Report of Foreign Issuer (6-k)

August 15 2016 - 6:06AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of August, 2016

Commission File Number 1-15106

PETRÓLEO BRASILEIRO S.A. - PETROBRAS

(Exact name of registrant as specified in its charter)

Brazilian Petroleum Corporation - PETROBRAS

(Translation of Registrant's name into English)

Avenida República do Chile, 65

20031-912 - Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

New composition of Petrobras Statutory Audit Committee

Rio de Janeiro, August 12, 2016 - Petróleo Brasileiro S.A. - Petrobras informs

that the Board of Directors approved, today, the new composition of the Statutory Audit Committee with the appointment of Director Marcelo Mesquita to replace the former Director Walter Mendes de Oliveira Filho and the nomination of Director Jerônimo Antunes as new Chairman of the committee.

Therefore, the new composition of Petrobras Statutory Audit Committee is: Jerônimo Antunes (Chairman), Durval José Soledade Santos and Marcelo Mesquita.

Find below the curriculum of the committee members:

Jerônimo Antunes

(Coordinator)

- He graduated in Accounting and Business Administration and has a masters and a Ph.D. in Controlling and Accounting from FEA-USP. He currently holds the positions of (i) Professor-Doctor of the undergraduate course in accounting from FEA/USP; (ii) independent member of the Board of Directors and a Coordinator at the Auditing Committee for the Basic Sanitation Utility Company of the State of Sao Paulo - Sabesp, a publicly held company listed on the NYSE, in the field of water treatment and distribution; (iii) Board member of Petrobras Distribuidora; (iv) Professor of several MBA courses and specialization in accounting, auditing, finance and business management courses at FIPECAFI-USP, FIA-USP, UFC and other higher education institutions. He served as an independent Auditor of large, medium and small businesses for more than 30 years. He is still contracted as an Expert-Accountant and as a Technical Assistant Expert-Accountant in several disputes at Arbitrations and Mediation Chambers of CIESP FIESP, OAB, the Brazil-Canada Chamber of Commerce and the Judiciary Branch since 2005.

Durval José Soledade Santos

- He graduated in Law from the Federal Fluminense University (1970/74). He has an Executive MBA from COPPE/UFRJ and has a post graduate degree in Development Economics from PUC/BNDES and Corporate Law from Cândido Mendes University. He worked at BNDES between 1973 and 2008 in the following capacities: Chief of Staff of the Presidency, Administration Areas Superintendent, Capital Markets and Special Operations, Judicial Superintendent of the BNDESPAR, Legal Adviser of FINAME, Director of Legal Affairs and Operations at BNDESPAR. At CVM, he was the Director for two administrations and General Superintendent. He worked in state-owned companies, occupying the position of Vice President Director of Finance and Corporate Affairs and Superintendent Director at BANERJ Bank. He was also the Vice-President of DIVERJ- in Rio de Janeiro S.A. Currently he sits in the Lawyers Council of the Bar Association of Brazil (OAB), Rio de Janeiro Section. He was part of the Capital Market Councils (Bovespa, IBMEC and SOMA) and on advisory boards (FINEP, PACTI and Brazil Private Equity, the Guarantor Bank- Banco Garantia). He currently sits in the following boards of Directors: LOGZ-Logistics Brazil Inc (Vice President), PORTINVEST-Participations Inc, TGSC-bulk Terminal in Santa Catarina, Porto Novo INC (President), SATI RJ Participations INC (President). Previously, in Forjas Taurus INC, he served as a Board member of the Enterprise Governance Committee; and at Odebrecht Agroindustrial Inc as a member of the Financial and Investment Committee. He is currently the Chairman of the Fiscal Council of Cultura Inglesa Inc. He is also a guest Professor at the LLMDS Course, the FGV Law School in Rio de Janeiro and a Professor of Corporate Law

promoted by the OAB/RJ Capital Market Committee. He also acts as Vice Chairman of the Independent Investigation Committee at Eletrobrás.

www.petrobras.com.br/ir

Contacts:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

|

Investor Relations Department

I

e-mail: petroinvest@petrobras.com.br

Av. República do Chile, 65 – 10th floor, 1002 – B – 20031-912 – Rio de Janeiro, RJ | Phone: 55 (21) 3224-1510 / 3224-9947

FORWARD-LOOKING STATEMENTS

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. The forward-looking statements, which address the Company’s expected business and financial performance, among other matters, contain words such as “believe,” “expect,” “estimate,” “anticipate,” “optimistic,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. There is no assurance that the expected events, trends or results will actually occur. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

The Company’s actual results could differ materially from those expressed or forecast in any forward-looking statements as a result of a variety of assumptions and factors. These factors include, but are not limited to, the following: (i) failure to comply with laws or regulations, including fraudulent activity, corruption, and bribery; (ii) the outcome of ongoing corruption investigations and any new facts or information that may arise in relation to the “Lava Jato Operation”; (iii) the effectiveness of the Company’s risk management policies and procedures, including operational risk; and (iv) litigation, such as class actions or proceedings brought by governmental and regulatory agencies.

A description of other factors can be found in the Company’s Annual Report on Form 20-F for the year ended December 31, 2015, and the Company’s other filings with the U.S. Securities and Exchange Commission.

Marcelo Mesquita de Siqueira Filho

- Has a degree in Economics from PUC-Rio, in French Studies from Nancy University II and an OPM (Owner/President Management) from Harvard, he is a co-founder partner of Leblon Equities (since 2008) and co-manager of equity funds and of Private Equity. He has 25 years of experience in the Brazilian stock market, having worked 10 years at UBS Pactual (1998-2008) and 7 years in Banco Garantia (1991-1998). At UBS Pactual, he was the co-responsible for the Capital Market area (2007-2008); co-responsible for the Stock area (2005-2007); and responsible for the Business and Strategist Analysis area (1998-2006). At Banco Garantia he was a commodities companies analyst (1991-1997) and Investment Banker (1997-1998). Since 1995, he was appointed by investors as one of the leading analysts of Brazil according to several surveys made by Institutional Investor

magazine. He was rated as "#1 Brazil Analyst" from 2003 to 2006 (#3 in 2002, #2 in 2001 and #3 in 2000). He was also rated as "#1 Stock Strategist in Brazil" from 2003 to 2005. Marcelo Mesquita worked in more than 50 transactions in the Brazilian stock market (IPOs), both in Garantia and UBS Pactual. Currently he is also a member of the Boards of Directors of BR Home Centers S.A., of Mills SI S.A. and of Tamboro Educacional S.A.

www.petrobras.com.br/ir

Contacts:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

|

Investor Relations Department

I

e-mail: petroinvest@petrobras.com.br

Av. República do Chile, 65 – 10th floor, 1002 – B – 20031-912 – Rio de Janeiro, RJ | Phone: 55 (21) 3224-1510 / 3224-9947

FORWARD-LOOKING STATEMENTS

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. The forward-looking statements, which address the Company’s expected business and financial performance, among other matters, contain words such as “believe,” “expect,” “estimate,” “anticipate,” “optimistic,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. There is no assurance that the expected events, trends or results will actually occur. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

The Company’s actual results could differ materially from those expressed or forecast in any forward-looking statements as a result of a variety of assumptions and factors. These factors include, but are not limited to, the following: (i) failure to comply with laws or regulations, including fraudulent activity, corruption, and bribery; (ii) the outcome of ongoing corruption investigations and any new facts or information that may arise in relation to the “Lava Jato Operation”; (iii) the effectiveness of the Company’s risk management policies and procedures, including operational risk; and (iv) litigation, such as class actions or proceedings brought by governmental and regulatory agencies.

A description of other factors can be found in the Company’s Annual Report on Form 20-F for the year ended December 31, 2015, and the Company’s other filings with the U.S. Securities and Exchange Commission.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

PETRÓLEO BRASILEIRO S.A--PETROBRAS

|

|

|

|

|

|

By:

|

/

S

/ Ivan de Souza Monteiro

|

|

|

|

Ivan de Souza Monteiro

Chief Financial Officer and Investor Relations Officer

|

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Exchange Act of 1934, as amended (Exchange Act) that are not based on historical facts and are not assurances of future results. These forward-looking statements are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

All forward-looking statements are expressly qualified in their entirety by this cautionary statement, and you should not place reliance on any forward-looking statement contained in this press release. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

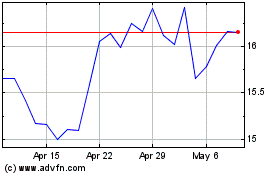

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

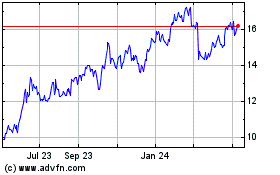

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Apr 2023 to Apr 2024