

(294.6)

|

NM

|

|

Income (Loss) before income taxes

|

34.7

|

(806.0)

|

NM

|

1,361.4

|

(3,447.1)

|

NM

|

|

Pre-tax Income Margin

|

1.3%

|

-30.4%

|

31.7 p.p

|

13.8%

|

-35.3%

|

49.1 p.p

|

|

Income Tax

|

(64.8)

|

(324.0)

|

-80.0%

|

(259.1)

|

(844.1)

|

-69.3%

|

|

Current income tax

|

(68.7)

|

(45.4)

|

51.4%

|

(257.9)

|

(196.1)

|

31.5%

|

|

Deferred income tax

|

3.9

|

(278.6)

|

NM

|

(1.1)

|

(648.0)

|

-99.8%

|

|

Net income (loss)

|

(30.2)

|

(1,130.0)

|

-97.3%

|

1,102.4

|

(4,291.2)

|

NM

|

|

Net Margin

|

-1.1%

|

-42.6%

|

41.5 p.p

|

11.2%

|

-43.9%

|

55.1 p.p

|

|

Earnings per Share (EPS) in R$

|

(0.09)

|

(3.25)

|

-97.3%

|

3.17

|

(12.36)

|

NM

|

|

Weighted average shares outstanding MM

|

347.2

|

347.2

|

NM

|

347.2

|

347.2

|

NM

|

|

Earnings per ADS Equivalent in US$

|

(0.003)

|

(0.08)

|

-96.8%

|

0.09

|

(0.37)

|

NM

|

|

Weighted average ADSs outstanding MM

|

34.7

|

34.7

|

NM

|

34.7

|

34.7

|

NM

|

*

Certain variation calculations in this report may not match due to rounding.

|

6

|

|

GOL Linhas Aéreas Inteligentes S.A.

|

|

Earnings Release

|

Net revenue

4Q16 net operating revenues, principally revenues from passenger transportation, increased 0.5% to R$2.7 billion primarily due to the increase of 19.0% in average fare, offset by the reduction of 18.8% in available seats. In 4Q16, RPK decrease was driven by a 16.2% increase in stage length and an increase in load factor from 75.4% to 77.6%, partially offset by a 19.5% decrease in departures. RPKs decreased to 9.2 billion and revenue passengers grew to R$2,342.3 million.

Average fares increased 19.0% from R$242.7 to R$289.0 and yields increases 3.8% to 25.57 cents (R$) per passenger kilometer, mainly due to a 16.2% increase in stage length.

The 5.7% capacity reduction, represented by ASKs, was facilitated by the reduction of 20 average operating fleet as compared to the quarter of the previous year (from 132 to 112 aircraft) that drove the ASK decrease.

Complementing operating revenues, gross cargo transportation revenue increased from R$86.0 million to R$91.5 million, and Smiles revenues increased from R$349.0 million to R$449.4 million.

In 2016, total net revenue reached R$9,867.3 million, an increase of 0.9% compared to 2015. In the quarter, total net revenue was R$2,664.0 million, a growth of 0.5%, primarily due to the increase in fares in the period. Passenger revenue was R$8,671.4 million and represented 87.9% of total net revenue in 2016, an increase of 1.0% related to the same period of 2015.

International passenger revenue totaled R$1,472.0 million from January to December of 2016, equivalent to 14.9% of total net revenue and an increase of 32.9% when compared to 2015. This result reflects the adjustments in capacity by 17.0% implemented in the international network of GOL.

Net cargo and ancillary revenue was R$1,195.9 million in 2016, representing 12.1% of total net revenue and an increase of 0.1% compared to the previous year, due to the supply increase in 2016.

Operating expenses

In 4Q16, total CASK decreased 4.6% to 20.93 cents (R$), due to lower aircraft rent expenses and a reduction in fuel prices per ASK. Operating expenses per ASK excluding fuel increased by 1.2% to 15.17 cents (R$). Total operating expenses decreased 10.1%, reaching R$2,469.3 million, due to lower aircraft rent expenses, a reduction in fuel prices, reduction in fees paid to agencies and reduction in consulting. Excluding non operating expenses in 4Q16 related to fleet restructuring, CASK was 19.73 cents of Real. Breakeven load factor decreased 6.1 percentage points to 72.0% vs 78.1% in 4Q15.

Operating costs and expenses totaled R$9,169.5 million in 2016, a decrease of 7.9% compared to the previous year and excluding fuel expenses, totaled R$6,474.1 million in the period, representing a reduction of R$182.4 million, or 2.7%, compared to 2015. The cost per ASK (CASK) reached R$19.79 cents, a decrease of 1.1% compared to the same period in 2015.

The breakdown of our costs and operational expenses for 4Q16, 4Q15, 2016 and 2015 is as follows:

|

7

|

|

GOL Linhas Aéreas Inteligentes S.A.

|

|

Earnings Release

|

|

Operating expenses (R$ MM)

|

4Q16

|

4Q15

|

% Var.

|

2016

|

2015

|

% Var.

|

|

Salaries, wages and benefits

|

(480.3)

|

(384.9)

|

24.8%

|

(1,656.8)

|

(1,580.5)

|

4.8%

|

|

Aircraft fuel

|

(678.7)

|

(870.3)

|

-22.0%

|

(2,695.4)

|

(3,301.4)

|

-18.4%

|

|

Aircraft rent

|

(120.4)

|

(377.2)

|

-68.1%

|

(996.9)

|

(1,100.1)

|

-9.4%

|

|

Sales and marketing

|

(168.5)

|

(171.7)

|

-1.9%

|

(556.0)

|

(617.4)

|

-9.9%

|

|

Landing fees

|

(170.7)

|

(179.0)

|

-4.7%

|

(687.4)

|

(681.4)

|

0.9%

|

|

Aircraft and traffic servicing

|

(275.3)

|

(282.2)

|

-2.4%

|

(1,068.2)

|

(1,019.8)

|

4.7%

|

|

Maintenance, materials and repairs

|

(203.3)

|

(207.8)

|

-2.2%

|

(593.1)

|

(603.9)

|

-1.8%

|

|

Depreciation and Amortization

|

(121.9)

|

(117.0)

|

4.2%

|

(447.7)

|

(419.7)

|

6.7%

|

|

Other operating expenses

|

(250.1)

|

(156.6)

|

59.7%

|

(468.1)

|

(633.6)

|

-26.1%

|

|

Total operating expenses

|

(2,469.3)

|

(2,746.8)

|

-10.1%

|

(9,169.5)

|

(9,957.8)

|

-7.9%

|

|

Total operating expenses

adjusted¹

|

(2,327.6)

|

(2,746.8)

|

-15.3%

|

(9,143.3)

|

(9,957.8)

|

-8.2%

|

|

Operating expenses ex- fuel

|

(1,790.5)

|

(1,876.5)

|

-4.6%

|

(6,474.1)

|

(6,656.5)

|

-2.7%

|

|

Operating expenses ex- fuel adjusted¹

|

(1,648.9)

|

(1,876.5)

|

-12.1%

|

(6,447.9)

|

(6,656.5)

|

-3.1%

|

|

Operating expenses per ASK (R$ cents)

|

4Q16

|

4Q15

|

% Var.

|

2016

|

2015

|

% Var.

|

|

Salaries, wages and benefits

|

(4.07)

|

(3.08)

|

32.4%

|

(3.58)

|

(3.18)

|

12.5%

|

|

Aircraft fuel

|

(5.75)

|

(6.95)

|

-17.3%

|

(5.82)

|

(6.64)

|

-12.3%

|

|

Aircraft rent

|

(1.02)

|

(3.01)

|

-66.1%

|

(2.15)

|

(2.21)

|

-2.7%

|

|

Sales and marketing

|

(1.43)

|

(1.37)

|

4.1%

|

(1.20)

|

(1.24)

|

-3.3%

|

|

Landing fees

|

(1.45)

|

(1.43)

|

1.2%

|

(1.48)

|

(1.37)

|

8.3%

|

|

Aircraft and traffic servicing

|

(2.33)

|

(2.25)

|

3.5%

|

(2.31)

|

(2.05)

|

12.5%

|

|

Maintenance, materials and repairs

|

(1.72)

|

(1.66)

|

3.8%

|

(1.28)

|

(1.21)

|

5.4%

|

|

Depreciation and amortization

|

(1.03)

|

(0.94)

|

10.5%

|

(0.97)

|

(0.84)

|

14.5%

|

|

Other operating expenses

|

(2.12)

|

(1.25)

|

69.4%

|

(1.01)

|

(1.27)

|

-20.7%

|

|

CASK

|

(20.93)

|

(21.94)

|

-4.6%

|

(19.79)

|

(20.02)

|

-1.1%

|

|

CASK adjusted¹

|

(19.73)

|

(21.94)

|

-10.1%

|

(19.74)

|

(20.02)

|

-1.4%

|

|

CASK excluding fuel expenses

|

(15.17)

|

(14.99)

|

1.2%

|

(13.97)

|

(13.38)

|

4.4%

|

|

CASK excluding fuel expenses adjusted¹

|

(13.97)

|

(14.99)

|

-6.8%

|

(13.92)

|

(13.38)

|

4.0%

|

¹ excluding non-recurring results on the return of aircraft under finance lease contracts and sale-leaseback transaction;

*Certain variation calculations in this report may not match due to rounding.

Aircraft fuel per ASK

decreased 17.3% over 4Q15 to 5.75 cents (R$), mainly due to lower oil prices in Reais in 12.7% and 10.7% lower volume of consumption.

For the full-year 2016, aircraft fuel per ASK

reached R$5.82 cents, a decrease of 12.3% compared to 2015, largely due to the reduction of fuel prices in Brazil by 8.7% year over year and the lowest fuel consumption in liters at 10.6%.

Salaries, wages and benefits per ASK

increased 32.4% to 4.07 cents (R$), mainly due to the reassessment of labor contingency proceedings and 11.0% increase in employee wages from the new collective agreement, partially offset by 7.4% reduction in full-time equivalent employees.

For the full-year 2016, salaries, wages and benefits per ASK reached R$

3.58

cents, up 12.5% compared

to the previous year

mainly due to the reassessment of labor contingency proceedings in the last quarter and

|

8

|

|

GOL Linhas Aéreas Inteligentes S.A.

|

|

Earnings Release

|

11.0% increase in employee wages from the new collective agreement, partially offset by 8.0% average reduction in full-time equivalent employees.

Aircraft rent per ASK

decreased 66.1% over 4Q15 to 1.02 cents (R$), mainly due to the impact of contracts renegotiations throughout 2016.

For the full-year 2016, aircraft rent per ASK

totaled R$

2.15

cents, a 2.7% decrease compared to 2015, due to the decrease in our fleet, partially offset by the average depreciation of the real against the U.S. dollar of 4.7% and the costs associated with the time lag between removing an aircraft from operation until its actual return.

Sales and marketing per ASK

increased 4.1% over 4Q15 to 1.43 cents (R$), impacted by the lower reduction in losses from direct sales channels per ASK, partially offset by the increase with sales incentives.

For the full-year 2016, sales and marketing per ASK

registered R$1.20 cents, a decrease of 3.3% compared to the previous year, mainly due to the reduction in losses from direct sales channels and lower commission for travel agencies, reflecting the reduction in the economic activity in the country and consequent decrease in the volume of transported corporate passengers.

Landing fees per ASK

increased 1.2% over 4Q15 to 1.45 cents (R$) (-4.7% in nominal terms), mainly due network composition and reduction of 19.5% in the volume of takeoffs, partially offset by the increase in the airport fees.

For the full-year 2016, landing fees per ASK totaled R$

1.48

cents, a 8.3% increase

(0.9% in nominal terms)

largely due to increases in airport fees - landing fee and navigation support, partially offset by a 17.2% decrease in takeoffs.

Aircraft and traffic servicing per ASK

increased 3.5% over 4Q15 to 2.33 cents (R$) (-2.4% in nominal terms), mainly due to consulting from fleet restructuring plan, offset by the reduction of expenses with other consulting companies.

For the full-year 2016, aircraft and traffic servicing per ASK totaled R$

2.31

cents in the period, a 12.5% increase

(4.7% in nominal terms)

, mainly due to IT services in the domestic and international bases and an increase in the number of Smiles redemption tickets purchased from partner airlines, which are paid by us upon ticket issuance and that will be recorded as revenue when the passengers fly.

Maintenance materials and repairs per ASK

in

creased 3.8% over 4Q15 to 1.72 cents (R$) (-2.2% in nominal terms), mainly due to the capitalization of the blocked checks and reduction of the average dollar in 14.3%, partially offset by the five planes returned in the period.

For the full-year 2016, maintenance materials and repairs per ASK registered R$

1.28

cents, up 5.4%

(-1.8% in nominal terms)

compared to 2015, due to less engines repaired, however partially offset by costs related to the anticipated return of aircraft and higher exchange rate of 4.7%.

Depreciation and amortization per ASK

increased 10.5% over 4Q15 to 1.03 cents (R$) (4.2% in nominal terms), mainly due to higher number of engines in depreciation and

the reduction of life cycle of spare parts from 25 to 18 years

.

|

9

|

|

GOL Linhas Aéreas Inteligentes S.A.

|

|

Earnings Release

|

For the full-year 2016, depreciation and amortization per ASK reached R$

0.97

cents, an increase of 14.5%

(6.7% in nominal terms)

, due to the reduction of the life cycle of spare parts from 25 to 18 years and depreciation of the Real against the average US dollar by 4.7%, partially offset by the fleet reduction.

Other expenses per ASK

increased 69.4% over 4Q15 to 2.12 cents (R$)

(59.7% in nominal terms), mainly due to the recognition of non-recurring expenses related to anticipated return of aircraft under operating leases.

For the full-year 2016, other expenses per ASK reached R$

1.01

cents, a 20.7%

(-26.1% in nominal terms) decrease year-over-year mainly due to non-recurring gains from early return of aircraft under finance leases, however partially offset by the non-recurring expenses related to anticipated return of aircraft under operating leases.

Operating result

The impact of a 1.39 cent (R$) RASK increase partially offset by a CASK decrease of 1.02 cents (R$), resulted in an increase in EBITDA per available seat kilometer to 0.03 cents (R$) in 4Q16. Compared to 3Q16, EBITDA per ASK maintained stable. 4Q16 EBITDA totaled R$320.1 million in the period compared to R$21.7 million in 4Q15 and R$333.4 million in 3Q16 (a 4.0% decrease).

On a per available seat kilometer basis, EBITDAR was 0.04 cents (R$) in 4Q16, compared to 0.03 cents (R$) in 4Q15. 4Q16 EBITDAR totaled R$440.5 million compared to R$398.9 million in 4Q15 (a 10.4% increase) and R$599.5 million in 3Q16 (a 26.5% decrease).

For the full-year 2016, EBIT was R$696.5 million, with a margin of 7.1%. EBITDAR was R$2,141.2 million with margin of 21.7%.

|

EBITDAR Calculation (R$ cents/ASK)

|

4Q16

|

4Q15

|

% Var.

|

2016

|

2015

|

% Var.

|

|

Net Revenues

|

0.23

|

0.21

|

6.6%

|

0.21

|

0.20

|

8.3%

|

|

Operating Expenses

|

(0.21)

|

(0.22)

|

-4.6%

|

(0.20)

|

(0.20)

|

-1.1%

|

|

EBIT

|

(0.01)

|

(0.03)

|

-66.1%

|

(0.02)

|

(0.02)

|

-2.7%

|

|

Depreciation and Amortization

|

(0.01)

|

(0.01)

|

10.5%

|

(0.01)

|

(0.01)

|

14.5%

|

|

EBITDA

|

0.03

|

0.002

|

1464.7%

|

0.02

|

0.005

|

420.7%

|

|

EBITDA Margin

|

12.0%

|

0.8%

|

11.2 p.p

|

11.6%

|

2.4%

|

9.2 p.p

|

|

Aircraft Rent

|

(0.01)

|

(0.03)

|

-66.1%

|

(0.02)

|

(0.02)

|

-2.7%

|

|

EBITDAR

|

0.04

|

0.03

|

17.2%

|

0.05

|

0.03

|

72.1%

|

|

EBITDAR Margin

|

16.5%

|

15.0%

|

1.5 p.p

|

21.7%

|

13.7%

|

8.0 p.p

|

|

EBITDAR

adjusted¹

|

0.05

|

0.03

|

54.9%

|

0.05

|

0.03

|

74.2%

|

|

EBITDAR Margin adjusted¹

|

21.9%

|

15.0%

|

6.9 p.p

|

22.0%

|

13.7%

|

8.3 p.p

|

¹

excluding non-recurring results on the anticipated return of aircraft under finance lease contracts and sale-leaseback transaction;

*

Certain variation calculations in this report may not match due to rounding.

|

10

|

|

GOL Linhas Aéreas Inteligentes S.A.

|

|

Earnings Release

|

|

Operating Margins (R$ MM)

|

4Q16

|

4Q15

|

% Var.

|

2016

|

2015

|

% Var.

|

|

EBIT

|

198.2

|

(95.3)

|

NM

|

696.5

|

(183.8)

|

NM

|

|

EBIT Margin

|

7.4%

|

-3.6%

|

11.0 p.p

|

7.1%

|

-1.9%

|

9.0 p.p

|

|

EBIT adjusted¹

|

339.9

|

(95.3)

|

NM

|

722.7

|

(183.8)

|

NM

|

|

EBIT Margin adjusted¹

|

12.8%

|

-3.6%

|

16.4 p.p

|

7.3%

|

-1.9%

|

9.2 p.p

|

|

EBITDA

|

320.1

|

21.7

|

1375.0%

|

1,144.2

|

235.9

|

385.0%

|

|

EBITDA Margin

|

12.0%

|

0.8%

|

11.2 p.p

|

11.6%

|

2.4%

|

9.2 p.p

|

|

EBITDA

adjusted¹

|

461.8

|

21.7

|

2027.8%

|

1,170.4

|

235.9

|

396.1%

|

|

EBITDA Margin adjusted¹

|

17.3%

|

0.8%

|

16.5 p.p

|

11.9%

|

2.4%

|

9.5 p.p

|

|

EBITDAR

|

440.5

|

398.9

|

10.4%

|

2,141.2

|

1,336.0

|

60.3%

|

|

EBITDAR Margin

|

16.5%

|

15.0%

|

1.5 p.p

|

21.7%

|

13.7%

|

8.0 p.p

|

|

EBITDAR

adjusted¹

|

582.2

|

398.9

|

46.0%

|

2,167.3

|

1,336.0

|

62.2%

|

|

EBITDAR Margin adjusted¹

|

21.9%

|

15.0%

|

6.9 p.p

|

22.0%

|

13.7%

|

8.3 p.p

|

¹

excluding non-recurring results on the anticipated return of aircraft under finance lease contracts and sale-leaseback transaction;

*

Certain variation calculations in this report may not match due to rounding.

|

EBIT, EBITDA and EBITDAR reconciliation

(R$ MM)*

|

4Q16

|

4Q15

|

% Var.

|

2016

|

2015

|

% Var.

|

|

Net income (loss)

|

(30.2)

|

(1,130.0)

|

-97.3%

|

1,102.4

|

(4,291.2)

|

NM

|

|

(-) Income taxes

|

(64.8)

|

(324.0)

|

-80.0%

|

(259.1)

|

(844.1)

|

-69.3%

|

|

(-) Net financial result

|

(163.6)

|

(710.7)

|

-77.0%

|

664.9

|

(3,263.3)

|

NM

|

|

EBIT

|

198.2

|

(95.3)

|

NM

|

696.5

|

(183.8)

|

NM

|

|

(-) Depreciation and amortization

|

(121.9)

|

(117.0)

|

4.2%

|

(447.7)

|

(419.7)

|

6.7%

|

|

EBITDA

|

320.1

|

21.7

|

1375.0%

|

1,144.2

|

235.9

|

385.0%

|

|

(-) Aircraft rent

|

(120.4)

|

(377.2)

|

-68.1%

|

(996.9)

|

(1,100.1)

|

-9.4%

|

|

EBITDAR

|

440.5

|

398.9

|

10.4%

|

2,141.2

|

1,336.0

|

60.3%

|

*In accordance with CVM Instruction 527, the Company presents the reconciliation of EBIT and EBITDA, whereby: EBIT = net income (loss) plus income and social contribution taxes and net financial result; and EBITDA = net income (loss) plus income and social contribution taxes, net financial result, and depreciation and amortization. We also show the reconciliation of EBITDAR, given its importance as a specific aviation industry indicator, whereby: EBITDAR = net income (loss) plus income and social contribution taxes, the net financial result, depreciation and amortization, and aircraft operating lease expenses;

*

Certain variation calculations in this report may not match due to rounding.

Net financial result

4Q16 net financial loss decreased R$547.1 million. Interest expense decreased R$126.4 million primarily due to a decrease in short-term debt and

the depreciation of the US dollar against the Real

. Interest income decreased R$1.6 million primarily due to a lower volume of cash and short-term investments, partially offset by the decrease in average Brazilian interest rates (as measured by the CDI rate).

|

Interest expense

totaled R$173.9 million in the 4Q16, a decrease of R$126.4 million or 42.1% compared to 4Q15, primarily the result of a lower debt level and also the depreciation of the US dollar against the Real.

|

Net exchange variation

totaled R$29.8 million negative in 4Q16, due appreciation of the Real against the dollar (end of period), which ranged from R$3.9048 on December 31, 2015 to R$3.2591 on December 31, 2016, generating a negative result of R$257.9 million in 4Q15.

|

11

|

|

GOL Linhas Aéreas Inteligentes S.A.

|

|

Earnings Release

|

|

Interest income

totaled R$30.9 million in the year, a decrease of R$1.6 million compared to 4Q15, explained by the lower level of our cash position held in Brazilian Reais.

|

Other financial expenses

totaled R$29.4 million in 4Q16, versus R$167.1 million negative compared to the 4Q15, primarily due to

the discount obtained on the senior and perpetual notes in the Company’s exchange offers.

In the full year 2016, net financial revenues were R$664.9 million, a significant improvement compared to net financial expenses of R$3,263.3 million in 2015. The variation in annual basis is mainly by the appreciation of the Real against the dollar (end of period), which ranged from R$3.9048 on December 31, 2015 to R$3.2591 on December 31, 2016, generating a negative result of R$2,267.0 million in the full year 2015.

|

Interest expense

totaled R$787.7 million in the period, a decrease of R$97.9 million or 11.1% compared to 2015. This decrease is a result of a lower debt level and also the depreciation of the US dollar against the Real.

|

Net exchange variation

totaled R$1,367.9 million positive in 2016. The variation on an annual basiswas primarily due to the appreciation of the Real against the dollar (end of period), which ranged from R$3.9048 on December 31, 2015 to R$3.2591 on December 31, 2016, and generated a negative result of R$2,267.0 million in 4Q15.

|

Interest income

totaled R$147.9 million in the year, an increase of R$14.2 million compared to 2015. The variation is explained by the higher level of our cash position held in Brazilian Reais.

|

Other financial revenues

totaled R$93.5 million in 2016, versus R$294.6 million negative compared to the same period of 2015, primarily due to the discount obtained on the unsercured senior and perpetual notes obtained in the Company’s exchange offers.

Hedge result

The Company uses hedge accounting to account for some of its derivative instruments. In 4Q16, GOL recorded gains of R$16.4 million from hedge operations.

|

Results (R$ million) 4Q16

|

Fuel

|

Foreign Exchange

|

Interest Rates

|

Total

|

|

Subtotal - Designated for Hedge Accounting

|

-

|

-

|

13.9

|

13.9

|

|

Subtotal – Not Designated for Hedge Accounting

|

(1.1)

|

3.7

|

-

|

2.6

|

|

Total

|

(1.1)

|

3.7

|

13.9

|

16.4

|

|

OCI (net of taxes, on 12/31/2016)*

|

-

|

-

|

(147.2)

|

(147.2)

|

*OCI (Other Comprehensive Income) or Statement of Comprehensive Income (loss) is a transitional account where positive and negative fair value adjustments of derivatives recorded as hedge accounting, designated as effective for hedging cash flow. GOL records the fair value of hedges due in future periods whose aim is to protect cash flow.

|

12

|

|

GOL Linhas Aéreas Inteligentes S.A.

|

|

Earnings Release

|

|

Results (R$ million) 4Q16

|

Fuel

|

Foreign Exchange

|

Interest Rates

|

Total

|

|

Financial Result

|

(1.1)

|

3.7

|

36.0

|

38.5

|

|

Operating Result

|

-

|

-

|

(22.1)

|

(22.1)

|

|

Total

|

(1.1)

|

3.7

|

13.9

|

16.4

|

|

Fuel:

fuel hedge operations were made for this quarter through derivative contracts. During the quarter, the Company hedged through derivative financial instruments of 55.9% of consumption in the next three months.

|

Interest:

swap transactions to protect the cash flow from future aircraft leasing deliveries against an increase in Libor interest rates generated total gains of R$13.9 million in 4Q16.

|

Foreign exchange:

foreign exchange hedge transactions through derivative financial instruments in the form of NDFs (non-deliverable forwards), futures and options totaled gains of R$3.7 million in 4Q16 and are used as the Company's economic hedge.

Income taxes

In 2016 taxes totaled an expense of R$259.1 million, a decrease of R$585.1 million compared to the same period of 2015. The result was mainly due to income taxes expenses from Smiles.

Net income and Earnings per Share (EPS)

Reported net loss in 4Q16 was R$30.2 million, representing a -1.1% net margin, vs. R$1,130.0 of net loss in 4Q15.

For the full-year 2016, GOL recorded net income of R$1,102.4 million, with a net margin of 11.2%, compared to losses of R$4,291.2 million and a negative net margin of 43.9% in 2015. This result mainly reflects operational improvementsand the appreciation on Brazilian Real versus the US Dollar.

|

(R$ MM)

|

4Q16

|

4Q15

|

% Var.

|

2016

|

2015

|

% Var.

|

|

Net income (loss)

|

(30.2)

|

(1,130.0)

|

-97.3%

|

1,102.4

|

(4,291.2)

|

NM

|

|

Minority Interest

|

72.7

|

51.6

|

40.9%

|

250.8

|

169.6

|

47.9%

|

|

Net income (loss) after minority interest

|

(102.9)

|

(1,181.6)

|

-91.3%

|

851.5

|

(4,460.9)

|

NM

|

|

Weighted average shares outstanding

|

347.2

|

347.2

|

NM

|

347.2

|

347.2

|

NM

|

|

EPS in R$ before minority interest

|

(0.09)

|

(3.25)

|

-97.3%

|

3.17

|

(12.36)

|

NM

|

|

EPS in R$ after minority interest

|

(0.30)

|

(3.40)

|

-91.3%

|

2.45

|

(12.85)

|

NM

|

|

Weighted average ADS outstanding

|

34.7

|

34.7

|

NM

|

34.7

|

34.7

|

NM

|

|

Earnings per ADS in US$ before minority interest

|

(0.003)

|

(0.08)

|

-96.9%

|

0.09

|

(0.37)

|

NM

|

|

Earnings per ADS in US$ after minority interest

|

(0.01)

|

(0.09)

|

-89.8%

|

0.07

|

(0.39)

|

NM

|

|

|

|

|

|

|

|

|

|

|

Earnings per share before minority interest were R$3.17 in 2016, compared to losses of R$12.36 in 2015. The weighted average number of shares considered in this calculation was 347,242,172, reflecting the ratio of 35 voting shares for each non-voting share.

|

13

|

|

GOL Linhas Aéreas Inteligentes S.A.

|

|

Earnings Release

|

Reported net losses per share were R$0.09 in 4Q16 compared to R$3.25 in 4Q15. Weighted average shares outstanding were 347,242,172 in 4Q16 and 4Q15. Reported net earnings per share were R$3.17 in the full-year 2016 compared to losses of R$12.36 in the full-year 2015. Weighted average shares outstanding were 347,242,172 in the full-year 2016 and full-year 2015.

Reported net losses per ADS were US$0.003 in 4Q16 compared to US$0.08 in 4Q15. Weighted average ADSs outstanding were 34,724,217 in 4Q16 and 4Q15. Reported net earnings per ADS were R$0.09 in the full-year 2016 compared to losses of R$0.37 in the full-year 2015. Weighted average ADSs outstanding were 34,724,217 in the full-year 2016 and full-year 2015.

Smiles Subsidiary - 4Q16 results

In 4Q16, reported net income was R$161.6 million, representing a net margin of 36.0%, compared to 32.2% in 4Q15. Operating profit was R$186.0 million, 70.3% up over 4Q15, representing an operating margin of 41.4%. Operating profit growth was mainly result of the 28.8% increase in net revenues to R$449.4 million and the improvement of 10.1 p.p. in operating margin when compared to 4Q15.

For the full-year 2016, Smiles recorded net income of R$548.3 million, representing a net margin of 35.4%, 5.1 p.p. higher than 2015. Operating profit was R$601.0 million, 46.6% up over 2015, representing an operating margin of 38.8%. Operating profit growth was mainly result of the 26.9% increase in net revenues to R$1,548.1 million and the improvement of 5.2 p.p. in operating margin when compared to 2015. For further information, please visit

http://www.smiles.com.br/ri

.

The following table summary of the results of our Smiles subsidiary:

|

Operating Data (million)

|

4Q16

|

4Q15

|

% Var.

|

2016

|

2015

|

% Var.

|

|

Miles Accrual (ex-GOL)

|

12,686

|

11,666

|

8.7%

|

46,889

|

44,979

|

4.2%

|

|

Smiles' Program Redemptions

|

11,729

|

10,032

|

16.9%

|

43,495

|

39,197

|

11.0%

|

|

Financial Information (R$ million)

|

4Q16

|

4Q15

|

% Var.

|

2016

|

2015

|

% Var.

|

|

Gross Billings (ex-GOL)

|

429.0

|

416.7

|

2.9%

|

1,616.2

|

1,546.2

|

4.5%

|

|

Net Revenues

|

449.4

|

349.0

|

28.8%

|

1,548.1

|

1,219.5

|

26.9%

|

|

Operating Income

|

186.0

|

109.2

|

70.3%

|

601.0

|

409.9

|

46.6%

|

|

Operating Margin

|

41.4%

|

31.3%

|

10.1 p.p

|

38.8%

|

33.6%

|

5.2 p.p

|

|

Net Income

|

161.6

|

112.3

|

43.9%

|

548.3

|

369.9

|

48.2%

|

|

Net Margin

|

36.0%

|

32.2%

|

3.8 p.p

|

35.4%

|

30.3%

|

5.1 p.p

|

Cash Flow

Cash, cash equivalents and short-term investments increased R$14.1 million during 4Q16.

In 4Q16, cash used in operating activities was R$191.1 million, mainly due to a the increase in accounts receivable balance (R$79.6 million), due to the reduction in the volume of prepayments of credit card receivables at the end of the quarter, and the increase in the balance of deposits (R$45.6 million), mainly due to obligations related to aircraft operating leases.

|

14

|

|

GOL Linhas Aéreas Inteligentes S.A.

|

|

Earnings Release

|

In 4Q16, cash used in investing activities was R$207.8 million, mainly due to the increase in capitalization of maintenance overhaul expenses by R$105.2 million. Net cash flow was R$93.8 million in the quarter.

In 4Q16, cash used in financing activities was R$79.7 million, mainly due to the amortization of loans and financing in the amount of R$24.4 million, financial lease payments in the amount of R$73.7 million and dividend payments.

|

Consolidated Cash Flow Summary (R$ mm)

(1)

|

4Q16

|

4Q15

|

% Change

|

3Q16

|

% Change

|

|

Net Income (Loss) for the Period

|

(30.2)

|

(1,130.0)

|

-97.3%

|

65.9

|

NM

|

|

Adjustment of Non-Cash Items

|

523.0

|

621.8

|

-15.9%

|

171.2

|

205.4%

|

|

Net Income (Loss) After Adjusting Non-Cash Items

|

492.8

|

(508.2)

|

NM

|

237.2

|

107.8%

|

|

Net Cash Provided to (Used in) Operating Activities

|

(191.1)

|

224.3

|

NM

|

(74.3)

|

157.2%

|

|

Net Cash Provided to (used in) Investment Activities

|

(207.8)

|

(415.2)

|

-49.9%

|

(138.2)

|

50.4%

|

|

Net Cash Flow

(1)

|

93.8

|

(699.1)

|

NM

|

24.6

|

280.8%

|

|

Net Cash used in Financial Activities

|

(79.7)

|

(306.8)

|

-74.0%

|

(242.1)

|

-67.1%

|

|

Net Decrease in Cash and Cash Equivalents

|

14.1

|

(1,005.9)

|

NM

|

(217.5)

|

NM

|

|

Cash beginning of period

|

1,148.1

|

3,305.4

|

-65.3%

|

1,365.0

|

-15.9%

|

|

Cash end of period

|

1,162.2

|

2,299.5

|

-49.5%

|

1,148.0

|

1.2%

|

|

Accounts receivable

|

760.2

|

462.6

|

64.3%

|

680.6

|

11.7%

|

|

Total Liquidity

|

1,922.4

|

2,762.1

|

-30.4%

|

1,828.6

|

5.1%

|

1-

Management cash flow: some items were reclassified for better presentation. The groups may not be comparable with the totals presented in our financial statements.

2-

Net cash flow = cash flow from operating activities + cash flow from investing activities

Capex

Capital expenditures for quarter ended December 31, 2016 were R$207.8 million, primariy related to engines. For more details on changes in property, plant and equipment, see Note 14 in the interim financial statements.

Operational fleet

|

Final

|

4Q16

|

4Q15

|

Var.

|

3Q16

|

Var.

|

|

Boeing 737-NGs

|

130

|

144

|

-14

|

135

|

-5

|

|

737-800 NG

|

102

|

107

|

-5

|

102

|

0

|

|

737-700 NG

|

28

|

37

|

-9

|

33

|

-5

|

|

Opening for rent Type

|

4Q16

|

4Q15

|

Var.

|

3Q16

|

Var.

|

|

Financial Leasing (737-NG)

|

34

|

46

|

-12

|

34

|

0

|

|

Operating Leasing

|

96

|

98

|

-2

|

101

|

-5

|

At the end of 4Q16, out of a total of 130 Boeing 737-NG aircraft, GOL was operating 121 aircraft on its routes. Of the nine remaining aircraft, seven were in the process of being returned to lessors and two were sub-leased to other another airline.

GOL has 96 aircraft under operating leases and 34 under finance

leases, 31 of

which have a purchase option for when their leasing contracts expire.

|

15

|

|

GOL Linhas Aéreas Inteligentes S.A.

|

|

Earnings Release

|

The average age of the fleet was 8.0 years at the end of 4Q16. In order to maintain this low average, the Company has 120 firm aircraft acquisition orders with Boeing for fleet renewal by 2027.

The next B737 aircraft is expected to be received by the Company in July 2018.

Fleet plan

|

Fleet plan

|

2016

|

2017

|

2018

|

>2018

|

Total

|

|

Fleet (End of Period)

|

130

|

115

|

121

|

|

|

|

Aircraft Commitments (R$ million)*

|

-

|

-

|

1,787.4

|

46,245.0

|

48,032.4

|

|

Pre-Delivery Payments (R$ million)

|

-

|

286.8

|

483.5

|

5,954.2

|

6,724.5

|

*Considers aircraft list price

Balance sheet: Liquidity and Indebtedness

On December 31, 2016, the Company reported total cash, including financial investments, restricted cash, and accounts receivable of R$1,922.4 million, equivalent to 19.5% of net revenue in the last twelve months. Short-term accounts receivables totaled R$760.2 million, consisting mostly of ticket sales via credit card and accounts receivable from travel agencies and cargo transportation and representing an increase of 11.7% versus the third quarter.

|

Liquidity (R$ MM)

|

4Q16

|

4Q15

|

% Var.

|

3Q16

|

% Var.

|

|

Cash and cash equivalents, short-term financial investments and restricted cash

|

1,162.2

|

2,299.5

|

-49.5%

|

1,148.1

|

1.2%

|

|

Short-Term Accounts Receivables

|

760.2

|

462.6

|

64.3%

|

680.6

|

11.7%

|

|

Total Liquidity

|

1,922.4

|

2,762.1

|

-30.4%

|

1,828.7

|

5.1%

|

|

Indebtedness (R$ MM)

|

4Q16

|

4Q15

|

% Var.

|

3Q16

|

% Var.

|

|

Loans and Financings

|

4,661.2

|

6,310.8

|

-26.1%

|

4,569.8

|

2.0%

|

|

Aircraft Financing

|

1,718.0

|

2,994.1

|

-42.6%

|

1,776.0

|

-3.3%

|

|

Total of Loans and Financings

|

6,379.2

|

9,304.9

|

-31.4%

|

6,345.8

|

0.5%

|

|

Short-Term Debt

|

835.3

|

1,396.6

|

-40.2%

|

742.6

|

12.5%

|

|

Debt in US$

|

239.5

|

280.9

|

-14.7%

|

225.2

|

6.4%

|

|

Debt in BRL

|

54.7

|

174.7

|

-68.7%

|

1.8

|

2894.3%

|

|

Long-Term Debt

|

5,543.9

|

7,908.3

|

-29.9%

|

5,603.2

|

-1.1%

|

|

Debt in US$

|

1,391.1

|

1,775.1

|

-21.6%

|

1,414.0

|

-1.6%

|

|

Debt in BRL

|

1,010.1

|

977.0

|

3.4%

|

1,013.2

|

-0.3%

|

|

Perpetual Notes

|

428.4

|

699.0

|

-38.7%

|

424.7

|

0.9%

|

|

Accumulated Interest

|

142.7

|

148.5

|

-3.9%

|

49.9

|

186.0%

|

|

Operating Leases (off-balance)

|

6,238.7

|

7,749.0

|

-19.5%

|

6,453.7

|

-3.3%

|

|

16

|

|

GOL Linhas Aéreas Inteligentes S.A.

|

|

Earnings Release

|

|

Indebtedness and Liquidity (R$ MM)

|

4Q16

|

4Q15

|

% Var.

|

3Q16

|

% Var.

|

|

Cash , Equivalents and Accounts Receivable as % of LTM Net Revenues

|

19.5%

|

28.2%

|

-7.8 p.p

|

18.6%

|

-1.2 p.p

|

|

Gross Debt (R$ MM)

|

6,379.2

|

9,304.9

|

-31.4%

|

6,345.8

|

0.5%

|

|

Net Debt (R$ MM)

|

5,217.0

|

7,005.5

|

-25.5%

|

5,197.7

|

0.4%

|

|

LTM Aircraft Rent x 7 years

|

6,978.6

|

7,700.6

|

-9.4%

|

8,775.8

|

-20.5%

|

|

% of debt in foreign currency

|

83.3%

|

86.3%

|

-3.0 p.p

|

83.9%

|

-0.5 p.p

|

|

% of debt in Short-Term

|

13.1%

|

15.0%

|

-1.9 p.p

|

11.7%

|

1.4 p.p

|

|

% of debt in Long-Term

|

86.9%

|

85.0%

|

1.9 p.p

|

88.3%

|

-1.4 p.p

|

|

Gross Adjusted Debt

2

(R$ MM)

|

13,357.8

|

17,005.5

|

-21.5%

|

15,121.6

|

-11.7%

|

|

Net Adjusted Debt

2

(R$ MM)

|

12,195.6

|

14,706.1

|

-17.1%

|

13,973.5

|

-12.7%

|

|

Adjusted Gross Debt

2

/ EBITDAR LTM

|

6.2 x

|

12.7 x

|

-6.5 x

|

7.2 x

|

-1.0 x

|

|

Adjusted Net Debt

2

/ EBITDAR LTM

|

5.7 x

|

11.0 x

|

-5.3 x

|

6.7 x

|

-1.0 x

|

|

Net Financial Commitments

1

/ EBITDAR LTM

|

5.4 x

|

11.0 x

|

-5.7 x

|

5.5 x

|

-0.2 x

|

1 - Financial commitments (gross debt + operational leasing contracts) less Cash / 2 - Debt + LTM operational leasing expenses x 7

; *Certain variation calculations in this report may not match due to rounding.

Loans and financing

During 4Q16, the Company’s total loans and financings totaled R$6,379.2 million (including finance leases), a decrease of 31.4% and an increase of 0.5% compared to 4Q15 and 3Q16, respectively.

The Company amortized R$900.7 million in debt in the year, of which R$520.5 million was from financial debt amortization and R$380.2 million in finance leases in 2016.

The adjusted gross debt/EBITDAR (LTM) ratio reached 6.2x in 4Q16, compared to 7.2x in 3Q16. This indicator improved by the reduction in the rent expenses in the last twelve months. The adjusted net debt/EBITDAR (LTM) ratio also improved and reached 5.7x in the period compared to 6.7x in 3Q16.

The average maturity of the Company's long-term debt in 4Q16, excluding aircraft financial leasing and non-maturing debt, was 3.5 years, compared to 3.8 years in 3Q16, with an average rate of 17.98% for local-currency debt, compared to 18.64% in 3Q16, and 7.51% for Dollar-dominated debt, compared to 7.45% in 3Q16.

|

17

|

|

GOL Linhas Aéreas Inteligentes S.A.

|

|

Earnings Release

|

Outlook

GOL has worked diligently to match fleet growth with GDP growth, and management believes it has successfully matched GOL’s supply of seats with demand, as indicated by the Company’s high load factors. 2017 guidance reflects the continuance of rational strategy, with a supply forecast matching GDP growth and the expected demand for seats. We expect to reduce our non-fuel cost per available seat kilometer (CASK) as we reduce the age of our fleet, operate an even more fuel efficient fleet, benefit from cost savings associated with our aircraft maintenance facility, and improve upon our cost-efficient distribution channels. We anticipate a solid first quarter, thanks to the dedicated effort of our employees to improve productivity throughout the Company.

For the first quarter of 2017, we expect load factors in the range of 80%, with passenger yields in the range of R$24 cents. In January, GOL had load factors of 83% and strong forward bookings for February and March. For the first quarter, we expect non-fuel CASK in the range of R$14.5 cents. We expect the increase in jet fuel prices will increase our fuel costs per ASK by 7.5% in 1Q17.

Financial guidance for 2017 is based on GOL’s capacity plan and the expected demand for our passenger transportation services, driven by the weak Brazilian economic environment. For 2017, we expect to reduce capacity by 0-2%. Passenger yields are expected to increase 6%, primarily due to an increase in average fare, partially offset by an increase in stage length, and RASK is expected to increase in the range of 7%. Full-year non-fuel CASK is expected to be in the R$14 cent (R$) range, representing a stable level versus 2016. Fuel costs per ASK are expected to increase approximately 18% in the year, due to increases in oil prices.

|

Financial Outlook

|

Preliminary Guidance

Full year 2017

|

Revised Guidance

Full year 2017

|

|

Average fleet

|

115

|

115

|

|

Variation in supply (ASK)

|

0% to -2%

|

0% to -2%

|

|

Variation in total seats

|

-3% to -5%

|

-3% to -5%

|

|

Variation in volume of departures

|

-3% to -5%

|

-3% to -5%

|

|

Average Load Factor

|

77% to 79%

|

77% to 79%

|

|

Net Revenues (billion)

|

-

|

+/- R$10

|

|

Non-fuel CASK (R$ cents)

|

-

|

+/- 14

|

|

EBITDA Margin

|

-

|

11% to 13%

|

|

Operating (EBIT) Margin

|

5% to 7%

|

6% to 8%

|

Given the volatility of the Brazilian economy, the current above guidance for 2017 may be adjusted in order to incorporate the evolution of its operating and financial performance and any eventual changes in GDP growth, interest rates, exchange rate, and WTI and Brent oil price trend.

|

18

|

|

GOL Linhas Aéreas Inteligentes S.A.

|

|

Earnings Release

|

|

Income statement (R$ MM)

|

4Q16

|

|

4Q15

|

% Change

|

|

Net operating revenues

|

|

|

|

|

|

Passenger

|

2,342.3

|

|

2,326.2

|

0.7%

|

|

Cargo and Other

|

321.7

|

|

325.9

|

-1.3%

|

|

Total net operating revenues

|

2,664.0

|

|

2,652.1

|

0.5%

|

|

|

|

Operating Expenses

|

|

|

|

|

|

Salaries, wages and benefits

|

480.3

|

|

384.9

|

24.8%

|

|

Aircraft fuel

|

678.7

|

|

870.3

|

-22.0%

|

|

Aircraft rent

|

120.4

|

|

377.2

|

-68.1%

|

|

Sales and marketing

|

168.5

|

|

171.7

|

-1.9%

|

|

Landing fees

|

170.7

|

|

179.0

|

-4.7%

|

|

Aircraft and traffic servicing

|

275.3

|

|

282.2

|

-2.4%

|

|

Maintenance materials and repairs

|

203.3

|

|

207.8

|

-2.2%

|

|

Depreciation and amortization

|

121.9

|

|

117.0

|

4.2%

|

|

Other

|

250.1

|

|

156.6

|

59.7%

|

|

Total Operating Expenses

|

2,469.3

|

|

2,746.8

|

-10.1%

|

|

Equity Income

|

3.4

|

|

(0.6)

|

NM

|

|

|

|

Operating Income

|

198.2

|

|

(95.3)

|

NM

|

|

|

|

Other Expense

|

|

|

|

|

|

Financial Income (expense), net

|

(163.6)

|

|

(710.7)

|

-77.0%

|

|

|

|

Income (Loss) before income taxes

|

34.7

|

|

(806.0)

|

NM

|

|

Current income tax

|

(68.7)

|

|

(45.4)

|

51.4%

|

|

Deferred income tax

|

3.9

|

|

(278.6)

|

NM

|

|

Net income (loss) before interest on

|

|

|

|

|

|

shareholder's equity

|

(30.2)

|

|

(1,130.0)

|

-97.3%

|

|

|

|

Earnings per share

|

(0.09)

|

|

(3.25)

|

-97.3%

|

|

|

|

Earnings per ADS - US Dollar