SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of January, 2016

Commission File Number 1-15106

PETRÓLEO BRASILEIRO S.A. - PETROBRAS

(Exact name of registrant as specified in its charter)

Brazilian Petroleum Corporation - PETROBRAS

(Translation of Registrant's name into English)

Avenida República do Chile, 65

20031-912 - Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras’ Proven Reserves in 2015

Rio de Janeiro, January 29, 2016 – Petróleo Brasileiro S.A. - Petrobras announces its proven reserves of petroleum (oil, condensate and natural gas), assessed at the end of 2015 according to ANP/SPE (National Petroleum, Natural Gas and Biofuels Agency / Society of Petroleum Engineers) and SEC (US Securities and Exchange Commission) criteria.

Proven Reserves according to ANP/SPE Criteria:

According to ANP/SPE criteria, on December 31, 2015, Petrobras´ proven oil, condensate and natural gas reserves reached 13.279 billion barrels of oil equivalent (boe), as shown in Table 1. In 2014, it was 16.612 billion boe.

Table 1 –Proven Reserves in 2015 (ANP/SPE criteria)

|

Item |

Proven Reserves |

|

Petrobras Total |

Oil and Condensate (billion bbl) |

10.946 |

|

Natural Gas (billion m3) |

372.450 |

|

Oil Equivalent (billion boe) |

13.279 |

www.petrobras.com.br/ir

Contacts:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS | Investor Relations Department I e-mail: petroinvest@petrobras.com.br

Av. República do Chile, 65 – 10th floor, 1002 – B – 20031-912 – Rio de Janeiro, RJ | Phone: 55 (21) 3224-1510 / 3224-9947

FORWARD-LOOKING STATEMENTS

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. The forward-looking statements, which address the Company’s expected business and financial performance, among other matters, contain words such as “believe,” “expect,” “estimate,” “anticipate,” “optimistic,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. There is no assurance that the expected events, trends or results will actually occur. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

The Company’s actual results could differ materially from those expressed or forecast in any forward-looking statements as a result of a variety of assumptions and factors. These factors include, but are not limited to, the following: (i) failure to comply with laws or regulations, including fraudulent activity, corruption, and bribery; (ii) the outcome of ongoing corruption investigations and any new facts or information that may arise in relation to the “Lava Jato Operation”; (iii) the effectiveness of the Company’s risk management policies and procedures, including operational risk; and (iv) litigation, such as class actions or proceedings brought by governmental and regulatory agencies. A description of other factors can be found in the Company’s Annual Report on Form 20-F for the year ended December 31, 2014, and the Company’s other filings with the U.S. Securities and Exchange Commission.

Table 2 presents the evolution of proven reserves in 2015, according to ANP/SPE criteria:

Table 2 – Evolution of Proven Reserves in 2015 (ANP/SPE criteria)

|

Composition of proven reserves |

Petrobras Total

(billion boe) |

|

a) Proven Reserves December/2014 |

16.612 |

|

b) New discoveries and new accumulations in 2015 |

0.016 |

|

c) Reserves Monetization in 2015 [1] |

-0.022 |

|

d) Revisions in 2015 [2] |

-2.395 |

|

e) Balance in 2015 (b+c+d) |

-2.401 |

|

f) Year Production in 2015 |

-0,932 |

|

g) Annual Variation (e+f) |

-3.333 |

|

h) Proven Reserves December /2015 (a+g) |

13.279 |

The main factors impacting the reserves were:

• The incorporation of 0.016 billion boe of proven reserves related to the discovery of new accumulations close to existing infrastructure in the Albacora Leste field in the Campos Basin, the Golfinho field in the Espírito Santo Basin and the El Mangrullo field in the Neuquina Basin, in Argentina;

• Additions to proven reserves in the pre-salt production fields in the Santos and Campos Basins, resulting from positive responses to reservoir behavior, recovery mechanisms (e.g. water injection), the operating efficiency of the systems in operation and growing drilling activity and well linkage;

• Appropriations due to the drilling of production development wells in onshore fields in in Argentina and in the Amazonas and Potiguar Basins, in Brazil, and in offshore fields in the Campos Basin;

• The declaration of commerciality of the Jandaia Sul field in Bahia;

• Divestments that provided early monetization of 0.022 billion boe of reserves in Brazil (Campos Basin) and Argentina (Austral Basin);

• Production of 0.932 billion boe in 2015, which represents an increase of 4% from 2014. This volume includes the production of shale but does not include the volume extracted from the Extended Well Tests (EWT) nor the production in Bolivia. EWTs occur in exploratory areas, which has not yet been declared commerciality of the field, so there is no associated reserves and, in the case of Bolivia, the country's legislation does not allow that reservations be recorded by the concessionaire.

[1] Divestments, which represent early monetization of reserves.

[2] Revisions based on technical criteria (eg reservoir characteristics) and economic.

www.petrobras.com.br/ir

Contacts:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS | Investor Relations Department I e-mail: petroinvest@petrobras.com.br

Av. República do Chile, 65 – 10th floor, 1002 – B – 20031-912 – Rio de Janeiro, RJ | Phone: 55 (21) 3224-1510 / 3224-9947

FORWARD-LOOKING STATEMENTS

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. The forward-looking statements, which address the Company’s expected business and financial performance, among other matters, contain words such as “believe,” “expect,” “estimate,” “anticipate,” “optimistic,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. There is no assurance that the expected events, trends or results will actually occur. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

The Company’s actual results could differ materially from those expressed or forecast in any forward-looking statements as a result of a variety of assumptions and factors. These factors include, but are not limited to, the following: (i) failure to comply with laws or regulations, including fraudulent activity, corruption, and bribery; (ii) the outcome of ongoing corruption investigations and any new facts or information that may arise in relation to the “Lava Jato Operation”; (iii) the effectiveness of the Company’s risk management policies and procedures, including operational risk; and (iv) litigation, such as class actions or proceedings brought by governmental and regulatory agencies. A description of other factors can be found in the Company’s Annual Report on Form 20-F for the year ended December 31, 2014, and the Company’s other filings with the U.S. Securities and Exchange Commission.

Petrobras presented a reduction of 2.401 billion boe in proven reserves because of other factors than the extraction of oil and natural gas, as monetization of reserves and revisions, which equates to approximately 2.58 times the annual production. The ratio between the volume of reserves and production volume is 14.2 years, 14.6 years of which in Brazil. The Development Ratio (DR), which is the ratio between developed proven reserves and total proven reserves, came to 44.5 in 2015.

Proven Reserves according to SEC Criteria:

According to SEC reserves classification and appropriation criteria, on December 31, 2015, Petrobras´ proven oil, condensate and natural gas reserves reached 10.516 billion barrels of oil equivalent (boe), as shown in Table 3. In 2014, these volumes were 13.141 billion boe, including shale reserves.

Table 3 – Volumes of Proven Reserves in 2015 (SEC criteria)

|

Item |

Proven Reserves |

|

Petrobras |

Oil and Condensate (billion bbl) |

8.774 |

|

Natural Gas (billion m3) |

278.435 |

|

Oil Equivalent (billion boe) |

10.516 |

www.petrobras.com.br/ir

Contacts:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS | Investor Relations Department I e-mail: petroinvest@petrobras.com.br

Av. República do Chile, 65 – 10th floor, 1002 – B – 20031-912 – Rio de Janeiro, RJ | Phone: 55 (21) 3224-1510 / 3224-9947

FORWARD-LOOKING STATEMENTS

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. The forward-looking statements, which address the Company’s expected business and financial performance, among other matters, contain words such as “believe,” “expect,” “estimate,” “anticipate,” “optimistic,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. There is no assurance that the expected events, trends or results will actually occur. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

The Company’s actual results could differ materially from those expressed or forecast in any forward-looking statements as a result of a variety of assumptions and factors. These factors include, but are not limited to, the following: (i) failure to comply with laws or regulations, including fraudulent activity, corruption, and bribery; (ii) the outcome of ongoing corruption investigations and any new facts or information that may arise in relation to the “Lava Jato Operation”; (iii) the effectiveness of the Company’s risk management policies and procedures, including operational risk; and (iv) litigation, such as class actions or proceedings brought by governmental and regulatory agencies. A description of other factors can be found in the Company’s Annual Report on Form 20-F for the year ended December 31, 2014, and the Company’s other filings with the U.S. Securities and Exchange Commission.

The evolution of the proven reserves, according to SEC criteria, is shown in Table 4.

Table 4 – Evolution of Proven Reserves (SEC criteria) in 2015

|

Composition of proven reserves |

Petrobras Total

(billion boe) |

|

a) Proven Reserves December/2014 |

13.141 |

|

b) New discoveries and new accumulations in 2015 |

0.020 |

|

c) Reserves Monetization in 2015[3] |

-0.022 |

|

d) Revisions in 2015[4] |

-1.690 |

|

e) Balance in 2015 (b+c+d) |

-1.692 |

|

f) Year Production in 2015 |

-0.932 |

|

g) Annual Variation (e+f) |

-2.624 |

|

h) Proven Reserves December /2015 (a+g) |

10.516 |

Apparent differences in the sum of the numbers are due to rounding off.

The same highlights previously made for proven reserves according to ANP/SPE criteria, applied to proven reserves, according to SEC criteria.

The main difference between the ANP/SPE and SEC criteria are sale prices considered in the calculation of the economic viability of the reserves.

By SEC criteria, Petrobras presented a reduction of 1.692 billion boe in their proven reserves due to factors other than the extraction of oil and natural gas, as monetization of reserves and revisions, which equates to approximately 1.82 times the annual production. The ratio between the volume of the reserves and the volume produced is 11.3 years, 11.5 years of which in Brazil. The Development Ratio (DR), the ratio between developed proven reserves and total proven reserves, of 51.1% in 2015.

It is important mentioning that Petrobras historically certifies about 95% of its proven reserves according to SEC criteria. Currently, D&M (DeGolyer and MacNaughton) is the certifying entity.

[3] Divestments, which represent early monetization of reserves.

[4] Revisions based on technical criteria (eg reservoir characteristics) and economic.

www.petrobras.com.br/ir

Contacts:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS | Investor Relations Department I e-mail: petroinvest@petrobras.com.br

Av. República do Chile, 65 – 10th floor, 1002 – B – 20031-912 – Rio de Janeiro, RJ | Phone: 55 (21) 3224-1510 / 3224-9947

FORWARD-LOOKING STATEMENTS

This release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. The forward-looking statements, which address the Company’s expected business and financial performance, among other matters, contain words such as “believe,” “expect,” “estimate,” “anticipate,” “optimistic,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. There is no assurance that the expected events, trends or results will actually occur. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

The Company’s actual results could differ materially from those expressed or forecast in any forward-looking statements as a result of a variety of assumptions and factors. These factors include, but are not limited to, the following: (i) failure to comply with laws or regulations, including fraudulent activity, corruption, and bribery; (ii) the outcome of ongoing corruption investigations and any new facts or information that may arise in relation to the “Lava Jato Operation”; (iii) the effectiveness of the Company’s risk management policies and procedures, including operational risk; and (iv) litigation, such as class actions or proceedings brought by governmental and regulatory agencies. A description of other factors can be found in the Company’s Annual Report on Form 20-F for the year ended December 31, 2014, and the Company’s other filings with the U.S. Securities and Exchange Commission.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

PETRÓLEO BRASILEIRO S.A--PETROBRAS |

|

|

|

|

By: |

/S/ Ivan de Souza Monteiro

|

|

| |

Ivan de Souza Monteiro

Chief Financial Officer and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Exchange Act of 1934, as amended (Exchange Act) that are not based on historical facts and are not assurances of future results. These forward-looking statements are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results o f operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

All forward-looking statements are expressly qualified in their entirety by this cautionary statement, and you should not place reliance on any forward-looking statement contained in this press release. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any other reason.

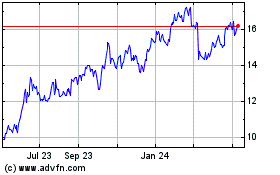

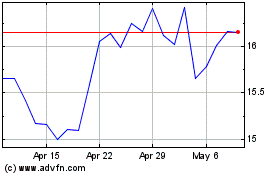

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

From Apr 2023 to Apr 2024